The Best Prop Firms in Japan that offer financed trading options for futures, CFDs, and FX traders will be covered in this post.

These companies provide competitive profit splits, expandable accounts, and adaptable evaluation procedures. Knowing the best Japan-accessible prop businesses will help you trade with more capital without having to risk your own money, regardless of your level of experience.

What is Prop Firms?

Prop firms, also known as proprietary trading firms, are businesses that give traders the capital they need to trade financial markets such as stocks, futures, CFDs, and forex without using their own funds. In order to demonstrate consistent profitability and risk management, traders typically need to pass an assessment or challenge.

They receive a profit split after funding, and the company bears the trading risk. Prop firms are a desirable choice for both novice and experienced traders because they provide tools, platforms, and support that enable traders to expand their accounts and access more cash than they could directly afford.

Why It Is Prop Firms in Japan Matter

Prop firms are becoming important for Japanese traders as they provide services not available in conventional trading. These are:

Access to Greater Funding – Japanese traders have the ability to trade larger accounts not backed by their own capital.

Less Financial Liability – During funded trading, the losses are taken by the firm.

Growing Accounts – Outstanding trading performance may lead to greater capital distributions as time goes on.

Shared Profits – Traders make as much as 90-95% profit splits from positive trades.

Professional Tools and Support – The option to use certain platforms as well as analytics and risk control is provided.

Key Point & Best Prop Firms in Japan List

| Prop Firm | Key Points |

|---|---|

| FundedNext | Flexible evaluation models, fast payouts, scaling plans, trader-friendly rules, global access including Japan |

| FundedPrime | Simple challenge structure, competitive profit splits, low drawdown pressure, beginner-friendly setup |

| TradeDay | Futures-focused prop firm, real market conditions, daily payouts, professional trading environment |

| FTMO (Japan Access) | Industry-leading reputation, strict risk management, high capital allocation, reliable payouts |

| The5%ers | Instant funding options, low-risk trading model, long-term scaling, consistent trader support |

| MyForexFunds (MFFX Successor) | Modern platform reboot, transparent rules, improved compliance, faster withdrawals |

| E8 Funding | No time limits, customizable challenges, competitive profit sharing, strong trader dashboard |

| Funded Trading Plus | High leverage options, aggressive scaling plans, quick evaluation process, flexible strategies |

| Funding Pips | Low-cost challenges, high profit split, fast account activation, popular among new traders |

| Alpha Capital Group | Institutional-style risk rules, rapid funding, advanced analytics, trusted global prop firm |

1. FundedNext

Since its founding in 2022, FundedNext has emerged as one of Japan’s and the world’s top prop firms for funded traders. It supports trading on popular platforms like MT4/5 and cTrader and provides challenge models with accounts up to about $300,000. It frequently scales further dependent on performance.

FundedNext is renowned for offering competitive profit splits of up to 90–95% after funding, as well as incentives during appraisal stages. It is perfect for anyone in Japan looking for clear, trader-first terms because traders enjoy quick payments and flexible timeframes. Both seasoned and aspiring traders have embraced it, as seen by its quick expansion.

FundedNext Features, Pros & Cons

Features

- Different models for evaluations.

- Account balances of approximately $300,000 or more.

- Payouts ranging from 90 to 95 percent profit splits.

- Quick payout processing.

- Compatible with MT4/MT5 and cTrader.

Pros

- Different options for challenges.

- High profit splits.

- Quick evaluations.

- Good support for traders.

- Sophisticated tools for risk management.

Cons

- Newer company.

- Limited data on performance over time.

- Less available educational content.

- High leverage with strict risk management.

- Plan-based fee differences.

2. FundedPrime

FundedPrime is often praised by the top prop firms in Japan and throughout the world for its ease of use and robust trading incentives. It is seen as a more recent newcomer with simulated funded accounts up to ~$200,000 and a simple evaluation approach, even though the precise creation year isn’t generally disclosed.

After overcoming obstacles with explicit guidelines like 10% profit targets and specified drawdowns, profit splits can reach 90%. The challenge pricing offered by FundedPrime varies according to the size of the account, and reimbursements usually take place 14 days after the profit is realized. Traders seeking a straightforward, lucrative route to sponsored trading may find it appealing.

FundedPrime Features, Pros & Cons

Features

- Easy to follow structures for challenges.

- Good pricing.

- Profit splits of 90 percent.

- Easy to follow rules.

- Good for beginners.

Pros

- Easy programs to follow.

- Good for novice traders.

- Quick funding opportunity to accounts.

- Simple risk management.

- Different funding levels.

Cons

- Less available advanced options.

- Smaller max capital compared to some competition.

- Less available options for brokers.

- Support response time may vary.

- Not a lot of name recognition.

3. TradeDay

TradeDay is known as one of the Best Prop Firms in Japan and in the world due to its unique and innovative approach to real-world futures and futures-based challenge accounts. There is minimal detailed public data pertaining to its founding year, however, TradeDay focuses on professional futures trading with capital allocation to funded traders after they pass evaluations.

Profit splits are highly competitive, in the 80% range or higher depending on the program, and accounts are available in the higher tens of thousands, and sometimes even more. TradeDay’s model is particularly suited for disciplined futures traders who are in need of substantial capital and want to move up in levels without having a lot of rules.

Trade Day Features, Pros & Cons

Features

- Focus on futures and forex.

- Professional environment for trading.

- Larger account sizes for serious traders.

- Competitive profit splitting, 80 percent or more.

- Real Market Situations

Pros:

- Perfect for future contracts traders

- Real Market Exposure

- Credible structure for payout

- Suitable for professional strategies

- Good risk frameworks

Cons:

- Higher entry criteria

- Less currency trading options

- Less friendly for beginners

- Less educational resources

- Fewer customer experiences

4. FTMO (Japan access)

FTMO was established in 2015 which makes it one of the oldest companies in the industry. This makes them trustworthy and well-established. They provide funded accounts of $10,000 up to $200,000 and account scaling up to $2 million for consistent traders.

FTMO requires traders to pass their 2-step evaluation process that has a profit target and risk control parameters. FTMO is known for a profit split of 25% up to 90%. Their payouts are bi-weekly and offer multiple platform options. They also provide strong educational materials to help their traders succeed.

FTMO (Japan Access) Features, Pros & Cons

Features:

- One of the oldest companies

- Multi-step evaluations

- Accounts from around [$10K to $200K+]

- ~90% profit splits

- Strong support and analytics

Pros:

- Good reputation

- Account growth is scalable

- Rapid profit splits

- Lots of support

- Many platforms supported

Cons:

- More evaluations

- It takes more time to get funded

- Larger accounts have higher fees

- No region dependent crypto trading

- Evaluations have time constraints

5. The5%ers

Among the Best Prop Firms in Japan for long-term traders, The5%ers stands out as a structured, growth-oriented company that was founded in 2016. It offers financed accounts that support many program tracks, including Bootcamp and Hyper Growth, and can grow rapidly, even to several million USD with disciplined performance.

While assessment targets concentrate on ongoing monthly growth rather than one-time earnings, profit splits begin at about 80% and can rise to 100% with persistent results. Traders are assisted in creating solid, long-term strategies by the firm’s mentorship resources and organized growth.

The5%ers Features, Pros & Cons

Features:

- Options for instant funding

- Scalable accounts into the multi millions

- 100% profit splits

- Growth targets monthly

- Mentorship available

Pros:

- Great for traders who are long term

- High scaling potential

- Minimal evaluation pressure

- Community Support

- Suitable for strategies that are consistent

Cons:

- Complex target growth rules

- Initial capital is lower compared to some

- Monthly targets are not for everyone

- Payout frequency changes.

- Feedback can take longer than expected.

6. MyForexFunds (MFFX successor)

Due to its easy access and adaptable programs, MyForexFunds—which has since succeeded or been partially relaunched as MFFX in some markets—is frequently listed among the Best Prop Firms in Japan. MyForexFunds offers funded accounts in Forex, CFDs, and other markets with expandable capital once financed, although specific establishment dates differ by area and brand evolution.

With several challenge courses and drawdown rules to accommodate various approaches, profit shares on funded accounts can reach approximately 85–90%. It is well-liked by both Japanese and international traders due to its competitive funding options and accessibility.

MyForexFunds (MFFX Successor) Features, Pros & Cons

Features:

- Newly branded model with improved compliance

- Different account types available (Standard, Rapid)

- Profit split around 85-90%.

- Supports various trading platforms

- Broad market access.

Pros:

- Multiple evaluation choices

- Several strategies can be employed

- Reasonable pricing

- Accessibility worldwide, including Japan

- More relaxed risk management policies

Cons:

- Payouts can be slower.

- New traders have varied experiences.

- Educational material is lacking.

- Delayed payouts.

- New branding can be confusing.

- Profit split is lower than variances.

7. E8 Funding

E8 Funding, which purportedly funds millions of trader accounts, is regarded as one of Japan’s Best Prop Firms due to its larger capital offerings and trader-friendly challenge structure. Accounts usually have a maximum value of $400,000 or more, and some programs emphasize quick payouts and unambiguous regulations by offering high-performing traders profit percentages of up to 80–100%.

Traders looking for forex and futures opportunities find E8 Funding appealing due to their emphasis on user experience and clear goals. A strong dedication to innovation and trader success is shown in E8’s expanding reputation.

E8 Funding Features, Pros & Cons

Features:

- High limits on funded account sizes

- Profit split ranges (80-100%)

- Simple structure for challenges

- Quick payouts

- Well-defined risk parameters

Pros:

- Rapid access to funded accounts.

- Streamlined process for trader certification.

- Intuitive trading dashboard.

- Variety of trading styles on funded accounts.

- Available for forex and CFD trading.

Cons:

- Limited historical data for newer firms.

- Risk parameters may be strict for scalpers.

- Support response time is inconsistent.

- Resources for education are limited.

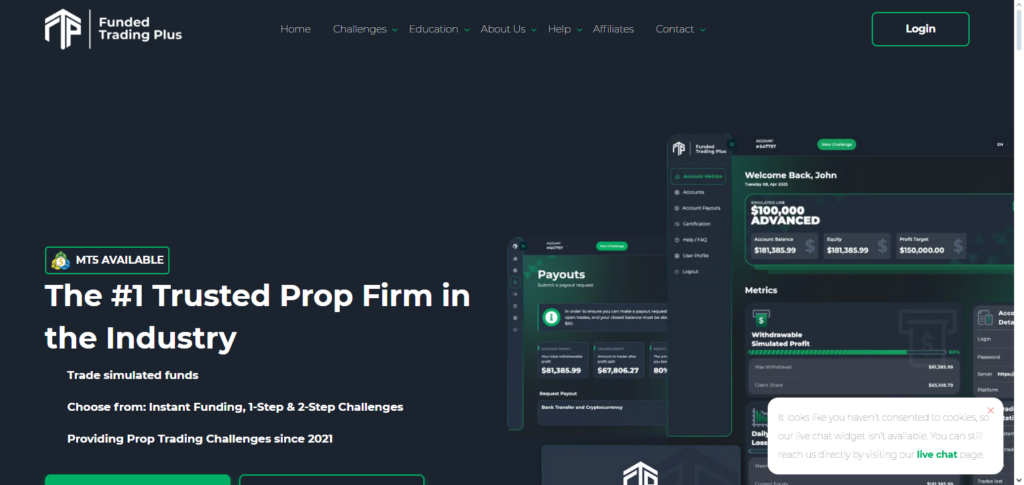

8. Funded Trading Plus

A well-known international prop company, Funded Trading Plus is frequently listed among Japan’s Best Prop Firms due to its adaptable programs that accommodate a variety of trading philosophies.

It has fair rules that permit hedging, scalping, and weekend holding, as well as 1-step and 2-step challenges with scalable accounts (up to $2.5M+ with performance). Traders can withdraw payments on a weekly basis without incurring reset penalties, and profit splits are usually competitive and generous. Systematic and diverse strategy traders find it appealing because of its emphasis on clear challenge rules and community assistance.

Funded Trading Plus Features, Pros & Cons

Features:

- 1-step and 2-step programs available.

- Scalable accounts up to over $2.5M.

- Weekly payouts.

- No restrictions on trading strategies.

- Reasonable risk policies.

Pros:

- High max capital

- Fast profit payouts

- Allows hedging & scalping

- Straightforward rules

- Strong community reviews

Cons:

- More expensive challenges

- Not beginner friendly

- High loss limits

- Some features only available at higher tiers

- Less industry familiarity

9. Funding Pips

Because of its well-defined evaluation standards and organized profit development, Funding Pips is becoming a preferred option among Japan’s Best Prop Firms. The company offers funded accounts in both forex and CFDs with profit percentages up to around 95% in upper tiers, while its founding facts are still not widely known.

Challenges frequently include predetermined profit goals and loss caps that correspond with accepted industry standards. Because of its flexibility and frequent payout alternatives, Funding Pips is particularly appealing to traders who value clear progression and constant performance goals.

Funding Pips Features, Pros & Cons

Features:

- Challenges at a low cost

- Up to ~95% profit splits

- Payouts are above average

- Evaluations are clear

- Easy access to platform

Pros:

- Easy to access

- Large profit potential

- Targets are achievable

- Payouts are quick

- Good for traders of all experience levels

Cons:

- New company

- Less capital more established firms have

- Tool selection is minimal

- Support is inconsistent

- Company does not serve all countries

10. Alpha Capital Group

Once review processes are completed, Alpha Capital Group’s strong funded trading programs are often listed among Japan’s Best Prop Firms. Although exact creation year information isn’t widely disseminated, it offers funded accounts with scalability and competitive profit splits of about 80%, frequently up to $200,000+.

In order to reward consistent achievement, the company usually employs multi-step evaluations with clearly defined profit targets, risk limitations, and scaling plans. Disciplined traders interested in long-term financed trading growth find its clear rules and risk measurements appealing.

Alpha Capital Group Features, Pros & Cons

Features:

- Provides an Institutional-level risk framework

- Same evaluation benchmarks

- ~$200K+ funds

- Profit splits of ~80%

- Emphasis on disciplined trading

Pros:

- Professional approach to risk

- Good for disciplined traders

- Clear rules & reporting

- Reliable profit payouts

- Consistent company policies

Cons:

- Less profit splits than others

- Less max capital than others

- More difficult for beginners

- Less marketing presence

- Fewer additional perks than others

Conclusion

Your trading style, degree of experience, and approach to risk management will determine which of the Best Prop Firms in Japan is best for you. Prominent companies like FTMO, FundedNext, The5%ers, and Alpha Capital Group are perfect for serious traders because they have solid reputations, clear regulations, and consistent payouts. With their flexible challenges and larger profit splits, newer companies like E8 Funding, Funding Pips, and FundedPrime draw traders. TradeDay offers a professional setting for futures traders. All things considered, Japan-accessible prop businesses today provide a variety of funding models, scalable accounts, and competitive profit sharing, providing Japanese traders with great chances to trade larger capital without jeopardizing personal finances.

FAQ

What are prop firms and how do they work in Japan?

Prop firms, or proprietary trading firms, provide traders with capital to trade forex, CFDs, or futures without risking their own money. In Japan, many firms allow local traders to participate through Japan-accessible accounts. Traders usually undergo an evaluation process or challenge to prove consistency and risk management skills. Once funded, they trade with firm capital and earn a profit split.

Which are the best prop firms for Japanese traders?

Some of the Best Prop Firms in Japan include FTMO (Japan access), FundedNext, The5%ers, MyForexFunds, FundedPrime, TradeDay, E8 Funding, Funded Trading Plus, Funding Pips, and Alpha Capital Group. They offer scalable accounts, flexible evaluation programs, and competitive profit splits.

What is the typical profit split for funded accounts?

Most top prop firms offer profit splits between 80% to 95%, depending on account type and trading performance. Some firms increase the split for consistent high performers or after scaling to larger accounts.

What types of accounts do these prop firms offer?

Japanese traders can access accounts ranging from $10,000 to $400,000+, with some firms offering instant funding or multiple evaluation programs. Accounts can be used for forex, CFDs, or futures depending on the firm.

How much does it cost to start a funded account?

Challenge fees vary by firm and account size. Entry-level evaluations often cost $150–$400, while larger accounts may require $500–$1,000. Some firms also offer trial or discounted programs.