When doing Best Forex Brokers for Overnight Swing Traders, you have to have a broker that has low holding costs, is strongly regulated, and has a reliable trading platform.

The best forex brokers for overnight swing traders tailor to the needs of those who hold positions for several days and have clear swap rates, consistent execution, and reliable charting tools.

The right broker allows traders to better manage their risks, minimizes overnight costs and enables them to concentrated on the confident trading of medium-term market trends.

Top 10 Forex Brokers for Swing Trading (2026)

| Broker | Regulation Strength | Key Advantage |

|---|---|---|

| IC Markets | ASIC, CySEC, FSA | Best for tools & execution |

| Pepperstone | ASIC, FCA, DFSA | Excellent for algo trading |

| FP Markets | ASIC, CySEC | Best for low spreads |

| FxPro | FCA, CySEC, FSCA | Wide instruments & research |

| Exness | CySEC, FCA | Unlimited leverage & scaling |

| AvaTrade | Central Bank of Ireland, ASIC | Guaranteed stop-loss protection |

| OANDA | CFTC, FCA, ASIC | Strong regulation & analytics |

| XM | CySEC, ASIC, IFSC | Great for beginners & education |

| FOREX.com | CFTC, FCA, ASIC | Best for US traders |

| Saxo Bank | FSA, FINMA | Premium research & execution |

1. IC Markets

IC Markets is one of the best forex brokers for overnight swing traders because of its low spreads, deep liquidity and transparent swap rates. Swing traders can maintain their positions in major forex pairs, minor and exotic pairs, indices, commodities and cryptocurrencies.

The broker supports MetaTrader 4, MetaTrader 5 and cTrader which are best for multi-day technical analysis and managing trades. IC Markets is regulated by ASIC, CySEC and FSA which provides good security for your funds. Payment options are bank transfers, credit and debit cards, Skrill, Neteller and Paypal which offer fast deposit and withdrawal.

IC Markets Features

– Established in 2007

– Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

– Regulatory Authorities: ASIC, CySEC, FSA (Seychelles)

– Payment Methods: Bank transfer, credit/debit cards, PayPal, Skrill, Neteller

– Other: Ultra-low spreads, ECN execution, very liquid, transparent swap rates

IC Markets Pros & Cons

| Pros | Cons |

|---|---|

| Very low spreads & competitive pricing — good for scalpers/algos. | Legal issues and class-action coverage reported in some jurisdictions (watch regional risk). |

| Fast execution, low latency — strong for automated trading. | Higher CFD financing/overnight rates on some instruments. |

| Wide platform support (MT4/MT5, cTrader) and many instruments. | Retail protections vary by region / regulator. |

2. Pepperstone

Thanks to its thin spreads and fast execution, Pepperstone is an excellent option for overnight swing traders. With an array of swing trading markets available including forex, cryptocurrencies, commodities, indices and shares, swing traders have multiple options to choose from.

Pepperstone is compatible with meta trader 4, meta trader 5, c trader and trading view, helping traders to efficiently manage their long term trading plans. With regulators such as the DFSA, ASIC, FCA, and CySEC, Pepperstone is a globally trusted broker.

Swing traders will appreciate the various payment options, including bank wire transfer, card payments, and e-wallets like PayPal, Skrill and Neteller.

Pepperstone Features

– Established in 2010

– Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader, TradingView

– Regulatory Authorities: ASIC, FCA, CySEC, DFSA

– Payment Methods: Bank transfer, cards, PayPal, Skrill, Neteller

– Other: Very low spreads, fast execution, very good for swing trades

Pepperstone Pros & Cons

| Pros | Cons |

|---|---|

| Tight spreads and low commissions — cost-efficient for active traders. | Certain account types or advanced tools may be region-restricted. |

| Strong platform variety (MT4/MT5/cTrader/TradingView) and fast execution. | Not the cheapest option for very small retail accounts in some markets. |

| Good research & copy-trading support. | Advanced features sometimes targeted toward experienced traders (steeper learning curve). |

3. FP Markets

Due to its low trading costs and transparent rollover fee, FP Markets is also a great option for overnight swing trading. Traders have the option to choose commodities, crypto, forex pairs, indices, and stocks for their multi day trading strategies.

For the analysis and execution of their swing trades, traders may choose to use any of the four trading platforms available with the broker which include meta trader 4, 5, c trader, and Iress.

FP markets is regulated by two authorities ASIC and CySEC ensuring protective measures against negative events in the trading environment.

Payments made have a variety of options including bank transfers, debit/credit cards as well as e-wallets like Skrill and Neteller, allowing users fast and flexible transactions.

FP Markets Features

– Established in 2005

– Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader, Iress

– Regulatory Authorities: ASIC, CySEC

– Payment Methods: Bank transfer, cards, Skrill, Neteller

– Other: Low swap fees, very liquid, multiple types of accounts

FP Markets Pros & Cons

| Pros | Cons |

|---|---|

| Very competitive pricing on ECN accounts (tight spreads + low commissions). | Asset depth for long-term investors (direct shares/ETFs) is limited vs big banks. |

| Good infrastructure (VPS, Myfxbook integration) and solid customer support. | Some premium platform/tools restricted by region. |

| Multiple platform options (MT4/MT5/cTrader). | Funding/withdrawal protections differ by license. |

4. FxPro

Having quality execution and many platforms, FxPro works well for overnight swing traders. It has a range of instruments, including forex, metals, indices, energies, futures, and cryptocurrencies.

FxPro is compatible with MetaTrader 4, MetaTrader 5, cTrader, and FxPro’s own platforms, and it lets traders manage positions for the long term.

FxPro is regulated by the FCA, CySEC, the FSCA, and the SCB, an above-average trust and protection of investors. FxPro has bank transfer and card payments, as well as Skrill, Neteller, and local payments.

FxPro Features

– Established in 2006

– Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader, FxPro Platform

– Regulatory Authorities: FCA, CySEC, FSCA, SCB

– Payment Methods: Bank transfer, cards, Skrill, Neteller

– Other: No dealing desk, multiple execution models, good risk management tools

FxPro Pros & Cons

| Pros | Cons |

|---|---|

| Strong regulation history and long track record (many awards). | Pricing can be higher than the lowest-cost brokers (esp. some account types). |

| Multiple platform support (MT4/MT5, cTrader, proprietary apps). | Minimum deposit and account thresholds may be higher for some markets. |

| Large global footprint and wide range of tradable assets. | Educational material and onboarding vary by region. |

5. Exness

Popular overnight swing traders encapsulate Exness. This is due to having flexible leverage, instant withdrawals, and of course transparent swap conditions. Exness traders have the opportunities to swing trade, major and minor forex pairs, metals, energies, indices, and cryptocurrency.

Exness is one of the few brokers supporting both MetaTrader 4 and MetaTrader 5, both of which are ideal for keeping a position for several days. Exness is also one of the brokers that is heavily regulated.

The list includes FCA, CySEC, FSCA, and FSA. Some payment methods available are bank transfer, Cards, Skrill, and Neteller. Along with local payment systems.

Exness Features

– Established in 2008

– Trading Platforms: MetaTrader 4, MetaTrader 5

– Regulatory Authorities: FCA, CySEC, FSCA, FSA

– Payment Methods: Bank transfer, cards, Skrill, Neteller, local payments

Exness Pros & Cons

| Pros | Cons |

|---|---|

| Ultra-low spreads and generally very competitive trading costs. | Regulatory availability differs — some products/accounts not offered to EU/UK retail clients. |

| Fast withdrawals and flexible funding options (popular for retail traders). | Unlimited/high leverage in some jurisdictions increases risk. |

| Good execution quality and multiple account types. | Limited localised services in certain countries. |

6. AvaTrade

AvaTrade is excellent for swing traders who appreciate consistent trading expenses, as it applies fixed spreads on various instruments. AvaTrade swing trading markets consist of forex, commodities, indices, stocks, ETFs, and cryptocurrencies.

AvaTrade is able to support MetaTrader 4, MetaTrader 5, and proprietary platforms such as AvaTradeGO, which allows for convenient supervision of overnight trades.

This Brokerage is regulated by the Central Bank of Ireland, ASIC, FSCA, and various other entities around the world. Available payment methods include bank transfers, credit and debit cards, Skrill, Neteller, and WebMoney.

AvaTrade Features

- Establishment Year: 2006

- Platforms: MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions

- Regulation: Central Bank of Ireland, ASIC, FSCA, ADGM

- Ways to Pay: Bank transfer, cards, Skrill, Neteller, WebMoney

- Important Aspects: Fixed spreads, beginner-friendly, fully regulated

AvaTrade Pros & Cons

| Pros | Cons |

|---|---|

| Beginner-friendly platforms, strong educational resources. | Not the absolute lowest fees — spreads can be average on some pairs. |

| Good social/copy trading and risk-management plugins (e.g., AvaProtect). | Platform customisation is limited vs pro platforms. |

| Multiple platform choices (MT4/MT5 + proprietary tools). | Some advanced order types or two-step security may be missing. |

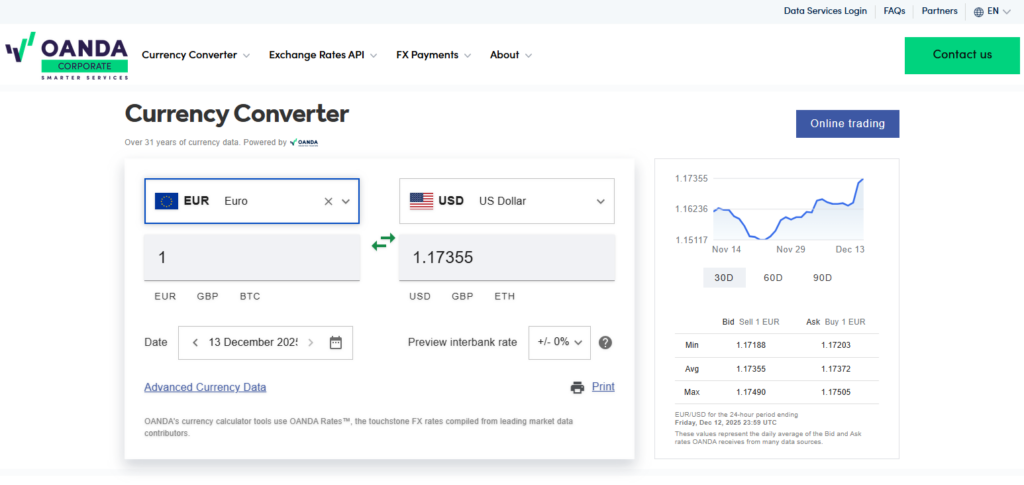

7. OANDA

Due to its ample trust, no minimum deposit, and overall strategic view, OANDA is one of the most trusted brokers in the market for overnight swing traders. OANDA traders can avail of forex, metals, indices, and commodities with various flexible trades in which they manage positions.

OANDA traders can consider and utilize MetaTrader 4, TradingView, and their proprietary platforms for better market analysis. CFTC, NFA, FCA, ASIC, IIROC, and other high authorities all offer their regulation on the OANDA entity. Bank transfers, cards, and other regional payment systems yield to convenient and suitable payment methods.

OANDA Features

- Establishment Year: 1996

- Platforms: MetaTrader 4, Trading View, OANDA Trade

- Regulation: CFTC, NFA, FCA, ASIC, IIROC

- Ways to Pay: Bank transfer, cards

- Important Aspects: No minimum deposit, exact position sizing, clear pricing

OANDA Pros & Cons

| Pros | Cons |

|---|---|

| Strong reputation, well-regulated, excellent research and APIs. | Product breadth is narrower (fewer forex pairs vs some competitors). |

| Easy account opening, beginner-friendly platform and tools. | Pricing for extremely high-volume traders can be less competitive unless in premium tiers. |

| Reliable charting & market data. | Fewer advanced asset types in some regions. |

8. XM

For overnight swing traders, XM is a viable candidate for this for having wide range of assets, bonus offers and low spreads. Forex pairs, indices, commodities, metals, energies and cryptocurrencies can be swing traded.

XM accommodates MetaTrader 4 and MetaTrader 5, which are compatible and suitable for multi-day trading. The broker is regulated by CySEC, ASIC and FSC which is a strong indicator of their reliable oversight.

XM offers a number of payment systems such as bank transfers, credit and debit cards, local systems and e wallets such as Skrill and Neteller which are processed very quickly.

XM Features

- Establishment Year: 2009

- Platforms: MetaTrader 4, MetaTrader 5

- Regulations: CySEC, ASIC, FSC

- Ways to Pay: Bank transfer, cards, Skrill, Neteller

- Important Aspects: Low spreads, fast execution, broad range of assets

XM Pros & Cons

| Pros | Cons |

|---|---|

| Strong educational content and customer service; good for beginners. | Not the lowest spreads across all account types — cost-sensitive traders may prefer ECN brokers. |

| Wide availability of MT4/MT5 tools and responsive mobile app. | Advanced traders may find product range and pro tools limited vs big global brokers. |

| Competitive promotions/bonuses in some regions. | Bonus conditions / withdrawal terms vary by region. |

9. FOREX.com

FOREX.com is deeply trusted and very well established for overnight swing trading, having deep liquidity and well competitive spreads. Swing traders can trade among forex, indices, commodities, metals and cryptocurrencies.

For advanced trading, the broker offers MetaTrader 4, the proprietary FOREX.com platform and TradingView which has a lot of risk management and charting options.

FOREX.com is regulated by FCA, CFTC, NFA, ASIC and IIROC which is a strong indicator of trust and security. Payment options for the users are also great with bank transfers, cards and regional online payments.

FOREX.com Features

- Establishment Year: 2001

- Platforms: MetaTrader 4, Trading View, Web Platform of FOREX.com

- Regulations: FCA, CFTC, NFA, ASIC, IIROC

- Ways to Pay: Bank transfer, cards

- Important Aspects: High liquidity, excellent charting, strong market research

FOREX.com Pros & Cons

| Pros | Cons |

|---|---|

| Very well-rounded: strong research, solid platforms, good regulatory footprint. | Certain account types / minimum deposits may be higher for casual retail traders. |

| Tight spreads on majors and robust charting tools. | Product / crypto availability can be limited depending on region. |

| Good education and market-research resources. | Inactivity fees may apply in some cases. |

10. Saxo Bank

Saxo Bank is perfect for professional overnight swing traders looking for institutional-level trading conditions. Saxo Bank offers a wide range of swing trading markets, including forex, stocks, indices, commodities, bonds, and ETFs. Saxo Bank supports SaxoTraderGO – and SaxoTraderPRO, tailor-made for analyzing multi-day trades.

The broker is regulated by leading authorities; the FCA, FINMA, and DFSA, offering robust capital protection. The payment methods are mainly bank transfers and cards, providing secure payment processing.

Saxo Bank Features

- Establishment Year: 1992

- Platforms: SaxoTraderGO, SaxoTraderPRO

- Regulations: FCA, FINMA, DFSA

- Ways to Pay: Bank transfer, cards

- Important Aspects: Pricing like an institution, advanced analytics, trading tools

Saxo Bank Pros & Cons

| Pros | Cons |

|---|---|

| Excellent multi-asset offering and institutional-grade platforms/tools. | Higher pricing and minimums make it better suited to active/high-net-worth traders. |

| Competitive pricing for high-volume and large balance clients; deep global market access. | Not ideal for passive, small-balance investors (custody/maintenance fees possible). |

| Strong regulatory protection and premium research. | Personal service and best pricing often tied to VIP/HNW tiers. |

What Are the Benefits of Best Forex Brokers for Overnight Swing Traders?

Lower Overnight Swap & Holding Costs

Top brokers tend to offer their customers highly competitive swap rates, or even swap-free accounts, which help to lessen the toll that holding trades overnight takes. This is especially important for swing traders that have to leave their open positions for several days at a time.

Strong Regulation & Fund Safety

Well reputed brokers are regulated by the industry’s top tier authorities like the FCA, ASIC, CySEC, or even CFTC. This gives respect and peace of mind on client fund segregation and transparency without protection of the accounts when trades are open for longer times.

Stable Execution Across Sessions

Top quality brokers that have swinging traders for clients are usually the ones that can afford to have deep liquidity with no lags on their order execution. With no lags, swing traders can stay stress free and are able to keep their trades where they want even if they don’t have their computers on.

Advanced Swing-Trading Platforms

Swing traders also take advantage of systems with best trading platforms like MetaTrader 4, MetaTrader 5, cTrader, TradingView, and proprietary platforms that come with own great system. Complex trading, order management, and even charting systems for multi day analysis give their operators a good edge in the market.

A Variety of Tradable Markets

Having the ability to swing trade various commodities, indices, metals, and even cryptocurrency is what the best brokers offer. It allows long-term strategy development and better diversification.

Pricing Structure Transparency

Transparency regarding the spread, commissions, and rollover fees allows swing traders to get an accurate total cost of the trade before getting into long positions.

Adjustable Leverage and Position Size

The best brokers on the market provide adjustable micro-lot trading, allowing better risk management on overnight or another multi-day trade.

Risk Management Tools

Swing traders need to protect their capital when the market is volatile overnight, and services such as guaranteed stop-loss orders, trailing stops, and negative balance protection help them.

Payment Methods

When positions are open, brokers need to provide accessible bank, card, and e-wallet payments while providing secure deposits or withdrawals.

Research and Market Analysis

Swing traders need to react to overnight market changes quickly, and quality brokers help them with this by providing daily calendar economics, market analysis, and forecasts.

Pros & Cons Of Best Forex Brokers for Overnight Swing Traders

| Pros | Cons |

|---|---|

| Tight spreads & low swap costs; ECN execution; strong liquidity; popular MT4/MT5/cTrader platforms | Swap fees can still accumulate on longer trades; advanced platforms for beginners might have learning curve |

| Fast execution; low trading costs; multiple platform options (MT4/MT5/cTrader); good for technical analysis | Limited proprietary research tools; swap fees vary by instrument |

| Clear rollover fees; low spreads; variety of platforms including Iress; solid regulatory oversight | Inactivity fees possible; fewer research tools vs institutional brokers |

| Multiple platforms; strong research resources; wide range of assets; FCA & CySEC regulation FXEmpire | Industry-average swap fees (not the lowest); inactivity fee on some accounts FXEmpire |

| Flexible leverage; fast withdrawals; transparent swaps; strong global regulation | Limited proprietary platform options; may be less suited for ultra-advanced traders |

| Fixed spreads on many instruments; user-friendly platforms; diverse assets | Spread costs can be higher on some pairs; fewer advanced tools than some rivals |

| No minimum deposit; transparent pricing; strong regulation; flexible trade sizes | Limited product range compared with some global brokers; swap costs still apply |

| Low spreads; good execution; reliable MT4/MT5 support; educational content | Limited range of non-forex markets; occasional inactivity fees |

| Deep liquidity; advanced charting & risk tools; multiple platforms | Swap/rollover costs can be moderately high; some tools locked behind platform tiers |

| Institutional-grade execution; premium research & analytics; wide asset range | Higher minimum deposits; pricing not ideal for small retail swing traders |

Conclusion

Finding the best forex brokers for overnight swing traders is an important part of creating a profitable and scalable overnight swing trading strategy. Swing trading implies that a trader will be holding a trade for a couple of nights or days.

This means that a trader should try and find a broker that provides low transparent swap rates, strong execution and regulation, decent trading platform, and provides reasonable overnight holding costs.

Brokers like IC Markets, Pepperstone, FP Markets, FxPro, Exness, AvaTrade, OANDA, XM, Forex.com, and Saxo Bank have the required stability and provide the decent tools required for efficient management of a trading position that is held for multiple days.

The best brokers forex to trade with will optimize the swing overnight trading strategy by eliminating excess holding costs, fund insurance/ fund protection by means of keeping client funds in a segregated and regulated account, and provide high-level trading platforms to complete an effective analysis of the market.

In the end, it will depend on the rest of your trading strategy, your personal risk, and the markets you like trading in. With a broker with overnight swing trading functionality, a trader is able to concentrate on more medium-term market movement without losing focus.

FAQ

What is an overnight swing trader in forex?

An overnight swing trader holds forex positions for more than one day, often several days or weeks, aiming to profit from medium-term price movements rather than short-term fluctuations.

Why is broker selection important for overnight swing trading?

Broker choice matters because overnight trades incur swap or rollover fees. The best brokers offer low swap rates, strong regulation, stable execution, and reliable platforms for managing multi-day positions.

Which forex brokers are best for overnight swing traders?

Top brokers for overnight swing trading include IC Markets, Pepperstone, FP Markets, FxPro, Exness, AvaTrade, OANDA, XM, FOREX.com, and Saxo Bank due to their pricing transparency and platform quality.

What are swap fees in overnight forex trading?

Swap fees are interest charges or credits applied when a position is held overnight. They depend on the currency pair, trade direction, and broker’s rollover policy.

Are swap-free (Islamic) accounts good for swing trading?

Yes, swap-free accounts can be beneficial for overnight swing traders as they avoid interest charges. However, some brokers apply alternative fees after a certain holding period.