In this article, I will look at the Best Crypto Portfolio Rebalancing Tools that enable asset allocation for the crypto investors. These tools help in almost automatically rebalance holdings with respect to market activity so as to mitigate risks and enhance profits.

Whether you are a buy-and-hold crypto investor or an active day trader, having the right tool for rebalancing could improve your portfolio. I will outline the top options, focusing on the key features, benefits, and useful tips regarding specific tools that will help in portfolio management. Let’s explore the best tools for portfolio rebalancing.

| Platform | Key Features |

|---|---|

| Quantum AI | AI-powered trading, automation, market analysis |

| Altrady | Smart trading tools, portfolio management |

| Coinigy | Multi-exchange access, charting tools |

| CoinLedger | Crypto tax reporting, portfolio tracking |

| CoinGecko | Price tracking, market analysis, research tools |

| Crypto.com | Trading, staking, Visa card, DeFi services |

| Kubera | Net worth tracking, investment insights |

| CoinStats | Multi-platform tracking, analytics |

| Delta Investment Tracker | Multi-asset tracking, real-time updates |

| Token Metrics | AI-driven insights, token ratings |

1. Quantum AI

Crypto portfolio rebalancing is done automatically through advanced algorithms and machine learning by Quantum AI. It allocates asset allocation by studying fluctuations in the market and user controlled risk factors.

The platform trades on multiple exchanges, ensuring the portfolio meets the set strategies. It enhances returns by making real-time changes to the portfolio, reducing emotional decisions.

Its predictive analytics can adjust to market changes, providing the user a hands off approach to maintaining target allocations.

Quantum AI Features

- AI-based trading algorithms

- Execution of trades without manual intervention on multiple platforms

- Market surveillance with instant updates

- Movement forecasting in digital currencies

- Risk management settings adjusted individually

- Old data tool applicable for strategy checks

- Adaptation of the market through machine learning

2. Altrady

Altrady helps with portfolio tracking, and multi exchange trading with its terminal. Users are able to seamless perform rebalancing with ease. It comes with “Smart Terminal” which makes it easy to mix and match liquidity when allocating, making arbitrage and diversification easier.

Sophisticated charts and risk management tools enable traders to maintain their portfolios while capturing market opportunities. Traders who require accuracy and control will find it satisfactory.

Altrady Features

- Trilateral trading on (Binance, Coinbase, etc.)

- Integrated bots for trading and tools for trade automation

- Dashboard for monitoring Portfolio’s returns

- Notifications and alerts on price changes

- Personalization of trade screen design

- Arbitrage market opportunity scanner

3. Coinigy

Coinigy provides in depth portfolio and chart management on 45+ exchanges. Portfolio analytics, price alerts, and trade automation through APIs are some of the features of its rebalancing tools.

Users can monitor performance analytics with the help of indicators to optimize their investment. It’s appealing to traders who are more data driven because the platform’s unified interface automatically makes diversification easy.

Coinigy Features

- Single platform supporting 45+ cryptocurrency exchanges

- Detailed drawings accompanied with more than 75 indicators

- Tools for locating arbitrage opportunities

- tracking portfolios in multiple wallets

- Evaluation of historical data for Bitcoin and Ethereum

- Trading while integrated with stop-loss or take profit orders

4. CoinLedger

CoinLedger helps one manage their portfolio in a tax-effective manner as it automates sync of transactions across wallets and exchanges, computes capital gains, and even aid in simulating the trading adjustments to maximize tax efficacy.

Although it does not automate trades, it aids users in making pre tax changes to their holdings. Effective for investors with primary focus on regulatory compliance and tax optimization,

CoinLedger Features

- Automated reporting for crypto taxes (IRS, HMRC, etc)

- Connection to more than 500 exchanges and wallets

- Gains and losses in capital from trades set

- Tools for tax loss harvesting strategy

- Forms 8949, Schedule D, etc. produced

- Audit trails and reports on transaction history

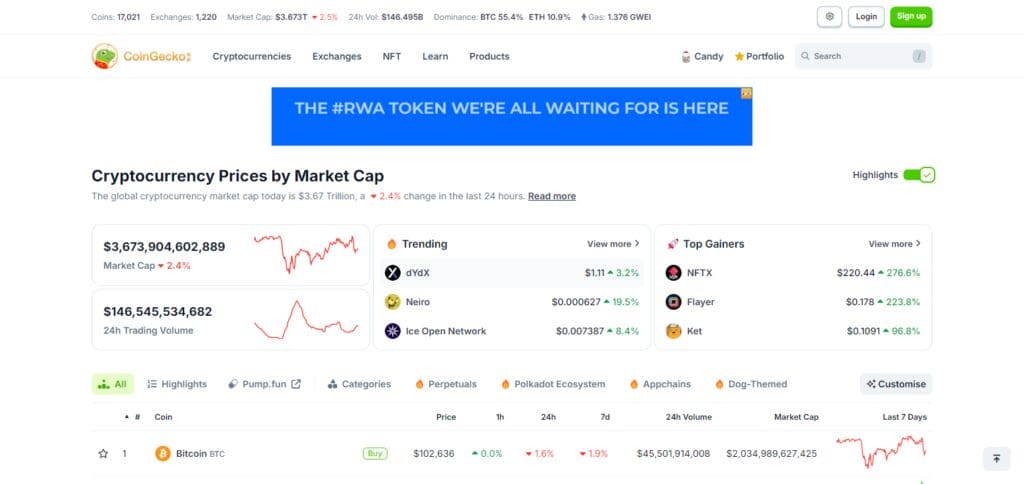

5. CoinGecko

CoinGecko offers free portfolio tracking and provides market data. Holders have the ability to monitor their holdings and create manual alerts for rebalancing based on market cap, volume or change in price.

While lacking Automation, the extensive analytics such as community trends and Defi metrics enable inform changes that are made manually. Best for casual investors valuing simplicity and broad market context,

CoinGecko Features

- Perform ranking of real-time cryptocurrency market cap.

- Charts with volume and price liquidity metrics

- Ranking of exchanges according to trust score and volume.

- Tracking Community growth and developer activities.

- Analytics of NFT marketplaces and collections.

- Portfolio tracker with price alerts.

6. Crypto.com

The app from Crypto.com offers an auto rebalancing portfolio tracker for Defi wallets and its exchange. Alerts are sent to notify users of any allocation shift, after which the user can rebalance by utilizing staking, trading or earning products.

Yield is improved by integrating with Kronos chain assets while achieving the desired target exposure. Best suited for users who favor the one-stop shop approach.

Crypto.com Features

- Spot and derivatives trading on Crypto exchange.

- Cashback rewards on VISA debit card (CRO).

- Earn program now available for staking and interest.

- Exclusive collection of NFTs on the marketplace.

- DeFi integrated crypto wallet.

- Crypto credit and loans offered.

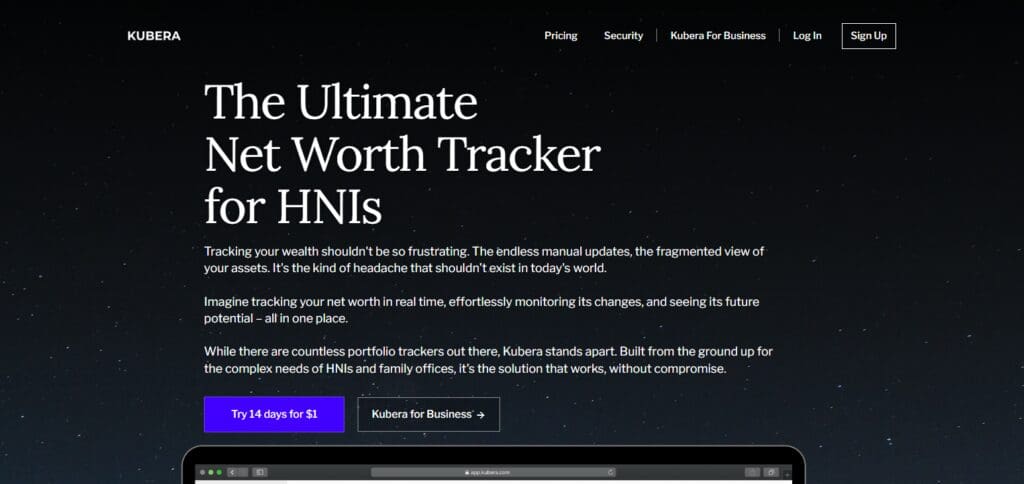

7. Kubera

Cryptocurrencies, stocks, and real estate come together on a net worth dashboard with an aggregated view on Kubera. Live valuation updates and allocation charts allow for manual rebalancing.

No trading is available, but strategic adjustments can be made with the help of financial advisors. Targets the wealthy looking for an all encompassing view of their finances.

Kubera Features

- Integrated asset tracker (crypto + traditional assets).

- Live value of assets using API sync.

- Update portfolio manually and automatically.

- Store documents for will/insurance policies.

- Beneficiary sharing for estate planning.

- Financial advisors can access accounts.

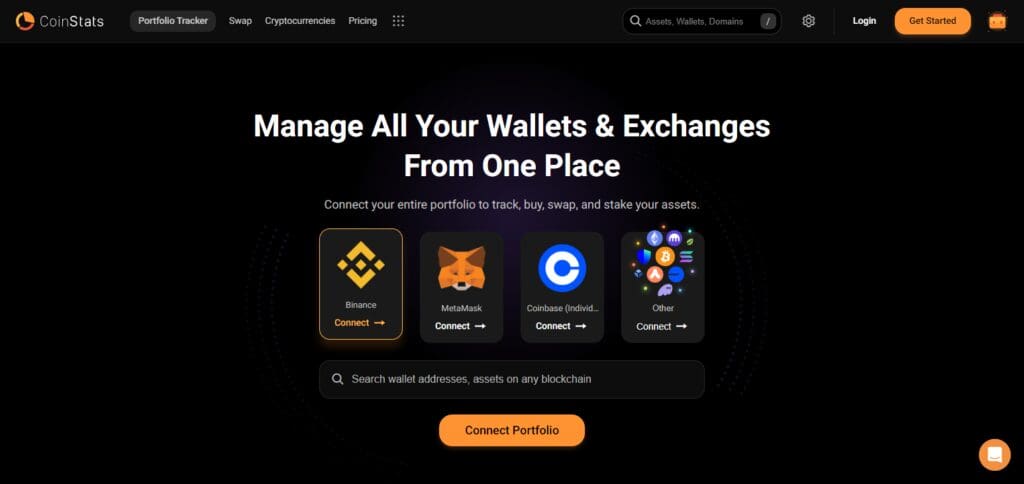

8. CoinStats

CoinStats connects more than 300 wallets and exchanges for portfolio analysis and rebalance alerts. Automated trades and dollar-cost averaging are available with premium accounts.

Their DeFi and NFT tracking enables keeping track of portfolios of varying risk appetites. Best for active investors with multiple assets.

CoinStats Features

- Get real time alerts for prices and news.

- Administer DeFi and NFT portfolios.

- Analytics of profit loss and ROI.

- Trade through connected exchange APIs.

- Tools for tax estimating and reporting.

- .Application with dark mode and widgets

9. Delta Investment Tracker

Delta helps track crypto, stocks and ETFs with an allocation breakdown and drift alerts. Performance reports paired with news integrations enable users to rebalance manually.

Informed changes can be made with the help of custom watchlists, performance reports, and historical data. This is appealing to diversified investors who value in depth analytics without automation.

Delta Investment Tracker Features

- Mult-asset investment tracking (crypto, stocks, ETFs).

- Comprehensive allocation and performance analysis.

- Set customizable alerts and get news.

- Portfolio risk analysis and market sentiment monitoring

- Estimation of altcoin value using deep learning

10. Token Metrics

Token Metrics uses AI rating systems to help strategically rebalance crypto portfolios. Their algorithms evaluate fundamentals, technicals, and sentiment to determine the optimal buy-sell signals.

While they do not perform trades, their users receive detailed insights that aid in portfolio management. Aim for data-driven investors that want AI assistance with strategies.

Token Metrics Features

- Crypto tracking and investment decision-making software

- Integration with more than 500 wallets and exchanges

- Crypto spending tokens

- Portfolio risk metrics for sentiment analysis

- Market video reports for token investors

- Investor plans (HODLer, Investor, Professional)

Conclusion

Real-time asset allocation tracking and automated analytics are what makes the best crypto portfolio rebalancing tools so impressive. For crypto and traditional investment integration with performance analysis, portfolio management services like Kubera and Delta Investment Tracker are superb.

Dynamic trade automation, alerts, and profit/loss analytics to maintain target allocations are provided by CoinStats and Altrady. Quantum AI and Token Metrics focus on AI strategies and use predictive analytics to modify portfolios according to the market.

Multi-exchange rebalancing can be done while using advanced charting and arbitrage tools on Coinigy and Crypto.com. In times of rapid market change, tools with a seamless data-driven approach which is also cross-platform user friendly, ensuring security and eeficient rebalancing, should be prioritized.