In this article, I will talk about Blockpit Crypto Tax Software, which is intended to make the work of crypto tax reporting much easier.

Blockpit integrates with leading exchanges provides history of your transactions, including any trading, wallets, and mining rewards.

This results in the generation of precise tax reports that are in accordance with applicable regulations.

Blockpit is perfect for both newbies and experienced traders as it helps one manage their crypto taxes efficiently and remain compliant.

What Is Blockpit?

Blockpit is a web and/or mobile platform designed for timely reporting for tax purposes as well as managing portfolios of crypto assets, which integrates with API’s from several exchanges such as Kraken, Bitpanda, Coinbase and Binance among others.

Blockpit allows users to easily combine their exchanges and wallets, mining profits, and any other earnings through airdrops drafted into a single dashboard.

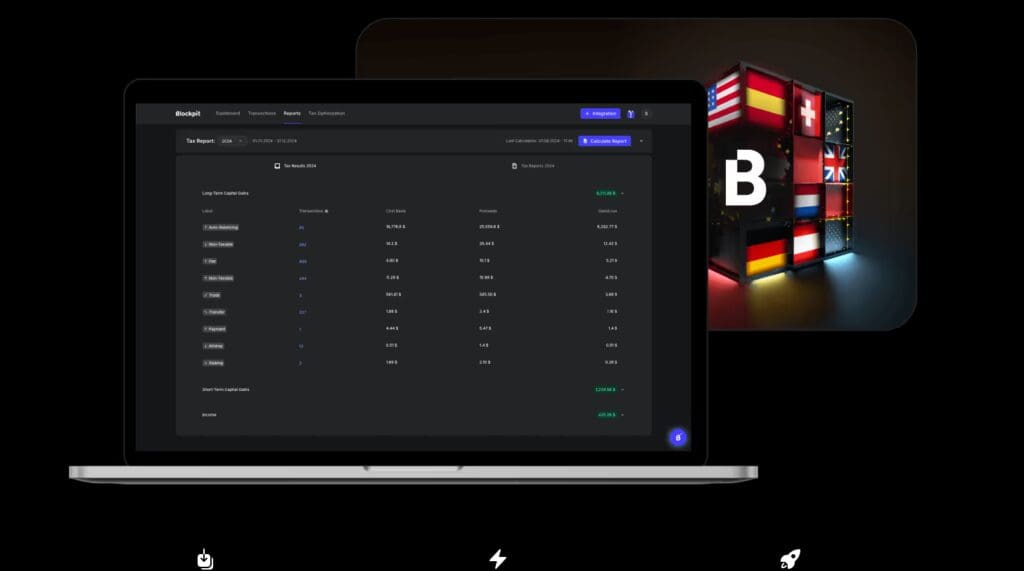

The dashboard makes it easy for one to get a quick overview of the gains one would have to report to tax authorities. Another feature available to Blockpit users is the generation of tax reports which can later be approved by one of its legal partners after reviewing it.

Blockpit Overview

| Feature | Description |

|---|---|

| Platform | Web and mobile-based application |

| Supported Exchanges | Coinbase, Binance, Kraken, Bitpanda, and more |

| Key Functions | Crypto tax reporting, portfolio management, automatic transaction syncing |

| Tax Report Creation | Generates detailed tax reports, ready for review and authorization by legal partners |

| Legal Compliance | Ensures tax reports are compliant with local regulations |

| Additional Features | Tracks mining rewards, airdrops, and integrates multiple revenue sources |

| Pricing | Subscription-based, with different plans based on user needs |

| Target Audience | Individual crypto traders, investors, and businesses |

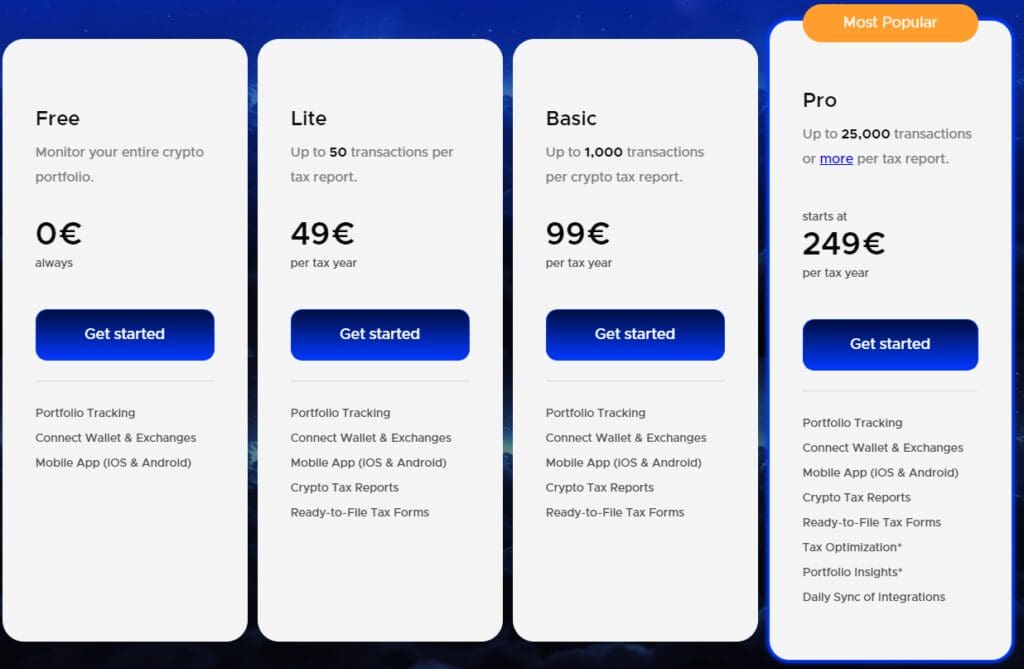

Pricing

There fair pricing is based only on the number of your transactions for each tax year, not your overall account.

How Blockpit Works?

Blockpit, a fully fledged tax calculator and portfolio manager specifically targeting the cryptocurrency space lets users manage their investments in cryptocurrency efficiently along with ease of reporting tax. The process of Blockpit can be broken down into a series of steps as stated below.

Create an Account: The first step towards using Blockpit is to create an account.

Set Up Integrations: Link your crypto exchanges, wallets and blockchains in order to pulled in your transaction data.

Automatic Labeling: Blockpit automatically tags and consolidates operations, assisting in the recording of trades and transactions, transfers, staking, and so on with ease.

Track Portfolio: View your total crypto portfolio that includes: NFTs and DeFi assets.

Generate Tax Reports: Blockpit caters customized tax reports encompassing factors and requirements posed by the localization.

Optimize Taxes: Find points where you can save taxes and further enhance your tax filing.

Access Insights: Analyse transactions and portfolio performance.

Secure Connections: Enjoy safe links to exchanges and wallets.

Blockpit boasts high compatibility as it allows users access to over 250,000 assets and makes tax filing effortless for users , both traditional and crypto savvy. Any crypto enthusiast would find it to be a helpful tool for portfolio management as well as managing tax coming from reporting

Blockpit Product

| Feature | Description |

|---|---|

| Crypto Tax Calculator | Automatically generates personalized tax reports compliant with your country’s regulations. |

| Portfolio Tracker | Tracks your entire crypto portfolio, including NFTs and DeFi assets. |

| Seamless Integrations | Connects with over 250,000 crypto assets, wallets, exchanges, and blockchains. |

| Advanced Insights | Provides detailed portfolio performance metrics and insights for data-driven decisions. |

| Tax Optimization | Identifies tax-saving opportunities and helps optimize tax reporting. |

| Secure Connections | Ensures secure connections to crypto exchanges and wallets. |

| User-Friendly Interface | Offers an easy-to-use design suitable for both beginners and advanced users. |

| Historical Data | Access to historical price feeds and transaction history. |

| NFT Support | Tracks and manages NFTs with accurate floor prices. |

| Comprehensive Dashboard | Provides a complete view of your crypto holdings and performance in one place. |

Blockpit Supported exchanges

Blockpit permits many exchanges for crypto transactions and has made it effortless for customers to suggest any additional currencies they would like to see incorporated into the platform. Blockpit reserves numerous exchanges including, but not limited to, the following ones:

First on the list is Binance, BitFinex, Bittrex, AscendEX among others. Blockpit also allows transactions for Bitstamp, Blockchain.com and Bitguide. Kraken and ByBit also fall under the limit as well as Paymium, Phemex and Poloniex. Hits wondering where to start? Starts off with Blockpit to see the rest of the currencies supported!

Expert-Backed Tax Reporting

Generate your personal crypto tax report, designed to comply with your country’s unique tax regulations. Our expert-audited reports ensure compliance and minimize audit risks with your local tax authority.

1. Import Transaction History

Import your transaction history from your wallets and exchanges.

2. Review & Optimize

Gain new insights into your transactions and discover tax-saving opportunities.

3. Generate Tax Report

Click the button to download your complete crypto tax report. It’s that easy.

Blockpit Unique Features

Blockpit provides an array of exceptional services that distinguishes it from others in the market including crypto tax calculators and portfolio trackers:

Seamless Integrations

It supports more than 250000 crypto assets, wallets, exchanges and all types of blockchains.

Expert-Backed Tax Reporting

Risk assessment reports catered specifically to your nation’s policies providing minimal risk during audits are offered.

Tax Optimization Tools

Special features such as the ‘Tax Loss Harvesting’ and sell simulation aspect are included.

NFT Support

Various tools to control and display your NFTs and accurate floor prices for NFT collections are provided.

Comprehensive Dashboard

It has full 360° cockpit view of the chart along with live portfolio values, performance as well as history.

Secure Connections

The platform has very secured connections with regards to crypto wallets and exchanges.

Historical Data Access

Analyzing programs are available which enables you to view historical price feeds and transaction history.

User-Friendly Interface

The platform can be utilized even by more novice traders alongside seasoned traders allowing seamless tracking of trades.

Global Compliance

Over 100 countries are supported on the Blockpit which enables local regulations to be followed.

Blockpit Pros & Cons

In this article, I will evaluate Blockpit, its advantages and disadvantages with a focus on crypto tax reporting.

Pros:

Automated Data Collection: Achieving accurate reporting is made possible through the automation of data collection with the help of multiple integrated Blockpit exchanges.

Comprehensive Reporting: Blockpit goes beyond mere executing of trades and does include any aspect of crypto transactions – trades, wallets, mining and even airdrops.

Fully Legal: It ensures compliance with tax regulations as you can get a legal partner review on your reports before submission.

Cons:

Low Number of Supported Exchanges: Blockpit encompasses most sought after platforms, however some minor exchanges may be incompatible with it.

Annual Fee Subscription: Crypto tools may sometimes offer cheaper costs, as the service is quoted to be higher for advanced platforms.

Difficult For New Users: As a new user you would find the working of its features too technical and hectic initially.

Blockpit Support

- Help Center: The Blockpit Help Center consists of broad content such as articles, guides, and FAQs to assist users with an issue.

- Submit a Ticket: Users can submit a ticket via the Blockpit Help Center which enables users to describe their problem for it to be sent to the appropriate department.

- Email Support: Users can send an email to Blockpit’s representatives for any technical or feature-related queries or for account support using the Contact Us page.

- Community: There are so many active communities on Telegram, Discord, and forums where Blockpit users can request help or insights from other users.

Blockpit Alternatives

Koinly

An intuitive tool that allows users to connect with exchanges, wallets or public addresses to obtain relevant tax reports from past transactions.

CoinTracking

Gathers adequate information for over 5000 crypto assets alongside charts for taxes and reporting purposes.

TokenTax

Processes tax calculations with ease and comes in handy for automated reporting on taxes for cryptocurrency.

ZenLedger

Targets tax obligations related to cryptos and assists with useful features related to tax report filing and saving.

Conclusion

Blockpit specializes in facilitating the management of cryptocurrency investments and handling tax reporting. It has a user-friendly interface suitable for both novice and advanced users, along with credible tax reporting features.

Boasting a plethora of prominent features comprising of NFT management and an advanced dashboard, Blockpit provides crypto investors with powerful tools to analyze their portfolios.

Providing secure connections and global compliance, it guarantees reliable and precise data management. Be it an individual or institutional investor or trader, Blockpit provides sufficient tools to manage crypto tax reporting and monitor investment portfolios.