In this piece, i will discuss the Best Cash Advance Apps Like Dave that provide instant steps toward relief without the headaches of a payday loan.

These apps offer quick access to previously earned wages, charge little to nothing fees, and come with helpful payment structure tools.

If you’re looking for a small loan ahead of your payday or wish to sidestep overdraft fees, these alternatives to Dave are definitely worth looking into.

Key Point & Best Cash Advance Apps Like Dave List

| App | Key Point |

|---|---|

| Albert | Offers financial planning and automated savings tools. |

| Earnin | Provides payday advances based on hours worked, no fees. |

| Brigit | Advances small cash amounts and offers financial insights. |

| MoneyLion | Combines banking, lending, and investing services. |

| Chime SpotMe | Offers no-fee overdraft protection and early direct deposit. |

| Branch | Provides earned wage access and financial wellness tools. |

| Klover | Instant cash advances with no interest or credit checks. |

| Empower | Offers cash advances, financial insights, and budgeting tools. |

| Vola Finance | Provides instant cash advances with flexible repayment options. |

| FloatMe | Offers small cash advances for a flat fee and budgeting tools. |

1.Albert

Albert is among the top cash advance applications similar to those offered by Dave. Albert distinguishes itself by emphasizing tailored financial analysis and featuring automated saving applications integrated within the app.

Unlike other applications, it combines budgeting with cash advances which enable users to better manage their finances.

The distinctive feature of this app is the instant access to earned wages without hidden fees, allowing users to effortlessly set aside small amounts for savings, making it a comprehensive option for financial wellness.

Pros & Cons Albert

Pros:

Cons:

2.Earnin

Earnin distinguishes itself from cash advance apps such as Dave by allowing users to access funds without fees.

What allows Earnin to stand out even more is the “Advance Shield” feature, which automatically pays to prevent overdrafts without any fees.

This flexibility gives users access to funds based on their hours worked instead of a fixed payday which offers increased control over compensating pay periods.

Pros & Cons Earnin

Pros:

Cons:

3.Brigit

Brigit distinguishes itself among cash advance apps like Dave through its emphasis on proactive support and financial well-being. Brigit is different from standard cash advance apps because it assists users with “financial insights,” actively aiding users in curbing unnecessary spending.

As well as helping users mitigate overdraft charges, it also offers automatic cash advances based on set income patterns which reduces the reliance on payday loans. Brigit’s interest-fee-free service with clearly defined repayment terms makes it a useful tool for financial stability.

Pros & Cons Brigit

Pros:

Cons:

4.MoneyLion

Like Dave, MoneyLion stands out in the world of cash advance apps as it combines cash advances with a full-suite of financial services.

MoneyLion also features credit-building mechanisms which aids users in increasing their credit scores while on wage access.

Along with highly personalized financial guidance, MoneyLion also provides flexible cash advancements, ensuring the platform is an all-in-one solution for short-term cash flow needs and long-term financial wellness, completely fee and interest free.

Pros & Cons MoneyLion

Pros:

Cons:

5.Chime SpotMe

Chime SpotMe flies high among the cash advance apps like Dave because of its effortless fee-less overdraft protection while meshing well with Chime’s other banking features.

What makes SpotMe different is its instant access to funds, allowing users to make purchases and withdraw cash even if their balance isbelow zero, up to a specific limit.

As an extra bonus, SpotMe facilitates early direct deposit, which makes it extremely user friendly and flexible for cash flow management without any espionage fees.

Pros & Cons Chime SpotMe

Pros:

Cons:

6.Branch

Branch differentiates itself from competitors, such as Dave, by specifically offering earned wage access and financial wellness services for employees. Its integration with employers enabling near real-time access to funds makes Branch unique. Users can retrieve funds without having to wait until payday.

Repayment of advances through payroll seamlessly is a distinct advantage and helps users fee sidestep financial pitfalls. Branch’s budgeting & savings tools further enhance its user’s financial well-being.

Pros & Cons Branch

Pros:

Cons:

7.Klover

Klover stands out from the likes of Dave in the cash advance app market by granting users instantaneous access to their earnings without interest or credit checks.

What makes Klover unique is its ability to offer cash advances based on a user’s transaction history and activity with direct deposits, thus tailoring it as a financial management app.

Klover’s claims of ‘no hidden fees’ further enhance its reputation as a reliable financial management tool in terms of one’s day-to-day expenses.

Pros & Cons Klover

Pros:

Cons:

8.Empower

Empower stands out as one of the best alternatives to cash advance apps like Dave because of it’s combination of cash advances and financial management features.

One of the unique aspects of Empower is the AI-enhanced budget guidance that analyzes a user’s spending behaviors and offers tailored suggestions to optimize their finances.

Users are also instantly able to access their wages, while Empower assists in saving towards future expenses, thus helping users get financially ready. This approach improves not just spending behavior, but the user’s entire financial habits alongside offering cash advances.

Pros & Cons Empower

Pros:

Cons:

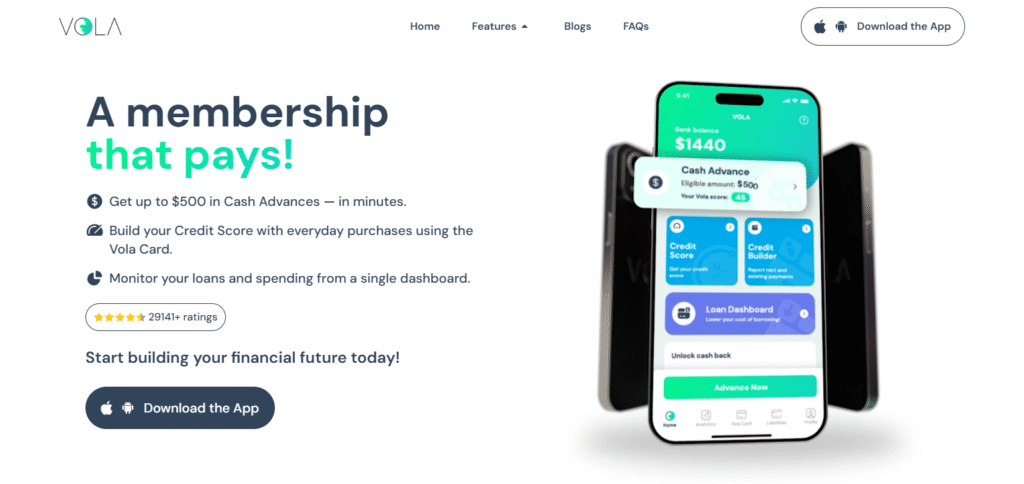

9.Vola Finance

Vola Finance stands out among its peers, such as cash advance applications like Dave, as its interface allows for instant cash advances with no hidden fees or interest.

Vola Finance’s ultra-unique feature is flexibility in repayment, allowing users to pay back the advance on their own accord.

Vola Finance helps users navigate their finances effortlessly while purposely avoiding payday loans, all while providing users the financial wiggle room they need making it a must-have tool in today’s economy.

Pros & Cons Vola Finance

Pros:

Cons:

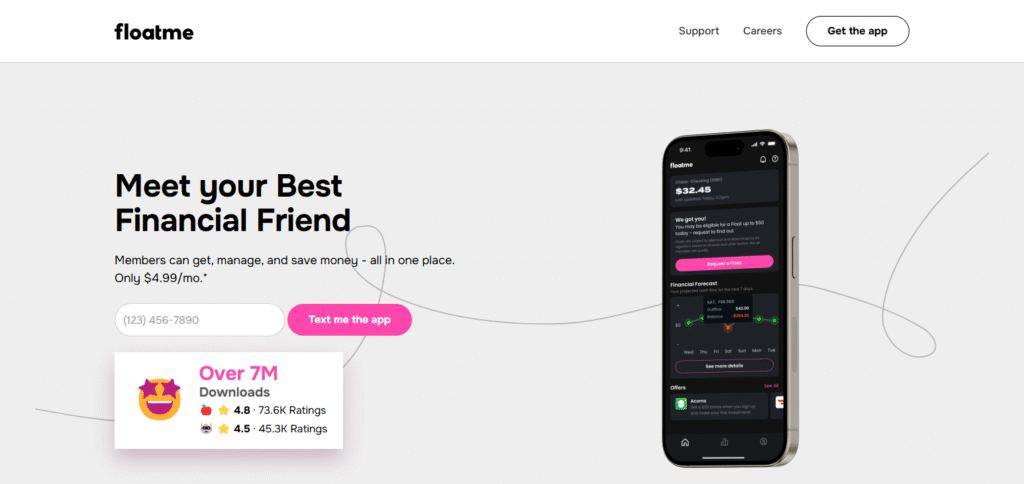

10.FloatMe

FloatMe stands out from other platforms, such as Dave, because it allows users to obtain small cash oversees instantly without charging interests or having any hidden fees.

FloatMe’s distinctive feature is the automatic savings that lets its users save some of their earnings while giving them access to funds when needed.

This remarkable integration encourages better financial habits complemented with a safety net which helps handle unexpected expenses.

Pros & Cons FloatMe

Pros:

- Cash Advance with No Interest or Fees: FloatMe does not collect any interest or charge additional fees for unserved cash.

- Savings Payment Plan: Users can incrementally set aside a certain percentage of their income with the app.

- Fast Payment Service: Users can get their payment in a timely manner when it is crucial.

Cons:

Conclusion

In short, leading cash advance apps like Dave provide specialized functions that offer unparalleled financial freedom while ensuring a simplified interface and no fees for accessing wages that have been earned.

These applications strive to help users manage their cash flow through tailored solutions like personalized budgeting, flexible repayment terms, and automated savings mechanisms.

The apps stand out as effective tools in managing a user’s financial liquidity as compared to conventional payday loans which impose exorbitant interest rates and fees.