Choosing a brokerage firm, more specifically, a trading platform, in November 2026 has one of the more important deciding factors in determining the investment potential.

As it stands, the market is fully equipped with a myriad of options that suits the needs of a beginner, a long term investor or an active trader.

Each broker has particular selling points that can be understood to allow investors to make a more rational choices while creating a balanced portfolio. For example, there is trading without commissions, low priced index funds, sophisticated tools and trading in many other nations.

Key Point

| Brokerage Platform | Key Point |

|---|---|

| SoFi | Offers commission-free trading, user-friendly mobile app, and integrated financial products like loans and investing. |

| Fidelity | Known for low-cost investing, excellent research tools, retirement planning, and strong customer service. |

| Charles Schwab | Offers comprehensive investment options, commission-free trades, and high-quality educational resources for investors. |

| Interactive Brokers | Best for advanced traders, offers global markets access, competitive fees, and professional-grade trading tools. |

| E*TRADE | Provides easy-to-use platform, robust research, retirement accounts, and a range of ETFs and mutual funds. |

| Merrill Edge | Integrates with Bank of America, strong research tools, and rewards for combined banking and investing accounts. |

| J.P. Morgan Self-Directed Investing | Access to a wide range of investments, strong research, and integration with Chase banking ecosystem. |

| Firstrade | Offers commission-free trades, extensive investment products, and an easy-to-navigate platform for beginners. |

| Robinhood | Known for zero-commission trading, simple interface, crypto trading, but limited research tools compared to others. |

| Vanguard | Focused on long-term investors, low-cost index funds and ETFs, strong retirement planning resources. |

1. SoFi Invest

SoFi Invest is highly recommended for very beginners and for those mobile-first users who want something really simple and want to use integrated financial tools. There is commission-free trading for stocks, ETFs, and options, and there is no account fee with a minimum deposit of $0 required. Fractional shares can be purchased for as little as $5.

Among the Best Online Brokers and Trading Platforms for November 2025, SoFi is incredible in terms of interface and the accessibility of crypto and automated investing. Even though there are no sophisticated charting options, the integration will be very beneficial for casual investors.

SoFi Pros & Cons

Pros:

- $0 commissions on stocks, ETFs, and options

- Beginner-friendly platform and mobile app

- Combines banking, lending, and investing

- Automated investing and financial planning tools

- Low minimum deposit requirements

Cons:

- Limited advanced trading tools

- Fewer research and analytical resources

- Cryptocurrency options are limited

- Customer support can be slower

- No advanced order types like conditional or stop-limit

2. Fidelity

Fidelity is perfect for long-term investors and retirement planners looking for useful research and investing at low costs. There are no commissions on stocks and ETFs, $0.65 per options contract, and no minimum deposit.

As one of the Best Online Brokers and Trading Platforms for November 2025, Fidelity has a lot of mutual funds and retirement accounts, and great educational material.

Active Trader Pro platform supports advanced strategies and the mobile app is great for daily use. Due to the great customer service and investor-first approach, Fidelity is a great option for building wealth over time.

Fidelity Pros & Cons

Pros:

- $0 commissions on stocks, ETFs, and options

- Extensive research and educational resources

- Ideal for retirement and long-term investing

- Supports a wide range of account types

- Fractional share investing available

Cons:

- User interface can be overwhelming

- Some mutual funds have high minimums

- Less intuitive for advanced traders

- Limited international trading options

- Occasional account fees for specific services

3. Charles Schwab

Charles Schwab is one of the best and most complete experiences for beginners and seasoned investors. There is commission free trading on stocks and ETFs, $0.65 per options contract and no minimum deposit.

Schwab is high on the list of Best Online Brokers and Trading Platforms for November 2025 as a result of the great research tools, retirement planning resources, and accessing futures and mutual funds.

The addition of TD Ameritrade’s thinkorswim platform is a great feature for active traders. Due to no annual fees and great customer service, Schwab is a reliable all around broker for diverse investment needs and great for active trading.

Charles Schwab Pros & Cons

Pros:

- $0 commissions on stocks and ETFs

- Strong research and educational tools

- Wide variety of investment products

- Excellent customer service

- Supports fractional shares and automated investing

Cons:

- StreetSmart Edge has advanced tools which can be complicated.

- Managed services, as well as mutual funds, have some fees.

- Higher margin rates as compared to others.

- Restricted access to international markets.

- Account verification can be slow.

4. Interactive Brokers (IBKR)

Interactive Brokers (IBKR) is designed for cost-conscious traders and international investors looking for highly sophisticated tools. It employs a tiered cost structure with ultra-low commission starting at 0.0005 per share and 0.15 to 0.65 per options contract.

Lite version offers commission-free trading on US stocks, whereas IBKR Pro enables more complex strategies. It is ranked as one of the Best Online Brokers and Trading Platforms for November 2025 and for good reason, as it covers 150+ markets and has low margin rates.

Its depth and flexibility do provide a steep learning curve for professionals and institutions, which may overwhelm a newbie. However, this is the reason it is ranked highly.

Interactive Brokers Pros & Cons

Pros:

- Global markets access.

- Professional account low commissions.

- Margin, Options, Futures, and Forex trading supported.

- Advanced analytics and charting.

- Highly customizable trading platform.

Cons:

- Complicated interface for beginners.

- Professional accounts have higher minimum deposits.

- Customer support can be slow.

- Inactivity and data subscriptions fees.

- Casual investors can be overwhelmed.

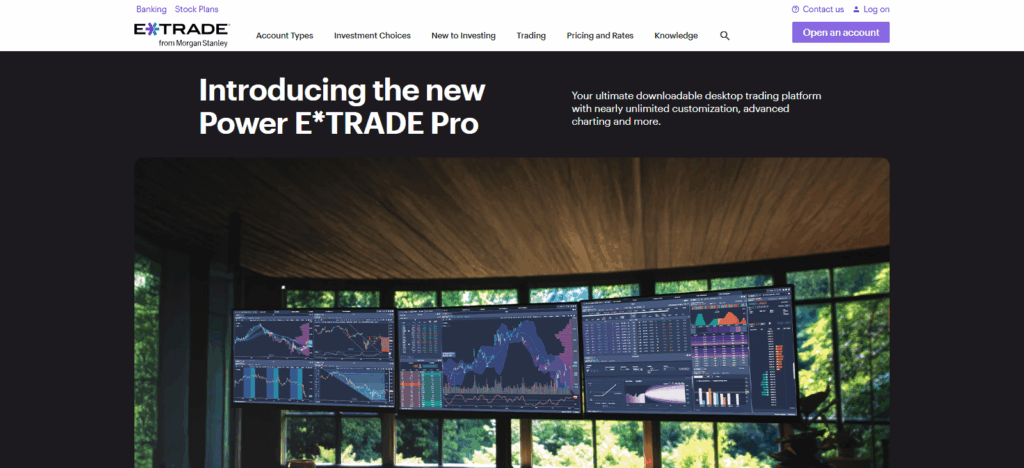

5. ETRADE

ETRADE is now owned by Morgan Stanley. It is flexible enough to be used by active traders and by those who focus on retirement. ETRADE offers zero commissions on $0 stocks and ETFs, which includes $0.65 options per contract, with no minimum deposit required, thus making it highly accessible.

Its benign fee structure and powerful ETRADE platform is the reason it is ranked among the Best Online Brokers and Trading Platforms for November 2025.

Despite Educational content and mobile app designed for all levels of investors, some access to ETRADE features may require refinement of the user’s skills and knowledge. Numerous strategies suit a wide range of investors, thus creating a balance between depth and usability.

E*TRADE Pros & Cons

Pros:

- $0 commissions on stocks and exchange-traded funds.

- Solid and advanced trading and research tools.

- E*TRADE Pro for advanced trading.

- Beginner-friendly trading platform.

- Strong mobile app for trading.

Cons:

- Options trading fees charged per contract.

- Transaction fees for some mutual funds.

- Restricted international trading.

- Advanced tools primarily on desktop.

- Inactivity fees on some accounts.

6. Merrill Edge

Merrill Edge is ideal for Bank of America customers seeking a convenient one-stop solution for banking and investing. It offers commission-free trades for stocks and ETFs, $0.65 for options contracts, and no minimum deposit.

In the November 2025 edition of the Best Online Brokers and Trading Platforms, Merrill Edge received accolades for having BofA Global Research and for the business and research analytics tools available to Preferred Rewards customers.

Although broker-assisted trades cost $29.95, the comprehensive research options and retirement maintained accounts for the platform make it a great option for long-term investors looking for quality and convenience.

Merrill Edge Pros & Cons

Pros:

- $0 commission on stocks and exchange-traded funds.

- Strong research tools that include Morningstar.

- Integrated with Bank of America.

- Automated investing and retirement accounts.

- Preferred Rewards and excess program perks.

Cons:

- Without advanced trading features.

- Slight range of international trading.

- Beginner’s experience could be negatively impacted by the design.

- Certain mutual funds and portfolios charge.

- Customer support is not 24/7 for some regions.

7. J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is a basic, commission-free platform perfect for Chase customers and passive investors. It has $0 commissions on stocks, ETFs, and mutual funds, and $0.65 for options contracts. A margin account has a $2,000 minimum deposit.

J.P. Morgan is one of the Best Online Brokers and Trading Platforms for November 2025 and its integration with Chase banking and mobile apps makes it a convenient option.

No complex trading instruments are provided, but that is compensated by the simple design and absence of annual fees. This is ideal if you want to make investments without much hassle.

J.P. Morgan Self Directed Investing Pros & Cons

Pros:

- Integrated with Chase banking

- Access J.P. Morgan banking research.

- Mobile and web interfaces are modern and easy to use.

- Self-directed accounts have no minimum deposit requirement.

- $0 commissions for stocks and ETFs

Cons:

- Limited advanced trading.

- Options trading will have associated fees.

- Little to no access of international markets.

- Little education offered.

- Some features Geo-locked to Chase.

8. Firstrade

Firstrade caters to value-conscious investors and mutual fund traders. With commission-free trading on stocks, ETFs, options, and mutual funds, it also boasts no account or inactivity fees, and no minimum deposit.

Recognized as one of the Best Online Brokers and Trading Platforms for November 2025, Firstrade thrives when it comes to its inexpensive offerings and supports fractional shares and overnight trading.

While basic, its research offerings will suit long-term investors who desire affordable, straightforward trading. They will simply be indifferent to the lack research and active trading offerings, as these do not suit their needs.

Firstrade Pros & Cons

Pros:

- $0 commissions for stocks, ETFs, options, and mutual funds.

- No required minimum deposit.

- International trading is permitted.

- Easy to use for beginners.

- Some education provided.

Cons:

- Limited trading tools.

- Mobile application lacks features.

- Slow customer service.

- Limited investment options.

- Limited account types.

9. Robinhood

Robinhood attracts beginners and is designed for mobile-first traders who appreciate simplicity and the absence of commissions. As such, it presents trading on stocks, ETFs, options, and crypto without any fees as well as no account fees, plus a $0 minimum deposit.

For $5/month, Robinhood Gold offers margin and research tools. Robinhood is also featured in the Best Online Brokers and Trading Platforms for November 2025. Its minimalist app and fractional share trading capability smoothens the experience for younger investors.

Robinhood Pros & Cons

Pros:

- No minimum account requirement

- Mobile software is easy to use

- Quick trading through instant deposits

- Trade crypto, stocks, ETFs, and options with no commissions

- Trade with fractional shares.

Cons:

- Inadequate research and analysis tools

- No IRA offerings

- Slow customer service response

- Limited complex trading tools

- Inappropriate for professional/high volume trading

10. Vanguard

Although Vanguard is often considered best for long-term, low-cost investment index retirement saving accounts, it is also regarded as best for retirement saving accounts due to its low-cost investment indices. Vanguard has commission-free stock and ETF trades, imposes a $1 fee for option contracts and has no minimum deposit.

Accounts with funds in Vanguard of under $10,000 may face a $20 fee each year. As one of the Best Online Brokers and Trading Platforms for November 2025, Vanguard is characterized by its customer-loyal policy on the low expense ratios and good performance of strong funds and strong performance of funds.

While its platform is basic, it is ideal for self-directed investors aiming to build wealth in a buy-and-hold strategy over the years.

Vanguard Pros & Cons

Pros:

- Their index and mutual funds are very inexpensive

- Good for banking for your retirement and long-term goals

- Stock and ETF trades incur no commissions

- Good educational and research materials

- Invest in fractional shares

Cons:

- Their trading tools are very basic and underdeveloped

- Certain mutual funds have very high minimum investments

- Mobile application has basic functionality only

- Limited options for short-term trading

- Limited access to trading in international markets

Conclusion

When it comes to selecting an online broker in November 2025, factors such as your investing goals, experience, and trading style will help determine which broker to choose. For ease and cost, beginners may choose SoFi, Robinhood, and Firstrade which all offer commission-free trading and simple, user-friendly platforms.

Fidelity, Vanguard, and Charles Schwab might be a better option for research and account options for those long-term investors concentrating on low-cost index funds, retirement funds, and/or long-term investing. Corporate and active traders would appreciate E*TRADE and Interactive Brokers for advanced features and trading on a global scale.

For those who are customers of a full-service financial institution, investing and banking as a Merrill Edge or J.P. Morgan Self-Directed Investing customer will be integrated and seamless. Due to the multiple features and services each platform provides, it is best to align a broker with personal objectives whether these are convenience, research, or growth.

FAQ

What are the best online brokers for beginners in November 2025?

SoFi, Robinhood, and Firstrade are ideal for beginners. They offer commission-free trading, no minimum deposit requirements, and user-friendly mobile apps that simplify investing for new users.

Which brokers are best for long-term and retirement investing?

Fidelity, Vanguard, and Charles Schwab are excellent for long-term investors. They provide low-cost index funds, robust research tools, and retirement account options like IRAs and HSAs.

Who should use Interactive Brokers or E*TRADE?

Active traders and professionals benefit most from Interactive Brokers and E*TRADE. These platforms provide advanced trading tools, access to global markets, margin trading, and customizable interfaces for experienced users.

Are there brokers with integrated banking services?

Yes. Merrill Edge and J.P. Morgan Self-Directed Investing integrate banking and investing services. They offer seamless connections with checking and savings accounts, making it easier to manage cash flow alongside investments.

Do all brokers charge commissions for trades in 2025?

Most major brokers, including SoFi, Fidelity, Charles Schwab, E*TRADE, Robinhood, and Vanguard, now offer $0 commissions on U.S. stocks, ETFs, and options trades. Fees may still apply for mutual funds, margin accounts, or advanced services.