In this guide, you will discover the best Coincheck alternatives in 2024 that suit your trading style and objectives.

Coincheck has been a major player in this sector. It is known for its easy interface, which lists all possible coins to trade.

Yet, as the market matures, quite a few Coincheck alternatives with more features, security, and detection options are in demand for many users in Japan.

Coincheck Alternatives List & Features

| Platform | Features |

|---|---|

| Binance Futures | High liquidity, diverse range of futures contracts, competitive trading fees, advanced trading interface. |

| Bybit | User-friendly interface, high leverage options, derivatives trading, insurance fund, risk management. |

| Deribit | High liquidity, diverse range of futures contracts, competitive trading fees, and advanced trading interface. |

| Kraken Futures | Focus on Bitcoin and Ethereum derivatives, futures and options trading, high liquidity, and API support. |

| Huobi Futures | Innovative products, tokenized stocks, futures, options, prediction markets, and leveraged tokens. |

| OKEx Futures | A comprehensive suite of futures trading tools, spot and derivatives trading, DeFi, staking, and lending. |

| Bitfinex Derivatives | Advanced trading options, high liquidity, margin trading, staking, lending, customizable interface. |

| PrimeXBT | High leverage, multiple asset classes (crypto, forex, commodities), advanced trading tools, copy trading. |

| Phemex | Zero-fee spot trading, high leverage, derivatives trading, intuitive interface, educational resources. |

10 Best Coincheck Alternatives In 2024

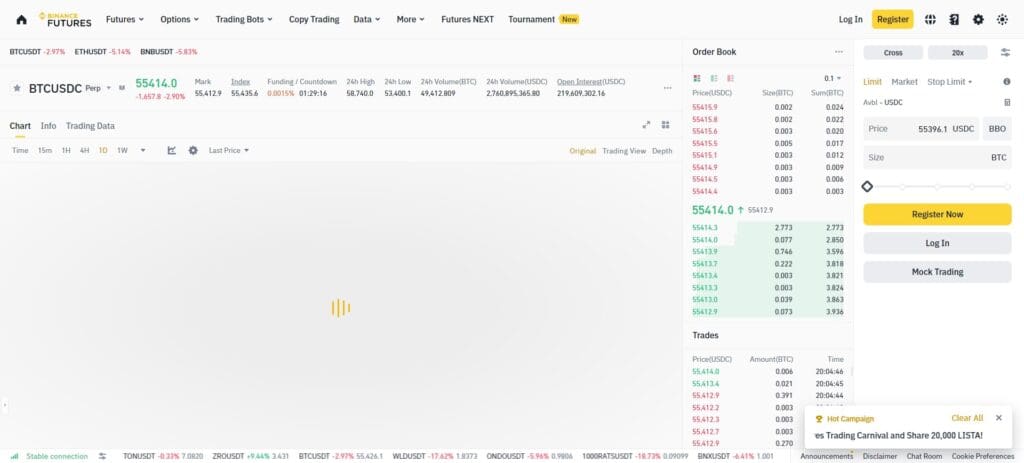

1. Binance Futures

Binance Futures – Best Coincheck Alternative for Advanced Traders(accounts are available to residents outside the US, but some restrictions will apply)Known worldwide as one of the leading cryptocurrency exchanges regarding trading volumes.

Offering futures trading, Binance Futures presents various cryptocurrencies paired with aggressive leverage options—optimal for speculators looking to capitalize on price movements across diverse digital assets.

This blend of an intuitive user interface, deep liquidity, and market data enables traders to execute their strategies efficiently on the platform.

In addition, the robust security model of Binance and 24/7 customer service also help to build trust.

Designed for traders who want to stake large amounts on the price of BTC and ETH (as well as other leading crypto assets), Binance Futures is still viewed by many in the space as offering one of, if not the most complete, futures trading solutions.

2. Bybit

Of course, this focus on leveraged cryptocurrency tradings makes Bybit a standout alternative to Coincheck.

Although Bybit offers easy-to-use and complete trading functionalities, It also supports a variety of trading pairs with competitive fees and high liquidity.

Traders also gain access to sophisticated order types such as limit, market, and conditional orders, which help improve accuracy when implementing strategies.

Bybit heightens traders’ sense of security by offering cold wallet storage and strict auditing procedures.

Customer support is offered 24/7, and its suite of educational resources helps educate traders, making Bybit a trustworthy destination for efficient and secure leveraged cryptocurrency trading.

3. Deribit

The Exchange is the best alternative to Coincheck for those looking for a broader range of offerings related to cryptocurrencies, including cryptocurrency options and the futures trading arena.

This can also be executed on the Deribit Exchange! Deribit, the flagship player in Bitcoin and Ethereum derivatives, offers traders an options-rich platform with good liquidity.

In addition to facilitating simple and compound trading, professional investors can use options spreads or perpetual swaps on the same platform.

Deribit prioritizes security, holding funds in cold wallets and conducting rigorous security audits.

Its responsive customer support and comprehensive range of educational resources further add to the charm, making Deribit one platform that you can bet on without losing your sleep if, instead, I said more than a few winks; however, it still rhymes for those who value their freedom above all else.

4. Kraken Futures

Kraken Futures is a diversified and mature alternative to Coincheck for futures trading on many cryptos.

It is supported by Kraken, one of the most respected exchanges in this sector. Due to its deep liquidity, it offers a low trading fee schedule on spot markets.

They feature an investor-friendly UX for lightning-fast trading execution and the ability to trigger their trades, augmented by a full suite of market data and analysis tools.

Kraken takes security very seriously and uses all the standard safety procedures, such as keeping digital assets in cold storage and periodic security audits.

Customer service is paramount to Kraken Futures, where commitment to regulatory compliance ensures confidence with a safe hand in trading cryptocurrency futures.

5. HTX

HTX (formerly Huobi Global) became a leading contender with Coincheck in 202,4 as it provides all possible cryptocurrency trading services.

Founded in 2013, HTX has become known for having a wide selection of digital currencies, from Bitcoin and Ethereum to all altcoins.

Other services include spot trading, futures contracts, and marketing,- with Stakialso being g being part of the menu for retail investors.

Cold wallet storage has ensured user funds are secured, while multi-signature technology provides an additional layer of security against fraudulent activities.

HTX maintains its popularity among traders due to its easy-to-use UI, low fees, and regulation compliance.

Security is paramount, with funds in cold wallets and enhanced security measures.

Considering Huobi’s excellent customer support and educational resources, it appears to be the best choice for future use of a top-tier cryptocurrency platform.

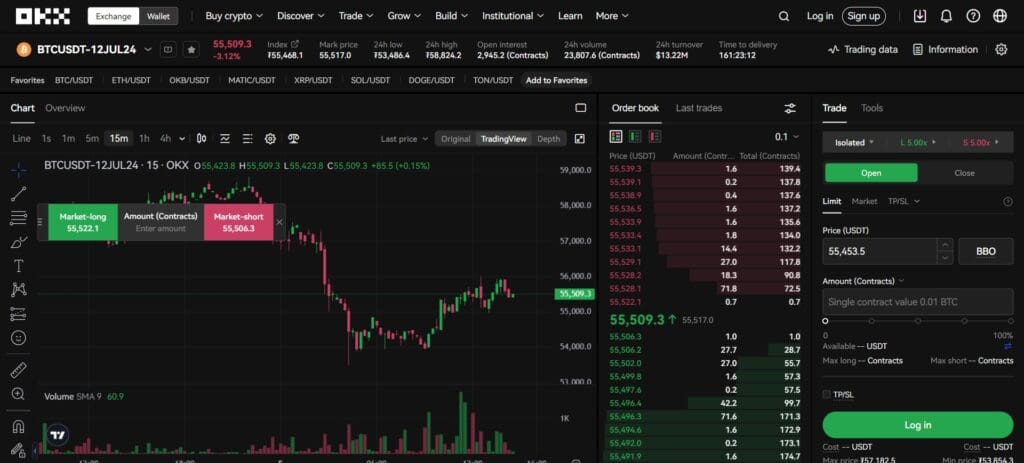

6. OKEx Futures

While this is a much more robust option than Coincheck, it does not meet the same level required for permissible handling of cryptocurrency futures trading as OKEx Futures.

It provides futures contracts on top cryptocurrencies such as Bitcoin, Ethereum, and more, including both standard perpetual swaps and traditional futures, in addition to OKEx-centric Perpetual Swap.

Traders enjoy low-cost and high liquidity trading privileges using advanced trading tools, including algorithmic orders.

OKEx prioritizes security with cold wallet storage and regular security audits, making OKEx Futures a proper place for worthy futures.

In the ctrinvestorsttonjothe timer of this platform, and ducat-educational platformlplatformrresources are.

7. Bitfinex

Bitfinex Derivatives is a prime example, offering Coincheck traders a range of derivative products designed specifically for the cryptocurrency market.

It provides futures and perpetual swap contracts on major cryptocurrencies like Bitcoin, Ethereum, etc., and is developed on top of Bitfinex’s high-performance REST platform.

Competitive trading fees, high liquidity, and margin trading with customizable order types benefit traders.

Security is a priority, with funds stored in cold wallets and security verification.

Finance Moreover, Bitfinex Derivatives is the premier platform for those looking to trade with continuous liquidity on a wide range of crypto derivatives products, including Bitcoin (BTC), Ethereum (ETH), and Chainlink Token against the US Dollar through an advanced trading experience.

8. PrimeXBT

PrimeXBTT is an alternative to Coincheck. It specializes in long and short positions at up to 1000x leverage and offers various asset options beyond Bitcoin.

It provides traders with diverse markets and leverage opportunities, which empowers them to have more excellent trading capabilities.

PrimeXBT is also known for its advanced trading tools, including custom charting software, risk management features, and other interfaces geared explicitly towards beginners and more experienced traders.

Users can expect security features with cold storage for funds & multiple-factor authentication options.

PrimeXBT offers the missing tools and features better than anyone else, which includes distribution from advanced customer support to available educational resources – The state-of-the-art trading platform enables newbies of all types who may explore day-to-day economies.

9. Phemex

In addition, a Coincheck alternative in 2024 that has attracted considerable momentum is Phemex, largely thanks to its technological capabilities and trading capacity.

Blazing fast trading platform The Phemex high-frequency trading engine can manage as many as 300,000 transactions per second, ensuring users enjoy an execution experience with minimal latency.

Phemex offers a one-stop solution for derivatives trading that attracts traders with its wide selection of pairs—from the ever-popular cryptocurrencies to traditional assets like precious metals like gold and silver. Different types fit various market views.

Security-conscious and user-experience-focused, Phemex has captured the imagination of traders seeking trustworthiness while standing for innovation in a trade ecosystem that demands both.

Choosing a Coincheck Alternative

Choosing the best alternative to Coincheck requires a proper assessment of numerous essential things.

Security is critical; ensure the platform includes security policies, like 2FA and cold storage for your fund, and has a good history of securing user assets. Also, consider the large size and excellent trading features in case of stock availability.

Advanced charting tools, various order types, and specific trading pairs could all be essential styles.

Another critical point is the trade fee structure on the platform. Fees affect the profit you make, especially if you trade a lot.

In addition, you should analyze the pool of accepted cryptocurrencies — this directly influences trading opportunities and limits.

Similarly, so is the user experience; having an easy-to-navigate platform and dedicated customer services can also hugely enhance your trading experience.

Finally, oversee regulatory compliance of the platform since, in such an industry, adherence to these regulations can give some faith and security.

Conclusion

In 2024, No Coincheck may not be a perfect match, depending on all the trading features you are looking for in one platform.

Suppose you pay close attention to aspects like security, trading tools and features, fee structure, user-friendliness, and compliance with regulatory norms. In that case, you should be able to strike a better alternative or custodian than Coincheck.

The cryptocurrency market is already growing with many other innovations, hence the need to select an appropriate platformtol guarantee successful trades.

With the information provided by this guide, you can now confidently explore all these different alternatives and find out which one is a uniquely built Coincheck alternative.