This article will cover the Best Maven Alternatives Prop Firms that offer flexible funding options, transparent evaluation processes, and competitive profit sharing.

These firms cater to beginners and professionals, offering low barriers to entry, a wide range of trading instruments, and ample room for growth. This makes them solid Maven alternatives.

What is Maven alternatives Prop Firms?

Maven Alternatives Prop Firms are trading companies offering funding services and support similar to those offered by Maven, but aimed at traders with differing risk appetites, trading instruments, account sizes, and other factors.

Such companies pffer evaluations to traders, who with more lenient entry requisites than those offered by Maven, can showcase their trading capabilities and ascend to the level of company capital managers.

MyForeFunds, FundedNext, The Funded Trader, and BrightFunded are some popular alternatives, each with different profit splits, challenges, support, and other offerings. Traders looking for Maven alternatives have a wide selection to choose from, which can meet their trading style, risk threshold, and desired capital growth.

How To Choose Best Maven alternatives Prop Firms

Trading Requirements & Rules: Document any firm’s rules on maximum drawdown, instruments that can be traded, and trading style (scalping, swing, etc.). Pick any that suit your style.

Evaluation Process: Examine challenge rules and determine how they set the initial capital, profit targets, and timeframes. Certain firms have evaluation programs that are simpler and less rigid.

Profit Split & Payouts: Ascertain their profit-sharing margins, accuracy and speed of payouts. Payouts that are quicker and reliable are preferred. More splits means more earning during a trading session.

Fees & Costs: Ascertain the challenge fees, monthly fees, or any other costs that may be hidden. Some firms have no-trial offers, or have lower entry fees.

Customer Support & Resources: Satisfactory firms offer responsive support, and provide educational and trading materials.

Reputation & Reviews: Collect online reviews and inquire the experiences traders have; check how honest and open the firm is.

Scalability & Growth Opportunities: Check whether the firm restricts the increase in capital allocation as you grow. More long term traders will benefit.

Key Point & Best Maven alternatives Prop Firms List

| Prop Firm | Key Points |

|---|---|

| Fundingpips | FundingPips’s flexible evaluation options come with more trader friendly ris |

| BrightFunded | Offers flexible evaluation programs, low entry fees, good profit splits. |

| DNA Funded | Focuses on forex and crypto, scalable funding, risk management rules. |

| FXIFY | Free prop firm challenges, quick evaluation, beginner-friendly. |

| E8 Markets | Supports multiple instruments, offers funded accounts, competitive payouts. |

| Funded Trading Plus | Transparent rules, daily profit targets, strong customer support. |

| Alpha Capital Group | Advanced account types, higher capital allocation, growth opportunities. |

| ThinkCapital | Flexible trading style allowance, low challenge fees, fast payouts. |

| Blue Guardian | Offers risk-free trials, multiple funding options, supportive community. |

| PipFarm | Simple evaluation process, forex-focused, beginner-friendly profit splits. |

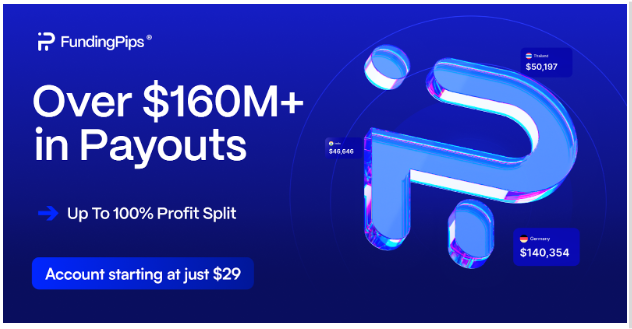

1. FundingPips

Maven Trading is recognized for having low entrance costs, having multiple challenge options, whether one-step, two-step, or occasionally three-step, and providing an 80% profit split for funded traders, however, this has an offset: comparatively strict drawdowns, i.e., maximum 8% losses, daily limits, wider spreads, and restricted variety in trading platforms.

Contrarily, FundingPips’s flexible evaluation options come with more trader friendly risk. FundingPips’s strong focus on challenge fee reasonableness, frequent profit payouts, quick responding support, transparency, and unbalanced trading costs with heavy restrictions make many traders perceive FundingPips as a more balanced option.

Payouts: Over $160 Million

Payout cycles: Total 6 Payout Cycles.

- For 1 step and 2 Step (Monthly 100%, Bi-weekly 80%, Tuesday 60%, On-demand 90%)

- 2 Step Pro (Daily 80%, Weekly 80%)

- FundingPips Zero/Instant (Bi-weekly 95%)\

USPs:

- No payout denial (Track record of 0 payout denial)

- 29,900 Reviews on Trustpilot (4.5 stars)

- Up to100% Profit split

- Account starting at just $29

- Over 100K+ traders

- Flexible Payout Cycles

2. BrightFunded

BrightFunded is one of the top Maven alternatives prop firms because of its flexible evaluation programs and trader-friendly policies. Most traditional firms set hefty entry fees; however, their rapid challenge processes permit traders of all skill levels to participate.

Low entry fees and quick challenge processes make BrightFunded very accessible to new traders. Their profit splits, funding possibilities, and customer support policies promote and foster growth. This is why BrightFunded is the top choice for traders looking for alternatives to Maven.

BrightFunded Features

- Diversified Assessment Types — Challenge types can be customized according to a trader’s preferences and proficiency.

- Minimal Initial Payment — The low cost of evaluation prompts beginners to engage in trading activities involving funded accounts.

- Expanded Funding — Account sizes awarded to successful traders can be expanded to enhance earning potential over time.

3. DNA Funded

DNA Funded is among the best Maven alternatives prop firms due to the balance between scale and trader flexibility. The firm supports numerous trading instruments like forex and crypto, giving traders the ability to diversify strategies.

Its evaluation programs great rules and attainable profit targets accessible to novice traders and experienced traders alike. With industry profit split averages, strong risk management, and growth potential, DNA Funded is a great option for traders wanting a structured replaced for Maven.

DNA Funded Features

- Enhanced Multi-Asset Functionality — Trading in forex and crypto and dealing with other related instruments enhances access to broader markets.

- Defined Risk Parameters — Effective rules on trading discipline ensure fairness and structure to all traders.

- Enhanced Capital Growth — Sustained allocation target achievement provides effective scaling to traders.

4. FXIFY

FXIFY stands out among Maven alternative prop firms since it provides free prop firm challenges, making it really easy for new traders to get started. Their evaluation is beginner friendly and doesn’t require huge amounts of capital to demonstrate one’s skill.

FXIFY allows traders to adopt numerous styles and offers clear guidelines, fair profit sharing, quick payment, and continued support. All of these attributes and an emphasis on easy access and user design makes FXIFY an excellent proposition for traders who want straightforward and low-risk options relative to Maven’s classic funding offers.

FXIFY Features

- Complimentary Assessments — The absence of an evaluation charge encourages participation from novice traders.

- Faster Evaluation — Time taken to verify the status of traders helps expedite the process of granting funded accounts.

- Rule Transparency — Policies with no restrictions that are kept hidden enhance the confidence of traders.

5. E8 Markets

E8 Markets has also been praised as an alternative broker to Maven because they value every trader equally. Their range of instruments such as forex, commodities, and indices enhances trader’s ability to diversify strategies.

Their evaluation programs are simple, with well-defined goals and adaptable strategies which makes it appropriate for sophomores as well as advanced traders.

Additionally, E8 Markets has an industry-leading support and agile bookkeeping which complements their reasonable profit splits. Combined with advanced alternatives to Maven, E8 Markets has become an invaluable and accessible choice for traders.

E8 Markets Features

- Diverse Trading Opportunities — Accessible markets include forex, commodities, and indices.

- Easy Assessment – Setting profit goals and risk thresholds simplifies the evaluation process.

- Generous Profit Sharing – Traders receive high profit share payouts considering their performance.

6. Funded Trading Plus

Funded Trading Plus is a great Maven alternatives prop firms because, unlike other firms, it has quite favorable and transparent conditions.

The evaluation programs set daily and total profit targets which allows traders a clear route to achieving a funded account, Structured evaluation programs are unlike other firms. Many other firms provide no clarity and a confusing route to funded accounts.

Flexible trading styles are applicable to many other traders as the firm allows trading in multiple instruments. Funded Trading Plus is a very responsive firm that pays its traders reliably and on time, and the profit splits are quite favorable. Overall, it is a great firm if you are looking to switch from Maven.

Funded Trading Plus Features

- Organized Programs – Daily and total profit objectives helps traders map their growth.

- Excellent Service – Provides necessary advice, tools, and tech support for successful trading.

- Prompt Payments – Clear and timely payments to traders so there are no delays.

7. Alpha Capital Group

Alpha Capital Group poses as a flexible prop firm alternative to Maven, thanks to its array of account types with varying allocation options. The firm showcases account scalability, enabling successful traders to grow their funded accounts.

Many traders, whether in forex or indices, appreciate tailored evaluation programs with easily understood flexible trading parameters.

Alpha Capital Group pairs this with dedication to efficient support, competitive payout splits, rapid payment execution, and smooth profit division. These factors make the firm the most professional and supportive of its kind, attracting traders in need of a flexible prop firm to Maven.

Alpha Capital Group Features

- Tailored depending on the sophisticated account type – Available options for more advanced traders willing to fork out more money.

- Diverse Trading Styles – Allows for scalping, swing trading, and more.

- Progressive Funding – Growth-oriented trading rewards consistent performers with bigger accounts.

8. ThinkCapital

ThinkCapital is seen as one of the best alternatives to Maven, and this is for a good reason, as they’re far less restrictive with trading rules, allowing for practically any trading style, from scalping to swing trading, to be used.

Their evaluation programs are affordable and straightforward, with reasonable targets, which makes the program attainable for traders at any stage of their careers.

In addition, ThinkCapital pays out quickly, has excellent profit-sharing and competitive splits, and offers awesome customer service. These benefits promote a positive and growth-oriented culture, which makes ThinkCapital a pragmatic and trader-friendly solution compared to Maven.

ThinkCapital Features

- Inexpensive Evaluation – Setting low challenge fees puts evaluation costs within reach.

- Timely Profit Payments – Payments of traders’ profits are made without undue delays.

- No Restrictions on Trading – Allows for many different trading strategies and pays no attention to any rigid conditions.

9. Blue Guardian

Blue Guardian is one of the leading alternatives to Maven™ because of the support diverse trading styles, instruments and strategies.

Blue Guardian is the only trading prop firm that provides a risk free trial on top of various funding options.

This firm is flexible and easily accommodates new or more advanced traders. Blue Guardian’s transparent evaluation criteria, competitive profit sharing, along with the supportive community of traders, fosters growth while improving skills.

This makes it an ideal option for traders looking to dip their toes into trading and hoping to find a flexible, low-risk, alternative to Maven’s propagated funding programs.

Blue Guardian Features

- Free Skill Assessment – Trial evaluations offer traders the chance to recover money they invested without losing anything.

- Variety of Account Sizes – Gives traders the latitude of range to set their trading account based on their objectives.

- Collaborative Environment – Provides an ecosystem that helps traders share knowledge and improve their performance.

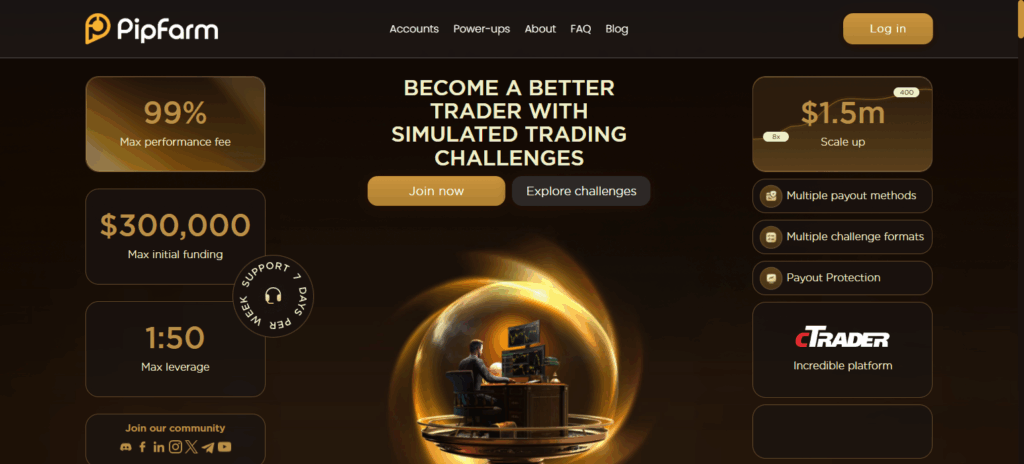

10. PipFarm

PipFarm is one of the best alternatives of Maven prop firms which appreciate easy and simple evaluation process, streamlined for both novices and seasoned traders.

Designed primarily for Forex trading, the firm offers accommodating and flexible trading rules for a multitude of trading strategies.

PipFarm is one of the few prop firms which is transparent and trustworthy due to quick payout timings and aligned profit split ratios. PipFarm’s simplicity and trader oriented policies makes it a pragmatic and expansion prop firm for traders looking to diversify beyond Maven.

PipFarm Features

- No Training Needed – Processes are simplified to emphasize ease of implementation.

- Focus On Forex – Focuses on the forex market to simplify strategy development.

- Fair Sharing of Profits – Ensures a reasonable distribution of the profit to the traders.

Pros & Cons Maven alternatives Prop Firms

Pros

- Capital Access – Traders will have access to large amounts of funding while risking none of their own money.

- Trade Strategy Flexibility – Many different strategies are offered for alternative prop trading as they allow scalping, swing, and even crypto trading.

- Low Barriers to Entry – Evaluation fees or even free trial offers are available with select firms.

- Profit Shrieking – Success is rewarded with competitive splits of trading profits.

- Growth Potential – Many firms allow growth of the account balance as the trader meets their targets.

- Training and Guidance – Many of these firms will supply the trader with trading tools, instructional material, and customer assistance.

Cons

- Stress of Evaluation – Traders are under stress to meet tough time targets that are set.

- Unsatisfactory Range – Other firms have a very limited focus, concentrating only on forex.

- Prohibitive Terms and Conditions – Some trading styles may not be allowed.

- Transitory Balances – In some firms, the process of withdrawal is lengthy or overly complex.

Conclusion

To sum up, alternatives to Maven provide traders with different options to access capital, enhance skills, and pursue professional development, all without having to touch personal savings. Every firm offers something different, with differing policies on trading, low barriers to entry, attractive profit-sharing, and expandable funding.

This makes them appropriate for traders, regardless of the employed method and the skill. Although the issues and costs may differ, alternatives such as BrightFunded, DNA Funded, and FXIFY provide dependable, growth-centered platforms, establishing their value as perfect and effective substitutions for traders looking to replace Maven.

FAQ

Who can join these prop firms?

Both beginners and experienced traders can join, depending on the firm’s evaluation requirements and allowed trading strategies.

How do I get funded?

Traders complete an evaluation challenge, meet profit targets, and follow risk management rules to qualify for a funded account.

Are there fees involved?

Most firms charge evaluation fees, while some offer free trials. There may also be monthly or service fees.