Cryptocurrency has changed the way that we think about money, ensuring that we can earn, spend, and invest crypto assets in new, innovative ways.

Crypto rewards cards are one of the most interesting developments in this area.

They work like regular credit/debit cards except that you earn in the crypto sphere instead of the typical cash back or for more restricted points.

For people interested in streamlining the use of cryptocurrency in their everyday routine, it makes conversions through normal purchases, such as cryptocurrency rewards cards, in the possibility of earning some digital assets while doing day-to-day shopping.

Crypto Rewards Cards & Its Features

| Crypto Rewards Card | Features and Details |

|---|---|

| Brex Card | – Cashback rewards in cryptocurrency – No annual fee – Business-focused benefits |

| Gemini Card | – Earn cryptocurrency rewards on purchases – No annual fee |

| Venmo Card | – Earn cashback in cryptocurrency – Integration with Venmo app |

| Binance Card | – Earn Binance Coin (BNB) rewards – Various crypto benefits |

| Coinbase Card | – Earn crypto rewards on all purchases – Coinbase integration |

| Bybit Card | – Earn rewards in Bybit tokens – Trading perks and benefits |

| Trustee Card | – Cashback in crypto – Security and custodial benefits |

| Ledger Card | – Earn crypto rewards – Ledger wallet integration |

| Nexo Card | – Earn rewards in Nexo tokens – Credit line backed by crypto |

| Crypto.com Visa Card | – Earn up to 8% cashback in crypto – Crypto staking rewards |

10 Best Crypto Rewards Card

1. Brex Card

Brex Card offers businesses a quick and easy option to handle costs with crypto benefits.

Get credit limits with no personal guarantee tailored to your business’s cash flow. Earn Bitcoin & Ethereum on every purchase.

It is perfect for startups and entrepreneurs because it has no annual fees and instant approvals.

It can help entrepreneurs save their spending power while affording options for hundreds of solid cryptocurrencies.

2. Gemini Card

The Gemini Card works hand-in-hand with your Gemini exchange account, and you can earn up to 3% back in Bitcoin, Ether, and other cryptocurrencies on every purchase.

Relax with Gemini’s superb security and invest your crypto directly from your card rewards. Great for those who are into Crypto and want to STACK more and create “income” by spending every day.

3. Venmo Card

Users can seamlessly spend, send, and earn crypto rewards with the Venmo Card. Get Bitcoin cash back, or select from other supported cryptocurrencies on every transaction using your Venmo balance or linked bank account.

It offers multi-currency support and an easy-to-use interface, and it is widely accepted, facilitating cryptocurrency integration into one’s everyday financial transactions.

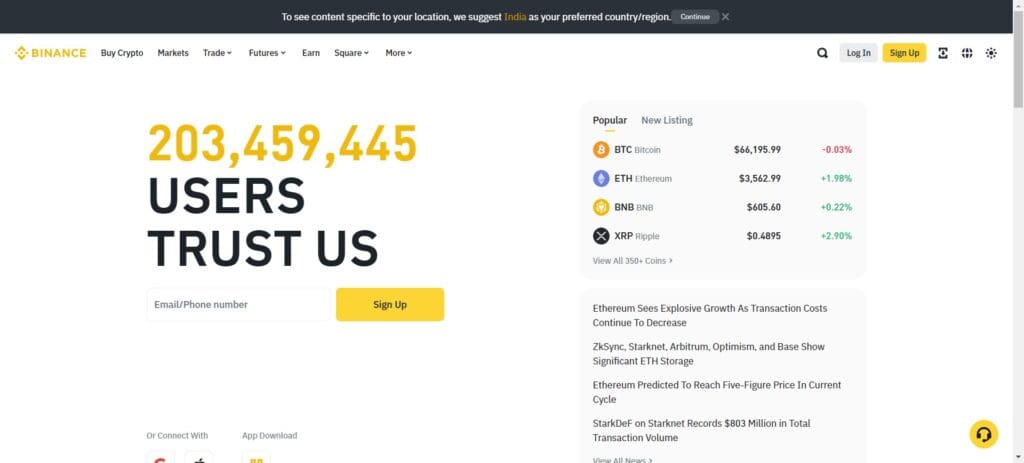

4. Binance Card

With the Binance Card, users can spend their crypto directly and earn up to 8% cashback on purchases with BNB.

Connect to your Binance account for an easy way to manage your crypto assets and enjoy immediate global acceptance at over ten million merchants.

Try it for an easy way to spend your cryptocurrency (earning rewards with every swipe), whether buying something online or travelling internationally.

5. Coinbase Card

Coinbase Card enables you to effortlessly spend your crypto and earn up to 4% back in Stellar Lumens or other supported cryptocurrencies on purchases.

It connects directly to your Coinbase account so you can manage your crypto portfolio and track your spending in real-time.

Ideal for the crypto user looking to leverage the utility of their digital assets and enjoy the same convenience of traditional payment methods with 0% fees and wonderless reward availability.

6. Bybit Card

Increased Usage and Functionality Options The Bybit Card – users can earn crypto rewards, including Bitcoin, Ethereum, and more, by using the Bybit Card for everyday purchases.

Bybit connects with the Bybit exchange platform for undisrupted investment management and is great for everyday transactions (up to 5% cashback).

It is best for traders and investors who want to diversify their crypto portfolio through gaining rewards after spending.

7. Trustee Card

The Trustee Card is a pay-in crypto card that allows users to select the crypto reward they wish to earn on their purchases – Bitcoin, Ethereum, or Tether.

It suits individuals who are more familiar with cryptocurrencies and looking to incorporate digital currency as a normal part of their everyday financial transactions while being rewarded.

It also offers features like adding higher security standards and global currency integration.

There is no need to change your existing workflows; you can easily manage all your crypto investments from your Trustee account using traditional payments and digital assets.

8. Ledger Card

This is one of the safest and simplest ways to use your crypto to spend and earn rewards in Bitcoin, Ethereum, or any other hundred cryptos this card supports.

Leverage Ledger hardware wallet integration for added security of your digital assets and seamless transaction management.

Ideal for people looking to secure their crypto and turn it into an everyday currency that can also earn rewards.

9. Nexo Card

With Nexo Card, you can get the value of your crypto as cash without selling it and earn up to 2% cashback in BTC, ETH, or Nexo, even in bear markets. Connected with your Nexo account, effortlessly manage your assets with low, transparent cashback rates.

This card is a convenient way to use a line of credit for online and in-store purchases while accruing rewards in your favourite digital currencies.

10. Crypto.com Visa Card

The Crypto.com Visa Card enables users to earn up to 8% back in CRO tokens on purchases and provides added benefits such as airport lounge access and competitive exchange rates.

Utilize it with its intuitive iOS and Android App and spend anywhere in the world, like a local, manage your cryptocurrency investments easily with traditional banking services benefits, and optimize your rewards into cryptocurrency.

Great for the enthusiast who wants to use crypto the way he might use regular bank accounts every day.

How to Choose the Best Crypto Cards

Before you choose a crypto rewards card, there are some things to remember to have one benefit you more in the long run, depending on your financial habits and goals.

Step 1: Look into Supported Rewards of Cryptocurrency While some cards reward in a particular cryptocurrency (e.g., Bitcoin or Ethereum), others offer many options, including stablecoins.

Pick a card that rewards the coin you are into and will be a holder of.

Then, look at the reward rates and structures. This depends on the card and your card type; each card offers different reward rates for various spending categories.

A few cards might give you higher rewards for particular categories (like dining or travel), while others give you flat-rate rewards on all your spending. With this type of tiered system, compare these rates and select a card that maximizes your rewards on your spending habits.

Also, consider assessing the related charges and terms that come with the card. Watch out for any annual fees, foreign transaction fees, or other fees that could wipe away the value of the rewards for you.

You also need to see if the card can be redeemed in different forms, but look at the terms and conditions regarding this point and look for potential restrictions or proof of ease to convert your crypto to other assets or local fiat.

Conclusion

Crypto rewards cards are an interesting new way to engage with the cryptocurrency ecosystem, and they can be used simply instead of traditional payment networks during everyday spending.

Picking the right card will help you accumulate virtual currencies efficiently and could even improve your investment portfolio.

The most common categories you should look at are a) types of cryptocurrencies, b) reward rates, and c) fees and terms.

It is highly recommended that you conduct a proper assessment before you get on board.

Through deliberate curation, applicants can benefit from one of the best crypto reward credit cards that can expedite the integration of cryptocurrencies into their financial life, offering a route to payment convenience combined with a position for long-term crypto gains in an increasingly tokenized financial landscape.