In this article i will discuss the Best Place To Exchange Dollars For Euros in order to assist you with effective, inexpensive, straightforward, and dependable search options.

The right method for currency exchange can help save time and money while traveling, sending money overseas, or even planning a purchase. I will cover many options along with their one-of-a-kind features to assist you in making the right choice.

Key Point & Best Place To Exchange Dollars For Euros List

| Option | Key Point |

|---|---|

| Local Banks | Reliable but may offer less competitive exchange rates and charge service fees. |

| Credit Unions | Often provide better rates than banks with lower or no fees for members. |

| Currency Exchange Services | Offer competitive rates but may charge commission or service fees. |

| Mobile Apps | Convenient for on-the-go exchange; rates vary depending on the provider. |

| Online Currency Exchange Platforms | Provide real-time rates and low fees, ideal for frequent transactions. |

| Post Offices | Accessible option with fixed rates, but limited currency availability. |

| International Banks | Great for global access; may have higher fees but wide range of services. |

| Forex Brokers | Best for large transactions with real-time trading and minimal spreads. |

| Specialized Currency Exchange Kiosks | Located in airports or tourist spots; convenient but often poor rates. |

1.Local Banks

Local banks offer some of the most preferred services in responding to the demand of currencry exchange, particularly for dollar to euro conversion, because of their reliable services and trustable transactions.

What makes them different from other banks is their ability to offer regulated exchange which fraud or hidden charges.

Unlike kiosks or third party vendors, banks directly give consumers reputable amount to currency with no contested fees. For clients who look for assurance to be responsible, local banks are the best sensitive choice for local and abroad currency.

Local Banks Features

2.Credit Unions

Credit unions are a wonderful place to convert dollars to euros for members looking for reasonable rates and low fees.

Unlike other institutions, credit unions operate on a not-for-profit model which enables them to offer lower rates and better service.

This is a good thing because it enables credit unions to offer more favorable exchange rates than banks. On top of that, credit unions tend to have better customer service, which makes the entire exchange easier and clearer. For cost-conscious travelers seeking highly responsive service, credit unions are extremely beneficial.

Credit Unions Features

3.Currency Exchange Services

Currency exchange services are some of the best providers for the exchange of dollars for euros because of their focus on foreign currency and their specialization.

Their unique advantage lies with their dealing in enormous volumes of currency on a daily basis which allows them to offer more competitive rates.

Unlike banks, these services specialize in currency conversion which almost always ensures better priced transactions and, in most cases, faster service. Standalone currency exchange providers offer more advanced solutions that are better suited for travelers and business users looking for optimized and favorable rates.

Currency Exchange Services Features

4.Mobile Apps

Mobile apps are ideal for exchanging euros to dollars as they provide unmatched comfort and access in real-time.

Their comparative advantage is the ability to view rates across numerous platforms simultaneously, allowing users to obtain the best deal without having to physically show up.

Many of the apps also have low fees and clearly advertised prices, which is convenient for users needing speedy exchanges. For users who are advanced in technology and appreciate speed, flexibility, and visibility of the rate, mobile apps work best for handling the conversion.

Mobile Apps Features

5.Online Currency Exchange Platforms

Currency exchange websites provide one of the cheapest rates when converting dollars to euros due to their ability to track live market rates and low operational costs.

Their unique selling proposition is the ability to freeze a rate instantly and avoid market swings, enabling users to plan exchanges in advance.

These websites also offer low or no commission and fast transfers. For people and companies valuing control, visibility, and low costs, online solutions provide a smarter and more effective approach than traditional ones.

Online Currency Exchange Platforms Features

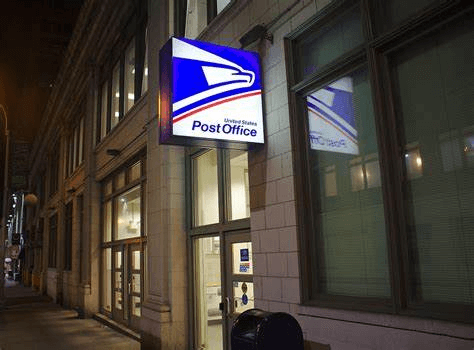

6.Post Offices

Post offices can be a convenient and straightforward option for exchanging dollars for euros. Their advantage stems from their government support which enables them to maintain trust and consistency across their network.

Although their rates aren’t the most competitive, many post offices offer fixed prices and no hidden charges. For travelers looking for a well-known institution with rules and regulations related to currency exchange, post offices serve as a reliable and easy option.

Post Offices Features

7.International Banks

International banks are leading options for dollar to euro conversions because of their global reach and uniform banking practices. One of their main benefits is borderless access—clients can change currency in one nation and get it from another through joint accounts.

This feature benefits better for international clients and frequent travelers. An international bank provides a proficient, efficient, and trusted solution for currency exchange because of the built-in security, multilingual support, and reliable infrastructure they possess.

International Banks Features

8.Forex Brokers

Forex brokers are one of the best options to swap dollars for euros when involving enormous amounts or real-time market values. Their unique advantage lies in offering low spreads and direct access to live forex markets which enables the users to trade at the most precise rates.

In contrast to banks and kiosks, forex brokers focus on active traders and investors, providing them with unparalleled instant execution and advanced trading tools.

Forex brokers offer a highly competitive experience in terms of precision, flexibility, and pricing aimed at meeting market-level expectations while catering to clients seeking heightened precision.

Forex Brokers Features

9.Specialized Currency Exchange Kiosks

Specialized currency exchange kiosks in high-traffic regions such as airports and tourist destinations serve as great help when there is a need to exchange dollars to euros.

The greatest benefit is that they offer foreign currency promptly without the use of accounts or waiting times, which makes expenditures while traveling very helpful.

Regardless of whether the rates vary, the kiosks focus on meeting the needs of clients who require immediate assistance. For tourists or travelers in a hurry, these kiosks are a sensible option as reliability and urgency are catered to with the no-hassle experience.

Specialized Currency Exchange Kiosks Features

Conclusion

To sum up the considerations you must have in mind while exchanging dollars to euro, are the safety, competitive rates or convenience based on which choice you opt for will highly determine your exchange experience.

While offering flexibility, online platforms and forex brokers provide better rates. Meanwhile, banks and credit unions are more local and reliable. For quick and easy access, kiosks and mobile apps are ideal. With paying attention towards the quality of service, speed and service determine the other factors that help smooth the exchange.