The Best Real-Time FX Conversion Tools for International Businesses will be covered in this article, with an emphasis on systems that provide precise exchange rates, real-time updates, and smooth multi-currency support.

By offering trustworthy, up-to-date foreign exchange data for international operations, these solutions assist businesses in managing cross-border payments, lowering exchange risks, and making more informed financial decisions.

Key Points & Best Real-Time FX Conversion Tools for International Businesses

| Tool | Key Point |

|---|---|

| CurrencyXchanger | Comprehensive multi-currency support with real-time updates and compliance features |

| ForexSoft | Advanced fraud detection and secure transaction monitoring for global businesses |

| Clear View FX | Customizable dashboards for tracking rates and managing exchange operations |

| Xpress Currency | API integrations with accounting and ERP systems for seamless workflows |

| Money Exchange Pro | Automated reporting and compliance management for international transactions |

| Global Remit Suite | Real-time rate calculation ensuring accuracy and transparency |

| FX Manager | Multi-branch support for businesses with global offices |

| Currency Hub | Customer management tools to enhance trust and loyalty |

| Rate Tracker Pro | Instant alerts on currency fluctuations for proactive decision-making |

| ExchangeDesk | Scalable platform suitable for SMEs and large enterprises |

10 Best Real-Time FX Conversion Tools for International Businesses

1. CurrencyXchanger

CurrencyXchanger is a provider of highly accurate and rapid real-time currency conversion, best serving businesses with numerous global transactions.

It allows for dealings in many global currencies, and provides subscriptions to live exchange rate updates that permit companies to make real-time financial decisions.

Features include customizable dashboards, historical data analysis, and subscription automation for notable rate changes.

Accounting payment integrations ease system overwrite, and save multiple entry mistakes. In addition to detailed documentation for foreign exchange verticals

CurrencyXchanger provides risk management features to assist companies reduce their exposure to volatile foreign exchange markets.

CurrencyXchanger Features

- Offers real-time conversion of currencies for a range of global currencies.

- Custom dashboards which monitor real time conversion, displays changes for trend updates, and change alerts.

- Advanced historical exchange rate data which allows users to analyze the data for strategic FX decision making.

- Ease of use features for multi-function integration for accounting, invoicing, and payment systems to streamline conversion.

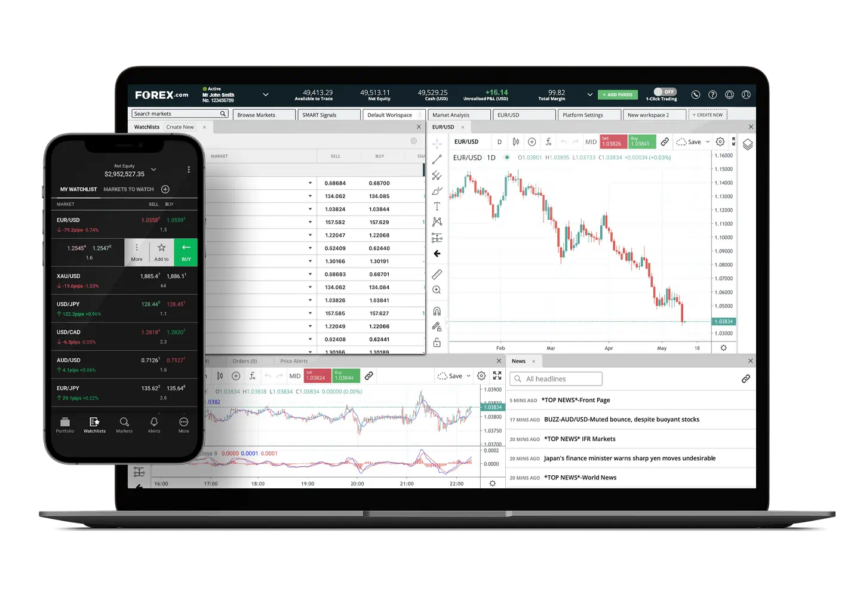

2. ForexSoft

ForexSoft is tailored for businesses that need seamless and accurate handling of currencies. The the software offers instant foreign exchange conversions, support for multiple currencies, and the ability to analyze in real time to keep track of the global markets.

The software offers a secure way to process transactions, analyze historical trends, and utilize forecasting tools to predict future price movements for currencies.

Businesses are provided to automate notifications to capture rate movements that are beneficial for timely decisions related to imports, exports, and overseas payments.

ForexSoft integrates with almost any ERP and accounting software for ease of operational functions, and it provides advanced financial reporting for effective reporting

Adherence to regulatory requirements. ForexSoft works great for small companies and multinationals with very complex foreign exchange needs.

ForexSoft Features

- Multiple currency configurations and support for real-time updates in FX rate.

- Tools for currency market analysis and visualization for real-time market volatility.

- Analytics in currency market activity for >$ value predictive currency movement and trending forecasts.

- Real-time tools for transaction processing and transactional ERP for accounting security.

3. Clear View FX

The focus of Clear View FX is on giving foreign exchange data in real time to businesses that trade internationally.

The platform prioritizes transparency and trust by displaying real time quotes and rates and market behavior as well as historical charts.

With that businesses can monitor several currencies at once and make rate comparisons to facilitate instant conversion of decisions.

Clear View FX also offers risk management with tools such as hedging to protect businesses from adverse rate changes.

Fully customizable dashboards and reports allow companies to monitor and budget for expenses.

The integration of an API for foreign exchange trading with other financial software removes the need for human input in managing

foreign exchange trading and greatly improves the efficiency of foreign exchange trading and streaming for accurate account management on international transactions.

Clear View FX Features

- Completeness and transparency in currency conversion for real time rates.

- Tools for users to analyze the chart of real time trends.

- Ability to monitor multiple currencies.

- Advanced and predictive balanced management for costs relative to FX volatility.

4. Xpress Currency

Xpress Currency prioritizes swift and instantaneous foreign exchange conversions for firms that carry out consistent cross-border transactions.

Xpress Currency features real-time multi-currency rate calculators which allow for instantaneous cost and profit calculations.

Xpress Currency makes predictive insights and alerts available for historical rates review, and provides proactive proactive rate alerts necessary for strategic decision making.

Xpress Currency provides seamless integration with invoicing and payments which allows for simplification of cross-border transactions.

Xpress Currency incorporates customizable dashboards which allow for real-time insight into prevailing foreign exchange exposure.

Xpress Currency reliably safeguards small and large businesses, exporters, importers, and multinational firms needing effective global foreign exchange management.

Xpress Currency Features Features

- Designed for users needing instantaneous conversions for global transactions.

- Ability to handle both major and minor currencies for international operations.

- Rate comparisons for historical ranges and alerts for trends to inform strategic pricing/purchasing decisions.

- Linking to invoicing software and payment systems to optimize cross-border billing and payment settlements.

5. Global Remit Suite

This is a solution made for international transaction processing. Global Remit Suite is able to provide customers with real time multi-currency conversions, payment location features and cross-region payment capabilities.

The Global Remit Suite helps to mitigate risk by allowing customers to monitor market trends and set alerts.

The Global Remit Suite also provides in depth analytical reports concerning customers transaction histories and conversion costs.

Global Remit Suite customers can also integrate Global Remit Suite with their ERPs and accounting systems.

The Global Remit Suite provides a simple to use secure interface that helps customers with a large number of transactions to refine their payments and cross-border remittance strategies while decreasing their foreign exchange expenditures.

Global Remit Suite Features

- Payments with live FX rates and automated payment-tracking for cross-border payments.

- Support for multiple conversions to ease payments in different countries and currencies.

- Features for time-sensitive payments to assist businesses with remittance timing to reduce currency risk.

- Detailed reports for historical transactions, cost of conversions, and performance metrics for enhanced transparency and granular cost control.

6. FX Manager

FX Manager’s clients are international businesses. FX Manager equips them with benefits of instantaneous conversion of transactions, access to live rates and a range of predictive analytical tools.

These benefits allow real time access and conversion of multiple currencies, automated alerts and detailed reports. FX Manager is perfect for companies with international trading and cross-border payroll or multi-currency invoicing.

Us integration to other finance and accounting sofware, we achieve seamless payment and reconciliation processes.

FX Manager facilitates businesses to hedge their exposure to currency risk and frictionless operation of the platform assists in perfecting the overall currency management of the business.

FX Manager is designed for use by international companies. and most of the time the features are selected by the clients to meet their specific benefits and functions.

FX Manager is designed for use by international companies. The platform is built to meet the specific needs of the clients.

FX Manager Features

- Real-time streaming market data for instantaneous conversions.

- Predictive trends and reporting to forecast/monitor financial strategies and investments.

- Users can support multiple currency pairs, which is essential for import/export, multi-currency invoicing, or payroll.

- Payment automation along with the integration of accounting/financial software provides seamless reconciliation.

7. Currency Hub

Currency Hub offers a streamlined service for real-time foreign exchange and payment management.

Users can make exchange rate and historical table selections to analyze trends and make informed payments.

Currency Hub automates informed payments and lets users set flexible dashboards as control centers for each payment.

Automated notifications and dashboards help to monitor significant changes in users’ payment currencies. Automated payments, alerts, and dashboard reporting tools allow users to manage multiple pays and reorders seamlessly.

Currency Hub is a valuable foreign currency management service for small and multinational enterprises.

Currency Hub Features

- Live exchange rates with centralized FX instruction for several currencies.

- Businesses can use historical charts and features for an analysis of the currency over time to understand its movement.

- Notifications for noteworthy market shifts to assist with prompt financial decisions.

- Global payment workflow automation with dashboard customization and integration with an ERP and accounting system.

8. Rate Tracker Pro

Specializing in accurate and instant provision of FX rates, Rate Tracker Pro caters for international trading businesses.

It offers real-time tracking of falling and rising rates, alerts in case of rate changes, and snapshots of rates over given periods.

Users are able to plan financial moves in line with the rates. Businesses can monitor several currencies, compare the rates of different providers, and automate frequent conversions for time and precision.

Rate Tracker Pro easily meshes with various invoicings and payments softwares for greater efficiency in international banking.

The software’s reporting and analytics features make users aware of the trends in the rates to aid in loss reduction.

With high levels of data safety and a well designed User Interface, Rate Tracker Pro offers a lot of value to its customers, assisting them in growing their operations.

Rate Tracker Pro Features

- Businesses are provided with accurate and reliable market monitoring to keep them updated.

- Quick action can be taken by companies for positive rate changes as they are notified.

- Budgeting and cost planning support as well as pricing support is provided by historical data and trend direction comparisons for availability and demand.

- Automated processes for recurring conversions across payment or accounting systems smooth cross-border trade with tasks.

9. ExchangeDesk

This software enables businesses to manage their currencies in real-time. ExchangeDesk offers users real-time currency rates, allows users manage several currencies at once, and has automated currency conversion.

Furthermore, ExchangeDesk allows your organization to integrate your accounts to the platform’s ERP.

This multi-currency payment platform is suited for businesses of any size, and offers your organization reliable and efficient software to manage your currency internationally.

Exchangedesk Features

- Live exchange rate feeds and support multiple currency pairs.

- Historical predictive charts and analytics for strategic FX decisions.

- Automated notification and scheduler for conversions are useful for budgeting and planning international payments.

Conclusion

In conclusion, given today s global marketplace, real-time FX conversion tools are crucial to ensuring that businesses can adequately manage their international transactions.

Providers such as CurrencyXchanger, ForexSoft, and ExchangeDesk offer live rates, trend analyses, and integrations with accounting that significantly minimize exposure to currency risk and operational errors.

These tools allow businesses to optimally manage costs and improve financial decision-making in order to remain competitive in today s rapidly changing global marketplace.

FAQ

What are real-time FX conversion tools?

They are platforms that provide live currency exchange rates, enabling businesses to convert and monitor multiple currencies instantly.

Why do international businesses need them?

They help minimize currency risk, optimize costs, and ensure accurate cross-border transactions.

Which tool is best for multi-currency tracking?

Currency Hub and FX Manager are ideal for tracking multiple currencies simultaneously.

Can these tools integrate with accounting software?

Yes, most platforms like Money Exchange Pro and ExchangeDesk offer seamless ERP or accounting integration.

Do these tools provide historical data?

Yes, tools like Clear View FX and Rate Tracker Pro provide historical trends and analytics.