In this article, I’ll cover the Best Gold Mining Stocks in 2026, helping shed light on companies and ETFs with prominence in the gold market.

Investors with an interest in growth and stability are shifting their attention to mining stocks as gold prices continue to surpass structural levels. The picks provided are likely to profit from the international demand for gold.

What are Gold Mining Stocks?

Gold mining stocks represent a share in the ownership of corporations that explore, mine, and produce gold. Investors wanting exposure to gold and wanting to diversify their portfolios usually buy these stocks since they cannot acquire gold in its physical form.

These companies earn profits by mining and selling gold; the stock prices of these companies tend to increase as the price of gold increases. Gold mining stocks allow exposure to the gold market while solving the drawbacks of owning physical gold.

This is because successful mining companies can increase gold production, which, in turn, creates profit. There are risks, however. Operational costs, fluctuating price of gold, and geopolitical circumstances still apply to these companies. Investors wanting exposure to these risks while wanting diversification will find gold mining stocks appealing.

Why Gold is on fire right now

The following listed points explain why gold is on fire right now:

Federal Reserve Rate Cut Expectations – Anticipation in the market for the U.S. to execute rate cuts will also lower the opportunity cost in holding gold and increase the price.

Weakening U.S. Dollar – Opportunities to buy gold become more favorable to foreign investors as the price of the dollar weakens.

Safe-Haven Demand – Investors tend to hedge investments toward gold in unclear economic conditions and due to tensions of US debt and geopolitical.

Central Bank & Institutional Buying – Unlike the U.S. dollar, gold is more favored by ETFs and as such, central banks have recently diversified.

Technical Momentum – As gold is being bought more, the value of gold during that time and the other factors, such as charts and seasonal attributes, will also increase.

Record Performance – The value of gold at the present time as seen in the displayed diagram is over \$3,500/oz which at this time is more than ever, gold is over \$3,500/oz, which is about more than 30\% of it’s value and this gives it’s more investors at the present time.

Key Point & Best Gold Mining Stocks in 2025

| Company / ETF | Key Points |

|---|---|

| Newmont Corporation | Founded in 1921, world’s largest gold miner, strong global presence, sustainable mining focus, pays consistent dividends. |

| Barrick Gold | Founded in 1983, operates large-scale mines in North America, Africa, and Middle East, known for strong reserves and joint ventures. |

| Agnico Eagle Mines | Canadian company established in 1957, focused on low-cost gold production, strong operations in Canada, Finland, and Mexico. |

| Kinross Gold | Founded in 1993, operates in Americas and West Africa, mid-tier producer, offers steady output with cost management strategies. |

| Royal Gold Inc. | Founded in 1981, royalty and streaming model (does not operate mines), provides exposure to gold prices with lower operational risks. |

| Harmony Gold Mining | South African miner, founded in 1950, one of the world’s largest, with expanding operations in Papua New Guinea, high leverage to gold prices. |

| Sandstorm Gold Ltd. | Canadian royalty and streaming company, founded in 2008, offers growth potential with low operating risk compared to traditional miners. |

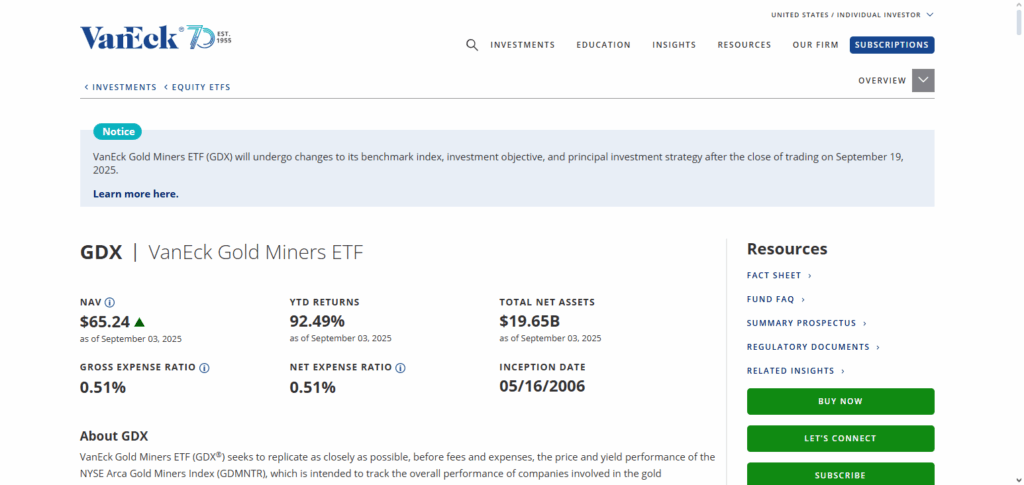

| VanEck Gold Miners ETF | Popular ETF tracking global gold mining companies, provides diversification, lower risk than investing in a single miner. |

1. Newmont Corporation

Newmount Corporation is one of the gold mining stocks of 2025 due to its unmatched scale and financial stability. Founded in 1921, the company has a market value of over 10 billion dollars, making it the biggest gold producer that is publicly traded. The unique feature of the company is it’s global portfolio of mines in North and South America, Africa, and Australia.

This lowers country-specific risks. Newmount also focuses on the sustainability of its mining operations which improves the long-term growth of the company. The company is not only capable of dishing out consistent dividend payments, the company also has strong cash flow which makes the stock not only a Newmount gold stock, but a reliable and consistent investing option.

Pros & Cons Newmont Corporation

Pros:

- Gold miner with revenue hydroponics grown in over 5 continents.

- Dividend policy ranks above the rest with tons of cash.

- Gold miner that holds one of the greatest portfolios in the industry.

Cons:

- Region variable high operating costs decrease profits.

- Politically high sensitive areas are a concern.

- Operating some of the smallest mines leads to decrease in value.

2. Barrick Gold

Barrick Gold was started in 1983, and sited as one of the Best Gold Mining Stocks in 2025, “Barbara Gold”, Dominated some of the wealthiest parts in the world and gained establishment. Worth tens of billions of dollars, Barrick’s diversified interests across North America, Africa, and the Middle East provide stable protections against regional risks.

Barrick is unlike many of its peers because it prioritizes the acquisition of high-quality, long-life mines which enables the steady production at the reduced competitive costs.

Global reach is consolidated by its strategic global partnerships as well as joint ventures with other miners and governments. Barrick has unique combination of attributes, growth, resilience, and value, which is appealing to the investors focused on gold market, that makes him still with strong free cash flow and disciplined debt reduction.

Pros & Cons Barrick Gold

Pros:

- Strongly located with long life mines and massive reserves.

- Joint ventures partnerships boost cooperation.

- Debt and dividends are supported with solid free cash flow.

Cons:

- Politically related risks are high in Africa and Middle East.

- Excessive stock performance are at high points of gold prices.

- Very limited in the amount of capital expenditure.

3. Agnico Eagle Mines

Among the Best Gold Mining Stocks in 2025, Agnico Eagle mines holds its place due to its strategic investor reputation and its operational invariable nature. Ever since its inception in 1957, Agnico, which is valued at some billion dollars, stands unique to its canadian, finish and meixcan autonomic geopolitical concern zones.

Lower the political risks and the issuer’s adequate production. Its specialization in the low-cost mining method of gold, which is aimed at sustaining profit POLinages during gold price shortages, is what makes it unique.

The increase in demand of the marketed ventured aids the company’s exploration policies to defend economic success. With dividend paying history and a balanced approach to finances makes the company a favorite to gold investors.

Pros & Cons Agnico Eagle Mines

Pros:

- Political areas operate with higher profit margins.

- Strong exploration pipeline for the rest of the year.

- Focus on low-cost mining to maximize profit.

Cons:

- Much smaller in scale compared to Newmont and Barrick.

- Dull geographic lower diversity to the rest of the world.

- Yielded less compared to peers.

4. Kinross Gold

Kinross Gold was established back in 1993 and is considered one of the Best Gold Mining Stocks in 2025, thanks to cost-effective management and being strongly positioned in the mid-tier. Kinross handles several operations in the Americas and West Africa and has built a portfolio worth billions of dollars which includes both maturing and growing assets.

Kinross’ disciplined approach toward extending the life of a mine and improving production efficiency on it is a rare quality. It enables the company to maintain a strong positive cash flow regardless of the shifting gold prices.

Unlike the company’s competitors, Kinross focuses on improving its balance sheet, paying down debt, and reinvesting in high-return ventures. Kinross is a rare case in the gold market. It has operational resilience with a strong potential upside. Kinross is very reliable for investors.

Pros & Cons Kinross Gold

Pros:

- Balanced portfolios in West Africa and the rest of the Americas.

- Focus managed properly with greater profit margins.* Benefits Assured funding helps to grow assets from the cash flow.

Cons:

- The constant mid-tier status is limiting their ability to dominate globally.

- Operations exclusively in higher risk jurisdictions.

- Dividend distributions are impossible to accurate predict.

5. Royal Gold Inc.

Founded in 1981, Royal Gold, Inc. is another example of a success story in gold mining. 2025 has Royal Gold listed as one of the Best Gold Mining Stocks. This is due to the company’s unique royalty and stream business model.

This unique model generates a multi-billion dollar valuation without having to directly operate a mining site. Instead, Royal Gold holds mining royalties across a plethora of global projects. This busess model, and the company’s diverse distribution across multiple jurisdictions, allows this company to avoid bulky operational expenses, and revenue streamin staiblility and consistent growth.

The operational expenses that Royal Gold does have are far outweighed by the company’s low overhead expenses, and strong cash flow, maximally benefitting the shareholders. This makes the company a low risk investor opportunity due to the diminished volatility in comparison to mining operations.

Pros & Cons Royal Gold Inc.

Pros:

- The operational risks are lowered due to the incorporation of the revenue from the royalties and streaming.

- Multiple revenue streams from several mining ventures.

- Significant cash flow with minimal operating expenses.

Cons:

- Reliance on the performance of a 3rd party mine.

- Limited revenue growth if production from partners declines.

- Less direct exposure to gold price than the mining companies.

6. Harmony Gold Mining

Harmony Gold Mining starts operating in 1950, is considered one of the best gold mining stocks in 2025 because of its historical operations in South Africa and its international development. Harmony ranks in the billions in market capitalization which is odd because most of its operations are considered costly yet deliver booming revenue when gold prices surge.

Much of the company’s gold revenue comes from Papua New Guinea which also adds geographical diversification. Harmony has honed its operational improvement, debt reduction, and sustainability initiatives which greatly enhances its competitiveness this cycle compared to past cycles. For investors focused on gold’s upside potential, Harmony is unique in the mining segment because most of its counterparts operate on the low-medium risk.

Pros & Cons Harmony Gold Mining

Pros:

- Amplified returns from leveraged core assets to rising gold prices.

- New operations in Papua New Guinea offer a significant increase to revenue.

- Extensive operating experience in South Africa provides a competitive advantage.

Cons:

- Increased risk exposure in a price downturn due to higher production costs.

- Political issues with South Africa are constant due to the large number of labor risks.

- There is reduced financial security than large global competitors.

7. Sandstorm Gold Ltd.

Established in 2008, Sandstorm Gold has made its name among the Best Gold Mining Stocks in 2025 due to its unique royalty and streaming model. Sandstorm, which is valued in the billions, gives its investors indirect exposure to gold, and avoids the complexities of traditional mining operations.

Sandstorm is differentiated from its peers due to its aggressive growth strategy — developing a diverse portfolio of investments in early stage projects and producing mines which results in positive long-term upside.

This strategy ensures positive cash flow generation while lowering risk and maintaining a thin margin of expenses. Sandstorm’s strong focus on partnership investments increases its global footprint and scalability which, in turn, enhances its flexibility in the gold market. This offers a lower risk profile, which is ideal for growth focused investors.

Pros & Cons Sandstorm Gold Ltd.

Pros:

- Increased flexibility with growth potential from royalties and streaming.

- Involvement with both operating and development stage projects.

- Reduced risk from the operational costs of the direct-owned mine.

Cons:

- Dependable on the partners success for the completion of the projects.

- There is lower liquidity than the largest gold mining companies.

- Compared to the established royalty companies, the firm has a smaller scale.

8. VanEck Gold Miners ETF

Launched in 2006, the VanEck Gold Miners ETF has been one of the Best Gold Mining Stocks for the year 2025 due to the fact that it offers consolidated access to the world’s premier gold producers through a single investment.

This ETF has billions in assets under management, and it mitigates risks associated with individual companies by holding Newmont, Barrick, and Agnico Eagle, along with other established miners. Its distinct benefit is to the investor’s advantage—broad exposure to the gold mining industry without the burden of research to buy and sell gold mining stocks.

Also, the ETF’s high liquidity and transparency make it suited for short and long-term investing. For a cost-effective and diversified access to the gold market, the VanEck Gold Miners ETF is an excellent option for investors looking for stability.

Pros & Cons VanEck Gold Miners ETF

Pros:

- Access to diversified position in leading gold mining stocks globally.

- Much less risk than investing in individual firms.

- Liquid and available to investors of all grades.

Cons:

- Much less than individual miners which aggressively grow.

- Subject to volatility of the whole sector.

- A slight decrease in value which affects the longterm return.

Features of Gold Mining Stocks in 2025

High correlation with gold price movements – Mining stocks shower profits as gold price zooms above \$3,500/oz, providing investors with favorable exposure.

Geographical Diversification – Newmont, Barrick, Agnico Eagle, etc. have mines across different continents reducing risks of a specific region.

Different business models – Investors may opt for traditional miners, streaming/royalty companies, diversified ETFs like VanEck, etc.

Free cash flow dividends – A positive correlation exists to the extent that equity holders of most major miners receive regular dividends.

Safe instrument to hedge against inflation – An increase in economic shift coupled with a central bank surge brings weak dollar inflation, providing gold miners with protective high demand.

Economical innovation – Superior miners are the lowest cost producers, investing in sustainability to automate defenses against competition.

Varied risk profiles – Investors may choose Harmony Gold for risk high reward plays, and Newmont for stable income.

Conclusion

To sum it all up, Gold Mining Stocks in 2025 stand as valuable opportunities for an investor looking for growth and stability in an unpredictable world. With demand from central banks, inflation worries, and safe-haven purchases, gold prices are hitting record highs, and mining firms are primed for profitability.

Newmont and Barrick continue to deliver steady dividends, while lower-risk innovative royalty players like Royal Gold and Sandstorm provide ample choices for exposure to the industry. For investors looking to buy shares in mining companies, ETFs like the VanEck Gold Miners provide additional diversification. These stocks are a great hedge against market volatility which gold prices continue to soar.

FAQ

Why are gold mining stocks attractive in 2025?

With gold prices reaching record highs above $3,500/oz, miners are generating strong cash flows, making 2025 a highly profitable year for leading gold companies.

Which are the best gold mining stocks in 2025?

Top picks include Newmont Corporation, Barrick Gold, Agnico Eagle Mines, Kinross Gold, Royal Gold, Harmony Gold, Sandstorm Gold, and VanEck Gold Miners ETF.

Do gold mining stocks pay dividends?

Yes, many major companies like Newmont and Barrick pay consistent dividends, making them attractive for both income and growth investors.