In this article, I will cover only the QT Funded alternatives Prop Firms and analyze the leading proprietary trading companies that provide traders with professional capital with no personal investment.

These alternatives provide traders with flexible account structures, varied market access, and an organized evaluation system, making it simple for new and seasoned traders to nurtur their trading career sustainably while making profits through effective risk management and competitive profit-sharing.

What is QT Funded alternatives Prop Firms ?

QT Funded alternatives prop firms are other proprietary trading firms with similar trading opportunities to QT Funded that allow traders to trade financial markets with company capital instead of their own.

These firms provide funded trading accounts the majority of which are preceded by a qualification process to assess a trader’s strategy and risk management consistency and overall trading routine.

These firms prop traders with varying account sizes, profit sharing, and other trading and withdrawal conditions. There are many alternatives to the ones mentioned above which include Dominate, The5ers, and Fidelcrest.

Each has its own unique rules, fee structures, and range of support. Using an alternative to the ones described above gives traders a unique opportunity to compare their risk limits, growth potential, and overall platform features earning them access to professional trading capital.

How To Choose QT Funded alternatives Prop Firms

Account Size Options – Check for firms with various account sizes to accommodate your trading style and capital.

Profit Splits & Fees – Check to see if the split percent profit and any charges (evaluation, subscription, or platform) are reasonable.

Evaluation Process – Review the metrics of ease and rules for the evaluation phase. Some firms focus on steady profits, and some focus on strict profit margins.

Leverage & Risk Policies – Check that the firm offers reasonable levels of leverage with well-defined risk parameters that are compatible with your strategy.

Markets & Instruments Offered – Ensure the firm allows trading in markets of your interest (forex, stocks, indices, and crypto).

Trading Platform & Tools – Check firms with dependable trading platforms that provide other tools to users such as charting, signals, or analytics.

Withdrawal Policy – Check that the firm has a clear transparency and fast withdrawal procedures with few restrictions.

Reputation & After Sales Support – Read reviews and assess the support services to avoid scams and make sure communication is seamless.

Key Point & Best QT Funded alternatives Prop Firms List

| Prop Firm | Key Points |

|---|---|

| FundingPips | FundingPips is among the Best Prop Firms globally, providing traders |

| FundedNext | Offers multiple account sizes, flexible evaluation, profit-sharing up to 80%, supports forex & indices, reliable platform, fast withdrawals. |

| E8 Markets | Low evaluation fees, global market access, transparent risk rules, flexible leverage, beginner-friendly support. |

| Alpha Capital | Focus on forex & crypto, moderate evaluation targets, fast profit payouts, advanced trading tools, clear growth rules. |

| BrightFunded | Provides forex & indices, simple evaluation process, competitive profit splits, risk management guidance, good support system. |

| Maven Trading | Offers larger capital accounts, strict evaluation rules, wide instrument access, detailed analytics, professional trading environment. |

| OANDA Prop Trader | Backed by OANDA, regulated platform, low evaluation cost, transparent rules, strong risk controls, reliable customer support. |

| Blueberry Funded | Offers scalable accounts, supportive evaluation, high profit share, multiple trading instruments, fast and easy withdrawals. |

| ThinkCapital | Beginner-friendly, low-cost evaluation, moderate leverage, focus on consistency, clear trading guidelines, responsive support. |

| Goat Funded Trader | Flexible account options, high profit potential, transparent rules, wide market access, good platform stability, fast payouts. |

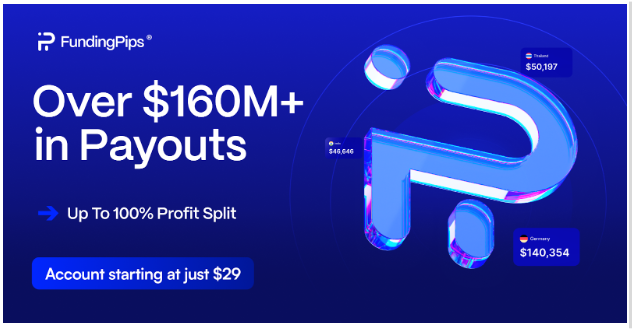

1. FundingPips

FundingPips is among the Best Prop Firms globally, providing traders everywhere with considerable trading capital and offering flexible and transparent conditions. Because of its inexpensive evaluation models, the company is very rewarding for talented traders, providing profit splits of 100%.

Supporting MetaTrader 5, cTrader, and Match-Trader, Funding Pips allows traders to execute manual and automated strategies.

Their extensive market offering for trading, which comprises forex, indices, and commodities, is beneficial for traders. Due to quick payouts and a globally recognized reputation, FundingPips is a safe option for ambitious traders looking for unlimited potential.

Payouts: Over $160 Million

Payout cycles: Total 6 Payout Cycles.

- For 1 step and 2 Step (Monthly 100%, Bi-weekly 80%, Tuesday 60%, On-demand 90%)

- 2 Step Pro (Daily 80%, Weekly 80%)

- FundingPips Zero/Instant (Bi-weekly 95%)\

USPs:

- No payout denial (Track record of 0 payout denial)

- 29,900 Reviews on Trustpilot (4.5 stars)

- Up to100% Profit split

- Account starting at just $29

- Over 100K+ traders

- Flexible Payout Cycles

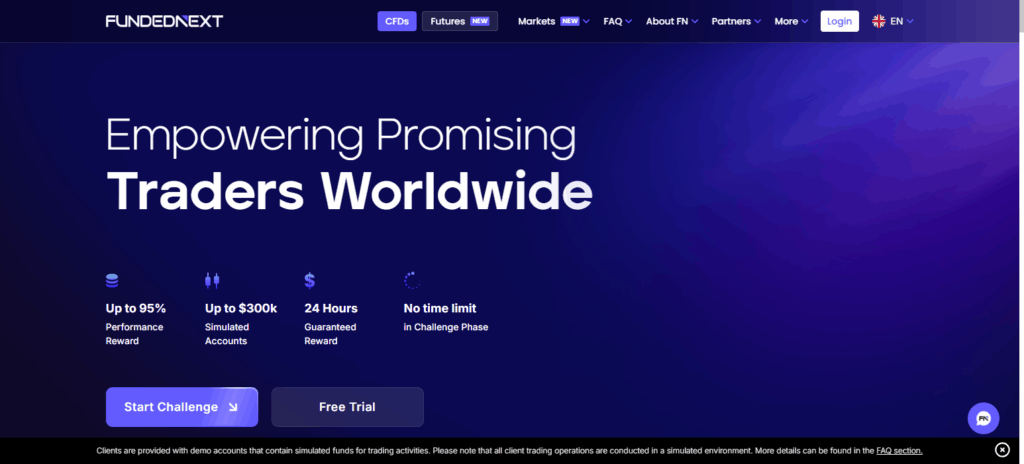

2. FundedNext

FundedNext is considered one of the best alternatives to QT Funded because it gives traders the chance to access professional capital without the burden of funding anything themselves.

Unlike other traditional firms, FundedNext has tailored evaluation processes to ease both new and professional traders into being able to qualify for funded accounts.

FundedNext combines varying account sizes, generous profit-sharing, and access to forex and indices to all traders. There are also rapid and fuss-free withdrawal policies as well as primary rules for risk management, which leads to the positive growth of the traders, which the firm places great importance on.

All these features combined, especially the flexibility, a burst of creativity, and the focus on traders, makes FundedNext one of the best alternatives to QT Funded prop firm.

FundedNext Features

- Flexible Account Sizes: FundedNext is Quickly funded accounts has Flexible Account Sizes in that it is designed for both beginners and professional traders.

- High Profit Sharing: Earn high profits while motivated to perform.

- Diverse Market Access: FundedNext supports and crypto traders with clear risk rules.

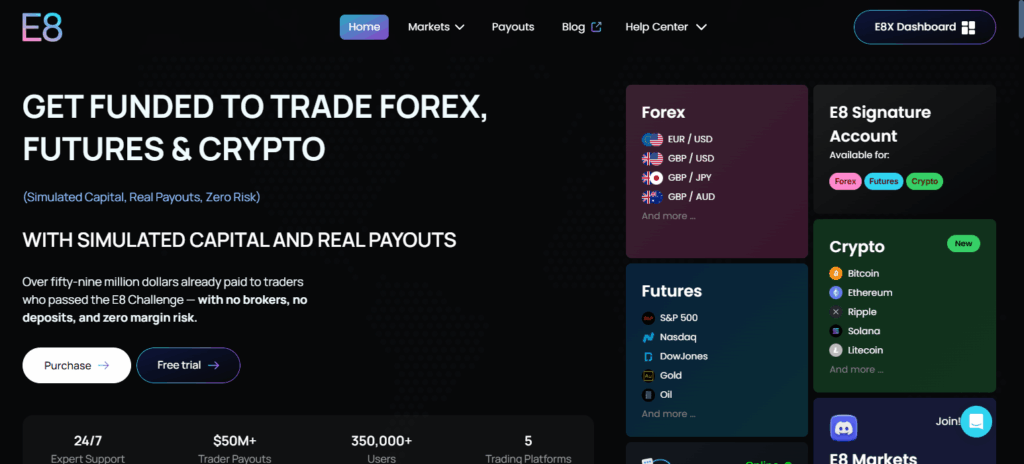

3. E8 Markets

E8 Markets is a direct QT Funded prop firm which has a unique friendly approach to funded trading. The firm has a unique approach to the evaluation process with reasonable pricing. The levels of fees are exceptionally low.

The firm covers global forex and indices which is a variety of strategies traders can implement. The unique style is the simple to understand risk rules and management. The flexible leverage and account growth means traders can minimize their risk efficiently.

QT Funded is almost the direct competitor of E8 Markets because their customer support is fast and withdrawals are quick. E8 Markets unlike QT Funded is approachable and useful to all traders.

E8 Markets Features

- Low Evaluation Fees: E8 Markets is an affordable trading site with traders of all levels.

- Global Market Access: E8 Markets allows trading across Forex, commodities, and indices.

- Transparent Risk Rules: Clear and defined risk rules ensure traders discipline and secure accounts.

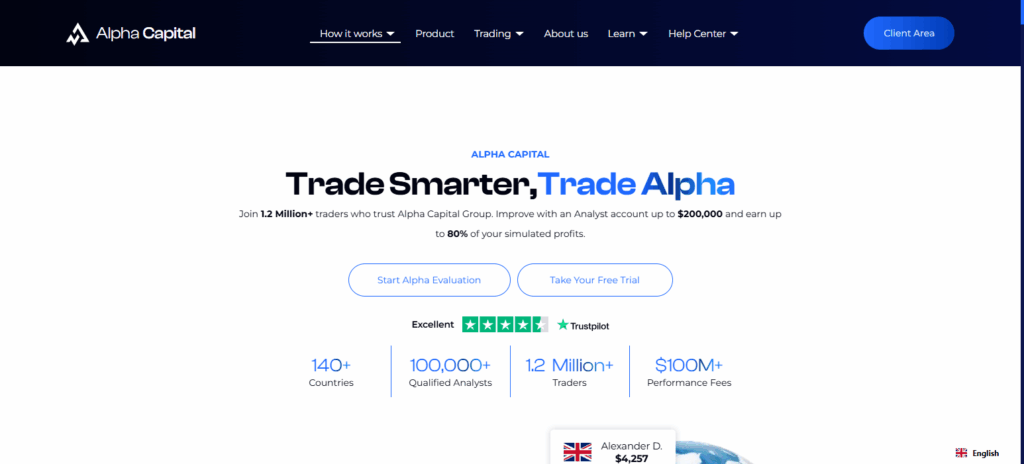

4. Alpha Capital

Alpha Capital is a QT Funded alternative prop firm and thus, allows traders to interact with professional trading capital without any personal monetary risk as a unique proposition to empower traders.

Their modular approach which offers flexible account structures and has scaled down evaluation matrix is realistic for traders with varying skill sets. Alpha Capital traders can strategize and approach trades in multiple ways as the firm provides and supports trading in several markets including forex and .

Alpha Capital has strong risk management strategies in place alongside the emphasis placed on swift profit withdrawals and rule transparency, thus providing a safe trading atmosphere.

Alpha Capital’s focus on providing accessible paths to growth make them a handy prop firm for any disciplined and ambitious trader, as they provide an alternative route to QT Funded.

Alpha Capital Features

- Multiple Market Options: Alpha Capital supports trading in Forex and cryptocurrencies for strategy diversification.

- Moderate Evaluation Targets: Easy profit goals for all achievement levels.

- Fast Profit Payouts: Alpha traders are paid with quick, clear profit withdrawals.

5. BrightFunded

BrightFunded is an alternative to QT Funded that is just as effective as a prop firm while helping traders grow. It has a simplified evaluation process with straightforward profit goals, simplifying the qualifying process for funded accounts for both novice and pro traders.

Besides, BrightFunded has the forex and indices markets, enabling traders to diversify their strategies while following clearly defined risk rules.

Its most distinguishing feature is the profit-sharing model, which, along with swift and easy withdrawals, allows traders to reap the benefits of their efforts and profit.

BrightFunded is the better alternative to QT Funded for professionals due to the clearly defined rules, multiple account types, and flexible options while prioritizing traders.

BrightFunded Features

- Simple Evaluation Process: Guided step come with easier, beginner-friendly targets that Let traders easily compete to qualify for profit accounts.

- Competitive Profit Sharing: Encourages traders and performance payout with high generous rewards.

- Clear Risk Management: Dictated rules lessen the risk of accounts being terminated.

6. Maven Trading

Maven Trading is one of the most reputable and QT Funded alternative prop firms dedicated to serious traders looking for large capital accounts and professional trading prospects.

Its distinguishing feature is the unprecedented access to multitude of trading instruments and sufficiently funded accounts including forex, indices and commodities, enabling traders to diversify their trading plans.

Maven Trading is balanced with a moderated thorough assessment, rational risk assessment and detailed performance analytics, enabling traders to foster their abilities while also receiving funding.

In addition, Maven Trading is a strong and practical alternative to QT Funded for ambitious traders, as it balanced high profit sharing potential with dependable profit withdrawal.

Maven Trading Features

- Large Capital Accounts: Designed for more ambitious traders, has higher tiered accounts.

- Broader Access to Financial Instruments: Enhance your strategies by trading forex, indices, and commodities.

- Robust Reporting Features: Analytics on trading and investor performance to enhance decision-making.

7. OANDA Prop Trader

OANDA Prop Trader is a reputable alternative to QT Funded Prop Firm which is combined with a regulated broker and a provider of funded trading.

Through a well-structured evaluation program that focuses on consistency, risk, and strategy execution, traders get access to OANDA professional’s capital.

The distinct features are its seamless integration with OANDA’s trading platform, which brokers provide to a retail broker on a white-label basis, which includes precise pricing with rapid execution and access to forex, forex, and commodity indices.

Withdrawals of profits are quick, the rules are transparent, and traders enjoy flexible account setups. OANDA Prop Trader is also a realistic and reliable substitute to QT Funded because it offers info-protection and prop-level tools, with a variety of clear growth paths.

OANDA Prop Trader Features

- Legitimate Broker: OANDA’s reputation adds credibility and security.

- Targeted Assessment Focus: Emphasis on building consistency and effective risk control.

- Professional Instruments: OANDA’s professional trading platform and exceptional trading information.

8. Blueberry Funded

Blueberry Funded is one of the top alternative prop firms for the QT Funded and has the primary aim of providing traders with enough pro capital while reducing personal risk as much as possible.

The combination of scalable account options and a supportive evaluation process is a consequence of fulfilling its primary aim. This unique combination ensures accessibility not only for traders of all experience levels but even for absolute beginners.

Blueberry Funded provides the unique opportunity of trading multiple instruments such as commodities, forex, and even indices. This allows traders to have greater flexibility in the implementation of various trading strategies.

Other things being equal, Blueberry Funded offers high profit-sharing potential, fast withdrawal, and transparent risk management which ensures traders a transparent and growth-oriented environment. It is for these reasons why Blueberry Funded is the most practical and reliable alternative to QT Funded.

Blueberry Funded Features

- Incremental Account Growth: Accounts expand as traders show sustained improvement.

- Increased Revenue Share: High retention of traded profits.

- Diverse Eligible Instruments: Forex, indices, and commodities for strategic diversification.

9. ThinkCapital

ThinkCapital is a prop firm alternative to QT Funded which aims to assist traders in attaining professional capital and using it trade without risking their personal funds. Its unique strength is in having beginner friendly evaluation programs that have a low cost to enter and realistic and achievable profit goals.

This lowers the barrier to entry for a large number of traders. ThinkCapital caters to and supports diverse trading strategies in multiple markets like forex and indices as well as commodities.

The firm continues to promote and maintain the principles of consistent risk control, rational trading ethics, and active trading customer support.

Alongside diverse flexible account structures with fully transparent profit allocations and fast withdraw options, ThinkCapital is a practical, safe, and growth-oriented QT Funded alternative prop firm which ensures an optimal trading environment for its prop traders.

ThinkCapital Features

- Affordable Programs for Beginners: Easier priced evaluations with reasonable goals for aspiring traders.

- Guidelines and Restrictions: Banking on risk and consistent growth potentials.

- Active Customer Support: Engages clients amiably and provides feedback on how to improve trading.

10. Goat Funded Trader

Goat Funded Trader is a new prop firm as an alternative to QT Funded which provides professional capital to traders while minimizing the traders’ personal financial risk as much as possible.

Its main differentiating factor is flexible account options with transparent evaluation criteria that allow traders with various skill levels to qualify for a funded account. Goat Funded Trader is accessible to traders using multiple instruments including forex, indices, and commodities, which allows them to deploy a variety of trading strategies.

Their environment is competitive with profit sharing, fast withdrawals, and well-defined risk management rules, which evokes the trust of traders while promoting growth. All of these factors combine to make Goat Funded Trader a QT Funded alternative for traders looking to make serious progress in their trading careers.

Goat Funded Trader Features

- Customizable Account Types: Different tiers for different experience levels.

- Attractive Payouts: High profit-sharing gives strong performance incentive.

- Comprehensive Market Coverage: Trade forex, indices, and commodities with simplified trading conditions.

Pros & Cons QT Funded alternatives Prop Firms

Pros:

- Access to Capital: Traders get to use the company’s funds and do not have to use their own money.

- Range of Account Options: Many firms have various account sizes to meet different needs.

- Profit Sharing: Traders can receive a percentage of profits which can be as high as 80–90%.

- Multiple Markets: Forex, indices, commodities, and in some cases, crypto are supported.

- Flexible Evaluation Programs: Some firms have evaluation processes that are beginner-friendly or can be tailored.

- Withdrawal Flexibility: Many firms offer quick and easy withdrawals of profit.

- Guided Risk Control: Rules help traders learn discipline and to which level the money can be put at risk.

Cons:

- Costs Facilitating Evaluation: Some firms have evaluation or subscription fees.

- Evaluations Too Strict: Risk limits or the account can be removed for breaking strategy rules.

- Profit Tiers: Traders do not have 100% profit retention.

- Account Rigidity: Some instruments and strategies may be available.

- Siloed Trading Platform: Some firms do not have sophisticated trading platforms or tools.

Conclusion

QT Funded alternative prop firms offer aspiring traders with access to valuable opportunities through which they can access professional trading capital to develop and execute their strategies to generate profit and all of this without having to personally invest their funds.

Firms like FundedNext, E8 Markets, and Alpha Capital are notable for flexible evaluation programs, account options, diverse market access, transparent evaluation programs, and hassle-free risk management rules.

While some traders may find evaluation fees or some rules too strict, what they provide, structured growth, profit-sharing, and hassle-free withdrawals are enough to attract a traders’ attention whether they are a novice or experienced.

All in all, QT Funded alternative firms are a practical and safe option for ambitious traders looking for professional trading opportunities.

FAQ

How do I qualify for a funded account?

Traders usually complete an evaluation program that tests consistency, risk management, and profitability according to the firm’s rules.

Which markets can I trade with these firms?

Most firms allow trading in forex, indices, commodities, and sometimes cryptocurrencies.

Are there fees to join these firms?

Some firms charge evaluation or subscription fees, but others offer low-cost or free entry options.

Is trading with these firms safe?

Yes, most reputable firms provide structured risk management rules and secure trading platforms.