In this article, we analyze the best crypto exchanges in Germany and explain their characteristics, fee systems, and security levels.

We will also take into account user-friendly interfaces, compliance with regulations, and trading pairs offered so that you can choose wisely based on information.

Key Point & Exchanges List

| Exchange | Key Point |

|---|---|

| Bitrue | Bitrue is a crypto exchange that supports a wide range of assets and offers features like yield farming and lending |

| Bitvavo | Low trading fees and a wide variety of supported cryptocurrencies |

| Bitpanda | User-friendly interface with multiple investment options |

| Coinmetro | Advanced trading tools and fiat support |

| Trade Republic | Mobile-focused trading with zero commission |

| Bison | Regulated by German authorities, ideal for beginners |

| Relai | Easy Bitcoin purchases via a mobile app |

| BSDEX | Direct integration with German bank accounts |

| Scalable Capital | Combines crypto trading with traditional investment options |

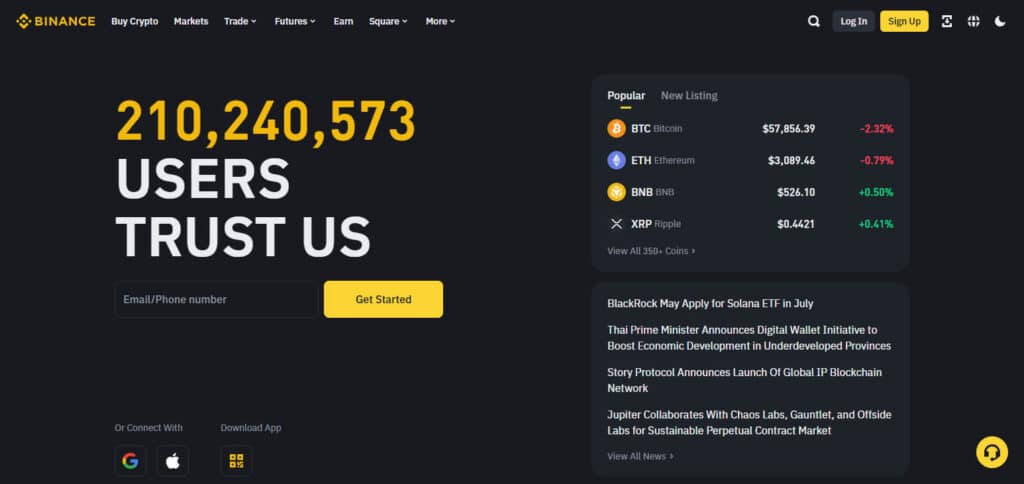

| Binance | Largest exchange by volume with extensive features |

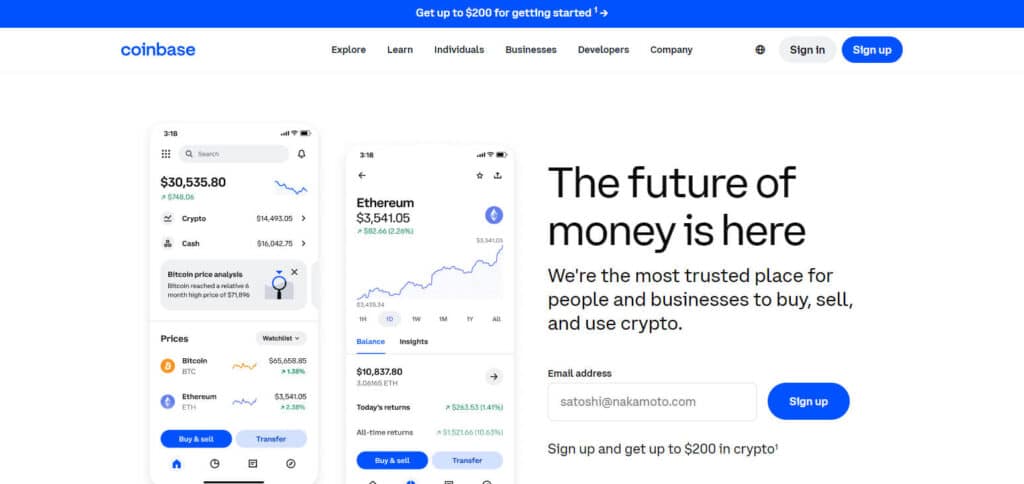

| Coinbase | High security standards and ease of use for beginners |

11 Best Crypto Exchanges in Germany

1. Bitrue

Bitrue Crypto Exchange: Claim Your Share Of $12,000 Now!

Bitrue has shaken up the crypto market with their New Users Campaign, where they are giving away $12,000 just for making your first Futures Trade!

It’s as easy as it sounds—if you trade over $250 in Futures, you are rewarded by randomly being selected for a token airdrop worth anywhere from $5 – $20. For new or seasoned trades alike, this is a great opportunity to earn free crypto while utilizing Bitrue’s powerful trading platform.

? What to consider when Joining Bitrue:

✅ Welcome gifts for new Signups

✅ Zero hassle when it comes to security and Futures trading

✅ Great fee structure with high liquidity

What are you waiting for? Go grab your free airdrop today! If you haven’t yet signed up, do it with my link and start trading straight away:

2. Bitvavo

Bitvavo is the best crypto exchange in Germany because it offers cheap trade charges, a wide range of supported cryptocurrencies, and an easy-to-use platform.

The Dutch Central Bank supervises it, so its practices are very safe, and beginners and veterans alike trust Bitvavo.

Among these features is the flawless integration with European bank accounts, which allows for simple depositing and withdrawing, as well as the possibility of many types of trades, including basic purchases or more advanced trading tools.

Bitvavo Pros & Cons

Pros

- A Wide Range of Cryptocurrencies to Choose From: This platform offers a broad spectrum of different virtual currencies.

- Cheap Trading Charges: An affordable fee system aimed at reducing costs for traders.

- Simple to Use: A clear-cut, easy-to-understand interface suitable for any user regardless of their experience.

- The Liquidity Is High: Facilitates smooth and fast transactions.

- It is Regulated: It complies with Dutch Central Bank regulations, hence ensuring a safer trading environment.

- Twenty-Four Hour Customer Support: Responsive customer service that can be reached at any time

Cons

- Few Advanced Trading Tools Available: Professional traders may not have all the necessary tools to trade profitably on this platform.

- Geographical Limitations: Various services and options may be blocked for people who reside outside Europe;

- Charges for Withdrawing Funds: Withdrawal fees are levied on users who transfer their digital assets to external wallets.

- No Leverage Trading: The investor is restricted in terms of possible moves while carrying out market operations within the system since it does not suggest margin trading;

- Mobile Version Does Not Fully Function as Desktop App: Some features in the mobile version are missing.

3. Bitpanda

Bitpanda is the most well-known cryptocurrency exchange due to its easy-to-use interface and numerous investment opportunities.

It provides a versatile range of cryptocurrencies, metals, and ETFs, which means it can be used for any type of investment strategy, either if you are a complete newbie or an experienced trader.

Bitpanda’s strict safety precautions, combined with its obedience to regulations, have created a secure trading space.

Moreover, one thing that sets Bitpanda apart from other exchanges is its integration with banks throughout Europe, so transactions are always seamless, especially when dealing with money from within Germany itself, as this country’s financial institutions work hand-in-hand alongside them, too.

Bitpanda Pros & Cons

Pros

- Revolutionary Savings Plans: It features automatic savings plans for regular investments to boost the long-term growth of portfolios.

- Bitpanda Card: This is a debit card linked to your account, which you can use to spend your crypto assets quickly.

- Educational Resources: Offers comprehensive tutorials and courses to assist users in understanding cryptocurrencies.

- Instant Transactions: These ensure quick, hassle-free transactions that make it easy to invest or withdraw money on time.

Cons

- Higher Fees for Certain Transactions: Instant purchases and some payment methods are more expensive than others.

- Complex Fee Structure: New users may find the fee structure somewhat confusing.

- Verification Process: For some people, the verification process is cumbersome and takes too much time.

4. Coinmetro

Coinmetro is recognized as a top digital money exchange in Deutschland since it provides state-of-the-art tools for trade and fiat currency support.

It has many things for beginners and experts alike, with user-friendly interfaces and refined trading options.

The platform ensures safety first by being secure, reliable, and adhering to regulations at all times.

Coinmetro offers competitive fees combined with a great customer experience, making it the perfect place to trade crypto in Germany.

Coinmetro Pros & Cons

Pros

- Transparent Fee Structure: It allows users to comprehend costs easily by providing a clear fee schedule.

- Regulated and Secure: It has an absolute license and complies with strict regulatory standards to enhance the security of its platform.

- Fiat Gateway: This enables it to offer seamless support for fiat currencies to make deposits and withdrawals easy.

- Staking Rewards: It lets users earn passive income by simply staking supported coins on site.

- Community-Driven: Its user base is highly engaged as it offers responsive customer service support and regular updates.

Cons

- Limited Cryptocurrency Selection: Compared to some larger exchanges, there are fewer cryptocurrencies available for trading here.

- Liquidity Issues: Certain pairs may have less liquidity, which can result in difficulties during large transactions between traders.

- No Mobile App: Lack of a dedicated mobile app compromises the experience of those who need to trade on the go

- Complex Interface: The advanced trading interface may be overwhelming for beginners.

5. Trade Republic

Trade Republic is a well-known cryptocurrency exchange in Germany that has gained popularity for its mobile-first strategy and commission-free trading system.

The user-friendly mobile application is designed to make trading easier for people who are always on the move.

Trade Republic prioritizes safety and follows all legal requirements related to crypto trading.

Moreover, the platform charges customers transparently and offers a wide range of investment options, which saves time and money for German crypto traders who want comfort.

Trade Republic Pros & Cons

Pros

Commission-Free Trading: This will allow users to trade digital currencies without paying any commission fees.

Savings Plans: Accordingly, it provides automated savings plans through which cryptocurrency investment can be made systematically.

Regulated by BaFin: This ensures that a safe and reliable platform that will follow Germany’s strict financial rules is in place.

Wide Asset Range: It also allows the user to access stocks, ETFs, and derivatives, among other things, to ensure diversified investing apart from cryptocurrencies.

Simple User Interface: It is an intuitive and user-friendly online platform for all levels of investors.

Cons:

Limited Cryptocurrency Selection: However, the selection of cryptocurrencies is smaller than that of other major exchanges.

Mobile-Only Platform: One important thing to note, though, is that this website is mainly optimized for mobile usage and, thus, isn’t very beneficial to desktop traders.

Restricted Trading Hours: Nevertheless, unlike all other sites with 24/7 Bitcoin trading hours, this site only has certain periods during which cryptocurrency trading may take place.

No Advanced Trading Features: Still, professional traders demand sophisticated trading tools and options which are lacking on this exchange

Slow Customer Support: In contrast to other platforms, customer support usually takes more time to respond.

6. Bison

Bison is often considered to be the best cryptocurrency exchange in Germany for beginners because of its easy-to-use interface, which has been created based on German authorities’ rules.

Börse Stuttgart, one of the largest stock exchanges in Germany, developed Bison; therefore, safety and credibility are guaranteed at the highest level possible.

This system charges no fees for trading operations and offers real-time market information together with feedback through the Coinroop tool.

What sets Bison apart from other platforms is its close ties with banks all over Germany, which enable fast money transfers onto or off of the site—this makes it very convenient when dealing with cryptocurrencies within Germany!

Bison Pros & Cons

Pros

Developed by Börse Stuttgart: It is supported by one of the biggest stock exchanges in Germany, which gives it a high level of trust and dependability.

No Hidden Fees: Transparent fee structure with no hidden costs that makes it easy for users to understand.

Crypto Radar: Its unique feature is that it analyzes social media and market data to provide market sentiment insights.

Tax Report Generation: Reporting cryptocurrency gains is simplified, as tax reports are automatically generated for users.

Beginner-Friendly: Created with an intuitive interface specifically for amateurs in trading, easing one into the system.

Cons

- Limited Cryptocurrency Options: Has a lower choice of digital currencies compared to other big exchanges.

- No Advanced Trading Features: Unlike some competitors, this product lacks features like margin trading or advanced order types.

- Mobile App Focus: Primarily tailored for mobile usage, this might make desktop traders disinterested.

- Limited International Availability: Its focus is mainly on Germany, but it is limitedly available to international users

- Withdrawal Limits. Some constitutions may limit the number of tokens that can be withdrawn at a time.

7. Relai

Relai, a crypto exchange in Germany, is well-known for its simplicity and focus on Bitcoin investment.

It can be accessed through an app that works on mobile devices, so users can buy Bitcoin straight from their banks without having to go through lengthy verification processes.

The directness of Relai’s system avoids the confusion common with other cryptocurrency exchanges, making it perfect for new users.

This application complies with European legislation by ensuring maximum safety and privacy protection.

Relai offers Germans an easy way to invest in Bitcoins without a minimum capital requirement.

Relai Pros & Cons

Pros:

- Developed by Börse Stuttgart: Guaranteed by one of Germany’s largest stock exchanges, providing trust and reliability.

- No Hidden Fees: Has a transparent fee structure without hidden charges that make it easy for users to understand.

- Crypto Radar: Provides a unique feature that analyzes social media and market data, which gives insight into market sentiment.

- Tax Report Generation: Automatically generates tax reports for users, thus simplifying the process of reporting cryptocurrency gains.

- Beginner-Friendly: Designed with an intuitive interface that caters specifically to novices, making it simple to get started.

Cons:

- Limited Cryptocurrency Options: Offers fewer cryptocurrencies than other major exchanges do

- No Advanced Trading Features. Does not have features such as margin trading and advanced order types.

- Mobile App Focus. Mainly designed for mobile use, which may not be attractive to those who prefer desktop trading.

- Limited International Availability. Mainly focused on the German market, with a limited presence outside Germany.

- Withdrawal Limits. It may restrict the amount of cryptocurrency that can be taken out at once.

8. BSDEX

BSDEX (Börse Stuttgart Digital Exchange) is a well-liked crypto exchange in Germany because it can integrate directly with banks there and has very strong regulations.

It was created by Börse Stuttgart, which is one of the biggest stock exchanges in Germany – this means that BSDEX offers high levels of safety and dependability for users.

The platform has clear pricing structures and low fees. It’s also easy to use, whether you’re new to or experienced in trading digital assets.

In order to trade cryptos safely within regulated environments like Germany’s, without any hassle over compliance issues while having good experiences doing so – this would be an appropriate choice.

BSDEX Pros & Cons

Strict Rules: Operates under the supervision of BaFin, the German financial regulator.

Clear Order Book: Users can view all buy and sell orders through a transparent order book, facilitating effective trading.

Integration with Solarisbank: BSDEX users can contact their Solarisbank accounts to facilitate quick fiat transactions.

No Hidden Charges: A simple fee structure with no hidden charges helps traders understand transaction fees.

Safekeeping Solutions: It provides custody services for cryptocurrency storage aimed at institutional clients with high-security levels.

Cons:

Limited Cryptocurrency Selection: It offers a smaller selection of currencies than other leading platforms for crypto trading.

No Mobile App: The lack of a mobile app may be inconvenient for those who prefer mobile trading.

Slow Transaction Speeds: Fiat transactions on this exchange may be slower than on some others.

Geographical Limitations: Services may be limited only to people from certain countries, thereby reducing their worldwide availability.

9. Scalable Capital

Being the best crypto exchange in Germany, Scalable Capital combines digital currency trading with traditional investment alternatives.

Scalable Capital has a user-friendly interface and automated wealth management services. With Scalable Capital, an investor is exposed to the entire package of investments.

Trustworthiness is key when it comes to investing; this platform guarantees security as well as compliance with regulations.

What sets this company apart from others is its competitive rates, variety of assets, and easy integration with any European bank account.

This makes it convenient for every German who wants to diversify their portfolio by adding cryptos alongside other investments available locally or internationally.

Scalable Capital Pros & Cons

Pros

- Automated Portfolio Management: This makes it easier for users to maintain a diversified portfolio as it offers automated investment management.

- Low-Cost Trading: The website has low-cost trading options, making it an inexpensive option for investors.

- User Education Resources: This platform provides very valuable educational resources to users to help them understand market trends and investment strategies.

- Wide Asset Range: Cryptocurrencies aside, stocks, bonds, and ETFs are supported, thus offering a wide asset range.

- Advanced Analytics: These advanced analytics and performance tracking tools offer users the opportunity to monitor and enhance their investments.

Cons:

- Limited Cryptocurrency Options: There are fewer cryptocurrencies available compared to dedicated crypto exchanges.

- No 24/7 Trading: Unlike other platforms, on which cryptocurrency trading may continue 24/7 all year round, on this platform, such transactions may be restricted to market hours only.

- Complex Platform for Beginners: Non-experts will find that the variety of investment opportunities and instruments is overwhelming them

- Account Minimums: Small investors might not be comfortable with a minimum account balance requirement.

- Slower Customer Support: Compared with other exchanges that have dedicated support teams, customer support response times might take longer.

10. Binance

Binance is an internationally acknowledged crypto exchange that has gained a strong foothold in Germany by offering a wide range of cryptocurrencies and advanced trading options.

It has more trading volume than any other exchange globally, allowing German users to access many diverse investment possibilities through different pairs of trades.

Among its features, this platform boasts tight security standards, an easy-to-use interface, and competitive transaction fees that make it one of the best places for trading digital coins.

In addition to these basic functions, Binane offers services such as staking, futures trading, and decentralized exchanges (DEX) that cater to both beginners and experienced traders.

With a good reputation backed up by comprehensive features like this one here, Binance remains among the most sought-after choices when it comes to finding reliable yet rich-in functionality platforms for dealing with cryptocurrencies in Germany.

Binance Capital Pros & Cons

Pros

- Wide Variety of Stakes: In which it offers an extensive range of staking options that will enable users to get passive income from their crypto assets.

- Advanced Security Measures: These involve using high-level security protocols like 2FA (two-factor authentication) and allowing listing on withdrawals, ensuring that accounts are not hacked.

- High Liquidity: This feature ensures deep liquidity across numerous trading pairs, allowing for huge trade volumes with negligible price impact.

- New Cryptocurrency Launchpad: Binance has a Launchpad that enables users to advertise promising cryptocurrency projects and token early sales.

Cons

- Complicated Interface: Given the large number of features and choices available, beginners may sometimes feel overwhelmed, making it difficult to use.

- Regulatory Uncertainty: It faces regulatory issues in multiple countries, which may interfere with its operations as well as user experience.

- Withdrawal Fees Paid: The first one is charged for withdrawing cryptocurrencies; thus, frequent traders would find themselves paying so much money in the long run

- Geographical Restrictions: Regulatory constraints may mean some features cannot be accessed or are unavailable in some regions.

11. Coinbase

Coinbase is considered one of the top crypto exchanges in Germany. It has a good reputation for being easy to use, having high-security standards, and complying with regulations.

Being recognized as a reliable service provider, it also ensures that buying, selling, or storing cryptos like Bitcoin and Ethereum are trouble-free on its platform.

The Germans can easily convert their fiat money into cryptocurrencies due to an uncomplicated fee system, which may be understood by beginners as well as experienced traders equally profitably.

To protect digital assets, Coinbase guarantees insurance coverage and meets all necessary legal requirements, thus making its security very tight. This will give peace of mind to any person who uses this platform regularly or occasionally knows about such things.

Thanks to the trustworthiness associated with this brand, along with its many features, Coinbase remains number one among other similar platforms in the German market where people trade bitcoins, etcetera.

Coinbase Capital Pros & Cons

- Wide Variety of Stakes: In which it offers an extensive range of staking options that will enable users to get passive income from their crypto assets.

- Advanced Security Measures: These involve the use of high-level security protocols like 2FA (two-factor authentication) and allowlisting on withdrawals, ensuring that hackers do not hack accounts.

- High Liquidity: This feature ensures deep liquidity across numerous trading pairs, allowing for huge trade volumes with negligible price impact.

- New Cryptocurrency Launchpad: Binance has a Launchpad here that enables users to access promising cryptocurrency projects and token sales early.

Cons:

- Complicated Interface: Given the large number of features and choices available, beginners may sometimes feel overwhelmed, making it difficult to use.

- Regulatory Uncertainty: It faces regulatory issues in multiple countries, which may interfere with its operations as well as user experience.

- Withdrawal Fees Paid: The first one is charged for withdrawing cryptocurrencies; thus, frequent traders would find themselves paying so much money in the long run

- Geographical Restrictions: Regulatory constraints may mean some features cannot be accessed or are unavailable in some regions.

How To Choose the Best Crypto Exchange in Germany?

To select the most suitable crypto exchange in Germany, you need to consider several crucial factors. It should be a good match for your trading needs and preferences.

Security and Regulation: Opt for exchanges regulated by reputable bodies like BaFin (Germany’s financial regulator) to ensure the safety of your funds and information about you.

Supported Cryptocurrencies: Determine if the platform supports different cryptos that you want to trade or invest in.

Fees and Costs: The fees charged on trades, deposit, and withdrawal rates, as well as any other hidden costs when using the platform, should be examined.

User Experience: Evaluate how easy it is to use the site, especially if you are new. It will simplify trading if it has a user-friendly interface.

Liquidity: Exchanges with high liquidity should be chosen because they guarantee smooth and efficient transactions, particularly for large orders.

Customer Support: Consider an exchange that has a responsive customer support team that can address your problem immediately after reporting them

Security Features: Find out what security measures have been put in place, such as 2FA (two-factor authentication), cold storage for funds, and insurance coverage on digital assets.

Additional Features: Some exchanges offer advanced trading tools, mobile applications, educational materials, or staking options. Assess these based on your trading preferences.

Reviews and Reputation: Look for user reviews and their image within the cryptocurrency community to determine whether they are reliable enough.

Geographic Restrictions: Make sure it is available in Germany without breaking any German law since some features may differ depending on your locality.

By considering these factors carefully, you can choose a crypto exchange in Germany that best suits your trading goals, risk appetite, and experience level.

Conclusion

Therefore, the choice of the ultimate crypto exchange in Germany depends on several major factors, including safety, legal compliance, transaction charges, and usage qualities.

Thus, investing in exchanges with strong security solutions, many cryptocurrencies available, low costs, and good-looking sites for users to trade from can provide a map of the volatile world of cryptocurrency.

In order to have an uninterrupted and secure trading experience, it’s important to perform thorough research on each platform based on personal investment objectives. This will guide you toward the most appropriate one that suits your needs.