This article will review the Best Prop Firms for Malaysia. Here, we highlight trading firms with funded accounts, minimal KYC, and great support for traders in Malaysia.

Prop firms increase your capital, allow you to better your skills, and increase your profit with professional support which is essential for beginners and seasoned traders alike.

What is Prop Firms for Malaysia?

Spend on Prop as you would on PayPer. A proprietary trading firm basically means you can trade forex, commodities, stocks, and other financial markets using the funds supplied by the company.

You don’t have to spend your money and you only keep a fraction of the profit you make. Most companies also offer a training course to improve one’s trading skills and provide other necessary tools to increase the probability of success.

For traders in Malaysia, prop firms provide the opportunity to work with bigger loans, increase the likelihood of profit, and get professional training all without the risk of losing your own money.

Why use Prop Firms for Malaysia

Access to Large Capital: Huge trading capital without the need to spend your own money.

Profit Sharing: You take a percentage of the profit while the firm takes the risk of losing money on the trade.

Professional Training: Trading skills are enhanced through formal training, strategic guidance, and mentorship.

Risk Management Support: Support in disciplined, structured trading and calculated risk taking.

Advanced Trading Platforms: Top tech and resources for in-depth market research.

Career Opportunities: The experience could lead to a permanent trading position and development of a trading career.

Key Point & Best Prop Firms for Malaysia List

| Prop Firm | Key Points / Features |

|---|---|

| RebelsFunding | Offers flexible funding plans, low entry fees, and profit split up to 80%. |

| FundedNext | Fast evaluation, multiple account options, and supportive trading community. |

| AlphaCapital | Provides high leverage accounts, risk management tools, and mentorship programs. |

| The5ers | Focus on long-term funding, instant scaling opportunities, and global trader support. |

| FunderPro | Simple evaluation, fast funding, and competitive profit share. |

| Funding Pips | Forex-focused, low-cost evaluation, and daily profit withdrawal options. |

| FXIFY | Offers funded accounts for forex & crypto, low-risk rules, and growth plans. |

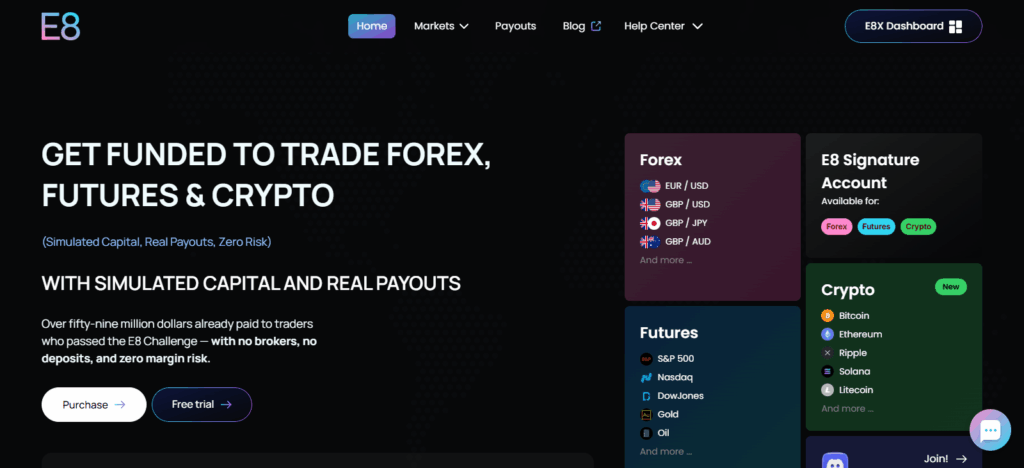

| E8 Markets | Instant funding, high account flexibility, and dedicated support team. |

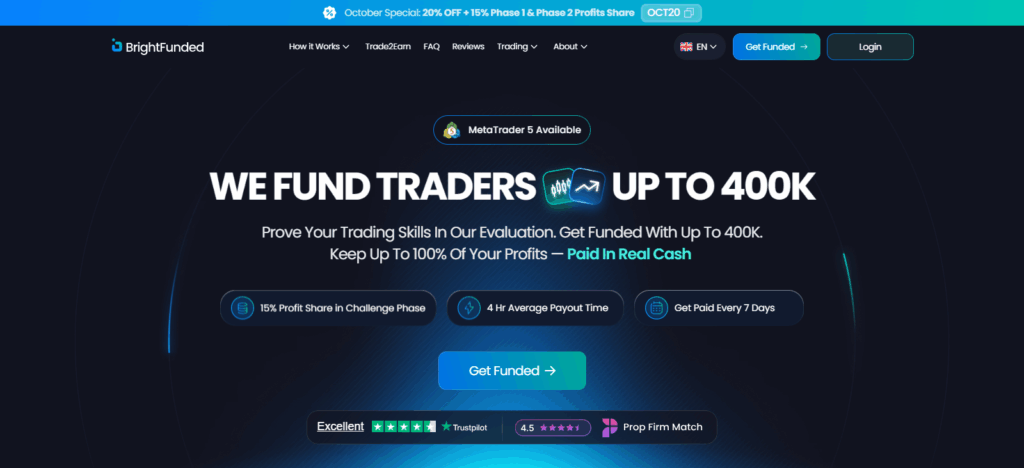

| BrightFunded | Easy evaluation, fast payouts, and supportive trader community. |

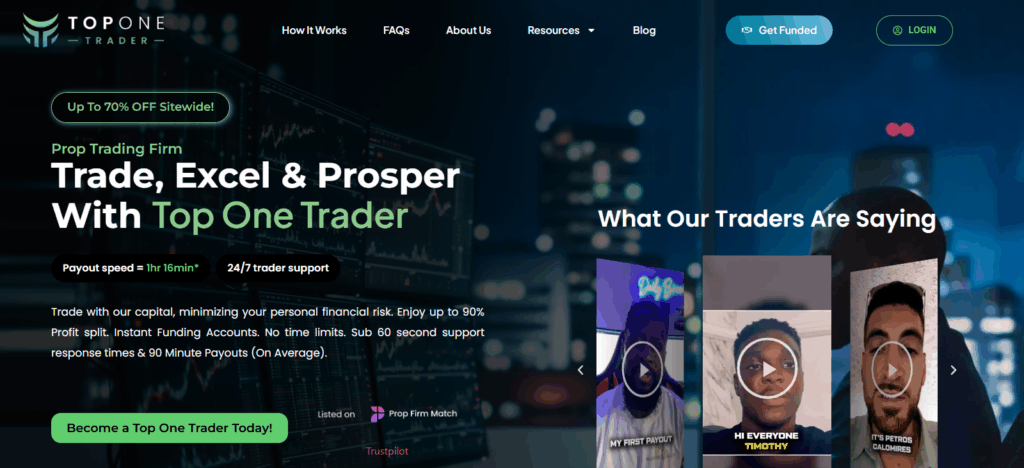

| Top One Trader | Multiple account types, high profit potential, and transparent rules. |

1. RebelsFunding

RebelsFunding deserves to be recognized as one of the best prop firms in Malaysia because of its versatile funding and trader-centric policies. Unlike most firms, it lets Malaysian traders begin with low opening costs and provides considerable funds to trade forex, commodities, and indices as well.

The clarity of the profit distribution approach guarantees that traders hold onto a considerable share of profits, which is motivational to the trader’s performance. RebelsFunding also offers guidance in risk management and has tiered account strategies.

Successful traders gain access to more funds as time goes on. With quick access to funds, open lines of communication, and custom rules geared toward disciplined trading, it is a good fit for novice traders as well as seasoned traders in Malaysia.

| Feature | Details |

|---|---|

| Firm Name | RebelsFunding |

| Country Focus | Malaysia |

| Funding Type | Forex, Commodities, Indices |

| Account Sizes | Small to Large Capital Options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Available – increases capital based on consistent performance |

| Funding Speed | Fast approval after evaluation |

| Support | Dedicated trader support & risk management guidance |

| Unique Point | Minimal KYC requirements with fast funding, ideal for Malaysian traders |

2. FundedNext

FundedNext has been recognized as one of the best prop firms in Malaysia due to its quick and smooth funding system. Malaysian traders get to enjoy several account types suited to their different trading styles whether they be trading forex, indices, or both.

FundedNext has a quicker-than-usual evaluation system as traders get to show their skills in a shorter time as opposed to the norm. The platform has a community system in place and provides support working with traders in conjunction with mentors and fellow traders.

FundedNext has clear profit splits, flexible risk guidelines, and instantly triggers account funding as evaluations are passed. These features make it great for traders, beginners or otherwise, to grow their trading accounts with minimal personal financial risk.

| Feature | Details |

|---|---|

| Firm Name | FundedNext |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices, Commodities |

| Account Sizes | Multiple account options for different trading levels |

| Evaluation Requirement | Simple evaluation process with minimal KYC |

| Profit Split | Competitive profit share (up to 75–80%) |

| Entry Fee | Low entry fees |

| Scaling Program | Yes – traders can access higher capital with consistent performance |

| Funding Speed | Fast funding approval after passing evaluation |

| Support | Community support and mentor guidance |

| Unique Point | Quick evaluation and instant funding with minimal KYC for Malaysian traders |

3. AlphaCapital

AlphaCapital ranks highly among Malaysian prop companies due to the availability of high leverage accounts with strong risk management for those traders seeking profit whilst still being responsible.

The firm focuses on mentorship for Malaysian traders which is a compelling offering. The firm also provides scalable funding which makes it easy for traders to receive more capital as they trade successfully.

Finally, the firm provides easy to use trading systems for Malaysian traders with clear rules, reasonable profit shards, minimal financial exposure, and balance risk, which is important to many traders. This makes the firm a top choice for traders in Malaysia.

| Feature | Details |

|---|---|

| Firm Name | AlphaCapital |

| Country Focus | Malaysia |

| Funding Type | Forex, Commodities, Indices |

| Account Sizes | Small to Large Capital Options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – allows access to higher capital for consistent traders |

| Funding Speed | Fast funding after evaluation |

| Support | Risk management guidance and professional trader support |

| Unique Point | High-leverage accounts with minimal KYC, ideal for Malaysian traders |

4. The5ers

The5ers has emerged as a primary option among Malaysian traders mainly due to its long-term funding model, enabling traders to expand without the constraints associated with short assignments.

The5ers has an automatic scaling system where traders can access bigger funds with sustained profitability. Malaysian traders can appreciate the variety of accounts, flexible guidance on trading, and worldwide assistance provided, which accommodates novices as well as advanced traders.

The5ers focuses on consistent expansion in trading to ensure there are no concealed costs or surprises in the fees, allowing Malaysian traders to develop their trading in a professional manner. The5ers prides itself on building a safe and profitable trading atmosphere in which Malaysian traders can thrive.

| Feature | Details |

|---|---|

| Firm Name | The5ers |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices |

| Account Sizes | Multiple levels, from small to large capital |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 75–80% |

| Entry Fee | Low entry fee |

| Scaling Program | Instant scaling available for consistent traders |

| Funding Speed | Fast funding upon passing evaluation |

| Support | Global trader support and guidance |

| Unique Point | Focus on long-term growth with minimal KYC, ideal for Malaysian traders |

5. FunderPro

FunderPro is a great option for Malaysian traders since it is simple and efficient, so starting trading with funded accounts is easy.

The evaluation process is unique and simple, letting traders assess their skills without wasting time. Malaysian traders appreciate the competitive profit split and responsibly trading rules that remain straightforward and easy to follow.

FunderPro cares about fast funding approvals and flexible accounts that adapt to a variety of trading styles. With support and risk management resources, FunderPro provides the means for Malaysian traders to develop professionally and succeed in their trading while reducing the financial risk on their part.

| Feature | Details |

|---|---|

| Firm Name | FunderPro |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices, Commodities |

| Account Sizes | Small to Medium capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – access higher capital for consistent traders |

| Funding Speed | Fast funding after passing evaluation |

| Support | Trader support and risk management guidance |

| Unique Point | Straightforward evaluation with minimal KYC, ideal for Malaysian traders |

6. Funding Pips

Funding Pips has earned the respect of Malaysian traders due to the specific focus on forex trading and the different levels accounts for newly minted and seasoned traders. The low-cost evaluation program that enables traders to obtain substantial funds with little initial costs is a distinguishing feature.

Malaysian traders appreciate the ability to withdraw profit daily, flexible risk parameters, and a safe environment to enforce self-discipline.

The straightforward profit split structure and unfettered rule sets underscore the minimal personal risk and substantial growth potential Funding Pips offers traders. The dedication to easily accessible capital and growth in professionalism positions Funding Pips among the most reputable prop firms in Malaysia.

| Feature | Details |

|---|---|

| Firm Name | Funding Pips |

| Country Focus | Malaysia |

| Funding Type | Forex |

| Account Sizes | Small to Medium capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 75–80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – higher capital available for consistent traders |

| Funding Speed | Fast funding after passing evaluation |

| Support | Risk management guidance and trader support |

| Unique Point | Focused on forex with minimal KYC, ideal for Malaysian traders |

7. FXIFY

FXIFY is among the top prop firms for Malaysian traders, as it offers funded accounts for forex and cryptocurrency accounts. This flexibility accommodates varying trading preferences.

Upon fusion of varying account sizes and low-risk trading rules, the firm becomes ideally suited for all trader levels. Malaysian traders enjoy prompt account approvals, clear and equitable profit-sharing structures, and a system that prioritizes growth and performance, allowing them to scale to higher levels of capital.

Powerful, educationally oriented, and simplified systems, as well as trading instructions and trading systems ensure that traders safely and professionally develop their trading skills while low risk investing personally, fulfilling the needs of Malaysian traders.

| Feature | Details |

|---|---|

| Firm Name | FXIFY |

| Country Focus | Malaysia |

| Funding Type | Forex, Cryptocurrency |

| Account Sizes | Small to Large capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – allows access to higher capital for consistent traders |

| Funding Speed | Fast funding after passing evaluation |

| Support | Trader support and educational resources |

| Unique Point | Flexible trading across forex and crypto with minimal KYC, ideal for Malaysian traders |

8. E8 Markets

E8 Markets has earned a reputation as a leading prop firm for traders from Malaysia for its flexible funding schemes as well as its seamless and rapid funding. One distinctive quality has been the opportunity to commence trading without delay after meeting a preliminary trading assessment.

This allows traders to focus their attention on trading results instead of wasting time with protracted onboarding procedures. Malaysian traders appreciate palpable funding dispersions, straightforward trading parameters, and support for active risk management.

E8 Markets is ranked among the best in Malaysia because of its sophisticated trading infrastructure. Traders of all skill levels are able to access scalable capital and training to preserve focused, automated methods in for capital growth, disciplined strategy formation, and consistent accomplishment in trading.

| Feature | Details |

|---|---|

| Firm Name | E8 Markets |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices |

| Account Sizes | Small to Large capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – increases capital for consistent traders |

| Funding Speed | Instant or fast funding after passing evaluation |

| Support | Dedicated trader support and guidance |

| Unique Point | Quick funding and flexible account options with minimal KYC, ideal for Malaysian traders |

9. BrightFunded

BrightFunded is well-known among Malaysian traders as a top proprietary firm, offering traders a straightforward approach with quick funding approvals, ensuring trading can begin without unnecessary waiting.

Their most notable feature is the supportive communities and educational tools which assist traders in strategizing and risk mitigation. Every Malaysian traders’ needs are met with different trading accounts, profit-sharing understandings, and rule systems that promote disciplined trading.

As trading improves, BrightFunded’s scalable funds improve which allows traders to receive more funds as they progress. Prioritizing accessibility, development, and professionalism, BrightFunded allows Malaysian traders to approach trading with confidence, build their careers, and develop sustainable trading habits.

| Feature | Details |

|---|---|

| Firm Name | BrightFunded |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices |

| Account Sizes | Small to Medium capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 75–80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – allows traders to access higher capital with consistent performance |

| Funding Speed | Fast funding after passing evaluation |

| Support | Community support and trader guidance |

| Unique Point | Fast approvals and supportive environment with minimal KYC, ideal for Malaysian traders |

10. Top One Trader

Top One Trader is ideal for Malaysian traders as it offers different account types for different trading styles, from forex to indices. What makes it stand out is its combination of high profit potential and clear, trader-centric conditions, allowing Malaysians to focus on consistent profit without worrying about opaque fees.

The firm values professional development and risk management and provides mentorship and scalable capital to traders which fulfills the firm’s success criteria.

With quick funding authorizations, dependable assistance, and sophisticated trading tools, Top One Trader enables Malaysian traders to optimize their capital, improve their trading techniques, and build their trading careers in a safe and responsible manner.

| Feature | Details |

|---|---|

| Firm Name | Top One Trader |

| Country Focus | Malaysia |

| Funding Type | Forex, Indices |

| Account Sizes | Small to Large capital options |

| Evaluation Requirement | Simple evaluation with minimal KYC |

| Profit Split | Up to 80% |

| Entry Fee | Low entry fee |

| Scaling Program | Yes – access to higher capital for consistent performance |

| Funding Speed | Fast funding after passing evaluation |

| Support | Trader support and guidance |

| Unique Point | Multiple account types with transparent rules and minimal KYC, ideal for Malaysian traders |

Conclusion

To summarize, traders in Malaysia can choose from many excellent prop firms. Each remains designed to meet different preferences and trading techniques. While RebelsFunding, FundedNext, AlphaCapital, and The5ers offer the ability to trade with little personal investment and substantial profit potential, they also provide different account scaling options, quick approvals, flexible funding, and professional assistance.

This allows Malaysian traders to refine a focused plan and earn a considerable amount of real-life market experience which is crucial for career advancement. Ultimately, prop firms provide the best opportunity for novice traders to begin their career.

FAQ

Why use a prop firm in Malaysia?

Prop firms give Malaysian traders access to larger capital, professional guidance, risk management tools, and scalable accounts without using personal funds.

How do I get funded by a prop firm?

Most prop firms require passing an evaluation, which tests trading skills, consistency, and risk management. Once passed, traders receive funded accounts.

Which prop firm is best for beginners in Malaysia?

Firms like RebelsFunding, FundedNext, and BrightFunded offer beginner-friendly evaluations, clear rules, and educational support.

Can I trade forex and crypto with Malaysian prop firms?

Yes, firms like FXIFY and AlphaCapital allow trading across forex, crypto, indices, and commodities.

How much profit can I earn?

Profit depends on the firm’s profit split, trading performance, and account type. Most firms offer 50–80% profit share to traders.