I will discuss the Differences Between Coinbase And Kraken in this article. Both are prominent cryptocurrency exchanges, but they serve different categories of users.

From trading costs and supported cryptocurrencies to user experience and staking options, each platform has its advantages. Knowing these differences will assist you in determining which exchange suits your needs and level of expertise best.

What is Coinbase?

Coinbase is a US-based cryptocurrency exchange platform which permits users to carry out trade on Bitcoin, Ethereum and Litecoin among other digital currencies. It was started in 2012 and has since evolved into one of the most reputable and convenient crypto platforms in the world.

Through its main platform and Coinbase Pro, Coinbase serves both novice and seasoned traders. The company offers a comprehensive array of cryptocurrencies, digital wallets, recurring buys, price alerts, and educational tools.

As a regulated entity and publicly traded company, Coinbase has established a reputation for strong security and compliance with financial regulations, making it a go to platform for investors in cryptocurrency.

What is Kraken?

Founded in 2011, Kraken is one of the first cryptocurrency exchanges and it is known for its strong security, high liquidity, and variety of supported digital assets. Kraken’s main office is in the US.

The exchange provides retail and institutional clients with advanced trading features such as spot and futures trading as well as staking. 200 cryptocurrencies and fiat currencies such as USD, EUR, and JPY are supported.

Experienced traders prefer the exchange due to its low fees, robust interface, and high trading limits. The exchange boasts strong regulatory compliance policies and user safety, employing two-factor authentication and cold storage. In the crypto industry, Kraken is one of the most trusted platforms.

A Comprehensive Look at Kraken and Coinbase Exchanges

| Feature | Kraken | Coinbase |

|---|---|---|

| Headquarters | San Francisco, USA | No headquarters as of May 2024. Previously San Francisco, USA |

| Year Established | 2011 | 2012 |

| Regulation | FinCEN, FINTRAC, FCA, AUSTRAC, FSA | Yes – complies with laws per jurisdiction- Money Transmission License- Registered with FinCEN |

| Cryptocurrencies Listed | 300+ | 260+ |

| Native Token | N/A | N/A |

| Maker/Taker Fees | 0.00% / 0.10% (lowest)0.25% / 0.40% (highest) | 0.00% / 0.05% (lowest)0.40% / 0.60% (highest) |

| Security | Very High | High |

| Beginner-Friendly | Yes | Coinbase: Very Beginner-FriendlyCoinbase Advanced: Slight Learning Curve |

| KYC/AML Verification | Yes | Yes |

| Fiat Currency Support | USD, EUR, CAD, AUD, GBP, CHF, JPY | USD, GBP, EUR |

| Deposit/Withdrawal Methods | USD – ACH, Wire, SWIFT, Signet, SENEUR – Debit/Credit card, SEPA, SWIFTGBP – Debit/Credit card, FPS, CHAPS, SWIFTCAD – Debit/Credit card, Wire, e-Transfer, SWIFT, EFTAUD – Debit/Credit card, Bank Transfer, Osko, SWIFTCHF – Debit/Credit card, SIC, SWIFTJPY – SWIFT, FurikomiCrypto deposits & withdrawals supported | USA – ACH, wire transfer, debit/credit card, PayPal, Apple Pay, Google PayGBP – Faster Payments, SEPA, 3D Secure Card, PayPal (withdraw only)EUR – SEPA, 3D Secure Card, iDEAL/Sofort (deposit only), PayPal (withdraw), Apple Pay (buy only) |

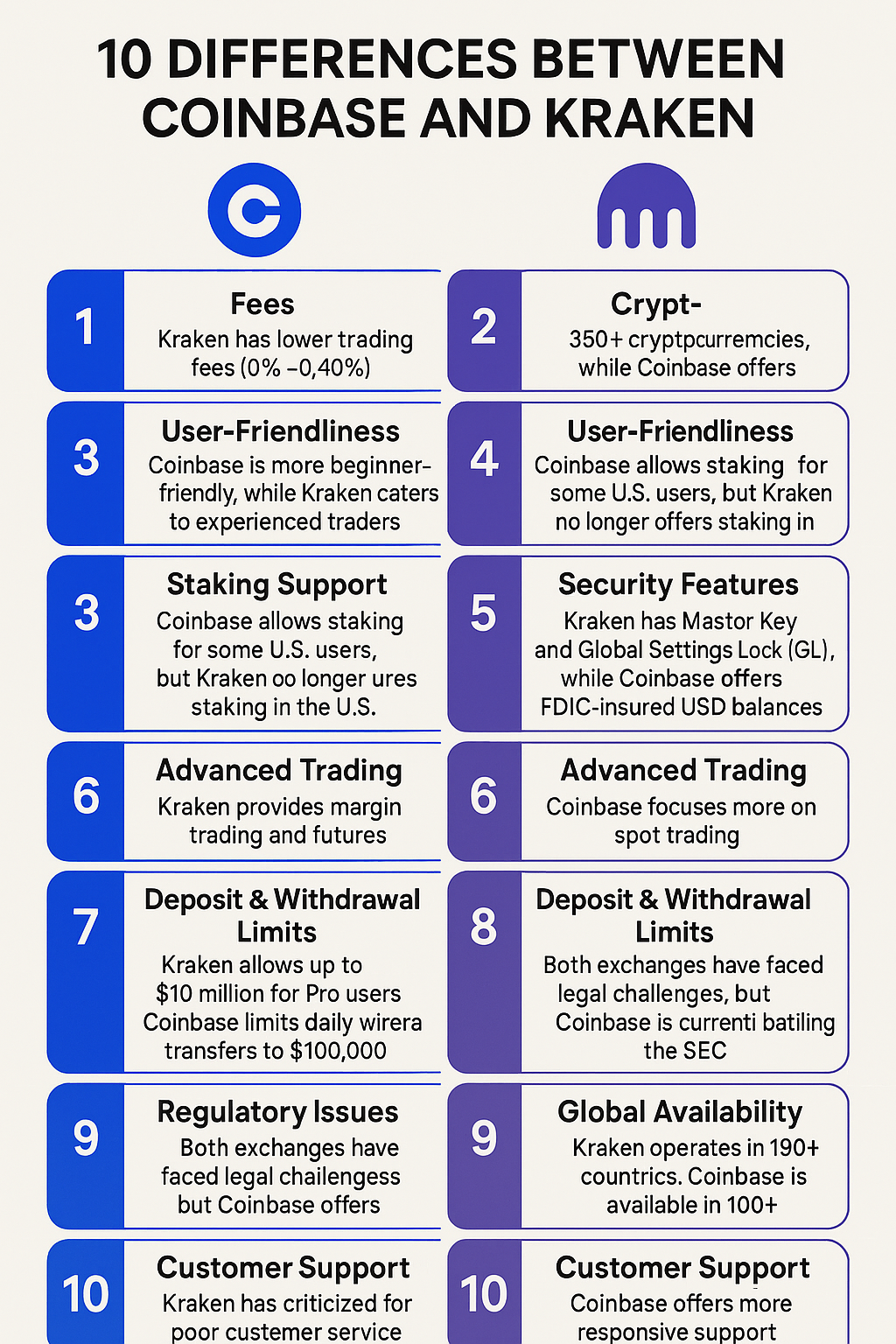

10 Differences Between Coinbase and Kraken

1. Fee Structure

Coinbase’s fees are higher as they charge between 0.00%–0.60% on Advanced Trade and up to 3.99% for card transactions.

On Kraken, Maker-taker rates are 0.00%–0.26% on Kraken Pro and card fees are 3.75% + $0.25. For active traders, Kraken is more cost-effective. For expensive trades or frequent smaller transactions, it is better to use Coinbase advanced trade.

2. User Interface

Coinbase has a Coinbase Learn feature which guides beginners on how to use the app. It also has a very easy to use interface, unlike Kraken which has advanced charting and trading options that make their interfaces sophisticated.

Because of the professional focus, Kraken is still accessible to beginners, but it can feel overwhelming. Coinbase focuses on ease and simplicity, which is what most crypto novices value.

3. Cryptocurrency Support

Both Coinbase and Kraken focus on Bitcoin and Ethereum, as Coinbase supports 240-269 cryptocurrencies with 404 to 500 trading pairs, while Kraken supports 200 to 306 cryptocurrencies with 656 to 758 trading pairs.

Although both platforms have different strengths, Kraken tends to be more attractive to traders looking for niche markets because of their wider assortment of trading pairs.

On the other hand, primary users of Coinbase would be those who prefer a curated list of mainstream assets. Both platforms cater to diverse needs, but Kraken edges out for trading pair variety.

4. Fiat Currency Support

Both Coinbase and Kraken support fiat currencies differently. Coinbase is limited to three supported fiat currencies (USD, EUR, and GBP), which restricts its reach globally. Kraken supports seven fiat currencies (USD, EUR, CAD, AUD, GBP, CHF, and JPY), making it more accessible to international users.

In this scenario, Kraken’s wider support of fiat currencies greatly assists in making easier deposits and withdrawals for users in Canada or Japan. On the other hand, Coinbase’s limited options would affect non-U.S./European traders looking to seamlessly integrate flexible fiat options for their crypto transactions.

5. Staking Opportunities

Coinbase has begun offering staking on 9 to 147 assets at up to 12% APY, available in most U.S. states except New York. Staking offered by Kraken is between 17 to 27 assets at up to 17% APY, but is only available in 37 U.S. states.

With Coinbase, learners can earn small bonuses through the Learn and Earn program, and with Kraken, flexible and bonded staking are available.

While Kraken offers higher yields, it is more limited in the states where it is accessible. This makes Coinbase more appealing as a go-to exchange for staking enthusiasts.

6. Advanced Trading Features

While Coinbase Advanced Trade comes with basic charting and indicators, it does not have futures or margin trading. Kraken Pro stands out with margin trading (up to 5x leverage), futures, and even perpetual contracts, all aimed at professional traders.

With advanced tools, Kraken appeals to those looking for sophisticated strategy, while Coinbase’s simpler platform is aimed at users primarily interested in spot trading.

For advanced traders, Kraken’s feature set offers significantly more flexibility and opportunities for sophisticated market engagement.

7. Security Measures

For security, Coinbase keeps 98% of funds in cold storage, offers FDIC insurance on USD up to $250,000, and provides some coverage for breaches on digital assets.

Cold storage and 95% digital asset protection put Kraken miles ahead with a perfect no-hack history, but they lack insurance for digital assets.

Both focus on security, but prefer different approaches. Coinbase users value insurance, while Kraken users appreciate audit transparency.

8. Geographical Availability

Coinbase operates in over 100 countries, having strong U.S. coverage which is ideal for American users. Kraken has a wider international reach serving about 190 countries, but misses out on New York and Washington.

Users based in other countries will appreciate Kraken’s global reach, while domestic users will find broader access through Coinbase’s U.S.-focused offerings.

9. Payment Methods

Both Coinbase and Kraken accept credit/debit cards, bank transfers, PayPal (deposits and withdrawals), but only Coinbase offers a debit card. Coinbase’s heightened payment versatility grants ease of use, while Kraken’s focus on banking appeals to users looking for low-cost transfers over innovative spending.

10. Regulatory Compliance

Coinbase is a Nasdaq-listed company and is highly regulated in the US, being registered with FinCEN, and has resolved an SEC lawsuit in 2025. Privately held Kraken is also FinCEN-registered and has settled SEC and OFAC disputes, now preparing for a potential IPO.

Public status of Coinbase offers investor transparency, broad compliance of Kraken supports global operations.

Both are trustworthy, but U.S. users of Coinbase take advantage of it’s regulatory compliance edge while international traders are better served by Kraken’s flexibility.

A Comparison of Costs on Kraken and Coinbase

| Category | Kraken | Coinbase |

|---|---|---|

| Spot Trading Fees (Pro/Advanced) | Maker: 0.00% – 0.25%Taker: 0.10% – 0.40% | Maker: 0.00% – 0.40%Taker: 0.05% – 0.60% |

| Instant Buy/Sell Fees | 0.9% for stablecoins1.5% for other crypto and FX pairs | 3.99% for credit/debit card transactions |

| Credit/Debit Card Fees | 3.75% + $/€0.25 per transaction | 2.49% per transaction (except USDC which is free) |

| ACH Transfer Fees | Free | Free |

| Wire Transfer Fees | $10 (deposit)$25 (withdrawal) | $10 (deposit)$25 (withdrawal) |

| NFT Marketplace Fees | 2% transaction fee | Variable fees depending on the NFT collection |

| Margin Trading Fees | 0.01% – 0.02% position opening fee0.02% rollover fee every 4 hours | Not supported |

| Futures Trading Fees | Maker: -0.01% to 0.015%Taker: 0.01% to 0.05% | Not supported |

| Staking Fees | Lower fees, e.g., ALGO: 4.75%, XTZ: 5.5%, ATOM: 7% | 25% commission on staking rewards |

| Earn Products Fees | Generally lower fees and better yields | Fees vary but are typically higher than Kraken |

| Coinbase Card Fees | Not applicable | 2.49% fee on card purchases |

| Pro/Advanced Trading | Kraken Pro: lower fees across all tiers | Coinbase Advanced: higher fees compared to Kraken Pro |

NFT offerings between Kraken and Coinbase

| Feature | Kraken NFT Marketplace | Coinbase NFT Marketplace |

|---|---|---|

| Transaction Fees | Gasless for buy/sell on platform (gas applies when transferring NFTs off-platform) | Gas fees apply for Ethereum transactions |

| Blockchain Support | Ethereum and Solana (multi-chain support) | Ethereum and Solana |

| Payment Options | Wide range: multiple cryptocurrencies and fiat currencies | Cryptocurrencies and limited fiat options |

| User Experience | Suitable for both beginners and experienced users; more feature-rich | Very beginner-friendly; intuitive UI |

| Wallet Integration | Supports MetaMask, Phantom; plans for WalletConnect | Supports Coinbase Wallet (Ethereum and Solana networks) |

| Educational Resources | Strong education tools built into platform | Coinbase Earn for NFT education and incentives |

| Marketplace Features | Rarity rankings, multi-chain trading, integrated with crypto trading services | Rarity rankings, simple NFT discovery and purchase process |

| Regulatory Compliance | Highly secure, regulated globally | Very strong regulatory focus; high compliance standards |

| Ecosystem Integration | Fully integrated with Kraken’s trading platform and services | Integrated with Coinbase exchange and wallet |

| Best For | Users seeking low-cost, flexible NFT trading with advanced tools | Beginners and those focused on ease of use and educational support |

Kraken Earn and Staking

Kraken has more assets available for staking, including popular ones like ETH, DOT, SOL, ADA, and KSM which even offers high APYs of 23%. Users can pick from flexible staking, where funds can be withdrawn anytime, to bonded staking where funds are locked for higher reward multipliers.

Compounding rewards is supported and payment automation is in place with distribution of rewards weekly. Staking commissions are charged, but high reward rates incentivize better net yields after commission.

Coinbase Earn and Staking

With Coinbase, the focus is on ease of use and learning. Eth, ALGO, XTZ, and ATOM are the only staking assets supported. Their streamlined design is great for novice users, but a 25% commission on staking rewards heavily cuts net returns.

The Earn program is unique as it educates users with short videos and quizzes about crypto while incentivizing learning through small amounts of crypto. With robust security measures and compliance, Coinbase is trusted by cautious investors.

Coinbase Pros & Cons

Pros

- Beginner Friendly Interface: Trading is simplified through a step-by-step guide and visually intuitive design which simplifies navigation.

- Educational Resources: Participants of Coinbase Learn and Earn not only get tutorials but also small amounts of cryptocurrency, which enhances their understanding.

- Strong US Presence: Offers services in most regions of the United States. Users also benefit from FDIC insurance for USD balances up to $250,000.

- Versatile Payments: Accepts credit and debit cards, PayPal, bank transfers, and even allows for the spending of crypto through a Coinbase Visa debit card.

- Account Security: Coinbase claims 98% of their funds are held in cold storage and partially insure against breaches for digital assets held.

Cons

- Higher Fees: Frequent traders face costly card fees up to 3.99% and maker-taker fees of 0.00%-0.60%.

- Limited Fiat Support: Only USD, Eruo, and British Pounds allowed, limits accessibility for rest of the world.

- Fewer Trading Pairs: Limited to 404-500 pairs compared to others, reducing options for trading altcoins.

- Limited Advanced Features: Less appealing to professional traders as margin trading and futures are not available.

- Regulatory Scrutiny: Past issues with the SEC still concern some users, especially after they moved all assets to crypto in 2025.

Kraken Pros & Cons

Pros

- Lower Fees: Active users benefit from competitive maker-taker fees (0.00%–0.26%) and card fees (3.75% + $0.25).

- Global Reach: Covers 190 countries and offers seven fiat currencies: USD, EUR, CAD, AUD, GBP, CHF, JPY.

- Advanced Trading Tools: Kraken Pro gives options for margin trading (5x leverage), futures, and perpetual contracts.

- High Staking Yields: Flexible and bonded staking options provide up to 17% APY on 17-27 assets.

- Strong Security Record: No hacks, 95% cold storage, and Proof of Reserves provides transparency.

Cons

- Complex Interface: Simpler platforms may be more appealing to beginners than Kraken Pro’s advanced tools.

- Limited U.S. Availability: Access is restricted for users in New York and Washington, limiting U.S. access.

- Fewer Staking Assets: Compared to Coinbase’s 9-147 range, only 17-27 assets supported.

- No Digital Asset Insurance: Unlike Coinbase, there are no third-party insured crypto holdings.

- Limited Payment Flexibility: Deposit via PayPal only. No debit card option for spending crypto.

Kraken vs Coinbase: Customer Service

| Customer Support Feature | Kraken | Coinbase |

|---|---|---|

| Chatbot | Yes | Yes |

| Phone Support | Yes – Available in North America, UK, and EU- US: +1 888 837 8818- EU: +353 1 223 8162- UK: +44 808 501 5031 | Yes – US only- +1 888 908 7930 |

| Email Support | support@kraken.com | support@coinbase.com |

| Self-help Materials | Yes – Help Center with guides and FAQs | Yes – Help Center, tutorials, and learning modules |

| Live Chat | Yes – 24/7 live chat with escalation to human agents | Yes – 24/7 live chat available |

| Response Quality | Fast response times; 90% satisfaction score | Slower response times but improved with Coinbase One |

| Premium Support Option | No | Yes – Coinbase One offers priority support |

| Overall Support Verdict | Better for fast response and phone availability across regions | Better rated overall, especially with Coinbase One subscription for priority help |

Conclusion

Coinbase and Kraken meet different requirements inside the crypto ecosystem. Beginners would prefer to use Coinbase because of their interface, educational content, and compliance with regulations.

Unfortunately, it has higher fees and limited features. Kraken, on the other hand, specializes in catering to experienced users. Their trading fees, additional staking options, and advanced trading features such as margin and futures are more affordable.

In the end, Coinbase is best for learning and simplicity while flexibility, cost-efficiency, and depth of crypto trades go to Kraken.