In this article, I will discuss the Best Crypto Wallets for Regulated Businesses. Choosing the right wallet is crucial for enterprises handling digital assets securely and compliantly.

With increasing regulations and growing cyber threats, businesses need wallets that provide robust security, insurance coverage, regulatory compliance, and seamless integration with trading or treasury operations. Here, we explore the top solutions trusted by institutions.

Key Points & Best Crypto Wallets For Regulated Businesses

| Wallet | Key Point |

|---|---|

| Fireblocks | Enterprise-grade security with multi-party computation |

| BitGo | Regulatory compliance and institutional custody services |

| Coinbase Custody | SEC-qualified custodian with insurance coverage |

| Ledger Enterprise | Hardware-based protection with governance controls |

| Metaco Harmonize | Integration with banks and financial institutions |

| Copper | ClearLoop technology for secure off-exchange settlement |

| Anchorage Digital | First federally chartered crypto bank in the U.S. |

| Kraken Institutional | Advanced reporting and compliance tools |

| Gemini Custody | Licensed trust company with $200M insurance |

| Matrixport Custody | Asia-focused institutional custody and yield services |

10 Best Crypto Wallets For Regulated Businesses

1. Fireblocks

Fireblocks does not act as a qualified custodian, rather developing secure custody technology focused on institutional digital assets.

Businesses can use the platform to manage crypto assets across multiple exchanges, counterparties, and DeFi platforms.

This is possible with the use of MPC (Multi-Party Computation) key management technology which removes single failure points.

Aside from crypto management, the company also provides enterprise treasury, trading desk, and lending operations automation tools and APIs which enhance workflow and reduce risk.

While many regulated custody and exchange operations use Fireblocks infrastructure, the company does not hold assets as a custodian.

Fireblocks Features

- MPC Security Technology. Fireblocks use Multi-Party Computation to disintegrate key material which removes single points of failure and better safeguards Enterprise assets.

- Unified Infrastructure. Syncs wallets, exchange, DeFi applications and counterparities so businesses can manage assets across systems from a single interface.

- Workflow Automation. Proprietary automation and API tools to create secure treasury, transfer and settlement workflows.

- Flexible Access Controles. Advanced role-based permission are policy enforcement are customizable, even for teams with tiered governance complexity.

| Pros | Cons |

|---|---|

| Multi-party computation (MPC) security | High cost for enterprise clients |

| Wide institutional adoption | Complex setup for smaller firms |

| Supports DeFi and tokenized assets | Requires strong technical expertise |

2. BitGo

BitGo is highly regarded as one of the first established expert service providers in providing crypto wallets and custody solutions for institutions, and is very highly regarded as a provider of custodial trust services in the US and internationally.

They were the first to provide services that offered security for wallets that required multiple approvals to complete a transaction.

This service added another level of enterprise protection. BitGo is highly regarded as a provider of the most secure custody solutions to funds, exchanges, and regulated entities since

They provide custody solutions that are insured and also provide cold, warm, and hot storage options. They also provide solutions for liquidity, staking, and governance.

They are very highly regarded and in demand by financial institutions for providing excellent, fully compliant integrated services.

BitGo Features

- Regulated Custody Services. Operates custodial entities in different jurisdictions, allowing for regulated businesses to offer compliant custody of assets.

- Multi-Signature Security. Apply multi-sig, for more than one approval to complete a transaction which helps manage the operational risk.

- Insurance Options. For insured assets, coverage limitations and terms apply.

- Broad Asset Support. Ahead of the game with hundreds of tokens and chains supported, along with built-in governance and staking, asset service.

| Pros | Cons |

|---|---|

| Regulatory compliance with qualified custodian status | Limited retail support, focused on institutions |

| Insurance coverage for digital assets | Fees can be high for smaller businesses |

| Multi-signature wallet technology | Geographic restrictions in some regions |

3. Coinbase Custody

Coinbase Custody, which has the institutional custody ownership of Coinbase and the NYDFS regulation as a Trust Company, has obtained its SOC 1 and SOC 2 certifications.

For institutional clients, comprehensive insurance, and compliance controls are provided, along with segregated cold storage, which is tailored for funds, ETFs, and corporate treasuries.

Coinbase Custody offers integration with Coinbase Prime, enabling institutions the ability to trade and earn in yields (staking for example) while keeping the assets in custody.

Its global ecosystem offers all the necessary international reporting, auditing, and governance, which makes it ideal for clients with high regulatory and trust requirements for custodial services.

Coinbase Custody Features

- NYDFS regulation. Trust license under New York Department of Financial Services which guarantees compliance for institutional clients.

- Cold Storage Segregation: Storage is offline, with strict audit controls, and is kept separate.

- Integrated Reporting Tools: Offers reporting that is complete, with auditing, and workflows for compliance.

- Prime Integration: Coinbase Prime can be partnered with for trading and yield services while keeping assets unmoved.

| Pros | Cons |

|---|---|

| SEC-qualified custodian | Available only to U.S. institutions |

| Insurance against theft and hacks | Limited flexibility compared to independent custodians |

| Strong brand trust and integration with Coinbase exchange | Higher custody fees |

4. Ledger Enterprise

Ledger Enterprise is a custom offering by Ledger, the renowned manufacturer of hardware wallets. Ledger Enterprise isn’t a custodian, but like Legder, they offer hardware-based key management, access management, and tailored controls for businesses and other regulated entities.

Ledger works with secure hardware modules (HSM) and custom permissions to provide enterprise governance.

This allows organizations to securely manage the private keys of their custoians across their enterprise teams.

This is especially a plus for organizations that operate with high self-custody and key security standards, as Ledger supports a variety of assets.

Because Ledger Enterprise is infrastructure-focused and does not provide custodial services, regulated businesses pair Ledger with qualified custodians to meet compliance requirements while driving their custodian key controls.

Ledger Enterprise Features

- Hardware Key Security: Secure modules that are hardware based, are used to store private keys offline which protects against online attacks.

- Custom Governance Controls: Integration of workflows for permissions and approval to meet internal policies is possible for enterprises.

- Asset Agnostic: Compatible with numerous tokens and protocols via supported standards that are hardware based.

- Self-Custody Focus: full reliance on third-party custody is avoided by giving businesses custody of the keys.

| Pros | Cons |

|---|---|

| Hardware-based protection with governance controls | Requires physical devices for access |

| Customizable governance workflows | Not as seamless for high-frequency trading |

| Strong reputation in hardware wallets | Limited institutional integrations compared to custodians |

5. Metaco Harmonize

Metaco Harmonize provides an integrated solution in digital asset infrastructures, enabling financial services and other regulated businesses to coordinate custody, trading, tokenization, and DeFi workflows.

Designed and built in Switzerland, Harmonize facilitates the implementation of governance, compliance-guided custody, and adaptable risk control policies across multiple asset classes for banks and corporates.

Harmonize is capable of connecting multiple vaults, sub-custodians, and liquidity layers, among other services, to provide institutions with comprehensive digital asset offerings.

Harmonize is stress-validated with major banks and custodians, underpinning complexity, security, and regulatory compliance for institutions.

Metaco Harmonize Features

- Orchestration Layer: Serves as a framework for digital asset management that integrates systems of custody, trading, compliance, and tokenization.

- Designed for Financial Institutions: Enterprise regulated needs are addressed by banking-grade controls.

- Policy-Driven Compliance: Workflow management is increasingly regulated by business rules, corresponding risk tiers, and controls.

- Multivault Connectivity: A unified platform enables connectivity to numerous vault and liquidity providers.

| Pros | Cons |

|---|---|

| Integration with banks and financial institutions | Primarily focused on enterprise clients, not startups |

| Flexible orchestration of digital asset operations | Implementation complexity |

| Supports tokenization and multiple asset classes | Costs scale with enterprise needs |

6. Copper

Copper is a UK-based institutional custody and prime brokerage platform that sets itself apart with settlement innovations like ClearLoop, which allows off-exchange settlements that lower counterparty risk and accelerate transfer speed.

Copper’s architecture accommodates institutional customer workflows, including hedge funds, asset management, and trading companies.

He offers custody services that are heavily regulated and insured, with custody governance features, and support a broad range of digital assets.

His integrated suite also includes execution, financing, and post-trade services, making him a well-rounded option for regulated firms that need custody coupled with active trading and settlement services.

| Pros | Cons |

|---|---|

| Secure off-exchange settlement via ClearLoop | Limited to partnered exchanges |

| Reduces counterparty risk | Higher fees than standard custody |

| Capital efficiency with collateral management | Still evolving adoption globally |

7. Anchorage Digital

Anchorage Digital is the first federally chartered digital asset bank in the U.S., regulated by the Office of the Comptroller of the Currency (OCC). This allows them to provide custodial services with bank-level security and compliance for over 70 digital assets.

Anchorage offers governance controls, staking, trading, and other services for institutional clients, including treasury and fund management, and corporate clients.

Their chartered banking model combines the regulatory clarity and trust that many enterprises need when adopting digital assets into their financial operations, providing traditional finance oversight with crypto-native features.

Anchorage Digital Features

- Federally Chartered Custody: Functions as a digital asset bank (OCC charter in the U.S.) with custodian lite status.

- Comprehensive Service Suite: Covers custody, staking, and trading, and also supports governance.

- Bank-Grade Compliance: Strong regulatory oversight with audit controls and patterns for AML/KYC.

- Secure Key Management: Employs enhanced security frameworks that combine MPC and institutional control

| Pros | Cons |

|---|---|

| First federally chartered crypto bank in the U.S. | Primarily U.S.-focused |

| Strong regulatory credibility | Not widely available internationally |

| Institutional-grade custody and lending services | Premium pricing |

8. Kraken Institutional

Kraken Institutional is focused on regulated businesses, offering qualified custody via Kraken Financial, a chartered crypto bank from Wyoming.

Kraken’s custody is fully regulated — client assets are segregated and protected by role based access, dual-factor (MPC and HSM) security, and audited transparency.

The Kraken Prime integration offers institutions trade, stake, and finance access — all without losing custody.

Kraken’s infrastructure is built for enterprises which need both deep liquidity and tight control — a full service offering to institutional traders, asset managers, and corporate treasuries.

Kraken Institutional (Custody) Features

- Global Reach: Provides institutional services with appropriate regional compliance, where possible.

- Wyoming-Chartered Custodian: Custody services offered as part of U.S. regulated digital asset bank charter.

- Integrated Trading & Staking: Provides seamless access to trading desks and staking services in one platform.

- Segregated Asset Control: Assets are held separately with role-based controls.

| Pros | Cons |

|---|---|

| Advanced reporting and compliance tools | Limited to Kraken ecosystem |

| Strong liquidity and trading integration | Not a standalone custodian |

| Trusted brand with regulatory focus | Less insurance coverage compared to custodians |

9. Gemini Custody

Gemini Custody secures client assets through separate and individual vaults and offers detailed reporting through custody solutions tailored to regulated clients.

As a U.S. based institutional custody service with compliance, cold storage, and insurance protection, offers clients peace of mind.

Being a licensed NYDFS trust company, Gemini is able to stake and offer governance on certain digital assets. Gemini’s transparency, compliance, and security enhance stakeholder confidence and trust.

Gemini Custody Features

- NYDFS-Licensed Custodian: Functions under tight regulation and is SOC-audited for custody security.

- Cold Storage Architecture: Employs separate vault storage with strong protections offline.

- Insurance Protection: Offers digital assets held under custody with insurance (coverage details apply).

- Compliance & Reporting: Detailed reporting, audit trails and regulatory controls.

| Pros | Cons |

|---|---|

| Licensed trust company with $200M insurance | Primarily U.S.-centric |

| Strong compliance and regulatory framework | Fees higher than consumer wallets |

| Integration with Gemini exchange | Limited global reach compared to competitors |

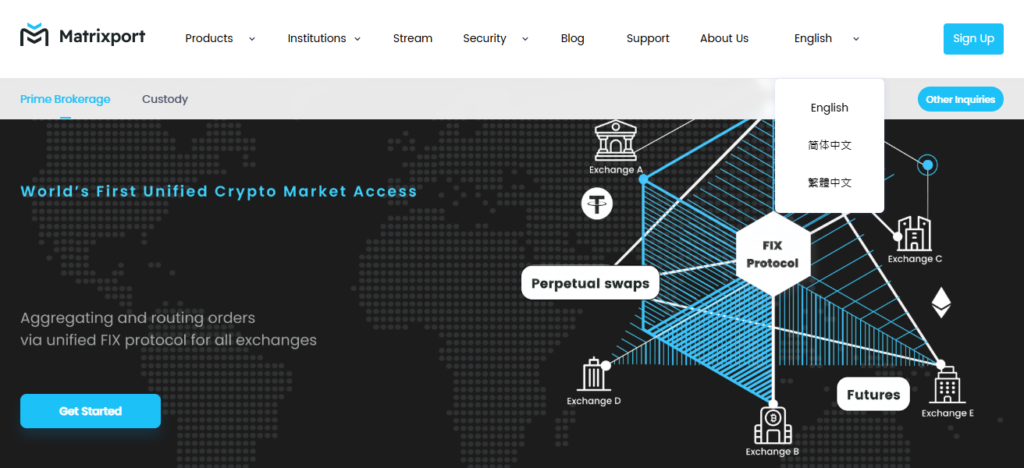

10. Matrixport Custody

Matrixport Custody works alongside other Matrixport institutional services components, serving hundreds of institutions worldwide through crypto custody solutions via Cactus Custody™, a licensed custodian with integrated hot and cold wallets and HSM encryption.

Custody services are integrated with prime brokerage, OTC settlement, and asset management service, giving institutional clients a complete crypto financial package.

With custody licenses in several jurisdictions, including Hong Kong and Switzerland, Matrixport’s solutions address the needs of regulated global businesses, focusing on custody compliance, institutional grade crypto security, and access innovation.

Matrixport Custody Features

- Licensed Global Custody Services: Custody through licensed partners, including Cactus Custody™, in multiple jurisdictions.

- Hot & Cold Wallet Infrastructure: Offline cold storage, coupled with online hot wallet access.

- Prime Brokerage & OTC Integration: Custody services linked with trading, OTC settlement, and asset management.

- Compliance Tools: Includes risk, reporting, and institutional-grade AML/KYC.

| Pros | Cons |

|---|---|

| Asia-focused institutional custody | Limited presence outside Asia |

| Offers yield services alongside custody | Regulatory uncertainty in some jurisdictions |

| Strong integration with trading and lending products | Less recognized in Western markets |

How To Choose Best Crypto Wallets for Regulated Businesses

Law Compliance: Check if the wallet has proper licensing and regulation where you do business.

Protection Options: Insurance, multi-sig, MPC, cold storage, and hardware key protections double wallet security.

Insurance: Check if the wallet offers insurance and for what amounts, if any, for crypto.

Supported Assets: Ensure the wallet can hold or exchange every crypto your business will use.

Integrative Options: Assess the enterprise compatibility with APIs, trading, staking, and DeFi workflows.

Audit & Reporting: Check for the availability of comprehensive compliance reporting, transaction logs, and reporting.

Operational Governance: Role-based access and policy enforcement systems will help you with operational governance.

Operational Friction: Your teams will run operational friction smooth if there is a friendly interface.

Guidance Availability: Expect friction from support with guidance and troubleshooting if responsive access is lacking.

Conclusion

To sum up, choosing the ideal crypto wallet for regulated businesses is crucial to manage digital assets safely, compliantly, and efficiently.

When selecting a wallet, businesses must emphasize regulation, security, insurance, and integration.

Fireblocks, BitGo, Coinbase Custody, and Anchorage provide enterprises with trustable features. These businesses need to make the right choice to ensure asset safety and seamless operations within the crypto world.

FAQ

What is a regulated crypto wallet?

A wallet compliant with legal and financial regulations for secure asset storage.

Why do businesses need regulated wallets?

To ensure legal compliance, security, and insurance protection for institutional assets.

Which wallets are best for institutions?

Fireblocks, BitGo, Coinbase Custody, Ledger Enterprise, Anchorage, Gemini Custody, Copper, Kraken, Matrixport.

What security features should I look for?

Multi-signature, MPC, cold storage, hardware keys, and role-based access controls.