In this blog post, I will talk about the Ultimate Financial Advice Websites that assist you in managing your finances. These sites provide more than just advice—offering guidance and investing calculators.

From retirement planning to budgeting and investing, these websites make available expert opinions, tools alongside detailed comparisons.

Every website is a treasure of information with different amenities catering towards diversified financial habits and proficiency levels. Like every other service, there are also useful aids like NerdWallet and Morningstar.

Key Points & Best Financial Advice Websites List

| Website | Key Features |

|---|---|

| NerdWallet | Personal finance tools, credit card comparisons, investing & mortgage advice |

| Investopedia | Financial education, investing tutorials, dictionary, simulator tools |

| The Motley Fool | Stock recommendations, investment strategies, premium advisory services |

| Yahoo Finance | Real-time stock quotes, news, portfolio tracking, financial analysis |

| Morningstar | In-depth mutual fund and stock analysis, ratings, investment research |

| CNBC | Financial news, stock market updates, expert analysis, videos |

| Kiplinger | Retirement planning, taxes, saving tips, personal finance advice |

| Bankrate | Mortgage rates, savings calculators, loan comparisons, credit card info |

| Seeking Alpha | Investment insights, earnings analysis, stock forecasts from analysts |

| SmartAsset | Financial calculators, advisor matching, tax tools, personal finance guides |

10 Best Financial Advice Websites

1.NerdWallet

NerdWallet is a simple and straightforward financial advice website that aims to help users with important money decisions. The site has detailed reviews and comparisons of credit cards, saving accounts, loans, and even insurances.

It also has budgeting tools, calculators as well as expert articles on personal finance that cover home buying, investing, student loans among other topics.

For those new to financial planning, NerdWallet’s tailored recommendations based on user input make it extremely useful. Content is frequently updated which makes the resource reliable for timely financial information in light of changes in interest rates or regulations.

NerdWallet

- Comparison Tools: Allows checks on credit cards, loans, mortgages and even savings accounts.

- Personalized Advice: Tailored suggestions directly aligned to user’s financial expectations and profile.

- Educational Content: Comprehensive guides on budgeting, investing, managing debt, and taxes.

- Financial Calculators: Mortgage, loan, and retirement calculators accessible tfor users.

2.Investopedia

Investopedia is one of the top websites for learning about finance and investment topics, receiving hundreds of thousands of visitors each month. It’s well known for offering a financial dictionary that contains thousands of investing and economic terms which are articulated in simple definitions.

Overhead guide teaches stock market investments as well as retirement planning through detailed tutorials, explainers, and step by step articles available on the site. There is even a simulator tool available on the site so users can practice trading without losing real money.

For beginners and advanced investors, there are expert articles plus video lessons with quizzes included on the site. No matter what concept you wish to grasp from ETFs to inflation, Investopedia gives accurate details alongside other reliable financial resources.

Investopedia

- Financial Dictionary: Thousands of finance & investing terms with plain explanations.

- Learning Center: Tutorials and guide videos covering all skill levels taught by various experts.

- Stock Market Simulator: Virtual trading allows skills building for new investors in a low risk environment.

- Expert Articles: Daily insights into finances from analysts and professionals are featured.

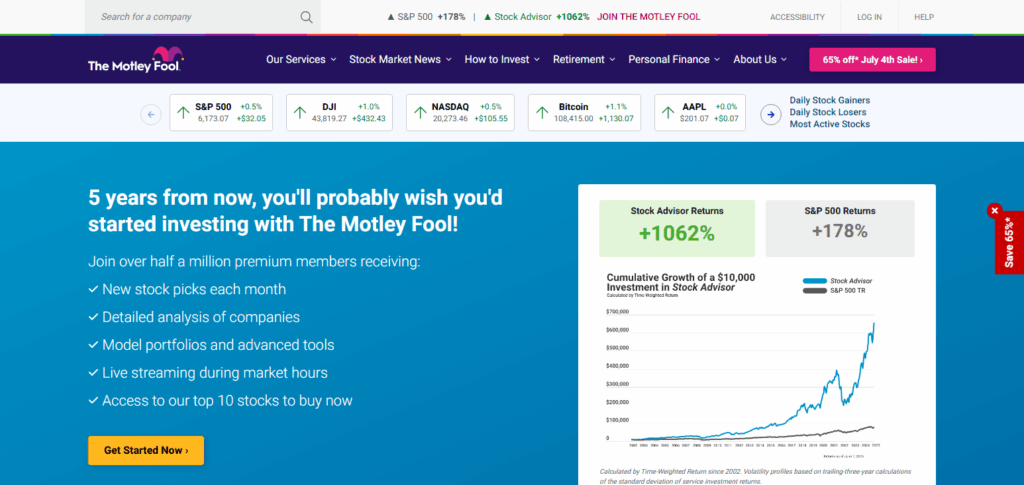

3.The Motley Fool

The Motley Fool is known for providing long-term investment advice and focuses on stock market strategies. It has both free educational content and paid services that offer stock recommendations and guide investors with portfolio management tips.

Founded by financial experts, The Motley Fool stresses comprehensive research, a sound understanding of finance, “buy-and-hold” strategies, and investing for the long term.

The site simplifies intricate financial concepts, is well-known for its community forums and podcasts, and offers curated stock picks tailored to most investors’ needs through its Stock Advisor service. With all this in mind,

The Motley Fool

- Stock Recommendations – Curated stock picks with strategies offered by premium subscriptions.

- Long Term Investing Advice – Focuses on wealth growth through long term “buy” strategies using held assets.

- Podcasts & Newsletters – Educational materials alongside timely updates from trusted finance professionals.

- Community Forums – Digital spaces dedicated to investor discussions form an interactive forum.

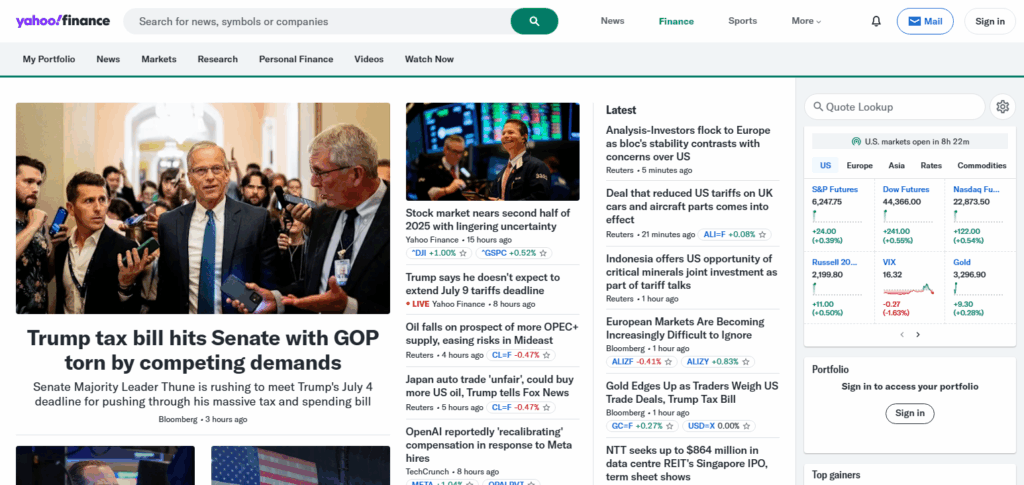

4.Yahoo Finance

Yahoo Finance is a one-stop portal for financial news and data, providing real-time stock quotes, historical charts, company profiles, as well as economic news. Eager users can effortlessly tap into market insights, earnings reports, curated watchlists and more.

They let users set up custom portfolios to track asset performance alongside receiving relevant news alerts. Yahoo Finance spans from global topics all the way to personal finance.

From reading articles to watching video interviews with market experts, there is something for everyone. It is useful for people who want an overview of investment snapshots along with current and emerging trends in the market because of its other Yahoo Services integrations

Yahoo Finance

- Real-Time Market Data – Provides live stocks quotes/indices alongside currency updates too.

- Portfolio Tracking – Lets users monitor their investments alongside market performance too

- Financial News Coverage: Reporting on global stock markets, the economy, and earnings reports from corporations.

- Video Content: Coverage includes interviews with specialists in finances as well as real-time analyses of the market.

5.Morningstar

Morningstar is known for its detailed research and impartial ratings on mutual funds, stocks, ETFs, and other investment products. It is a go-to resource for financial advisors and serious investors.

The site has a star rating system that aids in identifying high-performing low-cost investments and sorts them based on risk-adjusted returns. In addition to the research reports, planning tools, screeners, and portfolio analysis features are also included.

In-depth insights and data are accessible through premium services. Through credible data-driven guidance from Morningstar, users are able to build diversified portfolios.

Morningstar

- Investment Ratings: Provides star ratings based on performance for mutual funds, stocks and ETFs.

- In-Depth Research: Offers detailed analysis of various financial instruments and recent trends in the world’s markets.

- Portfolio Management Tools: Monitor and assess your financial strategies relative to your investments.

- Premium Access: Subscription grants high-end data access and proprietary research reports not available to non-subscribers.

6.CNBC

CNBC provides real-time market updates along with business news and expert commentary which makes it one of the top outlets for financial news. It serves as a great tool for tracking stock movements, economic indicators, and global events in finance.

With its vast collection of articles and video content along with leading market interviews and industry analysis, CNBC keeps its audience well informed. The television channel alongside the mobile app adds to the website’s already rich offerings by providing an around the clock stream of news and key insights.

While both everyday investors and professionals can benefit from CNBC, the latter proves most valuable for people looking at how macroeconomic trends affect markets around the globe and their personal investments.

CNBC

- 24/7 Market News: The channel offers unbroken coverage concerning finance and world news any time of day or night.

- Live TV & Streaming: Watch the broadcasts anytime along with expert interviews.

- Market Insights: Comprehensive assessment of various sectors, important stocks are listed alongside other economic indicators.

- Mobile App: Instant placement alerts on active markets as well as quotes for associated tickers.

7.Kiplinger

Kiplinger is a trusted site for personal finance information, emphasizing how to manage money effectively. Their articles on retirement, investment, saving, tax strategies, and even college funding are very helpful. The site features financial calculators along with newsletters and comprehensive guides aimed at improving one’s financial literacy.

Kiplinger is especially noted for its pragmatic writing style that provides simple but actionable tips. It works best for individuals who wish to improve their financial health over the long haul. From budgeting for your first home to retirement planning, Kiplinger offers reliable advice tailored to all stages of life.

Kiplinger

- Practical Advice: Straightforward advice around limiting spending, budgeting and even investing money wisely is provided.

- Retirement Planning Guides designed for guiding through IRAs, 401k plans as well as pensions.

- Tax Guidance Issues relevant taxes along with updates plus even tax calculators for families.

- Consumer Rankings Grade A recommendations for insurances like life insurance, credit cards together expanding into financial services.

8.Bankrate

Bankrate is known as a comparer site of finances due to its up-to-date rate feature where users can compare credit cards, savings and even mortgages. Users can also access articles concerning personal finance, credit health and debt written by experts in the field.

Among other financial comparison sites, Bankrate stands out due to its mortgage and loan calculators which assist users who are planning big purchases such as houses or even auto loans. Buying a house or trying to improve your credit score becomes much simpler with the right guidance aligned with your goals provided by Bankrate.

Bankrate

- Rate Comparisons: Latest rates for mortgages, loans, CDs, and credit cards.

- Financial Calculators: Tools for loan payments, affordability, savings, and more.

- Expert Articles: In-depth content on credit, debt, banking, and personal finance.

- Loan & Mortgage Guides: Step-by-step guidance for major financial decisions.

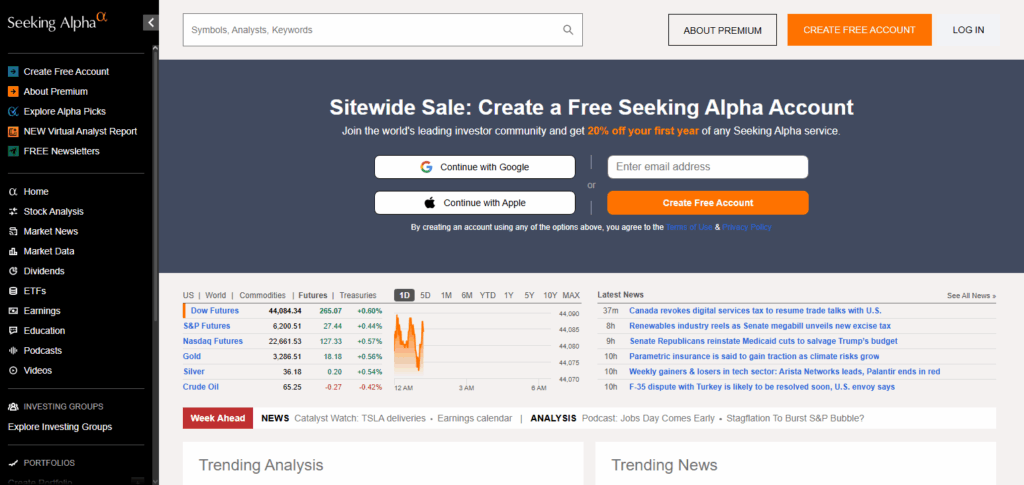

9.Seeking Alpha

Seeking Alpha is an investment research and market analysis platform that features independent contributors, analysts, and investors. It specializes in financial commentary, earnings previews, corporate stock forecasts, as well as in-depth analyses of publicly traded companies.

The site features equities and ETFs along with commodities and macroeconomic trends. Investors can manage portfolios, set alerts, participate in conversations, and more. Quant ratings alongside other premium content are unlocked by a Seeking Alpha subscription.

Active investors and traders focused on diverse insights regarding market shifts appreciate seeking Andrew’s firsthand experience from industry contributors with remarkable expertise.

Seeking Alpha

- Independent Analysis: Contributions by investors and various other financial professionals.

- Earnings Insights: Previews of earnings reports together with position statements on future earnings.

- Stock Ratings & Screeners: Evaluation and discovery tools for investment opportunities.

- Premium Content: Subscriber-exclusive quantitative ratings and supplementary research.

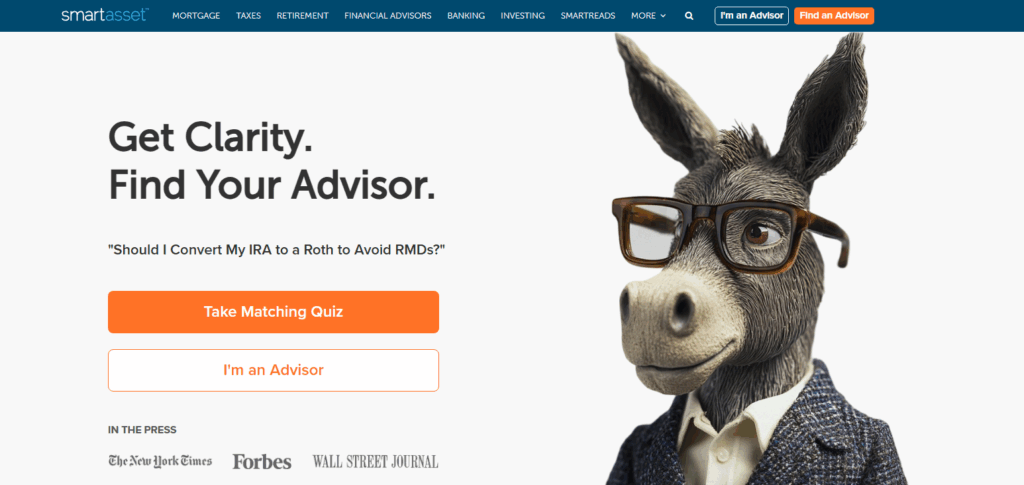

10.SmartAsset

SmartAsset helps users make better financial decisions by offering innovative tools alongside sound advice tailored to individual cases. This includes tax planning, retirement estimation, and home-budgeting among others with its famous calculators.

In addition to providing actionable recommendations on investing or even banking and insurance through advanced AI models integrated into the site under SmartAdvisor user are connected with real advisors too.

They effortlessly simplify complex financial plans like choosing between renting or buying a house or even devising a productive long-term strategy for retirement tailored to individual scenarios

SmartAsset

- Financial Calculators: Mortgages, budgeting, retirement, taxes, and more: budget-related tools.

- Advisor Matching: SmartAdvisor links users to verified advisors through an automated vetting process.

- Educational Content: Instructional materials on saving, insurance policies, investments, etc.

- Personalized Insights: Tailored guidance based on user data and articulated objectives.

Conclusion

In summary, the most effective financial advice websites give unparalleled insights, tools, and other resources due to an expertly curated list of insider information. Be it budgeting, investing or retirement planning – sites like NerdWallet, Investopedia and MorningstarSafely offer reliable access to expert advice.

These informative platforms help novice as well as professional investors take charge of their money management activities with ease, proving instrumental to attaining sustained financial growth over time.

FAQ

What are the best websites for financial advice?

Top sites include NerdWallet, Investopedia, The Motley Fool, Yahoo Finance, Morningstar, CNBC, Kiplinger, Bankrate, Seeking Alpha, and SmartAsset. They offer a mix of education, tools, and expert insights.

Are these financial websites free to use?

Most offer free access to articles, tools, and basic services. However, some (like Morningstar or The Motley Fool) have premium plans for advanced research or exclusive recommendations.

Which site is best for beginners?

NerdWallet and Investopedia are great for beginners due to their clear explanations, tutorials, and user-friendly tools.