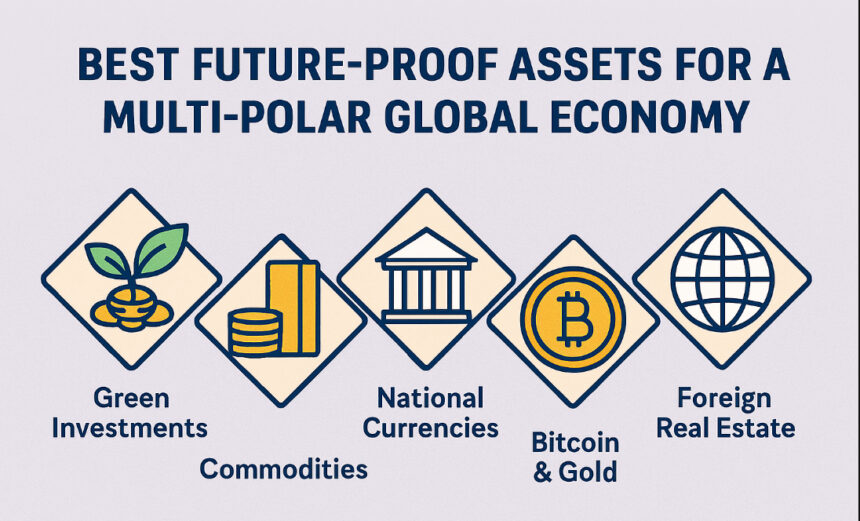

Most of the world’s power is currently distributed among several economic blocs. Investors today need to think about and invest in volatile assets. In a multi-polar economy, assets that are the most sustainable are those that are a mix of real and enduring wealth, the protection of a digital framework, and the enrichment of innovation.

These assets allow the owner to protect their wealth, aid their mobility, and gain their wealth seamlessly. These assets include Bitcoin, gold, renewable energy, real estate, and even intellectual property. These assets are very useful since they protect the owner from global inflation, inflation, and volatile events in trade.

Key Points Table – Best Future-Proof Assets

| Asset | Key Point |

|---|---|

| Bitcoin (BTC) | Decentralized digital hard money that protects wealth from inflation, capital controls, and geopolitical instability. |

| Gold | Universal store of value that holds purchasing power during currency devaluation and global uncertainty. |

| Productive Real Estate | Provides stable cash flow, long-term appreciation, and inflation-resistant income in strong rental markets. |

| Diversified Equity Index Funds | Reduces regional risk by capturing global market growth through broad, low-cost diversification. |

| Sovereign Bonds (AAA-Rated) | Offers capital safety and predictable returns backed by financially strong governments. |

| Strategic Commodities (Oil, Lithium, Copper) | Essential resources for energy, manufacturing, and technology with lasting global demand. |

| Decentralized Digital Identities & Web3 Assets | Ensures borderless digital access, ownership, and interoperability across global ecosystems. |

| Renewable Energy Investments | Benefits from global transition to clean power, energy independence, and long-term sustainability. |

| Second Citizenship or Residency Rights | Provides mobility, financial diversification, and access to multiple economic and legal systems. |

| Intellectual Property (IP) & Digital Businesses | Creates scalable, borderless income streams through digital products, content, and patents. |

1. Bitcoin (BTC)

This is a borderless digital asset that is as dependable as it gets, seeing as how it has the ability to resist censorship from any government in control. It is the most advanced cryptocurrency on the market, and acts as a hedge against inflation, as it is decentralzed and doesn’t fall under the control of central banks.

Countries employ diverging monetary policies, which make it all the more necessary to use bitcoin as a neutral settlement for overseas transactions. This makes the cryptocurrency and its immediate convinience a must for any investor, which increases BTC value and makes it a great investement.

Bitcoin(BTC) Features

- Decentralization: Functions independently of central banks, allowing for borderless liquidity.

- Scarcity: Bitcoin’s supply is capped at 21 million, making it inherently deflationary.

- Mobility: Can be transferred cross-border without friction.

- Institutional Participation: Members of the sector are offering payment processing services, and ETF offerings.

2. Gold

Gold has been humanity’s ultimate store of value for millennia, and in a multi-polar world, it retains unmatched credibility. It hedges against inflation, geopolitical risk, and fiat currency volatility.

Across Asia, Europe, and the Middle Eastern central banks accumulate reserves. This further cements gold’s strategic importance. Gold’s universal acceptance makes it a safe haven asset, bridging trust among competing blocs.

Owned in various forms, gold serves to diversify, enhance stability, and protect for most imbalances, which is why it is a central pillar for most gold imbalances.

Gold Features

- Store of Value: A universal and cross-culturally accepted asset.

- Inflation Hedge: Debasement of fiat currencies has a direct adverse effect on gold.

- Central Bank’s Gold Reserves: Gold is routinely and strategically acquired by central banks all over the world.

- Liquidity: Gold is one of the most liquid assets worldwide.

3. Productive Real Estate

Income-generating real estate, be it commercial, farmland, or logistics hubs, provides real security in uncertain times. Unlike speculative properties, productive real estate continues to generate cash flow, and protect against inflation for the investor.

In a multi-polar economy, demand for most housing, warehousing and agricultural land is still strong across most regions.

Productive real estate provides a hedge against currency volatility, as the rental receipts and land value tend to increase with inflation. Capital profit and cash flow provides security against most geopolitical and monetary shifts which makes it a desirable asset.

Productive Real Estate Features

- Cash Flow Generation: Real estate generates passive income through rent collection.

- Inflation Protection: In an inflationary environment, land and by extension, real estate rises in value.

- Tangible Asset: Owing a real asset is inherently safe.

- Versatility: Real estate includes residential, agricultural, and warehouse properties.

4. Diversified Equity Index Funds

Equity index funds manage risk through global corporate investments. These funds are ideal for fragmented economies. When investors put their money into diversified baskets such as the MSCI World or S&P 500, they receive exposure to multiple global companies that efficiently manage their supply chains to adapt to changes in multipolar trade.

Diversified equity funds achieve an ideal growth and resilient balance. These funds enable investors to capture innovation while protecting their investments from sudden shocks in specific economies. Their low cost and broad exposure make them a scalable option to stay future proof in a global market, no matter the volatility.

Diversified Equity Index Funds

- Broad Exposure: Individual stocks of opt for a cross-industry index fund and exposure to various mega-corporations.

- Risk Mitigation: Diversification practice through spreading of financial and operational risk across many corporates.

- Cost Effective: Cheaper than average as management of the fund is passive.

- Resilience: Particularly to the fragmentation of global trade.

5. AAA Sovereign Bonds

High quality, AAA-rated sovereign bonds from countries such as Germany, Switzerland, and Singapore guarantee peace of mind during uncertain times. These bonds provide predictably low returns and no risk of default, with the added benefit of safe haven protection during times of political crisis.

In a multi-polar economy, where emerging markets are often volatile, AAA sovereign bonds provide portfolios with trust, liquidity, and a safe anchor.

They also balance out risk from more volatile investments such as equities and commodities. Most investors including those looking for long term resilience and diversification, will consider bonds a key investment for global fragmentation.

Sovereign Bonds from AAA-Rated Countries

- Safety: Bonds from AAA-rated countries hold no default risk.

- Predictable Returns: Bonds yield guaranteed income via interest payments.

- Liquidity: As with most assets, bonds are tradeable.

- Portfolio Anchor: Provides stability while other investments are more volatile.

6. Strategic Commodities (Oil, Lithium, Copper)

The energy and industrial commodities are vital for every economy. Oil is important for global trading. Lithium is powering several electric vehicles and copper is used for a lot of electronics and infrastructure.

In a multi-polar world, the supply chains for these resources become more and more of a regional trade. This creates a scarcity, and with it, an opportunity. The integration of strategic commodities ensures exposure to the more essential growth drivers, and it makes commodities that much more valuable for the balancing portfolios.

Investing directly into the commodities or the equities of the mining businesses provides inflation protection. These either directly held assets or mining equities match with the demand that has a long term growth outlook for the world’s opposing trading blocs.

Strategic Commodities (Oil, Lithium, Copper)

- Essential Demand: Supports Modern Energy, Electric Vehicles, and Infrastructure.

- Inflation Hedge: Commodities are a more secure store of value than currency.

- Geopolitics: Demand increase, and supply concentration creates price volatility.

- Diversification: Direct and indirect access through mining and commodity companies.

7. Decentralized Digital Identities & Web3 Assets

The digital sovereignty creates primary focus in the field of digital identity and asset solutions in the blockchain. These assets provide individuals and businesses the ability to interact and transact freely, and without the dependence of a centralized authority.

It also allows people to have secure digital ownership and financial access. The Web3 assets allow for the digitized mobility of wealth and an investment into the decentralized finance ecosystems, and tokenized commerce.

The decentralized identity ensures participation in a fragmented global economy by offering the digital resilience and financial freedom. This is the potential to provide inclusive growth and the primary focus for financial hardware of the economy.—

Decentralized Digital Identities & Web3 Assets

- Borderless Access: Grants financial participation regardless of country access.

- Ownership Control: Users self manage their digital identity.

- Web3 Growth: Greater participation in Decentralized Finance (DeFi) and tokenized markets.

- Resilience: Reduced dependency on central authorities.

8. Investments In Renewable Energy

The transformation of global energy systems continues with no end in sight. Solar, wind and hydrogen investments are foremost renewables are the primary and long‑term growth assets that will be needed as countries continue to diversify. In a multi‑polar world, energy self sufficiency adds to the strategic and sovereign value of renewables.

Investments in renewables also tick ESG boxes and enhance climate compliance. Investments remain relevant to all countries in the world. Sustainability of wealth creation will be achieved through renewables, whether in the form of project finance, infrastructure funds, or green bonds.

Investments in renewable energy are positioned to offer significant wealth creation while also providing investors with a high level of wealth preservation.

Renewable Energy Investments

- Sustainability: Supports clean technologies.

- Energy Independence: Supports freedom from fossil fuels.

- Long‐Term Growth: Open markets and rising demand for solar, wind, and hydrogen.

- ESG Alignment: Positive for everyone’s well-being.

9. Right to Second Citizenship or Residency

The value of mobility in multi‑polar world is a positive impact of geopolitical fragmentation. Second citizenship or residency rights provides access to multiple jurisdictions, tax regimes, and financial systems.

This ensures investors can safeguard wealth, relocate assets, and access opportunities across blocs. Citizenship diversification acts as a hedge against political risk. Financial freedom and mobility is enhanced while political risk is diversified.

Countries like Portugal, Malta, or the UAE have programs that allow investors to obtain peace of mind and long‑term stability. This makes the right to second citizenship one of the most valuable intangible assets in a multi polar world.

Second Citizenship or Residency Rights

- Mobility: Access to peaceful, developed, other jurisdictions and financial systems.

- Political Hedge: Mitigates risk of home country disregarding citizen and family.

- Tax Optimization: Finance policies and wealth management systems can be very different.

- Freedom of Movement: International travel and residence at will.

10. Intellectual Property (IP) & Digital Businesses

Intellectual property such as patents, trademarks, and copyrights may be the most future-proof form of wealth in the twenty-first century. Digital businesses can be operated anywhere in the world, adjusting and scaling as needed, allowing them to bypass trade limitations.

Within a multi-polar economy, IP is the only means of assuring ownership of innovations. Digital services generate IP. Both IP and digital businesses thrive as a form of intangible asset. They provide a hedge against inflation and geopolitical shocks.

From SaaS to content provision, businesses with these assets meet global demand for digital solutions. These businesses are valuable to investors in adapting fragmented economies.

Intellectual Property (IP) & Digital Businesses

- Scalability: Digital assets and businesses can expand indefinitely.

- Recurring Revenue: software as a service (SaaS) and content businesses generate steady income.

- Innovation Ownership: Ownership of patents and trademarks provides value over time.

- Resilience: Intellectual property is immune to inflation and global turbulence.

Conclusion

In a multi-polar global economy, the ability to be resilient and adaptive is the most important factor to determine war-th preservation. When it comes to future-proof assets, the most optimal choices are Bitcoin, gold, real estate, equity funds, AAA-bonds, certain commodities, and renewables.

Likewise, diverse assets in the Web3 domain and second citizenship rights are invaluable. They all contribute protection against inflation, geopolitical fragmentation, and trade protectionism. Adds to volatility, what real assets do is hedge balance portfolio and digital assets to sustain mobility.

In growing range of these assets, investors gain access to all-world and sovereign controlled resources. They sustain volatile mobility and growing liquidity to balance access of digital assets. With all of these tools at one’s disposal, an investor is able to withstand alterations of global economy and the active realignment of global expanded geopolitics.

FAQ

Why are future‑proof assets important?

They protect wealth against inflation, geopolitical fragmentation, and shifting trade blocs.

What are the top assets to hold?

Bitcoin, gold, productive real estate, diversified equity index funds, AAA‑rated sovereign bonds, strategic commodities, Web3 assets, renewable energy, second citizenship rights, and intellectual property.

How do these assets provide resilience?

They balance tangible resources, digital innovation, and sovereign protections.

What is the key strategy?

Diversification across physical, digital, and sovereign assets ensures stability, mobility, and long‑term growth.