In this post, I will explain how DEX trading aids users in trading on a decentralized exchange, with particular attention to cryptocurrency trading.

DEX trading tools provide price aggregation, real-time analytics, portfolio and tax reporting. Whether you are a beginner or expert however, your experience and performance in DeFi will greatly benefit from appropriate DEX trading tools.

| DEX Trading Tool | Key Feature |

|---|---|

| 1inch | Aggregates liquidity from multiple DEXes for best prices |

| Matcha | User-friendly DEX aggregator with low slippage execution |

| DEXTools | Real-time trading data, pair explorer, and charts |

| Zapper | Portfolio tracker and multi-DEX trading interface |

| Slingshot | Fast swaps across DEXes with minimal fees |

| CowSwap | Gasless trading and MEV protection |

| Uniswap Interface | Simple and direct access to Uniswap liquidity pools |

| ParaSwap | Advanced aggregator offering optimized trading routes |

| Koinly | DEX trade tracker for tax reporting and portfolio analysis |

1. 1inch

1inch is the most popular DEX aggregator that makes trades easier by getting liquidity from more than 300 protocols across 10 blockchains, like Ethereum, BNB Chain and Polygon. It uses order splitting to reduce slippage and fees as well as provide the best swap rates.

Other important features are limit orders, gas optimization, and yield farming through 1inch Earn. It is also well known among traders for being cost efficient with $500 million in monthly trading volume.

1INCH token is used for governance as well as for participating in staking rewards. Its mobile application and wallet make it more convenient.

1inch is crucial for traders looking for ease of use and multi-chain support, however, complex tokenomics may put off some novice traders. Its robust API also powers DeFi integrations, solidifying its DeFi dominance.

1inch Features

- DEX aggregator using smart contracts.

- Conducts trades on different exchanges to get the optimal rate.

- Pathfinder algorithm for best optimization.

- Covers Ethereum, BNB Chain, Polygon and others.

- Saving on internal tokens and gas costs.

2. Matcha

Matcha, created by 0x Labs, is a simple DEX aggregator that enables easy trading across nine blockchains, including Ethereum, Arbitrum, and Avalanche. It consolidates liquidity from over 100 sources which provides competitive swap rates with no trading fees.

With more than 6 million supported tokens, both novice and expert traders will appreciate Matcha’s easy-to-use interface which offers limit orders and portfolio tracking. Its integration with 0x’s liquidity pools guarantees low slippage which increases its appeal.

Monthly trading volume is over 300 million dollars, indicating strong adoption. Its cross-chain focus along with gas-efficient swaps make Matcha stand out as a go-to for effortless trading.

Unlike 1inch, there is less yield farming available which is a drawback for more advanced users. For users looking for simplicity and wide access to tokens, Matcha stands out in the DEX ecosystem.

Matcha Features

- Collects and combines top DEX liquidities.

- Most swaps have zero trading fees.

- Supports limit orders.

- Clean, modern interface that is easy to use.

- Ethereum, Polygon and BNB Chain are covered.

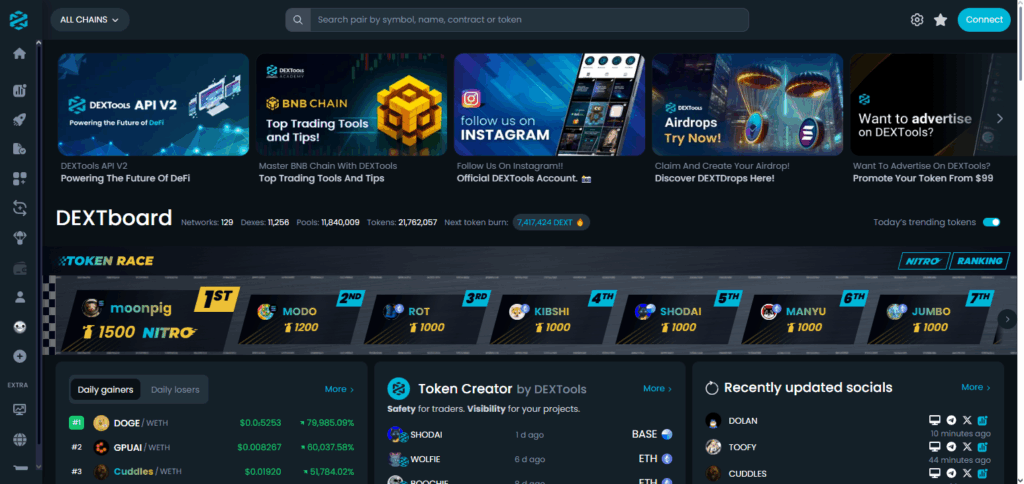

3. DEXTools

For DEX traders who require instantaneous information, DEXTools is one of the best DeFi analytics platforms. DEXTools allows trading on Uniswap, PancakeSwap, and other DEXs within the Ethereum and BNB Chain ecosystem.

Some of the features offered are: token pair analytics, price charts, liquidity analytics, trading signals, and more. DEXTools is used by over 1 million people monthly. Premium features, such as advanced alerts, are accessible through the DEXT token.

The portfolio tracker from DEXTools monitors assets across chains, helping traders make strategic moves. Its $50 million trading volume shows how useful it is for trend and scam detection.

Though not a trading platform, DEXTools provides enables well-informed decisions, which is crucial for active traders. Despite its unmatched data depth in DeFi analytics, DEXTools is complicated for beginners and may require some getting used to.

DEXTools

- Trading charts and token data are updated in real-time.

- Pair Explorer and Pool Explorer functions.

- Reliability scoring system for tokens (DEXScore).

- Integration with wallets and watchlists.

- New token alerts and analytics.

4. Zapper

Zapper serves as a DeFi portfolio management and a trading tool. It automates interactions with DEXs on Ethereum, Polygon, and six additional blockchains. Through the use of Uniswap and 1inch, token swaps, liquidity provision, and yield farming can all be done from a single dashboard.

With $200 million in managed funds, Zapper excels at asset tracking across more than 1,000 protocols. Retail traders gravitate towards Zapper due to its intuitive interface revealing net worth, APYs, and transaction history.

Compared to other platforms like Matcha, Zapper still has a broad focus instead of concentrating on advanced trading. It lacks native limit order functionality, which makes it difficult to execute more advanced strategies.

For traders who want to overlook their portfolios while DEX trading, Zapper is a helpful resource, but its trading capabilities are underwhelming.

Zapper Features

- DeFi dashboard that can host multiple wallets.

- Oversee yield farming, staking, and lending.

- Cross network token swaps.

- Portfolio allocation visualization.

- One-click access to liquidity pools.

5. Slingshot

Slingshot is a DEX aggregator supporting cross-chain trading on Ethereum, Polygon, Arbitrum, and BNB Chain. It has gathered over 50 DEXs and aggregated their liquidity providing low-slippage swaps.

Slingshot supports over 10,000 tokens and has a sleek interface, which is one of the reasons why it has a monthly trading volume of $100 million. Some of the features include limit orders, portfolio tracking, and no trading fees. The mobile app also improves access for retail traders.

While Slingshot’s user experience focus exceeds rivals like Matcha, its liquidity pool is smaller than 1inch’s. Designed for traders who need speed and ease of use, Slingshot performs well in multi-chain settings.

Less community governance comes with its newer status, but frequent changes position it as a DEX trading star.

Slingshot Features

- Real-time aggregation of DEX prices.

- Engaging price graphs and comparisons.

- Instant swaps with low slippage.

- Responsive sleek UI.

- Ethereum, Arbitrum and Polygon supported.

6. CowSwap

CowSwap is an innovative DEX on Ethereum and Gnosis Chain, using batch auctions and off-chain order matching to reduce slippage and MEV (miner extractable value) attack risks. It provides cost-efficient trades by aggregating liquidity from Uniswap and Balancer.

CowSwap’s gasless trading and limit orders are attractive to advanced traders. Its CoW (Coincidence of Wants) protocol settles peer-to-peer orders to cut costs further. It may not be as user-friendly as Matcha, but its transparency and protection against MEV help it stand out.

CowSwap has a $50 million TVL, which shows how it continues to grow. For those prioritizing security and affordable swaps, CowSwap remains one of the best options, even though its supported chains don’t quite compare to 1inch.

CowSwap Features

- Gasless trading with MEV protection.

- Order batching through solvers.

- Execution with zero slippage.

- Limit orders are supported

- Aggregates Balancer, Uniswap, and others

7. Uniswap Interface

Uniswap is one of the most-used DEXs in the crypto market, having achieved $4 billion in Total Valued Locked (TVL). Uniswap sits at the top of the Ethereum-based DEXs with a mind-blowing daily trade volume of $1.5 billion.

The interface for Uniswap is known as Uniswap Interface. It uses an Automated Market Maker (AMM) model that allows throttle-free ERC-20 token exchanges on Ethereum, Polygon, and Arbitrum.

The DEX offers numerous features including liquidity pools, yield farming, governance through the issuance of UNI tokens, and v3 concentrated liquidity models that enhance capital efficiency.

Traders on Uniswap enjoy ‘farmer-first’ design which earns higher yields with fewer assets traded or locked. Beginners are also catered to as Uniswap has a friendly user interface.

While it may lack aggregator features such as 1inch, it more than makes up for it with being a native DEX. Uniswap remains unmatched for all traders looking for reliability and diversity in tokens even though gas fees on Ethereum may be off-putting for smaller trades.

Uniswap Interface

- Token swap via AMM model

- Supports a multitude of ERC-20 tokens

- Layer 2 scaling support (Optimism, Arbitrum)

- Provides liquidity and earns fees

- User friendly, open-source interface

8. ParaSwap

As a DEX aggregator, ParaSwap optimizes trades across Ethereum, BNB Chain, and five other blockchains. It has over 100 DEXs, including Uniswap and Curve, providing liquidity which helps in lowering slippage and gas-efficient swaps.

ParaSwap offers $200 million in monthly volume alongside limit orders and governance PSP tokens. Its middleware API fuels DeFi integrations, improving developer resource use. While 1inch offers greater liquidity, ParaSwap’s interface is more polished than Matcha’s.

For cost-effective multi-chain swaps, traders will find over 5,000 tokens with unmatched gas optimization, ideal for smaller trades. Despite being lesser known than top aggregators, the versatility helps expand capabilities for DEX trading.

ParaSwap

- Proprietary algorithm para trades bridging multiple DEXs

- Trades can be divided among different DEXs

- Limit orders supported

- Low gas expenditure with high efficiency

- DeFi app APIs available for integration

9. Koinly

Even though Koinly is a crypto tax reporting service, we have included it in this list because it assists users in tracking their crypto taxes over DEX trading platforms. Koinly aids in tracking over 700 exchanges and blockchains including DEXs like Uniswap.

Koinly creates tax reports for over 20 countries and DEX trades are not ignored in the computation. Koinly currently has a user base of 1 million people and tax filling is simplified as Koinly integrates with wallets and DEXs to automatically import trade data.

For tax filing, Koinly is invaluable, however, the service is limited in that it does not provide swap facilitation or analytics the way DEXTools does.

The annual fee of $100 may drive away more casual traders. Koinly is a useful tool for DEX traders needing tax solutions, but its lack of trading functionalities compared to 1inch or Matcha makes it less relevant as a trading tool.

Koinly

- Automated DEX trading activity monitoring

- Crypto tax reporting available in over 20 countries

- Wallets and exchanges data retrieval

- Monitor portfolio performance over time

- Generate reports on capital gains and income

Conclusion

Tools for DEX trading have become increasingly important for navigating the decentralized finance industry safely and effectively.

Every tool from aggregators like 1inch and Matcha which guarantee the best prices to analytics platforms like DEXTools and even Koinly with tax solutions, serve a specific purpose.

Every trader from beginner to advanced can benefit from these tools as they can help improve trading accuracy, save on overall costs, and make managing portfolios simpler.