In this article, I will discuss the Best crypto ETF by performance Bitcoin ETFs, these share funds allow investors to access the cryptocurrency market without the complexities that come with holding the assets directly.

This guide analyzes returns, fees, and structure to present the most crypto-strong crypto ETFs for dependable performance alongside enduring value that caters to seasoned and novice investors.

Key Point & Best crypto ETF by performance List

| ETF Name | Key Point |

|---|---|

| Fidelity Wise Origin Bitcoin Trust (FBTC) | Offers direct exposure to Bitcoin with Fidelity’s trusted brand backing. |

| Grayscale Bitcoin Trust (GBTC) | One of the first Bitcoin investment vehicles, now converted to an ETF. |

| iShares Bitcoin Trust ETF (IBIT) | Managed by BlackRock, ensuring deep institutional support. |

| ProShares Bitcoin Strategy ETF (BITO) | First U.S. ETF to offer Bitcoin futures exposure. |

| Global X 21Shares Bitcoin ETF (EBTC) | Combines Global X’s reach with 21Shares’ crypto expertise. |

| Bitwise Bitcoin ETF (BITB) | Known for low fees and daily Bitcoin holdings transparency. |

| Invesco Alerian Galaxy Crypto Economy ETF (SATO) | Offers diversified exposure to crypto stocks and blockchain tech. |

| ARK 21Shares Bitcoin ETF (ARKB) | Backed by Cathie Wood, focuses on innovation in the crypto space. |

| VanEck Bitcoin ETF (VBTC) | Aims for cost-effective Bitcoin access with trusted fund management. |

| Global X Blockchain & Bitcoin Strategy ETF (BITS) | Mixes Bitcoin futures with blockchain-related equities. |

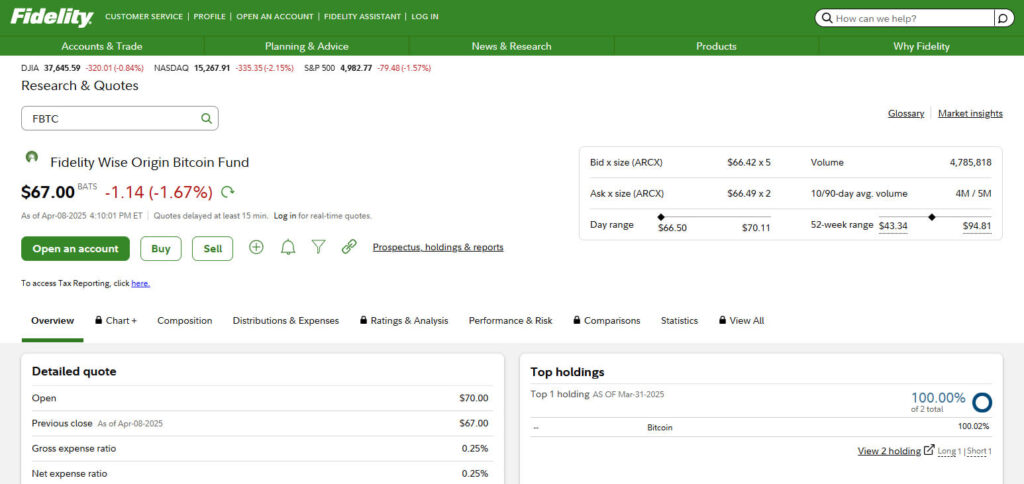

1.Fidelity Wise Origin Bitcoin Trust (FBTC)

Fidelity Wise Origin Bitcoin Trust (FBTC) remains the top performing crypto ETF because of its effective framework, low costs, and FBTC’s direct exposure to Bitcoin.

With Fidelity’s support, infrastructure, and institutional trust, FBTC minimizes tracking errors and maximizes returns by holding Bitcoin.

Its actual strength lies in efficient trading and liquidity, which improves market participation. Such performance, transparency, and support from a financial powerhouse gives FBTC an edge over other crypto ETFs.

Fidelity Wise Origin Bitcoin Trust (FBTC) Features

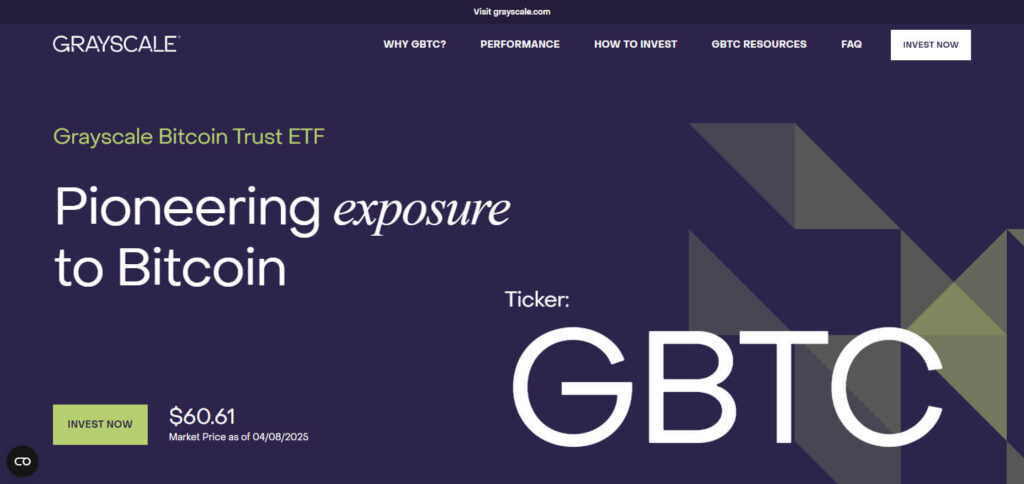

2.Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust (GBTC) grabs attention as the most successful crypto ETF because of its early entry to the market and large asset base. It achieved greater pricing efficiency and liquidity after becoming a spot Bitcoin ETF, generating institutional interest.

GBTC’s main differentiator is its crypto market history, providing investors historical performance data and familiar market insights. This strengthens the argument that GBTC will consistently and reliably perform like other Bitcoin ETFs, thanks to its legacy advantage and substantial scale.

Grayscale Bitcoin Trust (GBTC) Features

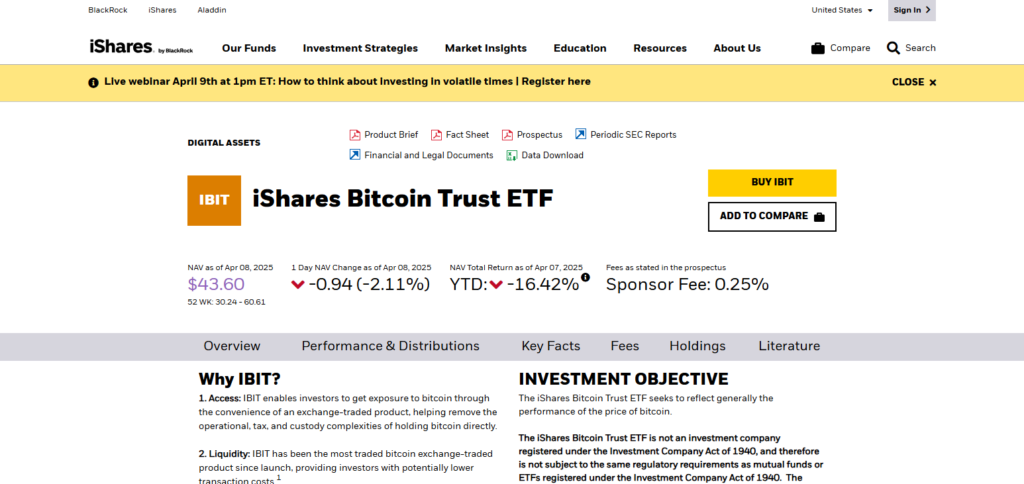

3.iShares Bitcoin Trust ETF (IBIT)

The new iShares Bitcoin Trust ETF IBIT created by BlackRock has risen to the top of crypto ETF performance because of its growing assets and institutional trust. Its unique selling point is iShares’ Bitcoin Trust ETF assets proliferating at a breathtaking pace.

IBIT enjoys the competing advantage of Bitcoin possessing strong custodial protection and strategic access to the markets, which allows low-cost exposure to Bitcoin. This blend of custodial trust, Bitcoin’s market capture potential, and the pace at which IBIT is adopted is remarkable, only making those ETFs outperform the others.

iShares Bitcoin Trust ETF (IBIT) Features

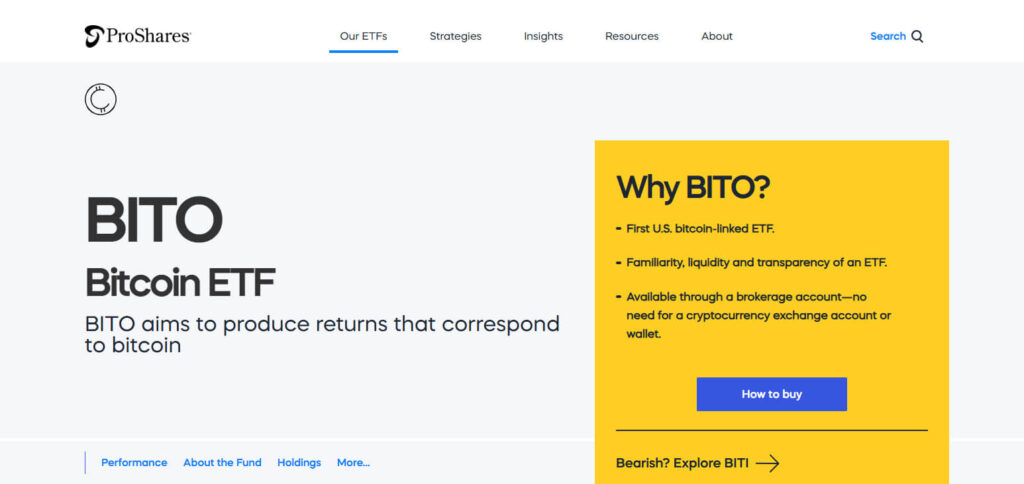

4.ProShares Bitcoin Strategy ETF (BITO)

The ProShares Bitcoin Strategy ETF (BITO) differentiates itself as a leading crypto ETF due to being the first U.S. Bitcoin futures ETF. Its very advantage stems from allowing regulated access to Bitcoin via futures contracts for investors who cannot directly hold crypto.

BITO’s deep liquidity and daily trading volume further its ability to facilitate seamless trading. Its launch on the market ahead of other options and sustained performance makes it attractive for investors wanting to utilize a futures approach to Bitcoin investing.

ProShares Bitcoin Strategy ETF (BITO) Features

5.Global X 21Shares Bitcoin ETF (EBTC)

Global X 21Shares Bitcoin ETF (EBTC) is integrating the proprietary crypto-focused approaches of 21Shares with the expansive reach of Global X, thus positioning itself as a top-performing crypto ETF.

Its distinguishing feature is the emphasis on providing direct exposure to Bitcoin through a dual-brand partnership that enhances trust.

EBTC is well known to have strong technical execution, investor-friendly costs, and increasing appeal among institutions, thus making it stand out for accessing dependable, performance-oriented Bitcoin investments.

Global X 21Shares Bitcoin ETF (EBTC) Features

6.Bitwise Bitcoin ETF (BITB)

Bitwise Bitcoin ETF (BITB’s) is ranked among the best performing crypto ETFs and BITB leads the comparison due to its transparency and cost effectiveness.

It sets a new record in the industry by daily reporting Bitcoin wallet addresses, thereby asserting transparency. Transparency unmatched anywhere BITB’s unique strength is greatly building confidence and accountability.

Transparency along with low fees and cost efficient tracking of Bitcoin’s spot price provided by BITB enables the ETF to sustain high performance trade results for investors, whether institutional or retail.

Bitwise Bitcoin ETF (BITB) Features

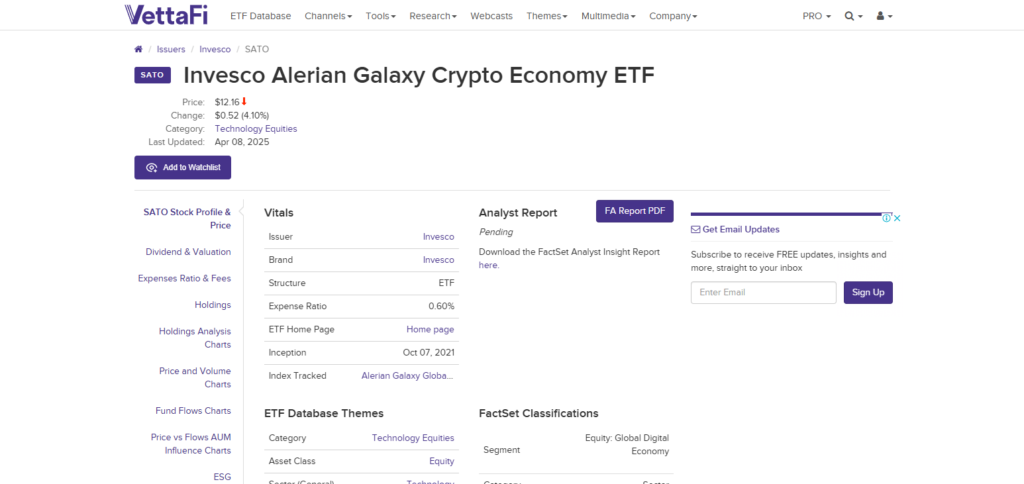

7.Invesco Alerian Galaxy Crypto Economy ETF (SATO)

Invesco Alerian Galaxy Crypto Economy ETF (SATO) is reserved as one of the better performing crypto ETFs due to its exposure to both the crypto ecosystem and crypto-related companies.

The ETF’s distinguishing feature is providing access to the entire breadth of the crypto economy by integrating digital assets with equities, which have traditionally been associated with economic growth.

The strong performance of SATO stems from its ability to derive value not only from cryptocurrencies but also from the relentless adoption of blockchain technology, making it an adaptable ETF option within the crypto ETF market.

Invesco Alerian Galaxy Crypto Economy ETF (SATO) Features

8.ARK 21Shares Bitcoin ETF (ARKB)

Notable ETF accounts including the ARKB managed by ARK Invest and 21shares were built off the speculative foresight of Cathie Woods and her affiliates, which gave 21shares direct access to bitcoin, making it one of the most effective performing crypto ETFs.

21shares takes pride in their active research driven methodology and aggressive, bullish stance towards digital assets. This allows growth centric investors to gain the long desired advantage over institutional grade security ARKB delivers.

ARK 21Shares Bitcoin ETF (ARKB) Features

9.VanEck Bitcoin ETF (VBTC)

VanEck Bitcoin ETF (VBTC) has emerged as a leader among crypto ETFs due to its low fees and efficiency. VBTC’s greatest advantage is its focus on expenses while preserving both security and performance.

It directly exposes investors to Bitcoin and employs a simple investment process, which is ideal for individual as well as institutional investors. Given VanEck’s history in managing innovative financial products, VBTC, amid the growing competition in the crypto ETF market, has been the reliable performer and value creator, earning VanEck’s reputation.

VanEck Bitcoin ETF (VBTC) Features

10.Global X Blockchain & Bitcoin Strategy ETF (BITS)

The Global X Blockchain & Bitcoin Strategy ETF (BITS)’s distinguishing feature is its dual exposure to Bitcoin futures and Bitcoin-related stocks. Investing can be done in digital assets as well as in the blockchain ecosystem because this combination is unique.

BITS, which is actively managed, attempts to balance these exposures to achieve appreciation of capital in the long run. This form of investment provides ample opportunity to gain in the ever-changing world of cryptocurrency by targeting investors who want full coverage through a single investment.

Global X Blockchain & Bitcoin Strategy ETF (BITS) Features

Conclusion

To sum up, the key differentiators of the highest-performing crypto ETFs are their efficient structure, low fees, and novel access to Bitcoin and the blockchain technology “s” ecosystem. From direct Bitcoin custody to futures contracts and crypto asset ETFs, each ETF has its highlights.

Some outperform their peers in scale and transparency, such as FBTC, IBIT, and GBTC, while others like ARKB and SATO offer more disruptive thinking. As with any investment, the choice of ETF is determined by one’s investment objectives, the level of risk acceptable, and the preference for direct vs. diversified crypto exposure.