I will talk about the Best Real World Asset (RWA) Projects that are changing the relationship between traditional assets and Decentralized Finance in this article.

Their goal is to create a blockchain token for real estate, loans, commodities and other physical and financial assets to increase liquidity, transparency, and accessibility and pave way for new investment opportunities in the blockchain.

Key Point & Best Real World Asset (RWA) Projects List

| Project | Key Point |

|---|---|

| Chainlink (LINK) | Provides decentralized oracles to connect real-world data with blockchain. |

| Maker (MKR) | Tokenizes RWAs like real estate and bonds to back Dai stablecoin. |

| Ondo Finance (ONDO) | Tokenizes bond portfolios and RWAs for yield-generating investment opportunities in DeFi. |

| Ribbon Finance (RBN) | Tokenizes RWAs like fixed-income instruments, offering yield and risk management in DeFi. |

| Algorand (ALGO) | Facilitates tokenization of RWAs like real estate and carbon credits in a fast, scalable blockchain. |

| Pendle (PENDLE) | Enables tokenization of future yield streams of RWAs for DeFi investment strategies. |

| Polymesh (POLYX) | Tokenizes regulated assets like securities and real estate on a compliant blockchain platform. |

| Goldfinch (GFI) | Tokenizes loans and credit to connect decentralized finance with real-world assets. |

| TrueFi (TRU) | Focuses on tokenizing real-world loans and credit, providing yield opportunities. |

| Creditcoin (CTC) | Tokenizes credit transactions and assets like loans, enabling decentralized access to credit. |

10 Best Real World Asset (RWA) Projects

1.Chainlink (LINK)

Chainlink (LINK) fuels countless real world assets (RWA) applications with the help of secure decentralized oracles that allow for off-chain data to interact with the blockchain.

Is the RWAs such as the MakerDAO that relies on Chainlink’s services for the acquisition of pricing feeds, or Aave who incorporates LINK for its asset tokenization.

These projects utilize Chainlink’s technology to build complex systems which are transparent to users which bridges the information gap for DeFi users who have access to on ground data and decentralized finance systems.

Fees:

- The charges made for various transactions are dependent on the oracle service used within the Chainlink ecosystem.

Support:

- Chainlink has created a large worldwide community of customers and developers which provides adequate customer assistance and support.

Key Feature:

- Connectivity to external data sources for smart contract operations.

- Wide reaching decentralized network of oracles to maintain integrity of data.

- Effective performing smart contracts that get triggered on the basis of real world data.

2.Maker (MKR)

Maker (MKR) uses RWA projects inside its DeFi platform and issues Dai stablecoins using tokenized assets as collateral.

Centrifuge and RealT are examples of applications that obtain output from MakerDAO by enabling real-world assets like invoices, real property, and other tangible assets to be tokenized.

This integration allows non-crypto assets to be used in the DeFi ecosystem which increases the liquidity and provides access to a wider range of users but ensures that the Dai stablecoin does not deviate from its value through decentralised management.

Fees:

- MakerDAO charges stability fees for the production of DAI, which varies according to the type of collateral and the governance rule.

Support:

- Support and Community : MakerDAO embraces its users and the whole community with wide support including forums, documentation, and live channels.

Key Feature:

- DAI can be borrowed against using multiple assets with the help of Multi-Collateral DAI.

- MKR token holders govern the protocol enabling them to enhance and extend the workings of the protocol.

- In the ecosystem, Collateralized debt positions (CDPs) are used for borrowing and managing debts respectively.

3.Ondo Finance (ONDO)

Ondo Finance (ONDO) seeks to enable the transition from traditional finance to decentralized finance through the tokenization of real-world assets.

Its pioneering initiative, the Ondo Treasury, allows investors to acquire portfolios of tokenized bonds and gain exposure to real-world assets such as bonds issued by governments and corporations.

This combination allows DeFi to access safer investment opportunities that also earn a yield.

The usability of the Ondo platform is the perfect balance of transparency, security and liquidity which allows RWAs to be integrated into the blockchain ecosystem but, also, reap the benefits of transaction efficiency and accessibility offered by decentralized finance.

Fees:

- Ondo Finance applies management charges in the case of purchase by structured products. They also apply fees that are based on performance for the purpose of yield creation.

Support:

- In the case of Ondo Finance, customer assistance is provided once the clients use the community forum, learning materials and the help center.

Key Feature:

- Real world assets structured in a tokenized form for use in the DeFi ecosystem.

- Opportunities to create structured products which would in effect combine traditional financial markets with blockchain ecosystems seamless.

- Paraktek also assists investors and issuers in better risk management in the RWA universe.

4.Ribbon Finance (RBN)

Ribbon Finance (RBN) is a decentralized application that aims to expand the scope of decentralised finance (DeFi) by enabling real-world asset exposure through structured products.

Ribbon allows tokenized exposure of RWA such as fixed income instruments and structured notes to users via its vaults, expanding product offerings for risk management and providing stable returns for investors.

Ribbons options strategies supplemented with operational options ensure traditional assets have a place in the DeFi ecosystem in an array of investment opportunities to yield returns with lower risks to investors.

Fees:

- Ribbon Finance imposes a fee on profits produced and a management fee for managed services which are both performance based.

Support:

- Users can obtain assistance via Ribbon Finance’s Discord, trust Vault’s knowledge base or refer to its developer documentation.

Key Feature:

- Structures yield products that use risk management strategies to enhance yields in DeFi markets.

- Automated vaults simplify the execution of complicated options strategies inside DeFi.

- Merging existing asset classes and protocols in order to provide investment in real world assets.

5.Algorand (ALGO)

Algorandi (ALGO) grants the composable blockchain of its network which help in supporting multiple RWA projects for tokenization of traditional assets.

The Republic and Carbon Credit Tokenization platform for instance use Algorand’s technology to goreal-estate, carbon credits and other tangible assets.

With high transaction speed, low costs, and great security, Algorand opens the door for decentralized finance and facilitates the inclusion of RWAs, broadening the market scope in terms of transparency, liquidity, and reach of both a traditional investor as well as an investor in crypto.

Fees:

- Algorand’s assets transfer and smart contract interactions are cost-effective as they oftentimes cost less than a cent to transact.

Support:

- Algorand has extensive support through developer documentation, community channels and corporate support.

Key Feature:

- High scalability at a faster transaction speed using the proof of stake consensus approach.

- Algorand smart contracts facilitate the real world assets tokenization without difficulty.

- Algorand’s blockchain infrastructure allows building of applications in decentralized finance (DeFi) and NFTs.

6.Pendle (PENDLE)

Pendle (PENDLE) aims at tokenization of real world assets to broaden the DeFi yield earning mechanisms.

It’s revolutionary platform permits users to invest in and trade future yield streams of RWAs such as real estate or bonds.

In such a unique structure of Pendle, users’ control in combining the ownership on the asset and gross future income is separated, thus new investment and strategy possibilities arise.

By borrowing incorporates DeFi into RWAs, Pendle ensures liquidity and transparency and liquidity proof previously illiquid yield bearing assets.

Fees:

- Pendle has a fee for turning real world assets into tokens and trading them for other tokens as well as on secondary market sales

Support:

- Pendle has also made support available via its community channels, in its documentation and through its Discord server.

Key Feature:

- Enabling income-producing-asset tokenization to be distinct from the ownership of future yield streams.

- Platform for the exchange of tokenized RWAs and assets that generate yields of all kinds.

- Empowers users in the DeFi space using real world asset backed tokens with properties such as trade, leverage and wrist staking.

7.Polymesh (POLYX)

Polymesh (POLYX) focuses on tokenizing real-world assets (RWAs), thus acting as a bridge between the traditional and the blockchain world.

Its platform specializes in the secure tokenization of regulated assets like commodity, real estate, and securities.

Tokeny and Polymath use the technology of Polymesh to facilitate compliant, transparent and efficient trading of RWAs in the blockchain space.

Polymesh allows investors to interact with tokenized real-world assets by eliminating regulatory hurdles and barriers of entry o further compliance.

Fees:

- Transaction fees, smart contract execution fees and the network fees are charged to PolyMesh users according to the kind of assets being used.

Support:

- Polymath provides support via its developer portal, documentation, and also a community forum.

Key Feature:

- Polymesh is suitable for the tokenization of compliance compliant real world assets since it has compliance features integrated in it.

- Ensures regulatory compliance by enabling KYC/AML in dealing with RWAs.

- The native asset tokenization framework of Polymesh accommodates a wide array of real world asset types.

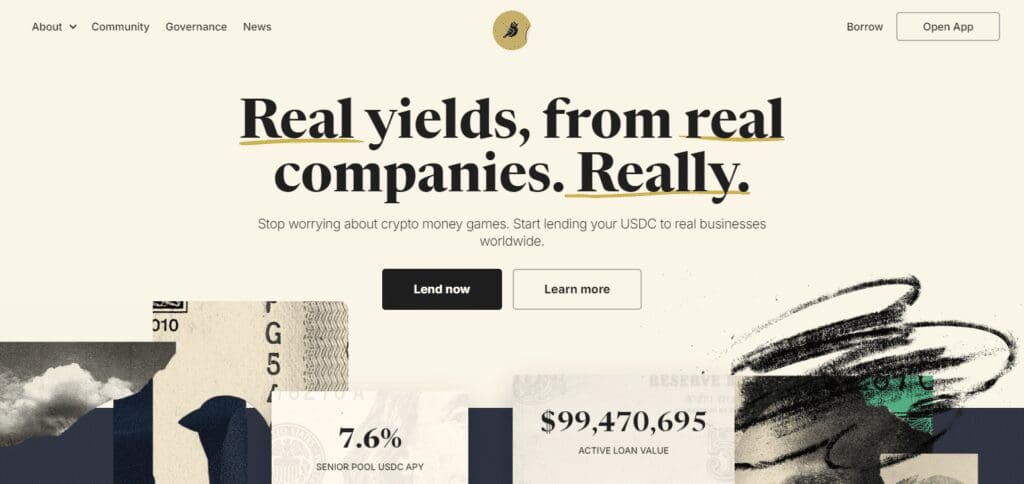

8.Goldfinch (GFI)

Goldfinch (GFI) makesth e tokenization of, for instance, real world assets, more accessible so as to amplify the scope of decentralized finance.

It’s infrastructure seeks to cater to the unserviced segments of the market by facilitating credit and financing in the form of tokenized real world assets in the form of loans, invoices, receivables etc.

Goldfinch works as an intermediary, connecting customers seeking loans for businesses and investors who are willing to provide these loans at a certain yield on their investments.

Via its decentralized credit protocol, Goldfinch helps in liquidating traditionally ilsioid assets which promotes growth in emerging markets and closes the gap between DeFi and traditional finance.

Fees:

- Goldfinch assesses a loan origination fee for the loan and performance fee for the yield the capital has generated.

Support:

- Goldfinch provides community support through the Discord platform, through documentation, and also a dedicated help centre.

Key Feature:

- Credit protocol that is decentralized for lending with real world assets RWA, for instance Bay, cash flows from organizations.

- DeFi allows access to institutional-grade investment opportunities remotely in RWA markets.

- Prudential measures that facilitate proper capital allocation in RWA supported lending.

9.TrueFi (TRU)

TrueFi or TRU allows decentralized finance to interact with real world assets through tokenized real-world credit and loans.

Its platform enables institutional clients to borrow capital while allowing the lenders to earn a profit.

TrueFi deals with credit and real estate holdings offering investors the chance to participate in traditional finance through a distributed network.

TrueFi makes it possible to tokenise real world loans, thereby enabling DeFi systems to leverage traditional finance systems, and improves the lending market in terms of liquidity, transparency, and effectiveness.

Fees:

- TrueFi charges performance fees on the returns generated on their pool of real-word asset backed loans.

Support:

- Community Discord, knowledge base and customer support provide users help in their TrueFi needs.

Key Feature:

- Users can contribute to RWA backed pools and access yields derived from real-world loans.

- Loaning pools have a credible scoring system to measure the risks of the underlying real-world assets.

- Borrowers are exempt from the need of collateral but are given loans based on their reputation and finance.

10.Creditcoin (CTC)

Creditcoin. CTC is a decentralized credit network which enables real-world asset tokenization on its platform.

It aims to enhance financial inclusion by bridging the gap between borrowers and investors while also deploying loans and invoices as digital assets.

Creditcoin has developed a groundbreaking technology that applies a trust mechanism to the blockchain by recording all credit transactions.

As CTC allows incorporation of the conventional financial sphere into the blockchain system, it benefits both ends of the transaction, both lenders and recipients, and also offers possibilities to invest into real economy assets via DeFi.

Fees:

- The network levies transaction fees for processing RWA-backed loans and also for all network operations, this is the way Creditcoin makes money.

Support:

- Creditcoin seems to offer support through community channels, documentation and customer support.

Key Feature:

- The team at Creditcoin aid in creating a decentralised credit marketplace through the use of blockchain technology.

- Tracking the credit history of individuals and companies through blockchain technology and greatly increasing their ability to borrow.

- Enhances lending within the ecosystem through the tokenization of real world assets.

Why Choose Best Real World Asset (RWA) Projects

Risk Management/Reduction: RWA, on the other hand, exposes investors to real estate, loans, and commodities, which adds variety to the DeFi investment portfolio.

Risk Coverage: These assets tend to be less volatile than pure digital assets, thus mitigating risks as a safer investment.

Income Generation Opportunities: Quite a few RWA projects provide great yield opportunities, especially with tokenized real estate, bonds or even loans.

Trust: Excellent and transparent transactions records which cannot be modified are ensured by blockchain technology.

Asset Management: By tokenizing RWA, asset management has become easy by designing RWA that was previously illiquid to be transferable on the DeFi market.

Legal Considerations: Some RWA projects guarantee safety across traditional finance by advocating for legal and regulatory frameworks.

Conclusion

To wrap up, the best RWA projects help to meet the needs of both the centralized and decentralised finance companies.

They are able to do this through the investment of new assets, loans, real estate or commodities which offer more opportunities.

Furthermore, they revolutionize the investment management field and provide diversification along with stability to the DeFi portfolios.

In addition, RWAs’ rapid development integration of blockchain technology signifies that these projects will transform how finance is conducted, making real world assets more affordable and usable within the digital world.