This article will cover the Best DEXs on Solana and identify key characteristics, benefits, and overall performance.

The popularity of DEXs that address the various trading requirements is majorly attributed to the rapid and practical Solana considerations.

Whether you are a novice or an advanced trader, it is essential to comprehend these platforms to optimize your journey through the world of DeFi.

key Point & Best DEXs on Solana List

| Platform | Key Point |

|---|---|

| Raydium | Automated market maker (AMM) and liquidity provider for the Solana ecosystem. |

| Jupiter | A leading aggregator on Solana, offering optimized token swaps across multiple decentralized exchanges (DEXs) |

| Orca | User-friendly decentralized exchange (DEX) offering low fees and ease of use. |

| Drift Protocol | Perpetual swaps trading platform focused on decentralized derivatives. |

| Saber | Stablecoin and wrapped asset DEX for cross-chain liquidity on Solana. |

| Bonfida | Full suite DEX and Solana name service provider with advanced trading features. |

| Lifinity | Automated market maker using proactive liquidity to minimize slippage. |

| Saros Finance | All-in-one DeFi platform with farming, staking, and swapping capabilities. |

| Mango Markets | Cross-margin trading platform with lending, borrowing, and leverage features. |

| Atrix | AMM and yield farming platform providing deep liquidity pools for Solana projects. |

10 Best DEXs on Solana in 2024

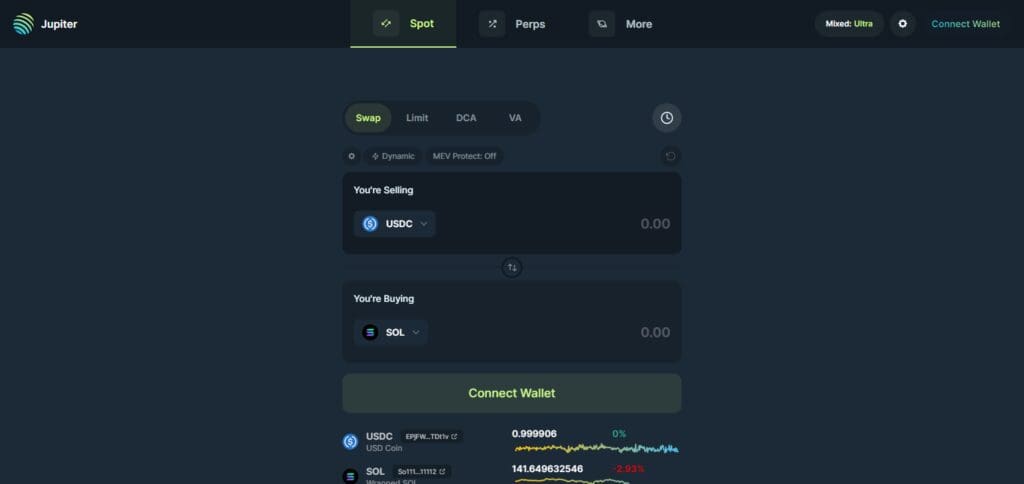

1. Jupiter

Jupiter stands out as one of the best DEX aggregators on the Solana blockchain due to its users’ ability to locate the most productive routing for token swaps among all DEXs available.

It sources liquidity from multiple platforms such as Raydium, Orca, or Serum, making its prices competitive and reducing slippage.

Jupiter simplifies trades on the Solana network thanks to its easy-to-use functionalities and powerful optimization tools.

Therefore, it is an ideal option for traders who desire efficient price execution.

Jupiter Features

Token Aggregation: Enhances token exchanges using liquidity from other DEXes, optimizing user token exchanges.

Low Slippage: Ensures lower slippages as the trades are routed through more effective passage.

Fast Transactions: Usually executes trades very fast using Solana’s speedy network.

User-Friendly Interface: This is a simple design where users efficiently swap tokens.

Cross-Chain Compatibility: Allows the trading of assets through different blockchains without any hassles.

2. Raydium

Raydium remains among the best DEX in Solana, with its remarkable Automated Market Maker and ample liquidity provision.

Integration with the serum order book allows the unlocking of vast liquidity and more advanced attributes trading attributes.

Users can also engage in yield farming, staking, and fast transactions, which explains why people seeking DeFi applications on Solana have adopted the platform.

Raydium Features

Automated Market Maker AMM: Employs a new AMM model that guarantees liquidity.

Serum Integration: Uses the order book of Serum to provide users with more liquidity and trading options.

Yield Farming: Allows users to gain rewards through liquidity provision.

Low Fees: This guarantees users low transaction costs when trading.

Fast Transactions: Implements fast executions of trades thanks to Solana’s ultrafast blockchain.

3. Orca

Orca is one of Solana’s most dominant decentralized exchanges because its interface is straightforward.

Orca provides quick and affordable token swaps and liquidity pools suitable for novice and experienced DeFi users.

The need for ease of use to the customers and the low transaction costs offered by Orca have made it a center of attraction for traders who want to trade in a decentralized manner on the Solana network.

Orca Features

Token Swap Interface: The platform provides a fast and straightforward mode for the transaction of tokens, thanks to the presence of the token swap interface.

Liquidity Mining: This enables users to access the platform opportunities, and the generator owes them additional rewards by printable liquidity on several pools.

User Education Resources: Provides various educational materials to make DeFi available and trade with users.

Analytics Dashboard: It provides tools for analysis in terms of performance and user transactions.

NFT Support: These include incorporating NFT trading functionalities with other standard tokens, thus providing more platform diversity.

Community-Focused Initiatives: Liaise with the community on most issues and encourage community participation in providing direction for development.

4. Drift Protocol

Drift Protocol is number one among the decentralized exchanges on Solana in terms of conducting perpetual swaps and derivatives trading – allowing users to trade leveraged.

And cross-margin products, wherein clients are responsible for more sophisticated financial assets.

Thanks to Solana’s infrastructure, Drain Protocol provides high-quality and fast transactions, which makes this platform a reliable place to use decentralized derivatives on this network.

Drift Protocol Features

Perpetual Swaps: Focused on providing perpetual contracts for various digital currencies.

High Leverage Options: A service where users can trade with significant leverage to improve returns.

Cross-Margin Trading: This feature enables users to open several positions across one or more accounts using the net equity of all accounts.

Liquidation Protection: Provides traders with a range of safeguards against unforeseen liquidations.

On-Chain Order Book: Implements an actual on-chain order book for the quick and precise filling of trades.

5. Saber

Saber is one of Solana’s most successful DEX (Decentralized Exchanges), specializing in stablecoin-wrapped assets swapping.

It allows users to trade stablecoins and pegged tokens with very low slippage by providing adequate liquidities for cross-chain assets.

This liquidity provides an integral piece for the Solana Blockchain, enabling users to exchange assets between multiple blockchains easily.

Saber’s practical purpose was to provide a medium for swapping between stablecoins, a nice feature of Solana’s DeFi services.

Saber Features

Stablecoin Swaps: Concentrates on efficient swapping of stablecoins and pegged assets.

Cross-Chain Liquidity: Ensure liquidity provision of assets from multiple blockchains.

Dual Token Farming: A mechanism where users are rewarded by farming two tokens simultaneously.

Impermanent Loss Mitigation: Able to develop measures to reduce the risk of impermanent loss for liquidity providers.

Integration with Other DeFi Protocols: Provides easy integration with other existing DeFi services, improving the performance of this one.

Low Slippage Transactions: Can execute trades with minimal slippage during trades, favoring the traders.

6. Bonfida

Bonfida is arguably the leading decentralized exchange (DEX) on Solana, providing various trading services such as advanced order and on-chain naming service.

It connects to Serum’s order book to ensure thorough liquidity and high-speed trade executions.

Such is the completeness of Bonfida’s platform, which makes it suitable for users who want to trade and use the more superficial aspects of the decentralized services on Solana.

Bonfida Features

Incessant Trading Function: Provides additional privileges such as placing limit orders and stopping loss.

On-chain Name Service: Delivers an easy-to-use name service that is decentralized.

Arbitrage Opportunities: Allows the user to exploit price differences across different markets.

Staking Rewards: This enables a user to become a token holder and earn passive income by staking those tokens.

API Access: Grants API integration for outside developers of the Bonfida platform.

Winning Liquidity Strategies: Complete liquidity provision strategies for varying methods of trade.

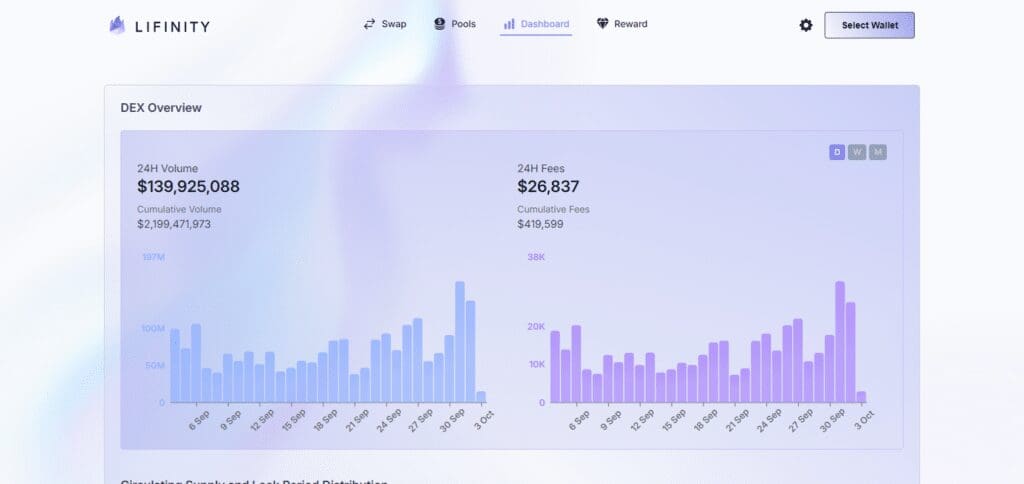

7. Lifinity

Lifinity is a unique decentralized exchange on the Solana blockchain that employs a Proactive Market Maker (PMM) model to manage liquidity and slippage efficiently.

Rather than a classic AMM’s boring liquidity pool, Lifinity varies its liquidity depending on market conditions, leading to better trade execution.

It is apparent from this description that Lifinity is different and efficient, meaning lower costs and higher execution for traders, which are the critical factors for Defi users on Solana.

Lifinity Features

Proactive Market Making: Quickly adjusts liquidity provision to the market using a unique algorithm.

Dynamic Liquidity Allocation: Efficiently manages the liquidity resources by pointing them towards optimal use for trade execution, including subsiding slips.

Integrated Price Feeds: Leverages accurate pricing that is readily available on the market for effective trade execution.

Gasless Transactions: Allows users to trade without the direct cost of gas fees.

Limit Order Functionality: Gives traders the option of placing buy/sell limit orders for better execution of trades.

User-Focused Design: Ensures the design is less cluttered and easy to navigate for better interaction with the software/backend.

8. Saros Finance

Saros Finance is an all-in-one decentralized exchange (DEX) built upon the Solana blockchain that provides a wide range of DeFi services, including but not limited to token swaps, staking, and liquidity farming.

Built for efficiency, Saros Finance enables all its users to handle their assets effectively and earn through yield farming and staking programs, all thanks to the user-centered design.

Given the system’s functionality and the simplicity of connecting new groups and participants to DeFi, it is equally timely and relevant to novice and experienced users of Saros Finance.

Saros Finance Features

Multi-Chain Support: Enables traffic to and trading in blockchains other than Solana.

Yield Optimization Strategies: These strategies devise guidelines and measures to ensure optimum liquidity provider returns.

Customizable Liquidity Pools: Users have the option of creating customizable liquidity pools.

Governance Participation: Users can influence the development of the platform with the help of a dedicated governance token.

Cross-Platform Compatibility: Allows integration of different wallets and platforms required for the service’s use.

Educational Resources: Offers information opportunities to help users operate in DeFi and improve their trading abilities.

9. Mango Markets

Mango Markets is a top over-the-counter spot and perpetual DEX in the Solana blockchain, with excellent capital efficiency.

Through it, one can trade many cryptocurrencies, lending, borrowing, and margin trading, all thanks to the speed and efficiency of the Solana blockchain.

Thanks to the novel approach with cross-margining, Mango Markets’ philosophy grants traders the power to scale their profitability

It is ideal for players seeking sophisticated trading strategies in the DeFi ecosystem.

Mango Markets Features

Decentralized Margin Trading: This allows users to make trades at high leverage levels by providing decentralized margin options.

Cross-Margin Functionality: Provides the upper hand in capital whereby users can use one piece of collateral against other positions.

Comprehensive Risk Management: Establishes tools and policies in the trading process to control risk in the strategies used.

Order Book Model: Has adopted a system of integration of bidders so that trades may be executed in a shorter time frame and slippages reduced.

API for Algorithmic Trading: It also helps users to develop their automatic trading solutions via API.

Community-Driven Features: Adapts constantly, thanks to the feedback and suggestions about improvement from the community.

10. Atrix

Atrix is one of the impressive decentralized exchanges built on Solana, with the primary objective being optimal trading and a place for users to engage in yield farming of different cryptocurrencies.

Users can quickly swap tokens for meager fees by harnessing the speed of the Solana network.

This vital tool also enables users to earn rewards by providing liquidity to the platform through liquidity pools within Atrix.

This unique blend of valuable features and simplicity of the platform has led to an ascertainable increase in the number of Attrix users actively using their trading and investment strategies on the Solana platform.

Atrix Features

Liquidity Aggregation: Liquidity from different sources is pooled together and helps in the efficient execution of trades.

User-Centric Interface: A simplified interface improves accessibility and efficiency of the functions performed.

Automated Trading Strategies: Provides supporting features for the users to devise, perform, and implement automatic trading strategies quickly.

Analytics and Reporting Tools: Allows advanced analysis to evaluate trading results and liquidity provision.

Low Latency Trading: Uses conclusive latency to fill orders on the infrastructure, improving trading speed.

Incentivized Liquidity Pools: Rewards and incentives focused on user provision of liquidity encourage liquidity provision.

How do you choose the right Solana DEX for you?

Selecting the best Solana DEX (Decentralized Exchange) has several considerations to ensure it fits your trading requirements and preferences. It is, therefore, advisable to consider the following attributes:

Liquidity

Before making a Choice on the DEX, consider its liquidity levels. Better price execution and lower slippage, also known as inflated prices, are usually standard features of higher liquid markets, and these results translate into efficiency in trading the tokens.

Fees

Note the difference in trading commissions, additional withdrawal fees, and all other charges while operating the said exchange. However, this only applies when the exchanges attract the noticed low fee structures.

User Interface

Using the platform should not be stressful and enhance the trading experience, which is more important for novice users. Look for such platforms where one is made to feel that they are in control.

Supported Tokens

Verify that the DEX provides for the cryptocurrencies the users aim to trade. It is worth noting the tendency of some DEXs to specialize in specific tokens or pairs.

Security

Check the security work done on the DEX regarding history, audits, and user reviews. The platform advocated helps retain the safety of the assets against hacks and flaws.

Trading Features

Alternatively, take note of the trading features offered: order types, leverage, multi-currency accounts, portfolio analytics, etc. These could assist in achieving better trading tactics as well as decision-making.

Community and Support

A present community and customer care facilities can be helpful, especially when one encounters challenges or needs to ask a question.

Reputation

Analyze the DEX’s reviews, the community’s opinion, and previous records to evaluate its trustworthiness and effectiveness in the Solana environment.

Considering these variables, you can come to an understanding and select the most suitable one that is appropriate for the kind of trading Solana DEX that you are looking for.

Conclusion

To summarize, the leading decentralized exchanges (DEX) on the Solana Network have varied features and advantages for meeting all trading requirements.

For example, Raydium, Orca, and Drift Protocol are remarkable platforms with decent liquidity, superior trading options, and high engagement.

Some off-list platforms, such as Saber and Mango Markets, top the charts in narrow subsets across platforms.

These DEXs are essential in providing more decentralization and innovation to accessibility and efficiency in the growing Solana ecosystem.

Finally, customer choice guides which DEX is appropriate for an individual user. In the ever-changing world of DeFi, such users will find all the platforms they need on Solana DEX.