In the following article we will focus on the dissimilarity of bridging against exchanging on a DEX. Although both of them involve the transfer of assets, they perform different functions within the context of decentralized finance (DeFi).

Bridging is the transfer of tokens over various blockchains while exchanging involves the swapping of tokens within the same blockchain network. Now, let’s look further into each.

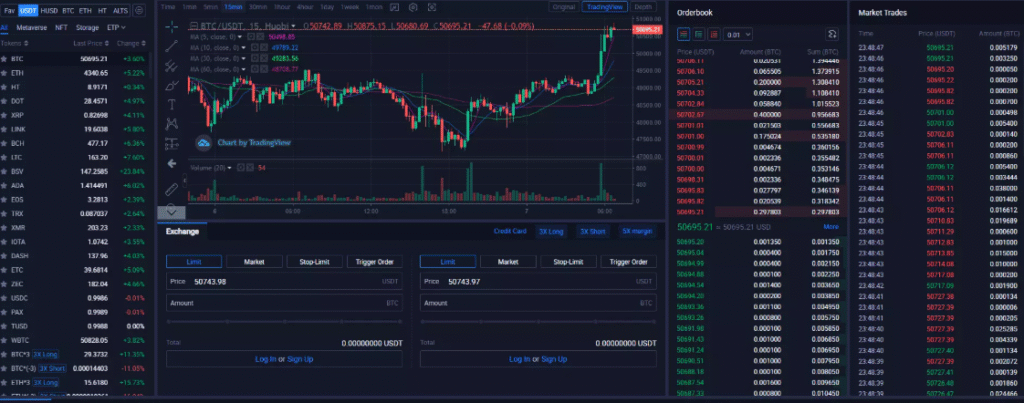

What is Exchanging on a DEX?

Exchanging is the process of changing a specific token into another token on the same blockchain.

DEX exchanges are commonly seen, for instance, swapping ETH for USDC on Uniswap on the Ethereum network. These trades can be done using liquidity pools or order books, based on the model of the DEX.

How It Works

A wallet can simply be connected to a DEX.

Choose a token to TRC/20 exchange.

Choose a token to be received.

The desired swap is done utilizing the DEX and executed based on prevailing available liquidity and price slippage.

What is Bridging?

Bridging enables one to move their tokens from one blockchain to another, which is essential if you intend to use your crypto assets in a different blockchain ecosystem; say, moving USDT from Ethereum blockchain to Binance Smart Chain.

Most of the time, bridging will require some kind of cross chain protocol or bridge and often, this function is part of or embedded in a DEX (Decentralized Exchange).

How It Works:

You perform a bridge handover using Stargate, Synapse, or Multichain and similar protocols.

Your tokens are either locked or burned on the source chain.

On the target chain, tokens of equivalent value are minted or freed up.

Key Differences Between Bridging and Exchanging

| Feature | Exchanging on a DEX | Bridging on a DEX |

|---|---|---|

| Purpose | Swap tokens within the same blockchain | Move tokens across different blockchains |

| Chains Involved | Single chain (e.g., Ethereum) | Two or more chains (e.g., Ethereum ↔ Polygon) |

| Speed | Typically fast (seconds to minutes) | Can take longer (minutes to hours) |

| Complexity | Simple and direct | More complex, may require multiple steps |

| Cost | Lower gas fees | Higher gas fees due to cross-chain actions |

| Use Case Example | Swap ETH for DAI on Uniswap | Bridge USDC from Ethereum to Avalanche |

| Risk Level | Relatively low | Slightly higher due to smart contract risks |

When to Use Exchanging

Exchanging is applicable when:

You intend to swap tokens on the same blockchain network.

If you are on a DEX: Uniswap, SushiSwap, PancakeSwap

You are rebalancing portfolio distribution within a single blockchain.

Example:

Imagine you are interested in taking profits from an altcoin and want to shift over to a stablecoin. If both tokens are on the Ethereum blockchain, you could just utilize a DEX and trade them in one step.

When to Use Bridging

Bridging is an option when:

You aim to engage with DeFi applications on a different chain.

You are looking for other chains in order to access lower gas costs or quicker transaction times.

Some tokens are exclusively available on other networks at more competitive rates.

Example:

If you have USDT on Ethereum and intend to use a DeFi platform on Arbitrum, you will bridge your USDT from Ethereum to Arbitrum, and afterward interact with the dApp.

Pros and Cons of Bridging vs Exchanging on a DEX

| Feature | Bridging | Exchanging |

|---|---|---|

| Pros: | ||

| Access to Multiple Chains | Allows transfer of assets across different blockchains. | Limited to one blockchain, typically the one you’re connected to. |

| Cross-Chain Opportunities | Enables interaction with DeFi platforms on other chains. | Fast and simple to swap tokens within the same blockchain. |

| Avoid High Gas Fees | Potential to move assets to chains with lower fees (e.g., Polygon or Avalanche). | Lower transaction fees if liquidity is high and slippage is low. |

| Flexibility | Enables use of assets on chains with different protocols. | Can quickly swap between tokens without leaving your wallet. |

| Cons: | ||

| Complexity | More complex, often requiring multiple steps or platforms. | Simple, user-friendly, and direct. |

| Time-Consuming | Typically slower due to cross-chain processes (minutes to hours). | Fast transactions, usually completed within seconds to minutes. |

| Risk Level | Higher risk due to smart contract vulnerabilities on bridges. | Lower risk as you’re usually staying within one network. |

| Cost | Higher gas fees due to cross-chain activities and bridging protocols. | Lower gas costs, especially for swaps on the same chain. |

| Liquidity Constraints | Liquidity can be lower on some bridges, leading to slippage. | Liquid markets may have low slippage, but still dependent on pool depth. |

Conclusion

In conclusion In the world of decentralized finance (DeFi), both bridging and exchanging are equally important. For within-network token swaps, exchanging does a great job, whereas bridging expands the user’s experience into the multi-chain realms of crypto.

As DEXs develop and the demand for interoperability increases, knowing the difference between these two operations could immensely impact your time, fees, and mistakes. Stick to the reputable platforms and ensure that the token addresses are correct prior to performing any transactions.

Understanding when to bridge and when to exchange will have you making better decisions while moving around in the decentralized world.