In This Post I will elaborate on some of the most promising DeFi projects with the highest return on investment.

With lending and staking services, automated market makers, and even synthetic assets, these projects help to earn passive income as the DeFi market expands. Now, let us see who the top contenders are!

Key Points & Best High-ROI DeFi Projects List

| Project | Key Point |

|---|---|

| Lido | Leading liquid staking platform for ETH and other assets. |

| MakerDAO | Creator of DAI, a decentralized stablecoin backed by crypto collateral. |

| AAVE | Popular decentralized lending and borrowing protocol with flash loans. |

| JustLend | Main lending platform on the TRON blockchain. |

| Uniswap | Most widely used decentralized exchange (DEX) for token swaps. |

| Curve Finance | DEX optimized for stablecoin trading with minimal slippage. |

| Summer.fi | User-friendly interface to interact with DeFi protocols like MakerDAO. |

| Compound | Pioneering decentralized money market protocol for earning interest. |

| Balancer | Flexible DEX and automated portfolio manager with multi-asset pools. |

| Synthetix | Protocol for issuing and trading synthetic assets (synths) on Ethereum. |

10 Best High-ROI DeFi Projects

1.Lido

Lido is one of the top high-ROI DeFi projects because it has made staking easy, liquid, and accessible. As opposed to freezing ETH or other assets, users get stTokens (such as stETH) which are liquid and usable across DeFi.

This dual earning potential — yield farming from DeFi and staking rewards — is why profits are maximized. Following Ethereum’s shift to proof-of-stake, Lido became critical to the ecosystem’s staking infrastructure.

Its position as a leader is cemented due to strong security audits, deep liquidity, and integrations with major DeFi applications which allow investors to earn passive income while retaining access to their funds and being part of DeFi advancements.

Features Lido

- Liquid Staking: Users can stake their assets and still have liquidity because of stTokens (like stETH).

- Multi-Asset Support: Staking for other assets in addition to Ethereum (ETH) such as Solana, Terra, etc.

- DeFi Integrations: Extensive use and integration within the major DeFi services and platforms for yield farming and lending of other tokens.

- Scalability: Provides a scalable solution for Ethereum’s proof-of-stake network.

2.MakerDAO

MakerDAO provides the opportunity to earn high ROI through its innovative stablecoin offerings, making it an integral part of a user’s DeFi portfolio.

Users can mint the decentralized stablecoin DAI by locking up crypto collateral in Maker Vaults.

This creates numerous income opportunities ranging from earning governance stability fees to leveraging assets and yield farming with DAI.

Moreover, MakerDAO’s impressive reputation, vast liquidity, and integration with leading DeFi platforms strengthen its feasibility as a reliable income source.

Even more, MakerDAO’s access to traditional finance assets allows it to tap into fresh ROI augmenting DAI’s RWA, further solidifying DAI’s backing. Overall, MakerDAO is favorable for those looking for a cross between innovation and reliability.

Features MakerDAO

- DAI Stablecoin: Decentralized stablecoin, DAI, is created and managed by fungible collateral, often ETH.

- Collateralized Debt Positions (CDPs): Lock up some asset such As ETH in a vault and borrower DAI against it.

- Stability Fees: Fees earned from governance and collateral management equity thanks to stability.

- Decentralized Governance: Upgrade parameters and set risk constituents is done by participants holding MKR tokens democracy-wise.

3.AAVE

AAVE takes the crown as one of the most rewarding DeFi platforms, distinguished for its groundbreaking and versatile lending and borrowing services.

Users can provide assets to liquidity pools while earning interest passively, frequently exceeding the returns from conventional saving accounts.

Additional yield strategies can be obtained with AAVE’s unique offerings which include flash loans, stable and variable rate borrowing, and collateral swapping. Also, governance token holders can stake AAVE to earn safety incentives, adding to the layer of income.

Its position as a leader was strengthened by multi-chain infrastructure expansion and integration with institutional investors, making AAVE a premier platform for return maximization in the decentralized finance ecosystem.

Features AAVE

- Lending & Borrowing: Allow users to do earning interest on given assets and debt against collateralized ones.

- Flash Loans: Unsecured loans up till a transaction block, are paid back on the transaction block.

- Interest Rate Options: Fixed and flexible rate interest obtainable.

- AAVE Token: Provides controlling stakes in the platform and them actively engaging in governance with staking benefits in return.

4.JustLend

JustLend offers the highest return on investment of any DeFi lending platform on the TRON blockchain and stands as the leader of the TRON DeFi ecosystem.

Users can earn high interest through supplying assets to liquidity pools which pay competitive interest rates, often higher than Ethereum based platforms due to lower fees and faster transactions on the TRON network.

Flexible borrowing against supplied collateral can be leveraged to amplify returns and JustLend makes this easy. It’s well integrated with the TRON ecosystem and allows for easy access and liquidity to stable coins like USDT and USDC.

The platform is user-friendly which makes it an excellent option in DeFi for those looking to earn stable passive income with very low gas fees.

Features JustLend

- TRON-Based Lending: It is a lending and borrowing DeFi platform established on the TRON Blockchain.

- Lower Transaction Fees: Less costly than Ethereum-based systems for quicker transaction completion.

- Collateralized Asset Lending: Users can borrow funds by supplying collateral like USDT or TRX.

- Community Governance: A platform where users can vote on proposed platform upgrades.

5.Uniswap

UniSwap is one of the leading players in the DeFi ecosystem because of its high-ROI prospects that come from trading and liquidity providing.

Uniswap users provide tokens to supply Uniswap to which they earn a portion of the trading fees which creates an effortless income opportunity for them.

This is especially true for popular trading pairs to which returns can be very high as there is substantial trading volume and liquidity.

The shift to AMM also allows for greater participation as there are no gatekeepers or third-party administrators to intervene.

With the launch of Uniswap V4, Uniswap SDK, and innovations such as shell smart contracts, the platform is favored by yield farmers wanting to optimize their returns in the DeFi space.

Features Uniswap

- Automated Market Maker: Participants trade tokens by using liquidity pools instead of order books.

- Decentralized Trading: Complete power rests with the users, with no single central authority overseeing the system.

- Token Swaps: Enables the effortless exchange of millions of ERC-20 tokens.

- Liquidity Provider Rewards: Earn revenues through the provision of liquidity to pools.

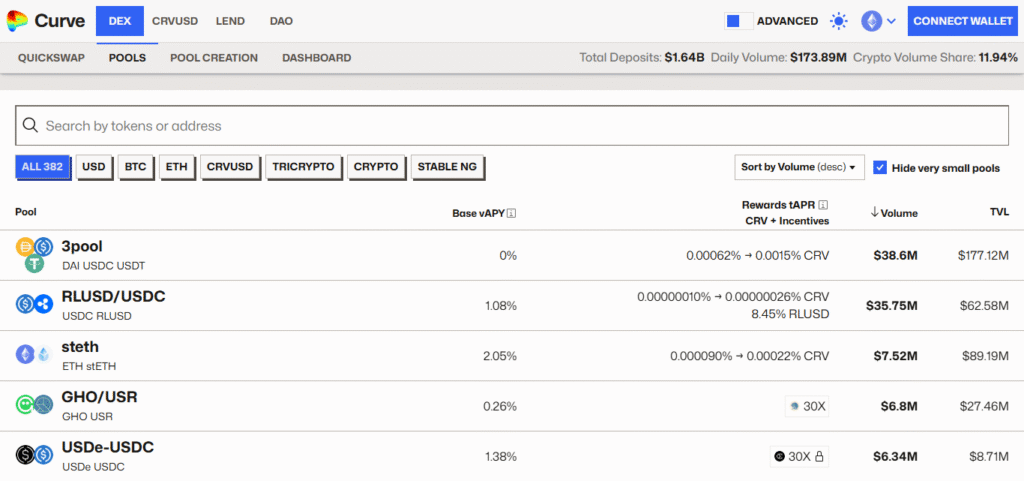

6.Curve Finance

Curve Finance is a dominant player in the DeFi space which focuses on trading units of stablecoin and other pegged assets because of the high ROI opportunities available while lowering the risk of impermanent loss.

Users earn trading and frequently receive other rewards because of CRV token incentives and yield farming partnerships by providing liquidity to Curve’s optimized pools.

Its one-of-a kind AMM design makes sure that low-slippage and efficient trades are possible, drawing substantial trading volume and improving COB returns.

The deep integration of Curve across different DeFi ecosystems, enhanced with inovative tokenomics of veCRV that increase yields, makes it a sought after platform for investors looking to generate consistent, low-risk income in an ever changing decentralized world.

Features Curve Finance

- Swap Concentration AMM: Maximized for cross trades between stablecoins with low slippage.

- Custom Pools: Participants have the ability of constructing pools containing different assets such as stablecoins or wrapped tokens.

- Yield Farming: Through the provision of liquidity, participants are able to obtain the governance token CRV and other incentives.

- Reduced Impermanent Loss: The algorithm provides protection against impermanent loss when trading stablecoins.

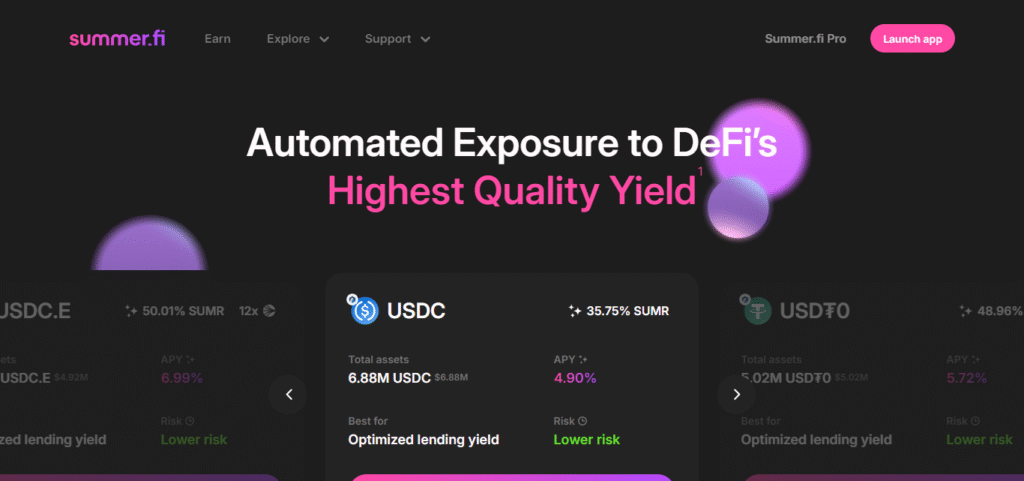

7.Summer.fi

Summer.fi (formerly Oasis.app) is a DeFi powerhouse that enables users to easily multiply and earn on their crypto assets through sophisticated strategies that have high-ROI opportunities.

Primarily built around MakerDAO’s ecosystem, it enables users to open vaults, borrow DAI, and deploy it into yield harvesting strategies through an easy interface.

By providing automated tools and strategic optimization, Summer.fi aids users in mitigating risks while maximizing returns.

Its support for multi-protocol access and real-world asset integrations further increases earning potential. For non-technical investors looking to utilize their crypto assets, Summer.fi serves as a fast and efficient high-ROI entrypoint into DeFi.

Summer.fi

- Easiest Navigation: Offers simpler navigation to DeFi protocols such as MakerDAO for DAI minting.

- Passive Yield Strategies: Provides tools to manage and optimize collateral automatically for improved returns.

- Centralized Protocol Access: Shelf for different protocols in the DeFi space.

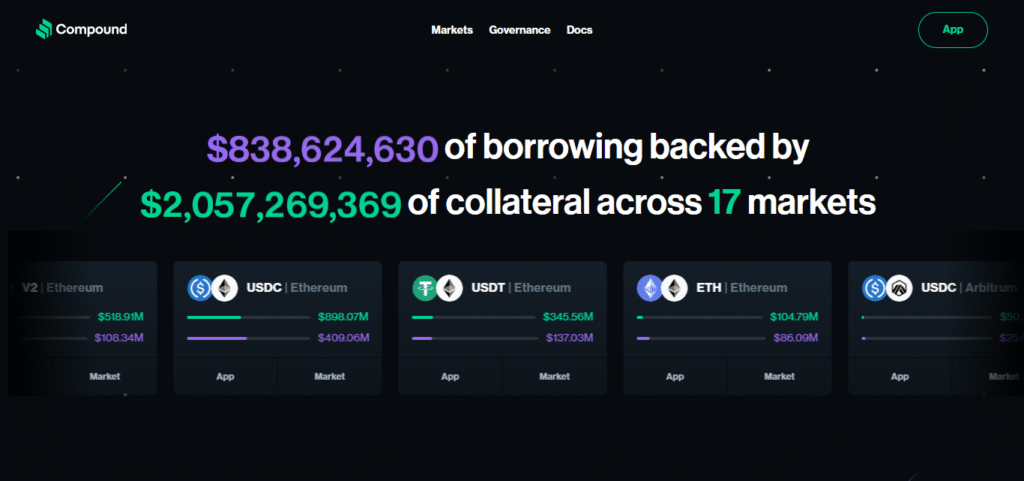

8.Compound

Compound is one of the first and most trusted protocols in DeFi lending. Users can earn passive income through interest compounded to a high ROI.

Whenever users supply assets to Compounds liquidity pools, they earn interest on it at variable rates, while being able to withdraw at any point.

Through the protocol, users can also earn COMP tokens which further increases their returns; these tokens are given by the protocol for governance.

Focusing on transparency, security, and efficient capital markets, Compound is the protocol preferred by risk-fearing investors who are looking for stable yields.

Due to its strong ecosystem integrations and simple user-friendly interfaces, new and seasoned DeFi users are able to optimize their earnings.

Features Compound

- Money Market Protocol: Earning interest by lending or borrowing assets on the platform.

- COMP Token: Get rewarded with governance COMP tokens for providing liquidity or participating in governance.

- Variable Interest Rates: Interest rates depend upon the economic principles of demand and supply.

- Collaterized Loans: Assets can be borrowed if equity has already been deposited on the platform.

9.Balancer

Balancer is an exceptional platform in DeFi since it offers high-ROI opportunities from customizable liquidity pools which are similar to self-balancing portfolios.

Balancer allows a greater variety of assets to be included in the pool, with flexible weightings for each, unlike the simpler two-token pools.

This means that users can optimize for much higher fees and lower impermanent loss. Liquidity providers receive trading fees as well as BAL token rewards which further increase total returns.

Its dynamic pool designs also support innovative strategies like managed pools, partnered boosted yields, and others.

Strong security, deep integrations with other DeFi services, and constant updates to the protocol reinforce Balancer’s appeal as a flexible and smart choice for ROI focused investors who wish to diversify over various crypto assets.

Features Balancer

- Multi-Asset Liquidity Pools: Allows for pools that have more than two assets with custom weightings when compared to typical two asset pools.

- Automated Portfolio Management: Balancer pools automatically rebalance resulting in less need for human intervention.

- BAL Token Rewards: Apart from trading fees, liquidity providers receive BAL tokens.

- Customizable Fees: Set transaction fees to increase the returns resulting from the liquidity pool.

10.Synthetix

Synthetix is a pioneer in the DeFi space allowing users to mint and trade synthetic assets (synths) that mirror the price of real-world assets such as commodities, stocks, and cryptocurrencies.

Users have the option to stake SNX tokens, thus earning fees from trading activity on the platform, creating an opportunity with high ROI.

Also, the stakers earn Synthetix’s native SNX tokens, which are stakable with yield. Synthetix stands out in its innovative collateralized debt positions, staked collateralized tokens, and asset offering, making the DeFi space more accessible and beneficial for users looking to interact with numerous global markets.

Features Synthetix

- Synthetic Assets (Synths): Commodify, stock, and crypto mirroring real-time trades into synthetic assets.

- Staking SNX: Crucial to mint and trade trusts and althrough locked as betting CNX.

- Decentralized Exchange: Trade assets without the use of centralized systems unlike other forms.

- Rewards & Fees: Traders using the platform and betting against SNX gain extra thesis through staking

Conclusion

To sum up, the high ROI Lido, MakerDAO, AAVE, Uniswap, Curve Finance and others provide various income earning avenues ranging from lending to yield farming, liquid staking, and trading synthetic assets.

These platforms are built on innovative protocols and decentralized governance that shift controls to the users so that they are able to maximize returns while risk exposure is kept very minimal in the everchanging landscapes of DeFi.