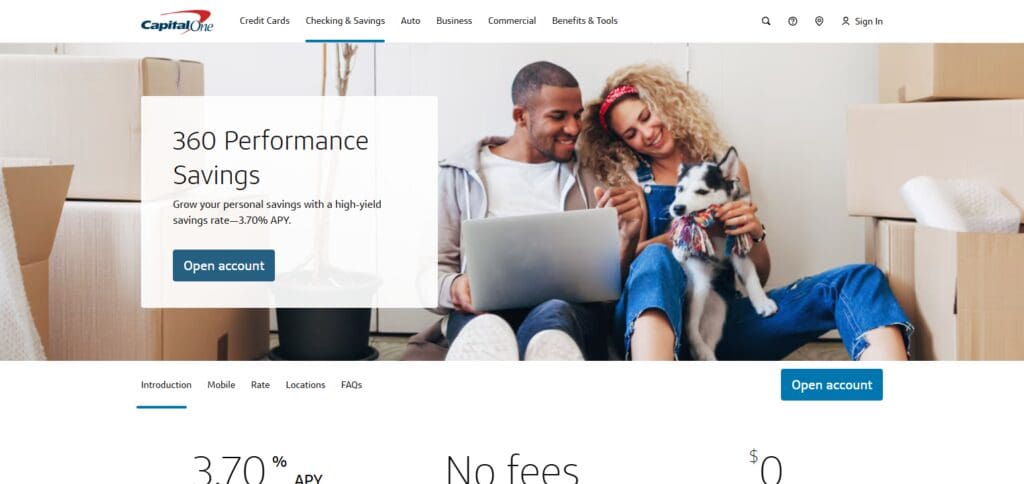

I want to explain What is Capital One High Yield Savings Account is. Capital One 360 Performance Savings Account had a different name before, and it provided an option for modern savings with an excellent interest rate.

Just like with other savings accounts, there are no fees and no minimum balance requirements.

The account is meant for the expanding world of digital banking. This is perfect for savers because it offers great security and ways to grow your money fast. Now let us look at the features and benefits in more detail.

What is Capital One High Yield Savings Account

The Capital One High Yield Savings Account belongs to Capital One, a leading bank in the United States.

This account is tailored to grow savings more effectively than other saving accounts due to its higher interest rate. This is a summary of the features guaranteed by this account:

Higher Interest

Unlike many standard saving accounts, this account has a higher annual percentage yield (APY), allowing your savings to flourish.

No Fees

Losing out on benefits is one thing that a saver will never have to encounter. This account does not incur a monthly maintenance fee which gives the customer more control over their money.

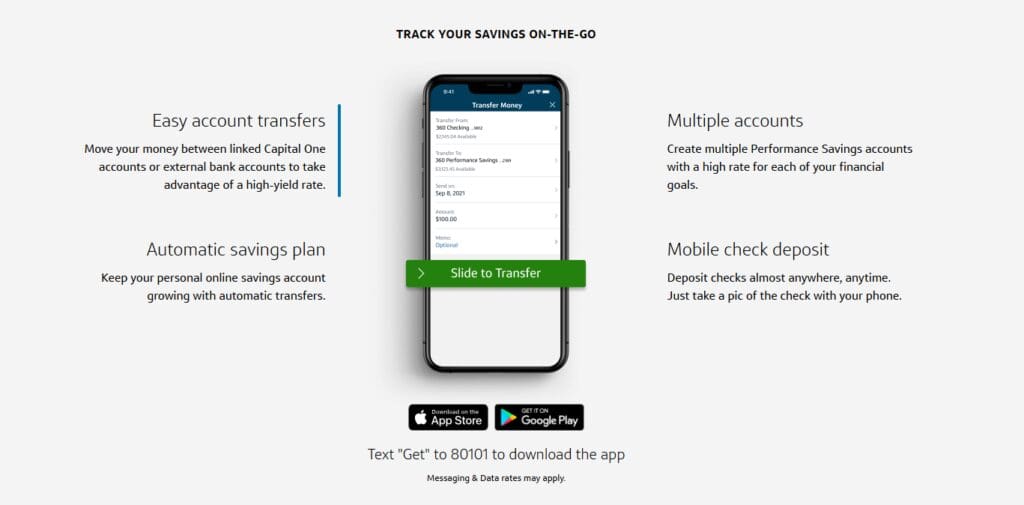

Online and Mobile Access

This account requires very little, or no minimum deposits so it is handy to a myriad of customers.

FDIC Insurance

Saving your funds in this account guarantees safety to a federal level as all saving accounts with Capital One are insured by Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed by law.

Automatic Savings Plans

You are able to designate automatic deductions of money from your checking account to your saving account which promotes good saving habits.

24/7 Customer Service

You can call CapitalOne’s customer service anytime as they provide support all day and night.

This type of account is targeted toward users wishing to save money in a quality bank. Remember to visit CapitalOne.com or call Capital One for the latest information.

How to Open a Capital One High Yield Savings Account

Opening a Capital One High Yield Savings Account, also referred to as the 360 Performance Savings Account, is simple. Below is a breakdown of the steps you need to follow to open your account.

Go To The Capital One Site

Make sure you visit the official site of Capital One at Capital One.

Click To Apply

To apply for the account click on the “Open Account” button which you will find on the website.

Fill In The Application Form

Mention relevant personal details including: name, date of birth, address, active email, phone number, current employment, expected salary, social security ID, and country of citizenship.

Contact Terms Agreement

Make sure you read the terms and conditions provided by Capital One Account carefully before accepting.

Verification Of Identity

To enable you verify your identity, some documents will be needed from your end.

Tax Information Submission

Enter the relevant information regarding tax for the completion of the tax certification.

Account Funding

The account must be funded with an initial deposit. You can do so by transferring from another bank or through a check.

Online Access Configuration

Create your login information to the banking platform online, either through the Capital One site or mobile application.

To begin earning interest on your savings, ensure you follow all the steps with attention. Please note that you can find more information in the official link.

Who Should Consider This Account?

Some individuals are better served than others. The Capital One 360 Performance Savings Account (previously known as High Yield Savings Account) is ideal for a wide array of individuals but certain types of savers may benefit from it more. Here are some people who may benefit from the offer:

Always on the Hunt for Higher Interest Rates

If you typically go for accounts that earn more in savings compared to traditional accounts, this one works best for you. This account also offers competitive interest rates, thus helping manage the money more effectively.

Newcomers with Nuanced Saving

This account is perfect for those who are just learning how to save, or newbies who don’t want to put down a lot of money initially. There are no minimum balance requirements which adds icing on the cake.

Everyone Saving For Targeted Goals

Whether you’re setting aside money for an emergency fund, a vacation, a wedding, or a house down payment to name a few, this account’s features assist you in keeping track of how much you have saved alongside motivating you.

Insatiable Digital Bankers

If you enjoy managing accounts online, you will appreciate Capital One’s website and mobile app because it allows you to handle your savings 24 hours a day across the globe.

American Express

That’s right, with the Capital One 360 Savings account there are no monthly maintenance fees or hidden charges which makes this offer feel more favorable to users who wish to steer clear from account fees.

Current Users Of Capital One

Customers with an existing Capital One checking account, credit so, Capital One’s Another savings account can be integrated into their system; this makes it easy for users to manage multiple products from one site.

People Who Create Emergency Funds

Due to the feature of high interest and no limit on the number of withdrawals, this account is perfect for any emergency funds. It serves as a great place to set aside those funds while earning some interest.

People Focused On Environmental Issues

Seeing as Capital One focuses on digital banking and reduces the use of printing statements and opening physical branches, their services appeal to eco-friendly users.

Family Members Saving Money For Their Children’s Future

Due to the account’s flexibility, it can also be used to save funds for future child expenses such as education of any extracurricular involvement.

Individuals Who Benefit From FDIC Insured Accounts

The primary selling point for users who care about safety is the account’s FDIC insurance of up to 250,000 dollars per depositor.

Users Interested In Automation

If savings need to be automated, this account takes away the hassle of setting up weekly reminders by letting users set up saving goals and Jan 1st transferrs.

Users Who Prefer No Withdrawal Restrictions

This account unlike most other savings accounts provides unlimited withdrawals for users without setting up a limit on the number of times money can be taken out of the account.

Benefits of the Capital One High Yield Savings Account

Competitive Interest Rates

With capital one 360 performance savings, the interest on savings is comparably higher than the regular savings bank account. This ensures that the growth rate of the money is higher.

No Fees

The account does not have any monthly fees to maintain nor does it require a certain amount to be held in the account which makes it convenient and cost friendly for savers.

FDIC Insurance

The funds in the account are insured by the FDIC up to the legal limit of $250,000 for each depositor per account type. This means that your money is secure.

Easy Access to Funds

You can access your savings online through the Capital One mobile app or at Capital One ATMs. Getting money from one Capital One account to another is very simple and fast.

No Minimum Opening Deposit

People can start saving, by opening an account with any amount, which makes it convenient for everyone.

Automatic Savings Tools

Tools to automate accounts such as reoccurring transfers and custom savings goals on Capital One are available.

Integration with Other Capital One Accounts

If you have other capital one accounts, like checking or credit cards, managing all your finances at one place is super convenient.

Mobile Application and Online Banking

The Capital One app and website are very simple to use. You can keep track of your savings, move money around, and set goals all from your phone.

No Restriction on Withdrawals

Capital One does not limit the number of withdrawals you can make per month, unlike some savings accounts which do. With Capital One, you have complete freedom.

Conclusion

Lastly, the Capital One High Yield Savings Account, now the 360 Performance Savings Account, is one of the most effective accounts for managing your finances.

It puts no charge on users and offers great interest rates, plus no minimum balance limits needed. It also includes powerful digital banking features. It is perfect for rational savers since it is fully remote.

This bank account is suitable for achieving various financial goals, whether as specific as an investment or as unplanned as a long-term saving strategy.

In case you place value on straightforwardness, clarity, and high returns, make sure to check out the Capital One 360 Performance Savings Account.