In this article, I will discuss the Best Crypto Cards in Singapore, examining various opportunities available for crypto enthusiasts to spend.

From earning cashback on your spending to high limits and low fees, I will guide you through choosing the card that suits your needs.

It does not matter if you are an experienced investor or just starting, there is a card for everyone.

Key Point & Best Crypto Cards in Singapore List

| Card Name | Key Point |

|---|---|

| Crypto.com Visa Card | Offers up to 5% cashback; tiers based on CRO staking amount. |

| Swipe Visa Debit Card | Supports multiple cryptocurrencies with instant conversion at spending. |

| Nexo Card | Earn up to 2% cashback; uses crypto as collateral, keeping assets intact. |

| Wirex Card | Provides up to 8% cashback in crypto and supports both fiat and crypto. |

| PlasBit Crypto Card | Offers high spending limits with privacy-focused features for crypto users. |

| Coinbase Card | Allows spending crypto directly from Coinbase wallet with up to 4% rewards. |

| CoinJar Card | A prepaid Mastercard; supports multiple crypto-to-fiat conversions. |

| Bitpanda Card | Enables spending of crypto, stocks, or metals with real-time conversion. |

| Crypto.com Pay | A payment feature to spend crypto at merchants without needing a card. |

| Kraken Card | Offers competitive cashback rewards while integrating with Kraken accounts. |

10 Best Crypto Cards in Singapore in 2025

1. Crypto.com Visa Card

The Crypto.com Visa Card is regarded as one of the best crypto cards in Singapore, and indeed, there are advanced features that allow users to earn up to 5% cashback on purchases.

This card has several membership tiers based on CRO staking, and each allows the user to enjoy increasing rewards, such as rebates on Netflix and Spotify.

It also features an instant crypto-to-fiat exchange, allowing for easy daily transactions. It does not charge annual fees, and its acceptance is widespread through Visa in more than 200 countries, making it an ideal card for all crypto holders and users.

Pros & Cons Crypto.com Visa Card

Pros:

- Airport lounges are some of the amenities offered to cardholders.

- Multiple Cryptocurrencies can be used for payments.

- There are different tiers of rewards available for CRO staking.

Cons:

- Requirements of high staking for higher amounts.

- Some card types charge transaction fees.

- To new lower tiers, points begin to fall after the first calendar year.

2. Swipe Visa Debit Card

The Swipe Visa Debit Card is a superb way of using cryptocurrencies as it allows instant conversion to fiat or any other currency at the point of sale, thus eliminating the hurdles of crypto spending.

It has the Swipe Wallet, allowing integration with multiple cryptos and enabling users to keep their assets efficiently.

The card has also been upgraded to allow purchasing at the user’s stake level and giving cashback for their purchases.

Its interface is easy to use, and its global acceptance allows the Swipe Visa Debit Card to be used conveniently, making it fantastic for cryptocurrency users in Singapore.

Pros & Cons Swipe Visa Debit Card

Pros:

- Easily convert crypto into local currencies at the time of purchase.

- Users have access to multiple cryptocurrencies during their spending.

- Free of charge, including setup and maintenance for basic customers.

Cons:

- Compared to some of the other cards, the cashback returns currently have a limit.

- Only some regions have access to the card.

- Stake requirements for maximum rewards are greater than 84%.

3. Nexo Card

The Nexo Card has quite an interesting feature in that it enables users to use their crypto without having to liquidate it.

It liquidates using crypto assets and provides instant credit, meaning the user owns what he has.

The card even offers cashback rewards at 2% in either NEXO Tokens or Bitcoin, depending on which side you spend.

Ideal for long-term holders of crypto assets who want to use their cards without fear of losing the value of their assets, the Nexo Card has no monthly or annual fees and can be used across the globe.

Pros & Cons Nexo Card

Pros:

- Do not sell all crypto assets first to get liquidity on cards.

- Payments are made on the cashback in NEXO tokens.

- Options for competitive credit lines are ample.

Cons:

- Without proper collateral, crypto is a necessity.

- A limited number of coins are offered as lending collateral.

- Non-collateralized loans have a higher cost than collateralized loans.

4. Wirex Card

The main advantage of the Wirex card is that it allows users to spend cryptocurrency and fiat with the added beauty of further accruing up to 8% in WXT tokens.

You will be able to perform smooth transactions in different currencies. The card is best suited for travelers and crypto users because of its lower transaction fees and favorable currency exchange rates in real time.

They are also widely accepted in most places worldwide, including Singapore, so it is easy to use them without worrying about going to buy goods in different countries.

Pros & Cons Wirex Card

Pros:

- Aside from managing one’s crypto holdings, users also receive high cashback rates in WXT tokens.

- Both fiat and crypto assets can be managed with ease.

- There is support for several crypto wallets.

Cons:

- WXT token users can only earn cashback on select categories.

- Currency exchanges are subject to certain fees.

- More WXT needs to be staked to earn more rewards.

5. Plasbit Crypto Card

With heightened privacy, the Plasbit Crypto Card aims to promote large spending limits among crypto users.

Thus, it permits a wide range of cryptocurrencies at real-time exchange rates when one is purchasing.

The card suits users who want to maintain financial confidentiality while purchasing from anywhere.

One of the reasons why Plasbit is securing a large base of clients is its emphasis on security and privacy compared to other crypto cards, especially in Singapore, where people value privacy and control in their financial dealings.

Pros & Cons Plasbit Crypto Card

Pros:

- Unusually high limits on spending for premium customers.

- Robust privacy and anonymity features.

- Crypto flexibility with multiple integrated supports.

Cons:

- Higher stakes are necessary for enhanced features.

- Does not support all geographical locations.

- Poor customer support availability.

6. Coinbase Card

The virtual currencies stored in the Coinbase Wallet can be directly used with the Coinbase Card.

Up to 4 percent rewards on crypto, including Ethereum and Bitcoin, are offered as cashback. Such a feature eliminates the need for users to intervene while making purchases manually, ensuring ease of use.

Apart from being widely accepted, the card is well incorporated with Coinbase and, therefore, is useful for users based in Singapore who wish to spend their digital currencies in day-to-day transactions.

Pros & Cons Coinbase Card

Pros:

- With an active Coinbase account, getting funds is easier.

- Purchase seamlessly converts from crypto to fiat.

- End users have access to several crypto coins.

Cons:

- Adding transaction fees on the conversion of currencies.

- Currently only available for users in the United States.

- Infinite options for cashback rewards are not available.

7. CoinJar Card

The CoinJar Card lets users utilize their Bitcoins, Ethereum, and other currencies in real time.

It transforms coins into cash, making it simple to use. CoinJar ensures that no monthly charges are applicable for holders who possess the card.

CoinJar makes it easy for users to tame inflation as it is available globally. Everything in Asia seems to stay fuelled by the long-established reputation of CoinJar in the region, taking its roots in Australia.

CoinJar is likely very popular among Singaporeans who are considering cryptocurrency due to its simplicity.

Pros & Cons CoinJar Card

Pros:

- Quick and easy setup without any monthly fees.

- Global Payments via Mastercard Support.

- Cryptocurrency is converted to fiat currency without delay.

Cons:

- Very finite reward scheme.

- May charge higher transaction fees in certain situations.

- Digital assets support is not very detailed.

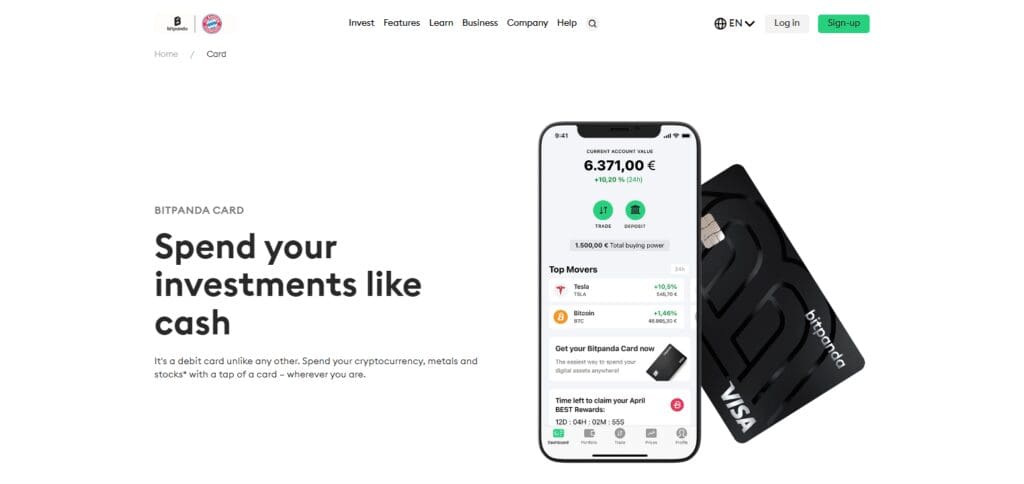

8. Bitpanda Card

BitPanda Card bit traditionally enables users to spend their assets in cryptocurrency, stocks, and even precious coins, but with coin limitations.

The card integrates the power of technology when making a payment. The Bitpanda card gives you a seamless spending experience that includes real-time viewing of your assets and earning rewards.

Moreover, the card is underlined by Mastercard, and the reach is enabled by their network.

All this, in a bear-free environment, has made the Bitpanda Card suitable for users who reside in Singapore and are looking for easy financial access.

Pros & Cons Bitpanda Card

Pros:

- Assets can be managed in a single interface through the integration with Bitpanda.

- Immediate conversion between crypto and fiat currency.

- The range of accepted asset types is extensive.

Cons:

- On select transactions, fees are charged.

- For maximum benefits, a very high trading volume is a prerequisite.

- Available in a few countries only.

9. Crypto.com Pay

With Crypto.com Pay, users can use cryptocurrencies without conventional banking methods or a card.

This method is useful for Singaporeans who wish to make various online and offline purchases with crypto.

This feature links with merchants worldwide, allowing users to pay directly using their crypto.

Additionally, Crypto.com Pay is able to provide cashback and discounts, which means it is a great option for individuals looking to combine cryptocurrencies with their shopping.

Pros & Cons Crypto.com Pay

Pros:

- Supports crypto payments without a physical card being issued.

- Offers discounts on certain types of merchant transactions.

- If the merchant’s company accepts crypto, no transaction conversion fees apply.

Cons:

- For customers that do not possess a Crypto.com card, functionality is limited.

- The rewards are ordinarily lower than those offered by card-based systems.

- It is not fully operational without participation from the merchant.

10. Kraken Card

The Kraken Card is a cost-effective card that is widely accepted around the world. Considering that this card requires relatively low fees, it is suitable for Singaporeans looking to utilize their Kraken accounts but have a seamless payment experience.

The Kraken Card consists of various cryptocurrencies and allows users to use this card to earn cashback.

Furthermore, with the global endorsement from Visa, this card is perfect for those who wish to maximize the rewards on their daily purchases.

Pros & Cons Kraken Card

Pros:

- Supports seamless integration with the Kraken exchange (for buying and selling crypto).

- Customers can get cashback rewards for spending in selected cryptocurrencies.

- Acceptable across the globe via the established Visa network.

Cons:

- There are few options for reward choices.

- Holding a current Kraken account is a requirement.

- May have withdrawal limitations.

How to Choose the Best Crypto Cards in Singapore

Supported Cryptocurrencies

It’s worth checking whether crypto cards support Bitcoin, Ethereum, stablecoins, or any other currencies you mostly use in your transactions. The more they have, the better to spend.

Rewards and Cashback

Different cards come with varying rewards, cash back, and offers. For instance, the Crypto.com Visa card & Wirex Card offer 5%-8% cash back.

Fees and Charges

Look out for monthly, annual, and transaction fees. Try to find cards with as little forex fees as they can get and other fees as well.

Spending Limits

Depending on your spending habits, choose a card with limits you think you’ll need. For example, the PlasBit card has high spending limits.

Ease of Use

Select cards that have better integration with wallets and mobile applications. Some cards, such as the Coinbase and Kraken, offer an easier experience.

Security and Privacy

Selecting cards with higher security and privacy features, such as the PlasBit Crypto Card, is important.

Global Acceptance

Ensure the card is accepted in multiple regions, especially places with various payment options, including Visa or Mastercard.

Collateral Options

Some crypto cards, e.g., the Nexo card, allow users to borrow against their crypto assets without having to sell them.

Real-Time Conversion

Look for cards that allow faster conversions of crypto to fiat at the point of sale to make purchases quicker.

Conclusion

Selecting the best crypto card in Singapore is ranked by the coins supported, rewards offered, fees incurred, and international acceptance.

For lucrative cashback offers along with wide cryptocurrency support, many users opt for a Wirex Card, while others have a crypto.com Visa Card as their choice.

If high privacy is required or a high spending level is desired, the PlasBit Card and Nexo Card are strong options.

For those who wish to use their crypto easily on daily expenses, Coinbase and Kraken Cards are the most appropriate.

Still, the primary consideration when deciding which card to choose is your particular needs, such as low charges, worldwide coverage, or incentivizing rewards.