In This Post i will review est Forex Brokers for Cross-Border Traders has become a crucial entry point for investors looking for chances outside of their home markets in today’s interconnected financial world.

Global traders need platforms that offer multi-currency support, robust regulation, minimal costs, and seamless execution across jurisdictions, so selecting the appropriate broker is crucial.

With dependable technology, a variety of payment alternatives, and compliance protections, the top forex brokers enable cross-border traders to participate in international currency markets profitably and securely.

What Is Cross-Border Forex Trading?

The buying and selling of foreign currencies between nations, which allows traders and companies to take part in global financial markets, is known as cross-border FX trading. In order to enable international trade, investment, and speculation, currencies are traded on the global foreign exchange (FX) market.

Cross-border trading enables participants to access liquidity from several jurisdictions, hedge against currency risks, and profit from exchange rate movements because FX is the largest decentralized market in the world.

Because it helps manage exposure to a variety of currencies while negotiating different legal regimes, this kind of trading is particularly crucial for multinational corporations, international investors, and retail traders that conduct business internationally.

Key Point

| Broker | Key Strength / Feature |

|---|---|

| Pepperstone | Ultra-low spreads + multi-platform access for algo traders |

| IC Markets | Very low ECN spreads & fast execution |

| Exness | Instant 24/7 withdrawals + low min deposit |

| IG Group | Long-established broker with broad global access & tools |

| OANDA | Strong research & stable regulatory reputation |

| FXTM (ForexTime) | Good mix of account types; beginner-friendly options |

| Interactive Brokers (IBKR) | Extremely wide multi-asset access + tight pricing on FX |

| CMC Markets | Huge instrument range & detailed charting tools |

| FP Markets | Broad asset access & competitive spreads |

| XTB | Award-winning proprietary platform + strong research |

1. Pepperstone

Among the many different brokerage firms, Pepperstone is one of the most highly rated all around the globe. They have received regulations from the FCA (UK), ASIC (Australia), DFSA (Dubai), as well as CySEC (EU).

Pepperstone has positive customer feedback when it comes to how cheap it is to trade with them, having minimal spreads of around 0 pips on a few accounts, furthermore, having good customer service.

Along with this, they’re compatible with many different trading platforms including the highly rated cTrader, MT5, MT4, as well as TradingView.

Among Pepperstone’s competitors, they have some of the best prices, as well as the fastest trade execution. Trading with them is highly recommended to people who are high volume forex traders.

Pepperstone Features

- Regulation: FCA, ASIC, CySEC, DFSA

- Fees: 0.0 pip spreads (Razor Account) + commission

- Platforms: MT4, MT5, CTrader, TradingView

- Strengths: Excellent liquidity, global regulation, and tunnel execution (77ms)

- Best For: Cross-border traders, algo traders, and scalpers

Pepperstone Pros & Cons

Pros:

- FCA, ASIC, CySEC, DFSA regulation (Strong Compliance)

- Ultra-fast execution (77ms)

- Multiple Routing Platforms (MT4, MT5, cTrader, TradingView)

- Spreads from 0.0 pips

Cons:

- No proprietary platform.

- Product range lower than competitors (Less than IG or Interactive Brokers)

- EU/UK leverage 1:30 cap

2. IC Markets

IC Markets has additional regulations overseas, as they have partnered with ASIC (Australia), CySEC (Cyprus), and even the FSA (Seychelles). IC Markets offers some of the lowest raw spreads on the accounts they offer.

Any traders that engage in scalping can benefit tremendously from the accounts IC Markets offers, as they have a zero spread account, and a true ECN execution account.

Along with this, the MT4, MT5, and cTrader platforms offer, with their integrated advanced-charting features, to further assist their traders.

They also advertise to have some of the best trade execution speeds. Also, they have high liquidity, which is a feature a lot of traders are looking for.

IC Markets Features

- Regulation: ASIC, CySEC, FSA (Seychelles)

- Fees: 0.02 pip spreads (Raw) + commission ($3.5 per lot)

- Platforms: MT4, MT5, CTrader, TradingView

- Strengths: Outstanding spreads and liquidity. Free VPS

- Best For: Professionals, high-volume traders, and scalpers

IC Markets Pros & Cons

Pros:

- ASIC, CySEC, FSA regulation.

- Globally, 0.02 pips (t) lowest Raw Spreads.

- High liquidity, Ideal for Scalping.

- Platforms MT4, MT5, cTrader, TradingView

Cons:

- Offshore regulation (Seychelles) Less strict than FCA/ASIC.

- Educational materials are sparse.

- No proprietary platform.

3. Exness

Trading with Exness is appealing to many cross border traders, as they have received regulations from the FCA (UK), CySEC (EU), and even the FSCA (South Africa), which enables them to have more flexibility.

It provides exceptionally narrow spreads starting at about 0.0 pips on select accounts and special adjustable dynamic leverage that can get quite high depending on the area and trading volume.

Users have access to MetaTrader 4 and MetaTrader 5, along with a web terminal and mobile apps. Unique 24/7 withdrawals, numerous local payment methods, and pricing make it great for all forex and crypto traders, especially those needing quick access to their money and adjustable high leverage.

Exness Features

- Regulation: FSCA, FSA (Seychelles), CMA (Kenya), JSC (Jordan)

- Fees: From 0.6 pip spreads, and standard accounts with no commission

- Platforms: MT4, MT5, Exness Terminal, and App

- Strengths: Instant withdrawals and unlimited leverage

- Best For: Traders in Africa, Asia, and emerging markets requiring adaptable leverage

Exness Pros & Cons

Pros:

- Regulation (FSCA, FSA, CMA, JSC) Multiple licenses.

- Offshore Leverage Unlimited.

- Flexible payment systems, Instant withdrawals.

- Platforms: MT4, MT5, Exness Terminal, mobile app

Cons:

- Standard accounts have higher spreads (~0.6 pips).

- Offshore regulation worse than Tier-1.

- Research tools are worse than IG or CMC.

4. IG Group

An established brand, IG Group, is available on the London Stock Exchange, and regulated by the FCA, so their oversight is some of the strongest available with institutional protection.

Forex fees are mostly embedded into the spreads (variable), including their own proprietary platforms and MetaTrader, with direct market access.

They cover a range of markets in forex and CFDs, and also offer analytical and research tools. They have a growing reputation and cover a range of high end trading environments, reputation and products.

IG Group Features

- Regulation: FCA (UK), ASIC (Australia), BaFin (Germany), FINMA (Switzerland), NFA/CFTC (US)

- Fees: Market-maker spreads, available DMA accounts

- Platforms: MT4, ProRealTime, IG proprietary platform, L2 Dealer

- Strengths: Extensive product range (forex, CFDs, shares, crypto, spread betting)

- Best For: Broadly diversified traders who need cross-border access, global regulation, and multi-asset products

IG Group Pros & Cons

Pros:

- Global regulation with a presence in all major jurisdictions (FCA, ASIC, BaFin, FINMA, NFA/CFTC, MAS)

- Global product offerings, including forex, CFDs, shares, crypto, and spread betting.

- Proprietary platforms include IG, L2 Dealer, and ProRealTime.

- Strong presence for over 45 years in the industry.

Cons:

- Spreads are generally higher compared to ECN brokers.

- Complex fees associated with Direct Market Access (DMA) accounts.

- Beginners may find the platform overwhelming.

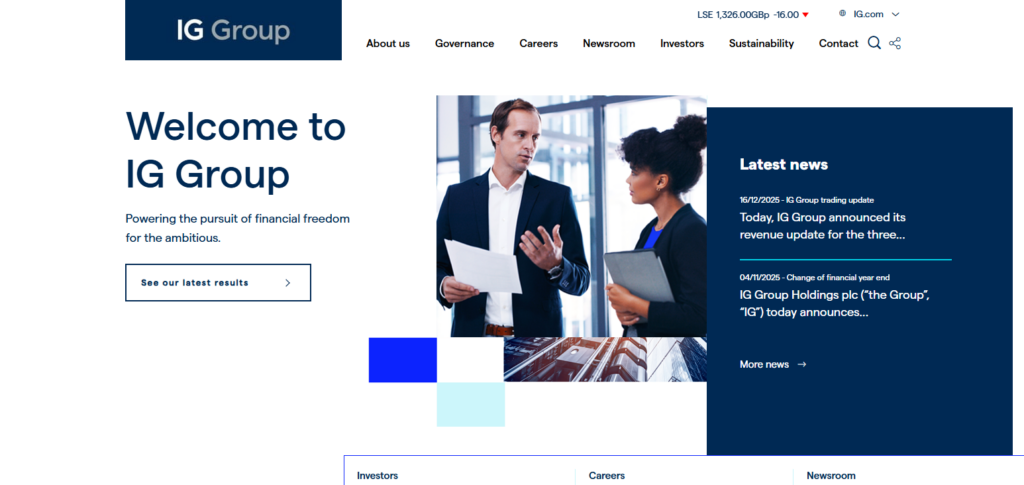

5. OANDA

OANDA has major and strong regulators, which are CFTC/NFA in the US, FCA in the UK and ASIC in Australia, giving a good trading environment OANDA has offers forex trading by using a variable spread with low or no commission on the standard accounts.

They support proprietary platforms and also offer MetaTrader 4. OANDA offers a friendly pricing model that Is suitable for people that like transparency. They have major advantages from strong regulatory, good execution, and reasonable price description.

More advanced traders may consider that spreads are wider than the ECN brokers including the OANDA for traders, while valuing transparency and regulatory protection.

OANDA Features

- Regulation: CFTC (US), FCA (UK), ASIC (Australia), MAS (Singapore)

- Fees: Spread-only pricing (EUR/USD ~1.2 pips) with no commission

- Platforms: MT5, TradingView, OANDA proprietary platform

- Strengths: Pricing transparency, strong presence in the US, and good analytical software

- Best For: Traders in the US and Europe who need strong compliance, transparency, and reliability

OANDA Pros & Cons

Pros:

- CFTC, FCA, ASIC, and MAS regulations.

- Pricing is completely transparent with no commissions (spread-only).

- Significant presence in the US.

- Platforms used include MT5, TradingView, and a proprietary platform.

Cons:

- Wider spreads than Pepperstone/IC Markets (~1.2 pips on EUR/USD).

- Compare to IG and IBKR, product offerings are more limited.

- In the US, no high leverage is allowed (capped at 1:50).

6. FXTM (ForexTime)

FXTM is regulated by the FCA (UK), CySEC (EU), and FSCA (South Africa), which offers credibility for international clients.

The FXTM is one of the brokers with various account types, moderate to low spreads, and tiered commission structures for its ECN accounts. Supported trading platforms include MetaTrader 4 and 5 and a copy trading feature.

Localized payment methods, educational resources, and diverse account types make FXTM more accessible for different types of traders; flexible resources and account pairings make FXTM most accessible for novice and intermediate traders, while educational tools and localized payment options make it more appealing for those who require more direct guidance.

FXTM (ForexTime) Features

- Regulation: FCA (UK), CySEC (Cyprus), FSC (Mauritius)

- Fees: Variable spreads, standard accounts with no commission

- Platforms: MT4, MT5, FXTM mobile app

- Strengths: Fast and easy account opening, good educational materials, low fees on forex

- Best For: Low-cost retail traders in Africa, Asia, and Europe who want education

FXTM Pros & Cons

Pros:

- FCA, CySEC, and FSC regulations.

- Account opening is quick, and there are solid educational resources.

- Platforms include MT4, MT5, and the FXTM mobile app.

- Good fees in forex.

Cons:

- Fees are applicable for withdrawals.

- Outside of forex and CFDs, product offerings are more limited.

- Offshore regulation (in Mauritius) is more lax.

7. Interactive Brokers (IBKR)

Interactive Brokers is a multi-asset broker with a reputation for strong regulation across multiple jurisdictions, including the FCA, CFTC, ASIC, and MAS. Such multi-jurisdictional coverage makes them a safe partner for cross border businesses.

Rather than a combination of spread and commission, their pricing model is based on commission only and is competitive. Currency trading in one direction will set you back $2.

The advanced proprietary platforms include Trader Workstation (TWS) and apps for web and mobile with comprehensive global market coverage, advanced tool support, and deep market analysis.

The considerable access to multiple trading instruments and highly rated institutional trading tools are key advantages. The higher level of platform sophistication will result in greater difficulty for starters. They are recommended for professional and advanced traders.

Interactive Brokers (IBKR) Features

- Regulation: SEC (US), FCA (UK), ASIC (Australia), IIROC (Canada)

- Fees: Low commissions and tight spreads on multi-asset products

- Best For: Professional traders & institutions needing global reach and lowest fees

Interactive Brokers (IBKR) Pros & Cons

Pros:

- IRA, SEC, ASIC, and FCA regulations.

- Spreads are very tight and so are the commissions.

- Access to multiple asset classes including forex, stocks, ETFs, options, and futures.

- Access to top-tier technology and APIs.

Cons:

- The platform is very complex. Trader Workstation is not beginner-friendly.

- Higher minimum deposit requirements compared to retail brokers

- More generalized customer support

8. CMC Markets

They operate under the regulation of the FCA and other tier one regulators and are well known for their trading infrastructure which includes competitive pricing and deep liquidity.

It also includes CMC’s proprietary platform, which has deep charting and analysis options, as well as integrations with MetaTrader in select countries.

CMC’s fees are embedded in spreads and has a diverse offering with over 12,000 instruments and a wide variety of forex pairs and CFDs. Some of its notable features include research, education, and trading flexibility.

This is best suited for traders who prefer a more straightforward trading experience while still having access to a wide range of features and tools.

CMC Markets Features

- Regulation: FCA (UK), ASIC (Australia), MAS (Singapore), BaFin (Germany)

- Fees: Spread-only accounts, EUR/USD average 0.7 pips

- Platforms: MT4, Next Generation proprietary platform

- Strengths: Advanced charting, 35+ years of experience, guaranteed stop-loss orders

- Best For: Intermediate traders seeking strong risk management & advanced tools

CMC Markets Pros & Cons

Pros:

- Regulatory bodies: FCA, ASIC, MAS, BaFin

- Advanced charting and proprietary Next Generation platform

- Stop-loss orders are guaranteed (risk management)

- Over 35 years of experience in the industry

Cons:

- Higher spreads than ECN brokers (~0.7 pips EUR/USD)

- In the EU/UK, there’s limited leverage (1:30)

- No features to copy trades

9. FP Markets

With regulation from ASIC and CySEC, FP Markets offers low spreads, with some starting at 0.0 pips on raw accounts, and a clear commission for ECN trading, which is quite attractive on a global scale.

Supported platforms are MetaTrader 4 and 5, and cTrader, and services include more than just forex CFDs, including indices and commodities.

Competitive pricing, a wide variety of platforms, and negative balance protection are some of FP Markets’ best attributes for forex and CFD trading. This is best suited for traders who require condition flexibility at lower costs and multiple platform choices.

FP Markets Features

- Regulation: ASIC (Australia), CySEC (Europe)

- Fees: Raw spreads from 0.0 pips + commission, standard accounts ~1.2 pips

- Platforms: MT4, MT5, cTrader, TradingView, IRESS

- Strengths: Low-cost trading, copy trading, strong customer support

- Best For: Cross-border traders seeking affordability & multiple platform choices

FP Markets Pros & Cons

Pros:

- Regulatory bodies: ASIC, CySEC

- On the MT4, MT5, cTrader, and TradingView, spread starts at 0.0 pips + a commission

- Good customer support as well as copy trading support

Cons:

- Compared to IG or Pepperstone, global regulation is limited

- For advanced traders, there’s IRESS platform fees

- Less varied product range than IG or IBKR

10. XTB

XTB is on the Warsaw Stock Exchange and is regulated by the FCA (UK), CySEC (EU), and KNF (Poland). With a custom xStation 5 and MetaTrader in select areas, he has CFDs on forex, indices, commodities, and stocks.

They offers competitive pricing with average industry spreads. He supports risk management and negative balance protection. It has a modern trading interface with integrated analytical tools. This is best for traders who like flexible and wide-ranging platforms.

XTB Features

- Regulation: FCA (UK), KNF (Poland), CySEC (Cyprus)

- Fees: Commission-free forex trading, spreads from 0.1 pips

- Platforms: Proprietary xStation 5 platform, MT4 (limited regions)

- Strengths: Excellent customer service, strong education, user-friendly platform

- Best For: European & Asian traders wanting transparency, low costs, and ease of use

XTB Pros & Cons

Pros:

- Regulatory bodies: FCA, KNF, CySEC

- No commission on trading forex, spread on trading starts at 0.1 pips

- Excellent education, friendly customer support

Cons:

- The range of MT4 is limited to a few regions

- The product range is smaller than IG or IBKR

- There’s leverage is limited to 1:30 in the EU/UK

Why Cross-Border Traders Need Specialized Forex Brokers?

Global Regulation

Compliance with regulations is important. Specialized brokers are legally protected and safe to trade with and can operate in multiple, diverse, regulatory environments.

Multi-Currency Accounts

Specialized brokers offer a variety of currency accounts: USD, EUR, GBP, JPY, and AUD. This makes deposits, withdrawals, and conversions seamless and efficient.

Low Transaction Costs

Cross-border traders or brokers specializing in multiple currencies incur costs in transit. Low commission, low spread, and multiple international trade options increase profitability.

Fast Execution

Cross-border traders operate with multiple liquidity pools. Brokers who have cross-border trade options and ultra-low latency execution are the best options for no slippage.

Flexible Leverage

Balance the risk and trade the opportunity. This is the purpose of region-specific leverage. These options are available for traders who have differing regulations.

Multiple Platforms

Cross-border traders can operate through different devices. Brokers are versatile to use multiple platforms including MT4, MT5, cTrader, TradingView, and proprietary systems.

Diverse Payment Options

Making international payments is easy through crypto, e-wallets, and bank transfers. Brokers of cross-border traders have no friction in making deposits and withdrawals.

Risk Management Tools

Along with cross-border traders volatility and currency risk management with analytics, they use guaranteed stop-loss orders and hedging options.

Local Market Access

Emerging markets, often neglected by global players, are served with better spreads and execution by specialized brokers who are linking traders to regional liquidity providers.

24/7 Multilingual Support

Cross-border traders are served with multilingual support who customer service representatives are working in different shifts to cover all time zones to facilitate and assist in the problem in service.

Conclusion

Global regulated trading, low fees, multi-currency, and high execution reliable are some of the brokers needed for cross-border forex trading. The frontrunners—Pepperstone, IC Markets, Exness, IG Group, OANDA, FXTM, Interactive Brokers, CMC Markets, FP Markets, and XTB—contribute in their own unique way in supporting global traders with varying demands.

Known for speed and low spreads are Pepperstone and IC Markets, Exness is flexible on leverage, OANDA, FXTM, CMC, FP Markets and XTB are known for their compliance and educational resources. IC and Interactive brokers are great for global multi-asset access.

Brokers like XTB and FP Markets are great for low compliance and educational resources. FXTM, OANDA, and CMC are great for high education and compliance. These brokers will ensure trading is efficient and safe, and with no doubt will be the best for 2026.

FAQ

What is cross-border forex trading?

Cross-border forex trading involves buying and selling currencies across different countries, allowing traders to access global liquidity, hedge risks, and profit from exchange rate fluctuations.

Why do cross-border traders need specialized brokers?

Specialized brokers provide multi-currency accounts, global regulation, fast execution, diverse payment options, and multilingual support, ensuring smooth trading across different jurisdictions and time zones.

Which brokers are best for cross-border traders?

Top brokers include Pepperstone, IC Markets, Exness, IG Group, OANDA, FXTM, Interactive Brokers, CMC Markets, FP Markets, and XTB, each excelling in regulation, fees, and platforms.

How do regulations affect cross-border forex trading?

Regulations vary by region (EU/UK leverage capped at 1:30 vs. offshore 1:500). Choosing a broker with multi-jurisdiction licenses ensures compliance and trader protection.

What platforms do these brokers offer?

Most support MT4, MT5, cTrader, TradingView, and proprietary platforms. Interactive Brokers and IG Group also provide advanced institutional-grade platforms for multi-asset trading.