In this post, well explore the Best EU Crypto For Yield Farming. Yield farming lets European crypto holders earn passive income through decentralized finance apps.

Ill point out the top projects that deliver secure, high returns across several blockchains, designed for EU investors who want dependable, profitable DeFi plans.

Key Point & Best EU Crypto For Yield Farming

| Platform | Key Point |

|---|---|

| 1inch | A DEX aggregator that finds the best prices across multiple decentralized exchanges. |

| ReHold | Offers multi-chain DeFi swaps with automated yield generation and high APYs. |

| Biswap | A DEX on BNB Chain with the lowest trading fees (0.1%) and multi-type referral rewards. |

| BakerySwap | Combines a DEX with NFT marketplace features, operating on the BNB Chain. |

| Raydium | A Solana-based AMM and liquidity provider that integrates with Serum’s order book. |

| VoltSwap | Cross-chain DEX on the Meter network offering low-fee swaps and bridge functionality. |

| PancakeSwap | The largest DEX on BNB Chain offering swapping, farming, staking, and lotteries. |

| Synapse Protocol | Cross-chain bridge and AMM enabling fast, secure token transfers across blockchains. |

| Plena Finance | A smart wallet for DeFi users supporting automation, gasless transactions, and staking. |

| Exrond | A DeFi platform offering multi-chain interoperability with fast, scalable blockchain tools. |

1. 1inch

1inch ranks as a top DEX aggregator EU investors trust when chasing fresh yield-farming plays. The tool searches dozens of decentralized exchanges and pulls the best swap price, keeping slippage to a bare minimum.

This price-hunting method cuts trading fees and speeds up adding or removing liquidity, a big win for yield farmers. Because 1inch runs on both Ethereum and BNB Chain, users can mix cross-chain strategies without learning new interfaces.

Its non-custodial setup works smoothly with wallets such as MetaMask, Ledger and Trezor, so private keys stay in the users hands.

Plenty of liquidity and smart-order routing can boost returns on each farm. Last, its DAO lets token holders vote on upgrades, keeping the platform community-driven and responsive.

1inch – Features

- DEX Aggregator: Checks many exchanges at once and picks the best swap price.

- Gas Token Helper: Uses the CHI token to cut ETH fees.

- Multi-Chain: Runs on Ethereum, BNB Chain, Polygon, and others.

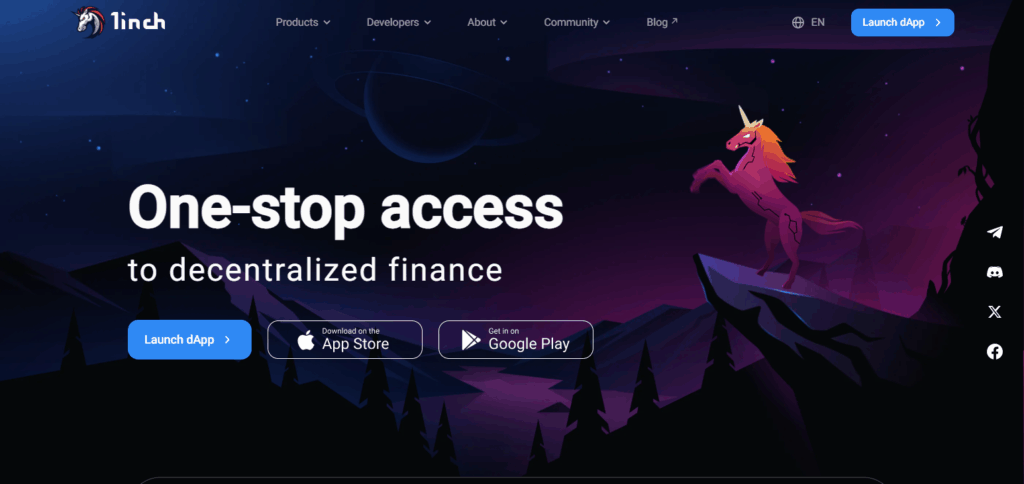

2. ReHold

ReHold is a cross-chain DeFi app that stands out because of its two-way yield plans. Built mainly for EU investors chasing high APYs, the platform lets users lock two crypto assets at a set return, no matter which way prices move.

Its clean, easy layout works with popular wallets, so newbies and pro yield farmers can jump in without fuss. Investors pick the network they like best, whether Ethereum, BNB Chain, or Polygon, giving them freedom to deploy funds where fees and speed suit them.

Regular smart contract audits and clear, open reporting help ReHold earn trust in a space still shaky for many. For extra muscle, the platform feeds AI market forecasts into each plan, making the farming grind leaner and the rewards brighter for European crypto fans.

ReHold – Features

- Dual Investment: Collects yield whether coins climb or drop.

- High APY Pools: Pays generous interest on crypto.

- Multi-Chain: Works with Ethereum, BNB Chain, and Polygon.

3. Biswap

Biswap is a decentralized exchange on the BNB Chain that grabs attention by charging only 0.1% on trades, the lowest fee in the space. That tiny cut means yield farmers keep more of what they earn.

EU users can jump into simple farming and staking pools, picking up rewards in BSW tokens or other assets. Trading pairs cover heavyweights like BNB, USDT and BUSD, so liquidity options stay broad and familiar.

The platform plays nice with popular wallets such as Trust Wallet and MetaMask, giving European traders safe, seamless access.

Throw in a rewarding referral plan, a lively community, regular token burns, and a clear roadmap, and Biswap stays a go-to choice for low-cost, steady yield farming in the region.

Biswap – Features

- Lowest Fees: Charges only 0.1% on each trade.

- Referral Rewards: Share links and earn up to 20% in BSW.

- Farming & Launchpools: Plenty of staking and liquidity pairs.

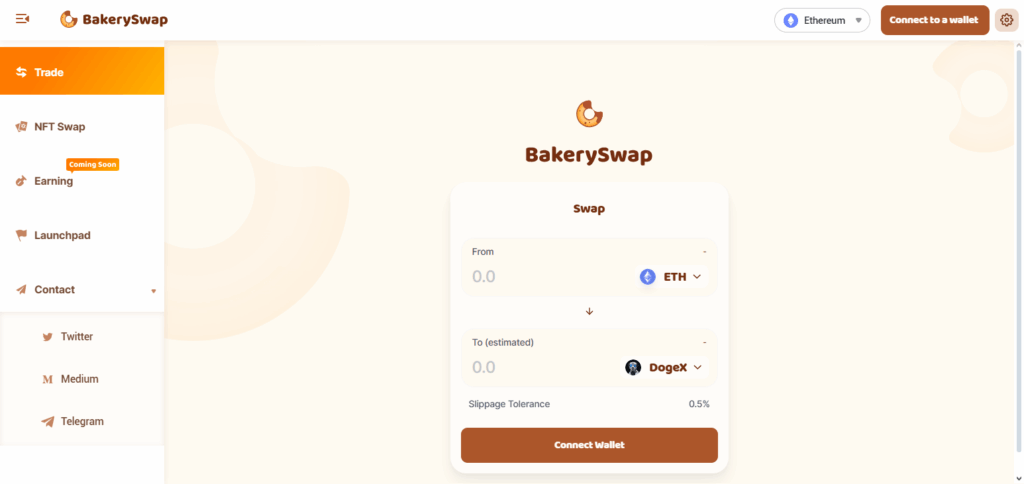

4. BakerySwap

BakerySwap is a handy, all-in-one hub on the BNB Chain that mixes yield farming and NFT perks, drawing in creative crypto folks from across Europe. Users can farm BAKE tokens simply by adding liquidity to a range of pools, many of which sit beside stablecoins or trusted blue-chip coins.

Its twin push on DeFi and NFTs lets investors not only collect yields but also flip or stake digital art for extra cash. Because BNB fees are low, the whole farming routine stays quick and wallet-friendly.

BakerySwap keeps the fun going with regular contests and giveaways that boost overall returns. Supported by solid smart contracts and a clean, friendly interface, it remains a top pick for European yield farmers.

BakerySwap – Features

- NFT Farming: Merge yield farming with a busy NFT market.

- Flexible Staking: Lock BAKE for different reward streams.

- BNB Chain: Fast, low-cost on-chain work.

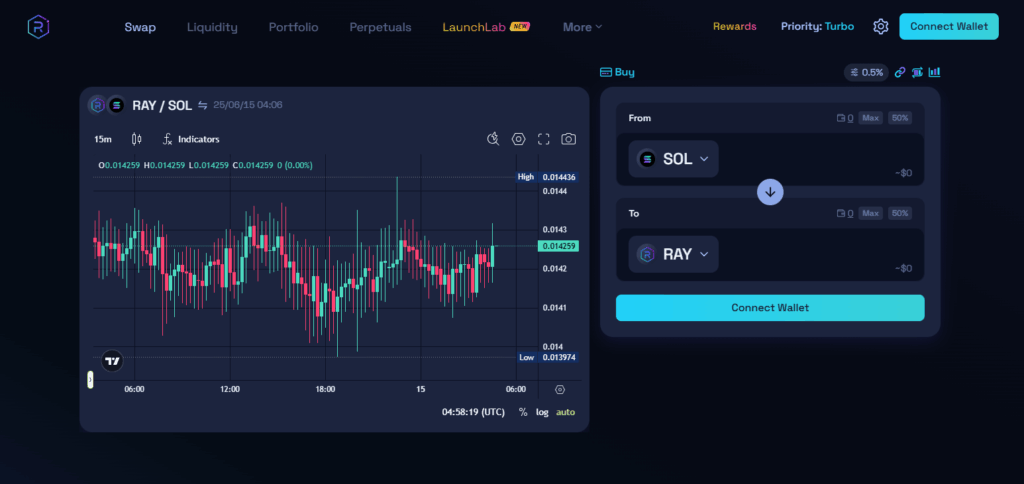

5. Raydium

Raydium is an automated market maker (AMM) built on the Solana blockchain, so trades happen in the blink of an eye and fees are practically zero. Because it plugs straight into Serums order book, users tap into much larger pools of buying and selling money, which often means better prices.

On the farming side, people can either stake the native RAY token or add liquidity in pairs to score extra yield. EU investors in particular enjoy this speedy setup, as Solanas fast block times clear congestion and keep slippage low.

Raydium supports a wide variety of tokens and regularly rolls out new farming and staking events, giving users plenty of choices. The clear dashboard, paired with Solanas overall ecosystem, makes Raydium a top pick for Europeans who want a scalable, eco-friendly yield farm.

Raydium – Features

- Solana AMM: Blazing-fast and cheap swap experience.

- Serum Layer: Taps deep order-book liquidity.

- High-Yield Farms: Competitive returns for liquidity providers.

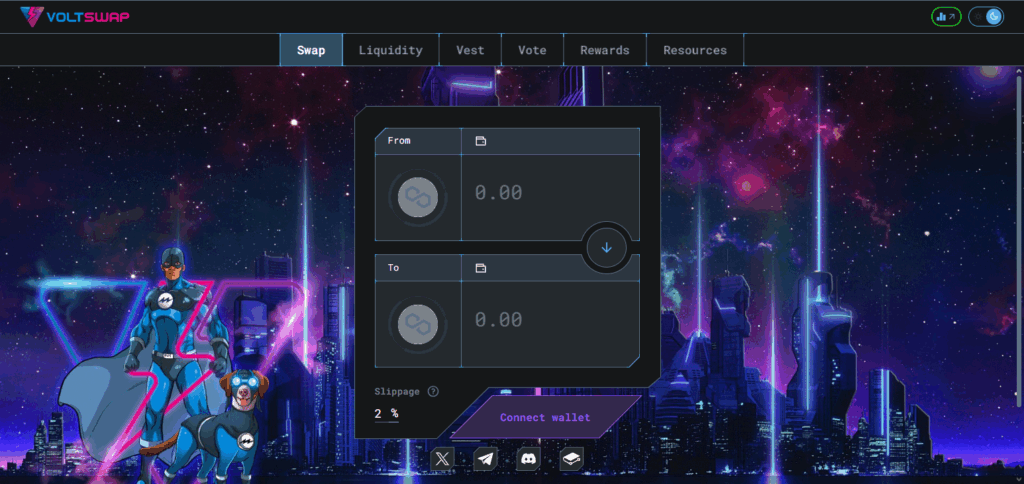

6. VoltSwap

VoltSwap is a cross-chain decentralized exchange built on the Meter network that gives farmers a fresh way to chase yields across many blockchains at once. Made with European users in mind, the DEX keeps gas fees low and swap speeds high, so traders dont lose time or money.

It lets people farm and supply liquidity on Meter, Moonbeam, and Fantom all from one dashboard, making it easy to spread risk. When users park tokens in the different pools, they earn VOLT, the platforms native reward token.

A light KYC process sits well with EU privacy rules, letting folks keep more of their info to themselves. Backed by secure smart contracts and Meter-layer scalability, VoltSwap is built to handle large volumes without hiccups.

For anyone in Europe keen to farm and test new networks, the platform combines solid incentives with a safe, flexible working environment.

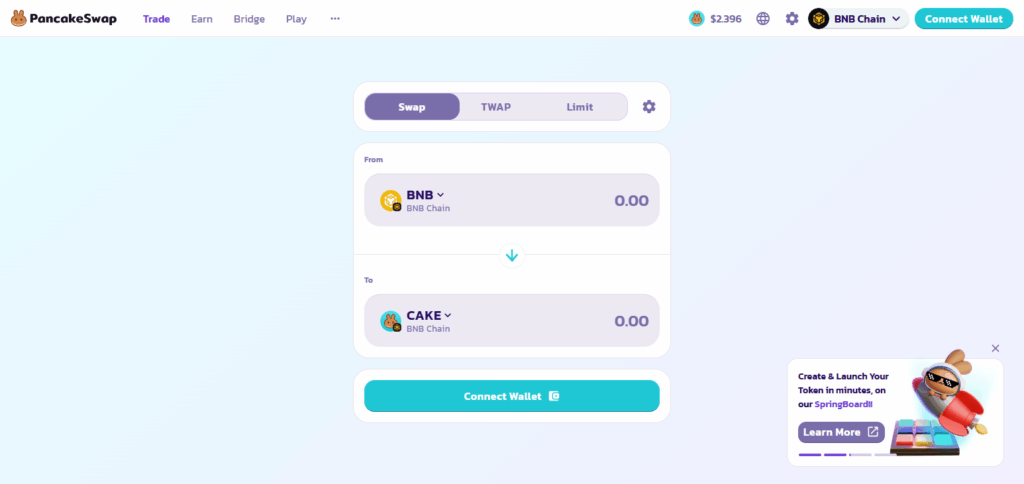

7. PancakeSwap

PancakeSwap is the biggest decentralized exchange on BNB Chain and a favorite spot for yield farmers in the EU. Users can pick from dozens of farming and staking options, such as CAKE pools or liquidity pairs that promise juicy returns.

With tiny fees and speedy swaps, traders stretch each euro further. On top of swaps and farms, the site hosts prediction games, weekly lotteries, and NFT art that can be traded or staked for extra tokens. EU investors enjoy simple wallet links and support in multiple languages.

Security comes from routine audits and day-to-day rule-making by the community. With deep liquidity and a wide list of tokens, PancakeSwap remains the go-to DeFi hub for European yield seekers who want a reliable partner.

PancakeSwap – Features

- Large Liquidity Pools: Choose from hundreds of farms on BNB Chain.

- Extra Earnings: Play the lottery, mint NFTs, predict prices, or stake CAKE.

- Community Voting: CAKE holders decide on future changes.

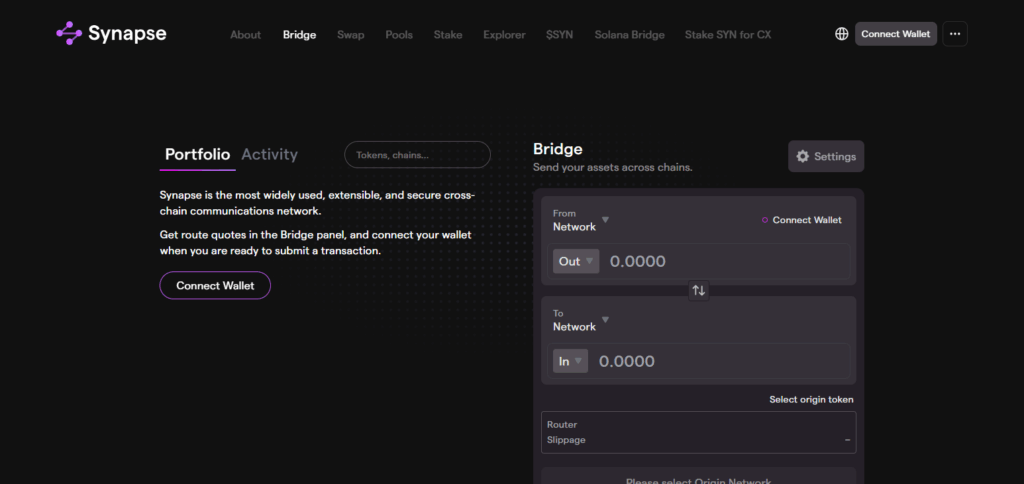

8. Synapse Protocol

Synapse Protocol is more than just a bridge between networks; its a full DeFi hub that lets users farm returns by adding liquidity to stablecoin pools across several blockchains. European farmers can earn SYN tokens simply by supporting these pools.

Because Synapse works with chains like Ethereum, BNB Chain, Avalanche, and Optimism, EU users can chase higher yields no matter where the best rates pop up. The service keeps slippage low and bridge fees tiny, so most of the profit stays in your wallet.

By letting assets move securely between ecosystems without manual transfers, Synapse appeals to traders who want broad DeFi exposure but hate constant wallet juggling. Ongoing security audits, easy-to-read guides, and a growing partner network make it a solid pick for cross-chain yield farming.

Synapse Protocol – Features

- Cross-Chain Bridge: Send tokens between chains without hassle.

- Stablecoin Pools: Safe yields with low risk.

- Earn SYN Tokens: Receive rewards for adding liquidity.

9. Plena Finance

Plena Finance gives users a fresh DeFi experience by packing yield farming, staking, and lending into one smart wallet. For people in the EU, its gasless feature is a real winner: you can run farming moves without ever touching on-chain fees.

The wallet talks to Ethereum, Polygon, BNB Chain, and a few others, so most assets fit right in. Newcomers find the clean layout easy to navigate, while seasoned traders enjoy auto-invest setups and live portfolio updates.

EU investors also love strong privacy, quick sign-up, and plain-language guides. By mixing DeFi tools with familiar banking habits, Plena Finance aims to make secure, hassle-free yield farming routine for users across Europe.

Plena Finance – Features

- Smart Wallet: Automates trades and yield farming for you.

- Gasless Transactions: No upfront fees, just profits.

- Live Portfolio App: Track every asset in real time across chains.

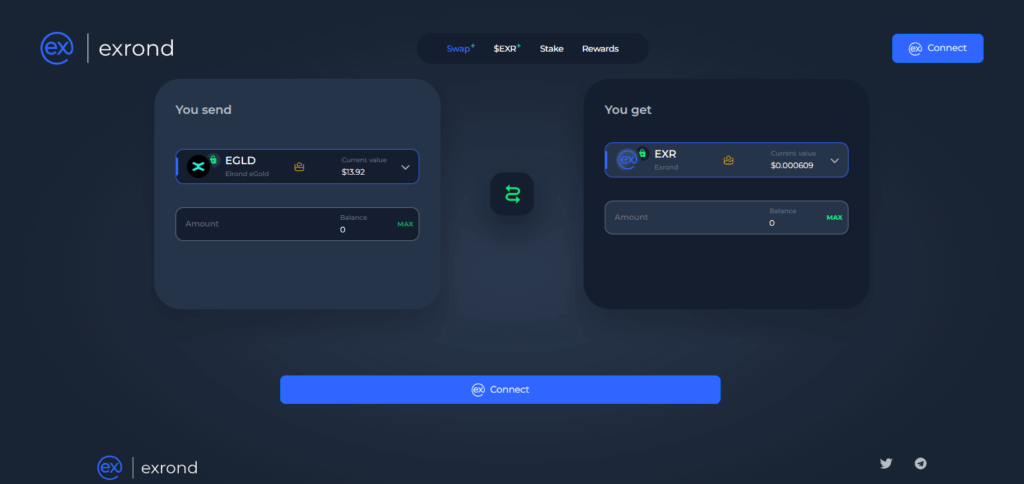

10. Exrond Blockchain

Exrond is a lightning-fast blockchain built for DeFi, spotlighting yield farming that works across multiple chains. Because it processes transactions quickly and for very little cost, EU users who want speed and grow-room find it appealing.

Yield farmers can dive into liquidity pools, stake tokens on any supported chain, and earn rewards without waiting on long delays. The network runs advanced sharding along with solid smart contracts, so each step of yield generation stays secure.

Designed with European regulators in mind, Exrond offers clear onboarding guides and keeps development progress open to the public. Its reputation is rising fast, turning Exrond into a go-to hub in the EU for smooth, borderless yield farming.

Exrond – Features

- Fast, Scalable Network: Sharding keeps performance high.

- Cross-Chain DeFi: Use apps on many blockchains.

- Safe Farming Tools: Built-in protection and low delays.

Conclusion

To wrap up this guide, top EU crypto farms blend solid safety, tiny fees, cross-chain reach, and generous returns.

Services such as 1inch, ReHold, and Biswap deliver fast trading alongside farming, whereas PancakeSwap and Raydium bring thick liquidity and lively networks.

EU users chasing fresh ideas and easy passive income will find in these decentralized apps steady chances for long-lasting yield.