This article will look into the best Bitcoin wallets that balance convenience and security.

These wallets are designed for beginners and advanced digital currency users because of their easy-to-use interfaces and state-of-the-art protective measures.

It is essential to protect your online wealth, so finding an excellent wallet is crucial.

This time, we will reveal some of the top Bitcoin wallets created with different types of cryptocurrency fans in mind.

Why do you need a Bitcoin wallet?

A Bitcoin wallet is like a savings account for your virtual money but in a digital form.

It is the place where you can save Bitcoins, or send and get them using a kind of digital money.

Therefore, without having this particular system, you cannot legitimately claim to own or use Bitcoin.

Your situation is like that when one possesses funds without any location for storage or expenditure.

Indeed, to buy/sell/keep your bitcoins, you ought to have a Bitcoin wallet! It’s just another piggy bank to put your digital cash in!

Best Bitcoin Hot Wallets

The safest hot wallets for Bitcoin are used to store digital currency safely.

These wallets have various security features and user-friendly designs and can be utilized on different devices.

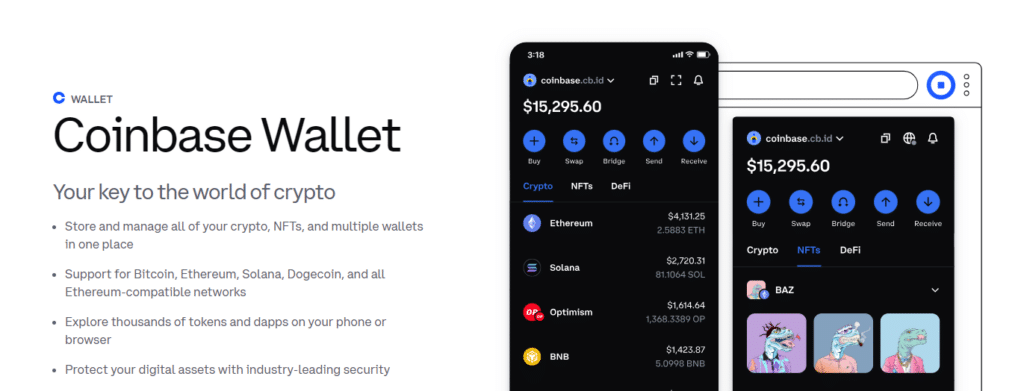

1- Coinbase Wallet – Best for Mobile

Coinbase Wallet functions as a primary Bitcoin hot wallet. It has an intuitive interface, strong safety nets, and a smooth connection with the Coinbase exchange platform.

It enables people to safely save, transfer, or accept Bitcoin and other digital currencies such as Defi tokens; it also allows managing Defi applications and accessing decentralized exchanges (DEXs).

This app provides maximum security while being easy to use, making it suitable for anyone who wants a trusted system for managing their cryptocurrencies.

Coinbase Wallet Features

- User-friendly interface for easy navigation

- Secure storage of Bitcoin and other cryptocurrencies

- Integration with Coinbase exchange for seamless trading

- Backup and recovery options for added peace of mind

- Multi-coin support for diversified crypto portfolios

Best Bitcoin Hardware Wallets

1- Ledger Wallet

Ledger is regarded as among the best Bitcoin hardware wallets because of its exceptional safety measures and easy-to-use interface.

It keeps private keys offline to prevent hackers and unauthorized persons from gaining entry into them.

With solid cryptography and secure chip tech, Ledger guarantees protection for your bitcoins.

Moreover, it supports many altcoins and can be used with different wallet programs, thus providing flexibility when dealing with your digital money.

Ledger Wallet Features

- Advanced security features for protecting your Bitcoin

- Offline storage to safeguard against online threats

- Compatibility with various cryptocurrencies

- User-friendly interface for easy management

- Backup and recovery options for added security

Best Bitcoin Browser Extension Wallet

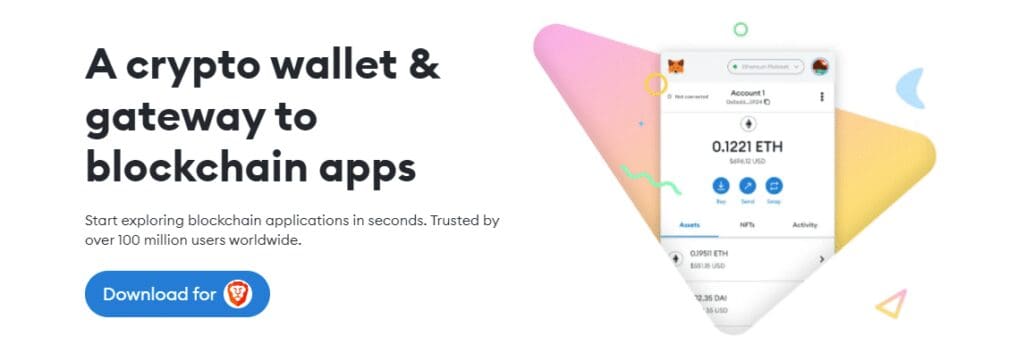

1- MetaMask

MetaMask is famous for being an Ethereum wallet and browser extension mainly focusing on Ethereum and its tokens.

Because it doesn’t support Bitcoin directly, you must use it with decentralized exchanges (DEXs) or token swap platforms that support it through wrapped tokens or bridges.

But if you need a wallet that supports Bitcoin directly, then Electrum or Exodus should be considered instead of MetaMask.

MetaMask Wallet Features

- Seamless integration with web browsers for easy access

- Support for multiple cryptocurrencies, including Bitcoin

- Secure storage of private keys within the browser extension

- Compatibility with decentralized applications (dApps)

Bitcoin Hot Wallet vs. Bitcoin Cold Wallet

Bitcoin hot and cold wallets are two different ways of storing Bitcoin, each with advantages and considerations.

Bitcoin Hot Wallets:

- Definition: Hot wallets are a type of Bitcoin wallet connected to the Internet, allowing funds to be accessed immediately.

- Usually, it is used for smaller amounts of Bitcoin for frequent transactions or easy access.

- Ease of Use: They can be easily reached and are convenient when making payments as they connect directly to the Internet, which can be found on smartphones, computers or online platforms.

- Risk: The main risk with these wallets is that they can easily get hacked or suffer online attacks.

- This is because they are connected to the Internet, which makes them more prone to security breaches than cold storage devices.

- Examples: Software wallets such as mobile wallets or desktop wallets and exchange wallets (wallets provided by cryptocurrency exchanges) are examples of hot storage.

Bitcoin Cold Wallets:

- Definition: A cold wallet is a type of Bitcoin wallet stored offline, i.e., not connected to the internet.

- It is mainly used for storing large amounts of bitcoins over an extended period or higher security measures.

- Security: They provide better protection than hot storage since they are not linked to any network, reducing hacking risks or cyber theft.

- Therefore, they are considered more challenging targets by hackers attempting to breach systems from remote areas.

- Ease of Access: Though superior in terms of safety precautions taken against unauthorized third parties gaining control over digital assets under management, convenience may take a hit due to having infrequent need-expenditures requiring human intervention before funds become spendable again, like transferring some part out into another one called “hot” (online) valuable wallet during spending/trading times

- Examples: Hardware wallets like Ledger Nano S and Trezor, among others, and paper wallets in printable versions also belong to the cold storage category.

Hot wallets are perfect for everyday use and convenience but have higher security risks because they are always online.

On the other hand, cold storage is best suited for long-term Bitcoin storage since it keeps the coins offline, making them more secure against hackers or unauthorized persons wishing to gain control over large amounts of cryptocurrencies.

How Many Types Of Bitcoin Wallet

There are typically four types of Bitcoin wallets:

- Software Wallets: These applications or software programs can be installed on a computer or smartphone and used daily. They can be further divided into desktop, mobile, and web wallets.

- Hardware Wallets: Hardware wallets are physical devices that store Bitcoin securely offline. They look like USB drives and provide vital protection because they spend most of their time not connected to the Internet.

- Paper Wallets: A paper wallet is a physical copy of the private keys required to generate a Bitcoin address; it often features a QR code for easy scanning.

- Brain Wallets: Brain wallets are more advanced than other types because they rely not on physical or digital storage but memorization. Users create a private key from words or a passphrase they can remember.

Each kind of wallet has its own benefits and security considerations—ease of use and reachability being some of them—so you must pick the one that best suits your needs.

How To Transfer Bitcoin From Current Wallet To Another Safely

What measures should be taken to secure a Bitcoin transfer from one wallet to another?

1. Choose a reputable destination wallet:

Choose a reliable and secure recipient wallet for temporarily keeping your Bitcoin. Ensure it is designed to accept Bitcoins and has a good security history.

2. Verify addresses:

You need to double-check the address of the person you are sending Bitcoins to ensure accuracy; even minor mistakes could result in a loss of funds.

3. Initiate the transfer:

Open your current wallet and select send, then follow the other necessary steps to ensure the transaction occurs successfully.

4. Set amount and fees:

Enter the amount of Bitcoin you want to transfer and consider setting appropriate fees for transaction confirmation time estimation, where a higher fee means faster confirmation.

5. Confirm transaction details:

Take time to review all transaction details carefully before confirming anything, ensuring that the recipient’s address and amount are correct.

6. Authenticate the transaction:

If there are additional security layers in your wallet, such as 2FA, complete them to authorize or authenticate this transfer of coins

7. Monitor the transaction:

Keep watching what happens after submitting it because sometimes transactions take longer than expected before being confirmed. Thus, using blockchain explorers can help confirm if it’s included in some block or has yet to be broadcast.

8. Store private keys securely:

Once transferred, keep private keys associated with the new address which received those BTC safe from unauthorized access; otherwise, they won’t be able to spend their balance

9. Update security settings:

Consider enabling extra security features like multi-signature support or 2FA if available on that software

10. Verify receipt:

When coins arrive in my friend’s account, I should also check once again whether everything went fine during this operation—did the correct number show up? How do I know these were mine?

How To Secure Your Bitcoin Wallets – Step By Step Guide

Follow my tips below to secure your Bitcoin wallets

1. Select a Trustworthy Wallet:

Choose a renowned software or hardware wallet with robust security measures and a good history of dependability.

2. Activate Two-Factor Authentication (2FA):

Enable 2FA on your wallet for extra security, usually with a mobile app such as Google Authenticator or Authy.

3. Backup Your Wallet:

To prevent loss, make a safe copy of your wallet’s recovery phrase or private key and store it offline in several places.

4. Use Strong Passwords:

Create a unique, complex password for your wallet to deter unauthorized entry; avoid easily guessable passwords.

5. Keep Software Updated:

Frequently update your wallet’s software to close any security holes and enjoy new features.

6. Watch Out for Phishing Attempts:

Beware of phishing scams. Always verify the authenticity of websites or emails before entering any confidential information.

7. Consider Hardware Wallets:

You might want to consider using a hardware wallet for added safety. These devices keep private keys offline, reducing the chances of online attacks.

8. Secure Your Devices:

Ensure that all computers, smartphones, and other devices through which you access your wallets have antivirus software installed and regularly updated security patches.

9. Try Multi-Signature Wallets:

Check out multi-signature wallets. These wallets require multiple signatures before transactions can be authorized, adding another layer of protection for funds stored within them.

10. Be Wary of Public Wi-Fi Networks:

Do not use public Wi-Fi networks when accessing wallets or making transactions, as they can be easily intercepted by attackers listening in on traffic between clients and servers.

11 Verify Addresses:

Double-check that addresses are correct before sending Bitcoin so that coins are not sent to the wrong destinations due to typo errors.

12 Educate Yourself:

Stay up-to-date with current best practices for securing digital assets like cryptocurrencies and emerging threats.

How To Choose the Best Crypto Wallet

1. Decide What You Need:

Consider what you will be using the wallets for, including safety, convenience, and types of cryptocurrencies.

2. Look Into Various Wallet Types:

Familiarize yourself with different kinds of wallets, such as hardware, software, and paper ones, so that you can understand their characteristics, strengths, and weaknesses.

3. Appraise Security Measures:

Give priority to wallets with solid security measures, including, but not limited to, encryption, two-factor authentication (2FA), or even multi-signature support; they should also have a good security track record.

4. Examine User Experience:

It would be best to choose an easy-to-use interface designed so that everyone uses it without any challenges.

This is because transactions must happen fast when dealing with digital assets management systems.

5. Verify Compatibility:

Ensure the wallet supports all coins one intends to keep safe at one point, besides considering whether it works well with your device(s) and OS(s).

6. Investigate Reputation & Feedback:

Do background checks on the company’s reputation behind each wallet before relying on them.

You can do this by reading reviews posted by other users who might have had experience using these apps before seeking opinions about their safety features, reliability, etc.

7. Validate Backup And Recovery Options:

Ensure the wallet has robust backup and recovery options, such as mnemonics or seed words. Such features help protect funds from being lost forever due to accidental deletion or hardware failures, among other reasons.

8. Pilot With Small Amounts:

Before entrusting vast amounts of money into any digital asset management system through downloading relevant applications onto personal computers or mobile gadgets.

First, make payments using small quantities so that if issues concerning functionality or security are noticed during the initial setup stages, they do not affect more significant sums, which could result in irrecoverable losses.

By following these steps, you can make an informed decision and choose the best crypto wallet that aligns with your needs and preferences.

Final Verdict

Ultimately, the best crypto wallet for you will come down to what you want as an individual.

Think about safety measures, user-friendliness, compatibility with other devices or software programs, reputation among users who have already used it, how much help they’ll be able to give if something goes wrong, and cost, which can vary significantly between providers.

So don’t rush into anything without researching first. There might be better alternatives that have yet to be considered.

Whether it be a physical complex drive device, digital desktop application, or even paper wallets printed at home, always prioritize security over everything else.