This article will focus on the Best Cross Border Wealth Containers for Multi-National Families. Wealth management across borders attentively needs to consider the challenges that come with it, such as the intricacies of taxation, the legal compliance and succession planning.

Depending on how each family structure the wealth, protection, optimal taxation, and the seamless transfer over generations, to new family members can be addressed with structures like international trusts, family offices, holding companies, and foundations.

Key Points & Best Cross-Border Wealth Containers for Multi-National Families

| Wealth Container | Key Point |

|---|---|

| International Trusts | Provide asset protection and estate planning flexibility across jurisdictions |

| Private Foundations | Ideal for philanthropy and long-term family governance with cross-border reach |

| Family Offices | Centralized management of investments, tax, and succession planning globally |

| Holding Companies | Efficient ownership structure for businesses and investments across countries |

| Dual Wills | Ensure compliance with inheritance laws in multiple jurisdictions |

| Cross-Border Life Insurance | Tax-efficient wealth transfer and liquidity for heirs worldwide |

| Global Investment Accounts | Diversified access to international markets under one umbrella |

| Residency & Citizenship Programs | Enable mobility and tax optimization for families with global footprints |

| International Pension Plans | Portable retirement savings across different countries and tax regimes |

| Cross-Border Estate Planning Structures | Minimize global tax exposure and ensure heirs’ access to assets worldwide |

10 Best Cross-Border Wealth Containers for Multi-National Families

1. International Trusts

International trusts provide multi-national families with a flexible structure to manage assets across borders. They offer strong asset protection, tax planning opportunities, and confidentiality.

Trusts manage a fixed pot of assets which can be distributed according to family rules. Trusts mitigate the risk of eroding family wealth. These structures are useful when trying to navigate the political and economic risks of a single country.

International trusts simplify civil succession law, to the centralisation of estate planning for the family head. They complex cross border wealth planning with philanthropy, succession and investment portfolio control.

Features International Trusts

- Asset Protection: Shields assets from political, legal, or creditor risks across jurisdictions.

- Flexibility: Can specify detailed distribution rules for beneficiaries.

- Tax Planning: Optimum tax consideration depending on family residence and place of trust.

- Succession Management: Smooth wealth transfer across generations.

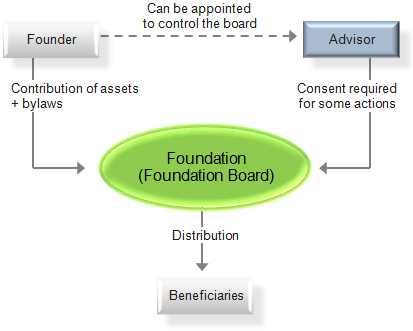

2. Private Foundations

Private foundations are legal entities set up to help manage and protect family wealth, and to fulfill certain philanthropic objectives.

Private foundations help preserve wealth and govern succession to wealth over long periods of time. They offer a means for families to designate heirs/beneficiaries, exercise oversight, and minimize family conflicts over inherited wealth.

Private foundations help families optimize tax obligations, contribute to charity, and help reputational uplift. They also help families with multi-generational wealth transfer.

They also protect the charitable assets and provide continuity to families with multiple legal jurisdictions and regulatory/tax environments.

Features Private Foundations

- Controlled Governance: Family assuming supervision and making decisions.

- Philanthropy: Assist charity efforts while continuing to manage family finances.

- Tax Efficiency: Cross-border tax flexibility.

- Legacy Preservation: Protection of family’s wealth and their values for generations.

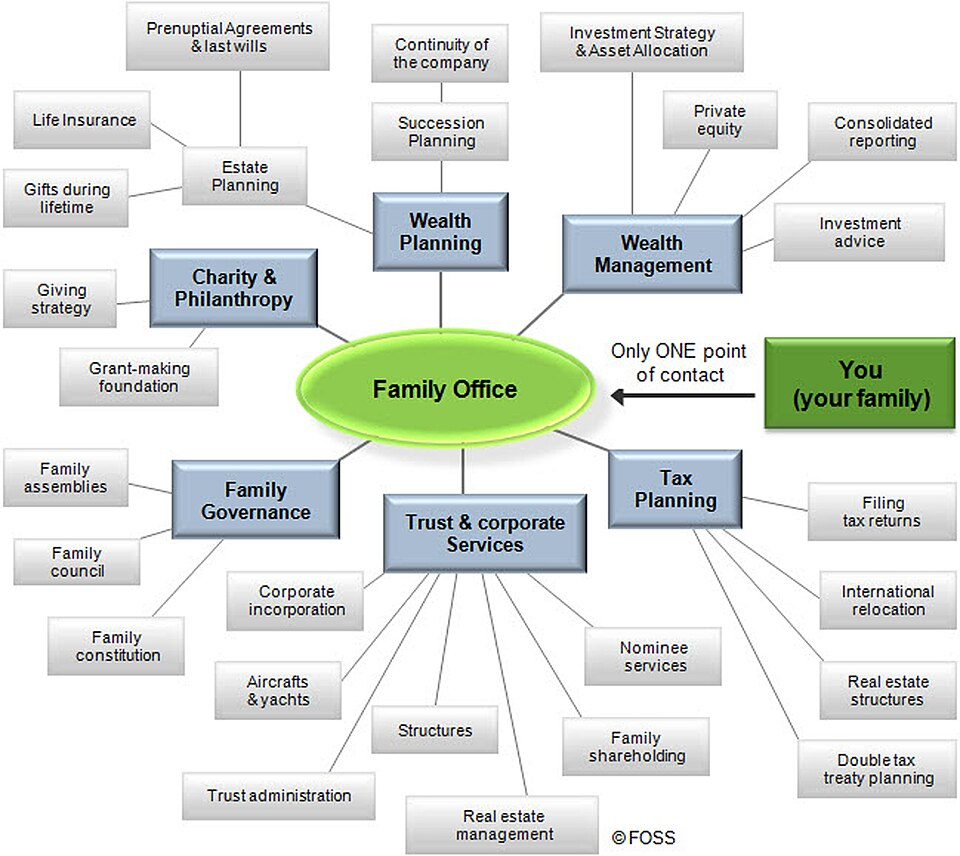

3. Family Offices

Family offices are structures that take care of the financial, investment, and administrative tasks of wealthy families.

They provide tailor-made services to complex, multi-national families, including wealth protection, taxation, succession, philanthropy, etc.

A family office can place global investments, track global risks, and ensure compliance for investments across various jurisdictions. It streamlines governance and allows family members of various branches and generations to make collaborative decisions.

Multi-jurisdictional family offices tend to also provide estate planning, insurance, and lifestyle management, enhancing integrated financial and operational efficiency.

Family offices act as single points of control, simplifying complex, cross-border wealth structures, while honoring the family’s evolving complex needs and preserving their socio-economic legacy.

Features Family Offices

- Centralized Management: Investment, finance, and legal integration for global cross-border activity.

- Custom Solutions: Tailored for the intended wealth of more than one generation.

- Risk Oversight: Financial, legal, and regulatory risk monitoring on a global scale.

- Operational Efficiency: Streamlining complex cross-border financial and lifestyle administration.

4. Holding Companies

Holding Companies unite family ownership of diversified worldwide investments into one corporate structure. They distinguish management of global investments, offer protection from legal liability, and improve tax management.

Through ownership of a number of subsidiaries, family members can streamline and maintain centralized control of governance, succession, and confidentiality. Holding Companies ensure seamless intergenerational transfer of wealth while managing and protecting estates from legal challenges.

Furthermore, they offer families the ability to invest operationally in multiple jurisdictions. Cross-border Holding Companies are especially useful for families with a wide array of businesses or real estate as they provide the ability to manage and structure decision-making and risk across multiple countries.

Features Holding Companies

- Asset Consolidation: Unified ownership of companies, real estate, or investments.

- Liability Protection: Isolation of family wealth from business operational risks.

- Succession Planning: Streamlining the transfer of wealth across generations.

- Tax Optimization: Permits organized strategies to save on taxes on a multi-jurisdictional basis.

5. Dual Wills

Dual wills are a legal strategy deixed by legal experts used by multi-national families to administer assets located in different jurisdiction.

It includes two different wills, one covering the local assets and one covering the foreign assets. This method ensures adherence to local regulations and lessens the complexities associated with probate.

Dual wills allow greater flexibility in succession planning, enabling families to assign assets with more equity due to the different tax regulations by jurisdiction. This method reduces the chances of legal disputes and quickens the transfer of the assets to the heirs.

This type of legal arrangement is most favorable in countries with tough rules regarding the succession of property or with places with high costs of transfer of property upon death.

It gives families a custom and complicated legal arrangement to manage the estate on a cross border basis and a protective structure regarding cross-border legacies. The system of dual wills is a legal strategy preferred by dual nationality families on a global basis.

Features Dual Wills

- Jurisdiction Specific: Keeps domestic and overseas assets apart, promoting adherence to the law.

- Less Probationary Complications: Facilitates the rapid transfer of assets and lessens dissent.

- Tax Efficient: Distributes the assets as per the local laws about inheritance.

- Bespoke Succession: Enables customized strategies to distribute multi-national estates.

6. Cross-Border Life Insurance

Cross-border life insurance assists multi-national families with the wealth protection and estate planning benefits of life insurance.

Policies can provide liquidity on estate dissolution, facilitate the secure wealth transfer across borders, and protect heirs from adverse financial positions.

Adjustable premiums, investment opportunities, and some tax benefits come with many international policies. Compliance with the regulations of multiple jurisdictions valuable for mobile families, and policies designed for cross-border life insurance.

Cross-border life insurance complements the use of trusts, foundations, and holding companies by providing the protection and streamlined transfer of assets. These policies, which balance risk and wealth, help inheritance planning cross multiple generations of the family.

Features Cross-Border Life Insurance

- Wealth Protection: Offers liquidity which is essential for tax payments or to cover emergencies.

- Global Compliance: Designed to comply with laws and regulations of multiple countries.

- Investement Growth: Policies of this nature provide an opportunity for investment.

- Estate Planning: Goes hand in hand with trusts or foundations, which allows for the seamless movement of wealth

7. Global Investment Accounts

International Investment Accounts enable families to access several foreign markets and manage the portfolios in multiple currencies.

They allow the family to invest in different countries and currencies while diversifying in multiple assets.

Global accounts allow families to have one central account which decreases the risk of foreign currency fluctuations, provides easier control over multiple currencies, and simplifies compliance with the local laws.

These accounts are best for families that are internationally mobile and want to achieve protection and diversification of their assets along with the income to be preserved for the future.

Consolidated accounts enable families to control their wealth and manage the assets strategically to react to changes in the market. Global accounts are great for wealth preservation and intergenerational wealth management.

Features Global Investment Accounts

- Multi-Currency Access: Facilitates investment in different currencies.

- Diversification: Provides access to different countries and varied assets.

- Centralized Reporting: Makes compliance easy, and provides excellent transparency.

- Liquidity and Flexibility: Allows easy access and movement of funds on a worldwide basis.

8. Residency & Citizenship Programs

Residency and Citizenship Programs have also become popular and they give affluent families legal status for residency in multiple countries.

This provides unique tax planning, mobility, and international business advancement opportunities.

Such programs will usually require an investment in real estate, business ventures, or government bonds. This allows families to avoid bankrupt and safeguard innovative succession routes.

Multinational families can optimize estate planning systemically by strategically selecting jurisdictions for inheritance or tax purposes.

These programs also enhance travel mobility and legal rights for supporting family members. These programs have become an effective means of balancing intergenerational wealth.

Features Residency & Citizenship Programs

- Legal Mobility: Offers the grant of residency and citizenship to a number of countries.

- Tax Planning: Provides the opportunity to choose jurisdictions that have tax advantages.

- Risk Diversification: Offers protected and secured assets and families from political and economic turmoil.

- Lifestyle & Security: Quality of life is enhanced with access to improved education and healthcare which leads to better security.

9. International Pension Plans

International pension plans are retirement strategies for globally mobile families. They facilitate tax-efficient retirement savings across multiple countries.

This plan allows investments in numerous currencies while providing flexibility in payment options. International pensions lessen the impact of local changes in regulations or political risks.

They neatly fit with other wealth structures such as trusts and holding companies to ensure seamless retirement planning.

Families are able to receive custom plans that focus on maximizing growth and wealth transfers across generations while reducing tax liability. This is especially true for multi-national families that desire long term financial security.

Features International Pension Plans

- Tax Efficiency: Contributions and growth may benefit from favorable tax treatment.

- Cross-Border Flexibility: Can manage pensions across multiple countries.

- Currency Diversification: Supports investments in different currencies.

- Long-Term Security: Ensures retirement income and intergenerational wealth transfer.

10. Cross-Border Estate Planning Structures

Cross border estate planning structures involve the use of several strategies including legal, governance, and wealth protection tools to customize protection strategies for wealth across borders.

Structures and tools used include trusts, foundations, holding companies, wills to eliminate entry of estate to judicial process of different jurisdictions, minimize inheritance tax, and ensure legal succession of the wealth.

The structures also address complex family dynamics, multi currency assets, and international investments. They reduce probate risks and maintain confidentiality.

Families are able to coordinate the global assets and estate planning to preserve wealth and adapt to legislative changes.

Efficiency and secure strategies for cross border estate planning are of more importance to multi-national families for planning wealth transfer, and flexibility for multi Generational.

Features Cross-Border Estate Planning Structures

- Integrated Planning: Combines trusts, foundations, and wills for global asset management.

- Tax Optimization: Minimizes inheritance taxes and compliance costs across jurisdictions.

- Succession Security: Ensures orderly transfer of assets to beneficiaries.

- Legal Compliance: Adapts to laws in multiple countries for multi-national families.

Conclusion

To summarize, multi-national families take advantage of a unique variety of cross-border wealth containers – trusts, foundations, family offices, holding companies, and more – that provide asset protection, tax efficiency, succession planning, and global flexibility.

The strategic combination of these structures offers families the ability to preserve wealth, the ability to seamlessly transfer wealth to the next generation

And the ability to meet legal compliance across multiple jurisdictions. This enables families to maintain the financial freedom and legacy all over the world.

FAQ

What is a cross-border wealth container?

A legal or financial structure that helps multi-national families manage, protect, and transfer assets across different countries.

Why are international trusts important?

They provide asset protection, tax planning, and flexible succession strategies for families with global assets.

How do private foundations benefit families?

They preserve wealth, support philanthropy, and maintain family governance across generations.

What role does a family office play?

It centralizes wealth management, investments, legal, and lifestyle administration for global families.

How do holding companies help in wealth management?

They consolidate assets, reduce liability, streamline succession, and optimize taxes internationally.