The Best Forex Brokers Offering PAMM & MAM Accounts will be covered in this post, with an emphasis on brokers that offer fund managers and investors sophisticated account management options.

These systems are perfect for experienced traders and investors looking for transparent, safe, and adaptable PAMM and MAM account services since they provide effective multi-account trading, risk allocation, and performance tracking.

What is PAMM & MAM Accounts?

Specialized forex account types called PAMM and MAM accounts are intended for professional money managers and investors. With a PAMM (Percentage Allocation Management Module) account, several investors can pool their money under a single trader who handles trades on their behalf and distributes gains and losses proportionately.

Professional traders can handle several individual investor accounts at once using a MAM (Multi-Account Manager) account, which provides sophisticated trade allocation and risk management. Transparency, effective fund management, and the opportunity for investors to profit from professional trading without having to handle trades themselves are all features of both account types.

Key Point & Best Forex Brokers Offering PAMM & MAM Accounts List

| Broker | Key Point |

|---|---|

| FP Markets | Offers ultra-low spreads with ECN execution for Forex and CFDs. |

| Exness | Known for flexible account types and high leverage options. |

| AvaTrade | Strong regulatory compliance with a variety of trading platforms. |

| Tickmill | Competitive fees and fast trade execution for professional traders. |

| Admirals (Admiral Markets) | Wide range of instruments with excellent educational resources. |

| OANDA | Trusted globally with transparent pricing and strong analytics tools. |

| Interactive Brokers | Advanced trading technology and access to global markets. |

| BlackBull Markets | Low latency trading with personalized customer support. |

| Fusion Markets | Low-cost trading with simple and transparent fee structures. |

| Vantage | Offers multiple account types and robust trading platforms for all levels. |

1. FP Markets

FP Markets has a strong global presence as a forex and CFD broker. With Advanced markets as the liquidity provider, FP has the right mix of depth and tight spredas to earn the trust of both beginners and seasoned professionals.

They offer a selection of account types: Standard, Raw, and Islamic and have adequate liquidity for most strategies. FP Markets ranks high among the Best Forex Brokers Offering PAMM & MAM Accounts as a cost-effective solution for managed accounts. account structuring where a money manager is activated to manage a trade for a pool of investors, accounts provide a more passive forex market participation for investors, clear allocation, and performance reporting.

FP Markets Features, Pros & Cons

Features

- Provides PAMM & MAM account types

- Compatible with MetaTrader 4 & 5

- Tight spread & High liquidity.

- Advanced tools for risk management

- Diverse trading options

Pros

- Managers of funds can tailor account management

- Performance reporting that is transparent

- Speed of execution is fast

- End users & seasoned traders can utilize it

- Compliance with regulations is fantastic

Cons

- For the PAMM/MAM, the minimum deposit could be too much

- Not much as far as educational tools when compared to some brokers

- Fees on the ECN accounts can be a lot

- Social trading options are limited

- No in-house trading platform

2. Exness

As a major forex broker, Exness has proven to be a flexible provider with a suitable mix of competitive pricing and strong trading tools across platforms (MT4, MT5 and MultiTerminal).

One of the most notable traits for capital allocators is support for Multi Account Manager (MAM) and PAMM services. This allows for professional traders to handle several sub-accounts or pooled investor funds from a single master account. This functionality enables Exness to be categorized as one of the Best Forex Brokers Offering PAMM & MAM Accounts.

This is especially the case for MAM account holders who would like to engage in forex trading without having to actively manage their accounts, thereby utilizing the services of money managers. Exness is known for its solid infrastructure, facilitating quick trade execution as well as access to a wide variety of markets.

Exness Features, Pros & Cons

Features

- PAMM and MAM options are available

- Supports MetaTrader 4 & 5

- Offers flexible with low spread and adjustable V. Leverage

- Provides multi-currency deposit options

- Managers have access to risk management tools

Pros

- Speed of execution is some of the best in the industry

- There is a lot of flexibility when it comes to the level of leverage

- Multiple account types available

- Managing funds is streamlined.

- There is a lot of trust from the retail trading community

Cons

- Few analytical and research tools available

- Beginners will most likely find the PAMM/MAM accounts to be a bit complicated

- Reporting features that are advanced are absent

- Legislation under which ticks are regulated is applicable regionally;

- Customer service is slow.

3. AvaTrade

Regulatory compliance is one of the most prominent traits for AvaTrade. Coupled with platform variety, such as the support of MetaTrader 4/5, and other proprietary tools like AvaTradeGO, makes AvaTrade a unique broker. AvaTrade also boasts an extensive offering of other financial instruments, such as forex pairs, commodities, indices, and cryptos.

AvaTrade also settles as one of the Best Forex Brokers Offering PAMM & MAM Accounts. This means that he/she is able to support managed account frameworks, whereby investors outsource their accounts to professional account managers, who in turn trade on their behalf. This allows the client to sit back and relax and avoid trading actively. However, there is a performance fee, as is the case with most of these accounts.

AvaTrade Features, Pros & Cons

Features

- Provides MAM and PAMM accounts.

- Links with MetaTrader and AvaOptions

- Spreads are reasonable

- Automated and copy trading are supported

- Provides forex and CFD trading as well as commodities trading.

Pros

- Well known and established regulation across the globe.

- MAM accounts are easy to operate.

- Automated trading is supported.

- CFDs, Forex and commodities as well as other trading instruments are available.

- The platform is easy to use.

Cons

- Limited proprietary trading tools.

- Inactive accounts are charged.

- In active trading, spreads are wide.

- Scalping is not promoted.

- Limited to poor analytic capabilities.

4. Tickmill

Highly appreciated by most traders for the value they offer is their low and competitive spread value, along with rapid order execution. This is especially the case for scalpers and algorithmic traders.

It integrates MetaTrader 4 and provides multiple account options for all experience levels, including beginner, intermediate, and VIP. While Tickmill generally downplays PAMM and MAM accounts, it does offer competitive trading conditions and high regulatory security. High liquidity and tight spreads contribute to making Tickmill a top choice for traders interested in low-cost direct market access.

Tickmill Features, Pros & Cons

Features

- MAM and PAMM accounts

- Compatible with MetaTrader 4 and 5

- Low commission and tight spreads

- Provides institutional-grade liquidity.

- Tools for the management of risk and allocation

Pros

- Quick execution of trades

- Fewer expenses for larger accounts

- Multi-account management is supported.

- Investors are provided with clear and transparent reports.

- Excellent service for customers.

Cons

- Educational materials are limited.

- There are fewer investment assets available than some competitors.

- The regulation of ticks is applicable to certain parts of the world.

- No unique trading platforms.

- Copy trading is supported.

5. Admirals (Admiral Markets)

Admirals, previously known as Admiral Markets, offers a wide range of instruments including forex, CFDs on stocks, indices, metals, and crypto, as well as top tier platforms MT4 and MT5. Admirals offers some of the best educational resources and research tools in the industry, which greatly assist traders in developing and improving their strategies.

Although Admirals is recognized for their trading ecosystem and client service, they are not known for PAMM or MAM managed accounts as other managed account brokers are. However, Admirals has a high level of asset and regulatory compliance, as well as a large asset selection which provides traders with a high level of reliability and educational support.

Admirals (Admiral Markets) Features, Pros & Cons

Features

- MAM and PAMM account solutions

- Support for MT4 / MT5 platforms

- Allocation of accounts in real-time

- Trading in forex, commodities, and indices

- Account analytics and reporting

Pros

- Strong account transparency

- Regulated broker

- Analytics and reporting tools

- Account automation and copy trading

- Lower trading costs

Cons

- High initial investment for PAMM/MAM accounts

- Account manager support is not very beginner-friendly

- Account transfers incur fees

- Less regional availability

- Less proprietary platform features

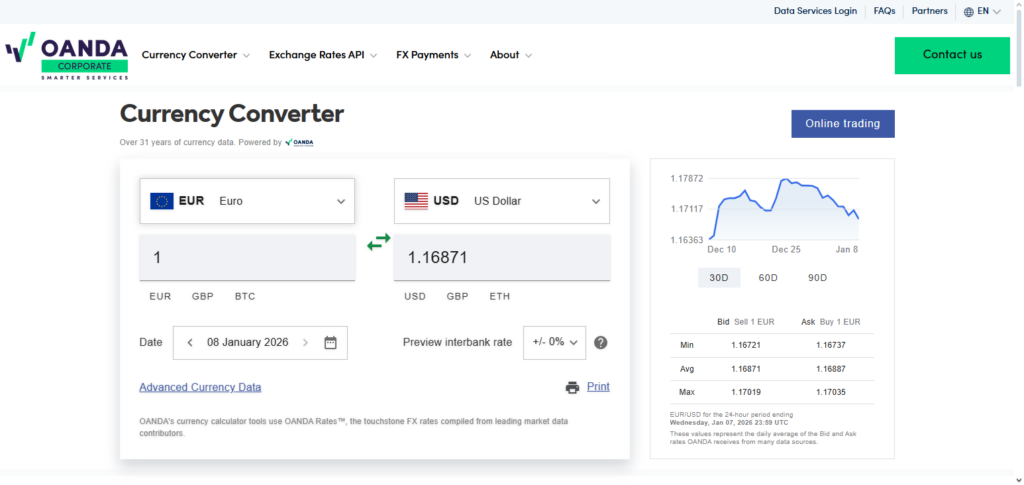

6. OANDA

OANDA is one of the most competitive forex brokers in the world, with highly rated transparent pricing, 24/5 support, and a robust set of analytical features including the OANDA Trade platform and MT4.

With extensive market data and competitive spreads, OANDA serves retail and institutional clients alike. However, unlike some competitors on the Best Forex Brokers Offering PAMM & MAM Accounts list, OANDA usually does not offer PAMM or MAM managed account services, but rather focuses on direct trading and API access for automated trading strategies. OANDA’s continued transparency and regulatory standing is a positive aspect of their business model.

OANDA Features, Pros & Cons

Features

- Support for MAM and PAMM accounts (via OANDA’s Management Solutions)

- MetaTrader trading platform and proprietary fxTrade

- Access to forex and CFDs

- Managerial tools for risk management

- Ongoing reporting

Pros

- Both strong and reliable in regulatory compliance

- Global presence

- Flexible account types

- Executions and pricing reliable

- Analytic reporting is detailed

Cons

- Limited features for automated trading

- MAM and PAMM accounts lack scalability

- On some pairs, there are high spreads

- Less asset coverage

- For new traders, there is an initial learning curve

7. Interactive Brokers

Interactive Brokers is known for high-end technology and access to global markets beyond forex such as stocks, futures, bonds, and options. Its advanced Trader Workstation is complemented by a low cost per trade, making it a premier offering for professional and institutional traders.

While Interactive Brokers provides a robust suite of trade execution and portfolio management tools, it typically does not provide traditional PAMM/MAM accounts for managed forex trading as many niche forex brokers do. However, the firm’s multi-asset suite draws in clients wanting extensive market access and tailored portfolio management across different assets.

Interactive Brokers Features, Pros & Cons

Features

- PAMM & MAM account equivalents via IB Managed Accounts

- Access to global markets (stocks, futures, forex)

- Advanced trading tools and analytics

- Portfolio management and allocation features

- Risk and compliance monitoring

Pros

- Institutional-grade trading

- Low fees and commissions

- Multiple available assets

- High investor transparency

- Good coverage within the regulations

Cons

- The interface is a bit convoluted for beginners

- PAMM/MAM configurations demand additional experience

- Not particularly geared towards smaller retail investors

- Customer support is slower for smaller accounts

- No built-in social trading

8. BlackBull Markets

Among active and professional traders, BlackBull Markets is recognized as a leading ECN forex broker, especially for its prompt execution, liquidity, and competitive spreads.

BlackBull Markets stands out for catering to both MT4 and MT5 users and operates as a money manager, enabling investors to drive pooled and mult-ied account arrangements, which is reflected in our list as helping manage accounts.

This makes BlackBull Markets enticing if what you want is a managed account coupled with exceptional trading terms, cost-effective conditions, and account flexibility for different categories of traders.

BlackBull Markets Features, Pros & Cons

Features

- PAMM and MAM accounts

- Compatible with MetaTrader 4 & 5

- Low-latency execution with tight spreads

- Risk management & reporting

- Supports multi-currency accounts

Pros

- Quick execution times for active trading

- Multi-account management support

- Clear reporting for investors

- Low spreads and fees

- Well-regulated and reputable broker

Cons

- Few resources for learning

- Fewer assets compared to global brokers

- More advanced features needed larger accounts

- More manual trading compared to others

- No custom trading platforms

9. Fusion Markets

Fusion Markets is a new entrant in the market, recognized for its cost-effective forex and CFD trading, providing straightforward fee structures with competitive spreads, which is attractive for traders focused on cost efficiency.

Fusion Markets is on the provider’s managed account list and is recognized in the Best Forex Brokers PAMM & MAM Accounts, where he provides both PAMM and MAM on the MetaFX platform.

It enables seasoned money managers to manage multiple client accounts with various allocation settings, which could be in lots or percentages. For clients, Fusion Markets provides managed accounts, which allow them to take a passive role in the market with professional management.

Fusion Markets Features, Pros & Cons

Features

- Supports PAMM and MAM accounts

- Integrated with MetaTrader 4 and 5

- Spreads on ECN accounts are low

- Allocation management tools

- Trading with a variety of assets

Pros

- One of the most inexpensive brokers

- Good flexibility to manage accounts

- Excellent and speedy execution

- Good reporting transparency

- Accommodates both retail and professional traders

Cons

- Underdeveloped research tools

- Less asset classes compared to the big brokers

- Limited range of regulation

- Little to no educational materials

- No in-house software

10. Vantage

Vantage (Vantage Markets) provides a consistently good service with several account options, and competitive rates with forex, CFDs and other instruments on MT4/MT5.

Vantage is also included in the rankings for Best Forex Brokers Offering PAMM & MAM Accounts, confirming that it offers managed account services, where professional managers trade for investors in bulk or linked accounts.

These account types appeal to investors who want diversified exposure but don’t want to trade. Overall, with solid platform capabilities and worldwide coverage, Vantage is excellent for both managed and direct Forex trading.

Vantage Features, Pros & Cons

Features

- PAMM and MAM account types

- MetaTrader 4 and 5 integration

- Tight spreads with ECN execution

- Advanced reporting and allocation tools

- Trading on multiple assets like forex, commodities and indices

Pros

- Strong speed of execution

- Adjustable account management

- Clear reporting for investors

- Good spreads and low commissions

- Regulation in several countries

Cons

- Lack of research and analytical tools

- MAM/PAMM accounts require a minimum deposit

- Less proprietary tools

- Interface less friendly to beginners

- Limited range of markets compared to global brokers

Conclusion

In conclusion, professional money managers and investors can find effective, transparent, and adaptable managed trading solutions from the Best Forex Brokers Offering PAMM & MAM Accounts.

By enabling skilled traders to oversee numerous accounts or pooled funds, brokers such as FP Markets, Exness, AvaTrade, BlackBull Markets, Fusion Markets, and Vantage stand apart and provide investors with passive market exposure while maintaining risk control.

These platforms are perfect for both novices looking for managed solutions and seasoned traders handling client funds since they offer competitive spreads, sophisticated trading tools, and strict regulatory control. In the forex market, selecting the appropriate broker guarantees long-term growth, security, and optimal performance.

FAQ

What are PAMM and MAM accounts?

PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) accounts are managed forex solutions. PAMM pools investors’ funds into one master account, while MAM allows a manager to trade multiple sub-accounts individually. Both provide passive trading opportunities and professional money management.

Which brokers offer PAMM & MAM accounts?

Top brokers offering these services include FP Markets, Exness, AvaTrade, BlackBull Markets, Fusion Markets, and Vantage. These brokers provide secure trading environments, flexible account structures, and regulatory oversight.

How do PAMM & MAM accounts work?

Investors allocate capital to a professional trader’s account. The manager executes trades, and profits or losses are distributed proportionally based on each investor’s allocation. PAMM pools funds collectively, whereas MAM gives individualized control over sub-accounts.

What are the benefits of using PAMM & MAM accounts?

They allow investors to earn passive income without trading, leverage the expertise of professional traders, and manage risk through diversification. MAM accounts additionally offer greater flexibility and control over individual sub-accounts.

Are PAMM & MAM accounts safe?

Safety depends on the broker’s regulation, transparency, and risk management policies. Reputable brokers provide clear reporting, segregated client funds, and performance tracking to ensure secure managed trading.