In this Coinroop article, we discuss the Best Crypto Trading Bots. We Cover around 15 robots, which are leading in ranking & good performance.

In the fast-changing earth of digital currency, cryptocurrency trade robots have become important for astute investors who want to maximize their profits.

These advanced bots offer multiple capabilities, including automated trading strategies and live market scanning, which simplifies the process of trading, thereby enabling traders to take advantage of the unstable nature of this market.

It is crucial that, as the need for these resources increases, one can differentiate among them in a crowded market such as this.

Below are some top crypto trading bots that are transforming investment management in today’s dynamic crypto world.

What are Crypto Trading Bots?

Crypto trading bots are software programs that automatically trade in the cryptocurrency market instead of traders. They use algorithms and specific parameters to scrutinize market situations,

Detect trading chances and carry out purchasing or selling orders sans human involvement. They streamline the trading process in automated trading by eliminating manual execution, enabling 24-hour trading.

List & Key Point

| Platform | Key Point |

|---|---|

| 3Commas | A social trading platform allowing users to follow and copy successful traders. |

| Defiquant | Scalable and customizable trading bot solutions. |

| SMARD | Integration of AI and machine learning for trading strategies. |

| Bitsgap | Multi-exchange trading platform with arbitrage and portfolio management tools. |

| Bitget | Leveraged trading and derivatives platform with advanced trading tools. |

| Growlonix | A cloud-based automated trading bot with a user-friendly interface. |

| Coinrule | Rule-based cryptocurrency trading platform for automated trading strategies. |

| CryptoHopper | Advanced trading bots and algorithmic trading platforms with customizable scripts. |

| TradeSanta | Automated trading bots with advanced order management features. |

| Zignaly | Social trading platform offering copy trading and signal providers. |

| Pionex | Exchange with built-in trading bots and liquidity mining options. |

| Gunbot | Highly customizable trading bot with support for multiple strategies. |

| HaasOnline | A platform for building and backtesting trading bots with a drag-and-drop interface. |

| Trality | Platform for building and backtesting trading bots with a drag-and-drop interface. |

| Ichibot | Cryptocurrency trading bot with built-in technical analysis indicators. |

15 Best Crypto Trading Bots

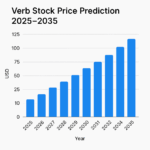

1. 3Commas

3Commas is a well-known automated crypto trading platform that offers multiple features for all types of traders. If you are either a novice or already an expert in this field, 3Commas provides tools and functionalities

that will make your trading experience easier and more profitable. 3Commas makes it possible for users to run complex strategies with its user-friendly interface and an extensive set of trading bots.

2. Defiquant

Defiquant unveils an AI-powered crypto trading bot designed to be the best crypto trading bot for beginners and seasoned traders alike.

The bot employs cutting-edge technology that enables fast execution of trades without integration via API links, taking advantage of different prices across exchanges.

Defiquant provides $5 free credit on sign-up plus an affiliate program complemented by many strategic options concerning its protection features available for new registrants only.

The goal here is precision-oriented practical approaches meant to optimize trading across multiple cryptocurrency exchanges.

3. SMARD

SMARD stands out among numerous automated trading solutions culminating in our recommendations.

This innovative trading bot comes with a user-friendly interface aimed at enhancing returns, ensuring a minimum monthly average gain of 5%, alongside robust security measures that make it one of the best crypto trading bots.

SMARD offers an exciting option for investors new to robotic process automation or those moving toward cryptocurrency markets, as it combines efficiency with access.

4. Bitsgap

When it comes to addressing various aspects of good crypto trades, both for beginners and experienced traders, Bitsgap represents one of the top crypto trading bots.

Bitsgap is designed to simplify trading by making it more accessible, efficient, and user-friendly, thus enabling users to enhance their strategies optimally.

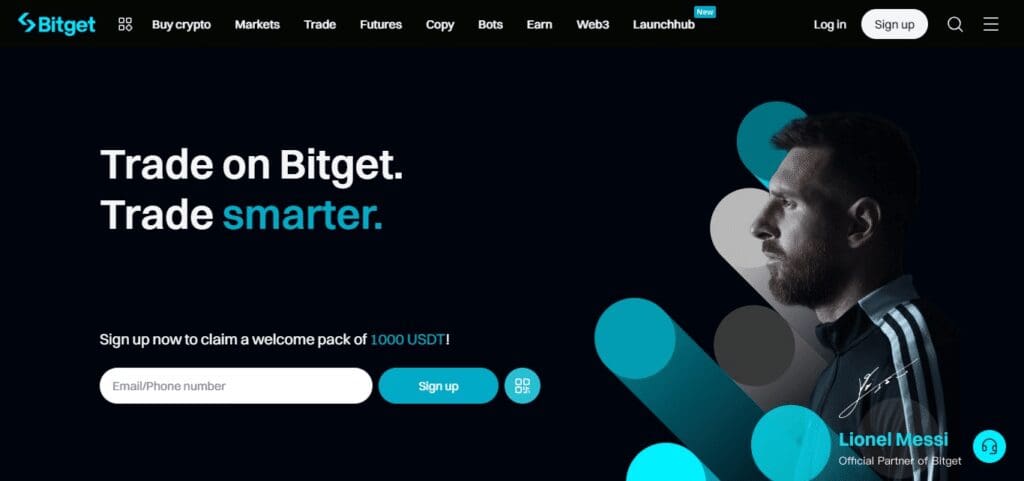

5. Bitget Bots

For experienced quants who want to connect their AI trading algorithms through APIs with some specific feeds, Bitget takes out any complexities involved.

Its user-friendly UI makes it simple for traders to code bots that automatically react to different indicators like RSI, price movements, volume metrics, and many others.

Furthermore, they offer pre-set bots for popular trade automation strategies such as DCA, Grid, and TWAP, which can be deployed fast enough in live mode with minor customizations.

6. Growlonix

Growlonix has created a complete platform that helps improve and optimize trading techniques in the cryptocurrency market.

It is said to be one of the best crypto trading bots, especially considering that its software has automated bots, an easy-to-use interface, and paper trading features with support for every trader’s proficiency level.

7. Coinrule

Being founded in 2018, this cryptocurrency is planned for specific trading strategies and custom options for its customers only.

It is an inclusive cryptocurrency offering rewarding auto-trading functionalities, robust security protocols, and convenience at various skill levels.

Moreover, without any hidden charges, you will be able to register freely after getting seamless integration on top-rated cryptocurrencies such as Binance, Coinbase, and Kraken, among others; it is too good to ignore this company’s products or services offered therein.

8. CryptoHopper

CryptoHopper values trust through tight relationships with exchanges as well as regulatory bodies because it gives priority to the safety and privacy of its members.

When strict security measures are put into place, accounts become protected, and user data remains private unless allowed otherwise.

Thereafter, CryptoHopper comes with several benefits besides creating a safe ecosystem. Its automated crypto-trading bot surpasses human abilities, making it easy for individuals to trade professionally.

Moreover, advanced tools are at your disposal, as well as global exchange connectivity and participation in lucrative prize-winning trade competitions.

9. TradeSanta

This is because TradeSanta believes in “Trade faster, Maximize results.” All these are made possible through the use of a strong trading bot as well as algorithmic strategies that help it scan for profitable trading opportunities now and then.

In addition, this platform offers a free trading terminal, which makes portfolio management tasks more manageable.

Trading bots that work well in bear or bull market conditions accept spot and futures trading, can easily link up with popular external signals, emulate winning traders’ strategies, and have robust risk management features.

10. Zignaly

Zignlay offers a unique investment model that is focused on profit sharing. Zignaly has investment funds that can be invested by users, with expert traders managing the funds, and investors receive some of the profits.

The platform verifies whether the traders are risk-conscious and yield positive results, aligning them with reliable peers needed to grow their crypto trading skills.

11. Pionex

Other added advantages are free software updates, reliable customer care services, easy plug-in-play strategies, features, and flexible customization options provided by Pionex, along with an instinctive interface enabling automated configuration changes.

In terms of crypto-trading bots, Pionex is exceptional because it provides free ones, which makes it facilitative for new entrants into cryptos and trades done automatically by machines.

As one of Asia’s fastest-growing crypto exchanges Pionex has developed tailor-made automated strategies suited both to novices as well as experienced traders.

With 16 advanced bots to choose from, users have a hassle-free setup experience without the need for complex programming or coding.

Pionex has gained recognition due to its good reputation and consistent performance. Other benefits are nominal fees, strong security measures, support for over 40 cryptocurrencies, and the absence of a minimum deposit required to utilize a free trading bot.

12. Gunbot

Having a non-traditional pricing model involving a one-time license charge instead of a monthly subscription system, Gunbot differs from its counterparts in how it charges fees.

It has attracted many individuals who would like to improve their cryptocurrency commerce abilities without incurring recurrent charges.

Gunbot operates 24/7, thus providing better privacy protection while collecting no data; it works securely on Windows, Linux, and macOS and does not use cloud-based solutions.

13. HaasOnline

When it comes to crypto trading bots, HaasOnline is one of the best options for day traders interested in developing or refining their automated trading strategies.

At the core of HaasOnline’s offerings lies TradeServer – an algorithmic engine that lets users build custom high-frequency trading bots based on their specifications.

14. Trality

Trality leads the way in the trading bot space with a unique proposition to Python lovers who want to create their own customized trading bots.

Its outstanding feature is the powerful Python API, which allows those with expertise in Python programming to design sophisticated trading strategies.

Trality also includes intuitive autocomplete, robust backtesting, debugging tools, and forthcoming rebalancing capabilities so that coding of trading bots becomes easier right within the browser.

15. Ichibot

Ichibot comes forth as a ground-breaking solution for technical traders who demand unprecedented control over their trading strategies.

Through its focus on command line interface (CLI) and TypeScript support, Ichibot offers an exclusive platform for programming and directing users’ trading bots with accuracy and personalization.

Advantages of Using Trading Bots

For investors, using trading bots in the cryptocurrency market comes with many benefits:

24/7 Trading: The use of trading bots allows traders to participate in the markets at any time they choose.

Speed and Efficiency: Trading bots can react to market movements in real time and execute your pre-set strategies almost instantly.

Elimination of Emotional Bias: But emotions don’t reflect logic and sometimes make people act without thinking about what they are doing.. However, trading should be devoid of feelings. Having said that, using bots is a good solution because they do not involve any emotions (Arya et al., 2017).

Backtesting and Optimization: You can test your strategy against historical market data by using many trading bots that offer backtesting functions. This will help you refine your strategy and optimize them for better performance.

Diversification: Bots perfectly handle various types of assets within multiple strategies so that investors need not constantly monitor their portfolios manually.

Risk Management: Such trading algorithms carried out over a certain period are typically equipped with stop orders as well as position sizing, which can limit possible losses or protect capital from declining too much.

Access to Advanced Trading Strategies: For example, arbitrage opportunities may arise due to price mismatches between exchanges for the same asset; such opportunities may be exploited automatically once identified by a bot.

Supplying advanced trade techniques that could otherwise be hard to execute manually through automated methods, such as employing bots for operations like arbitrage, trend following, or market making.

Reduced Human Error: Traders reduce their risk through automation since errors often result from fatigue, tiredness, or even physical errors.

The main advantage is that you will get more efficient results when using trading robots rather than manual trading in this rapidly changing cryptocurrency market.

How do you pick the best crypto trading bot?

The best crypto trading bot depends on you and your investment strategy, as well as the features that you want your crypto trading bot to have. Here are some of the standard critical features of crypto trading bots to look out for:

Automated trading: These are programmed to make digital asset purchases and sales based on defined trading strategies. They each have a diverse range of predefined trading strategies alongside adjustable ones.

Backtesting: Some crypto trading bots offer a back-testing feature that enables users to test their strategies on historical data before launching them live, thus allowing you to improve your strategy prior to their launch.

Technical indicators: Many crypto trading bots use technical indicators such as Bollinger bands, moving averages, and MACD, among others, to spot trade opportunities and make decisions based on market trends. However, they vary on a bot-to-bot basis; hence, understand what information is informing your investment plan.

Risk management: Certain crypto trading programs incorporate risk management functionalities like stop loss orders and position sizing, which helps users automate the process involved in managing their exposure risks.

Multiple exchange support: Crypto trading bots can generally work with various crypto exchanges. Still, the number of exchanges supported will vary, so you should always check which exchanges your bot supports.

Security: Trustworthy cryptocurrency trading robots include encryptions and two-factor authentications meant to protect traders’ accounts as well as their transactional information.

User-friendly interface: Several trade bots present themselves with user-friendly interfaces that help even newbies easily set up their instance or customize the bot’s strategy while monitoring its performance.

Cost: Price is important too. There are free crypto-trading bots, and those cost thousands of dollars depending on how much functionality and support they offer.

Conclusion

To end, the universe of crypto trading bots is alive and well, a whole of life with various investors looking for ways to navigate effectively through the market.

These automated instruments provide a wide range of benefits that can streamline exchanges and increase profitability, such as availability 24/7 and eliminating emotional bias.

These versatile systems enable users to confidently participate in highly volatile digital currency markets using sophisticated strategies, risk diversification, or mitigation, among others. Moreover, these creative solutions are essential with the growth of cryptocurrency spaces.

What traders should do is prepare themselves for prosperity within this fast-moving global network by making use of capabilities possessed by best-performing crypto trade bots.

FAQ

What are crypto trading bots?

Cryptocurrency trading bots are software programs that automatically execute trades on behalf of users based on predefined parameters and trading strategies. These bots can analyze market data, identify trading opportunities, and execute trades with speed and efficiency.

How do crypto trading bots work?

Trading bots work by monitoring market conditions, analyzing data, and executing trades according to predefined rules and strategies set by the user. These rules can include factors such as price movements, technical indicators, and risk management parameters.

What are the advantages of using crypto trading bots?

Using trading bots offers several advantages, including 24/7 trading capabilities, elimination of emotional biases, speed and efficiency in executing trades, access to advanced trading strategies, diversification of portfolios, and reduced human error.

How do I choose the best crypto trading bot for my needs?

When selecting a crypto trading bot, consider factors such as the bot’s features and functionalities, compatibility with your trading style and preferences, reputation and reliability of the bot provider, customer support options, and pricing structure.

Are crypto trading bots safe to use?

While trading bots can offer significant benefits, it’s essential to exercise caution and perform due diligence when choosing a bot provider. Ensure that the bot is secure, reputable, and transparent about its operations and risk factors. Additionally, always start with small investments and gradually increase your exposure as you gain experience.