In this article, I will analyze FixedFloat Crypto. This exchange operates without any custodial controls, enabling instantaneous cryptocurrency swaps without registration or KYC verification processes, and it works quickly and securely.

FixedFloat Crypto, unlike any other exchange, offers a simplistic interface that, alongside transparency, privacy, and design, supports both bolted and floating rates for all its users. It provides all users in its network an easy, reliable, and efficient method for securely trading digital assets.

What is FixedFloat Crypto?

Launched in 2018, FixedFloat Crypto, as a non-custodial exchange, focuses on the facilitation of cryptocurrency swaps without the requirement of registration and extensive verification processes, which are customary practices in the industry. FixedFloat is known for its fast and reliable service, which is made possible by its secure platform.

The exchange offers a diverse range of crypto assets, repackaged for flexible rate options—both fixed and floating. Unlike other competitive exchanges, FixedFloat does not require KYC and thus provides swift and fully anonymous cryptocurrency swaps. Crypto traders, therefore, can retain complete control over their wallets without sacrificing ease of use.

FixedFloat Crypto overview

| Feature | Details |

|---|---|

| Founded | 2018 |

| Type | Non-custodial crypto exchange |

| Core Services | Instant crypto swaps (Fixed Rate & Floating Rate options) |

| Supported Assets | Wide range of major cryptocurrencies (BTC, ETH, USDT, LTC, etc.) |

| Registration/KYC | Not required (anonymous trading supported) |

| Speed | Fast transactions with low confirmation times |

| Security | Non-custodial, users maintain control of funds |

| Accessibility | Global availability with no regional restrictions |

| Fees | Transparent, displayed before each transaction |

| User Experience | Simple, beginner-friendly interface with easy swapping process |

How To Sign Up on FixedFloat Crypto?

Visit The Website

Access Fixed Float at the address FixedFloat.com.

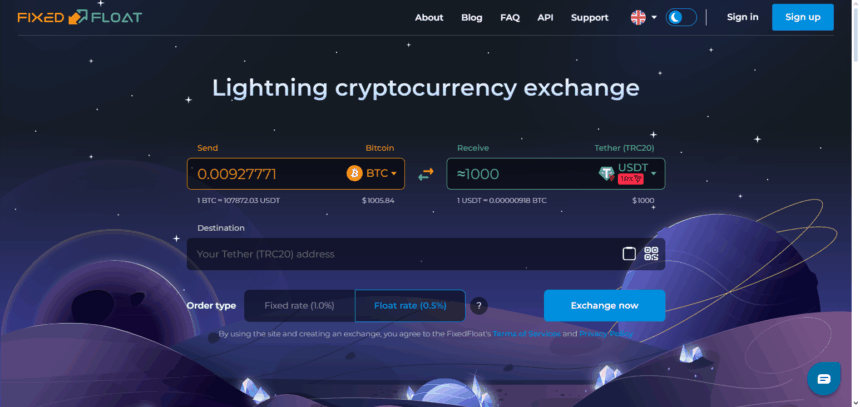

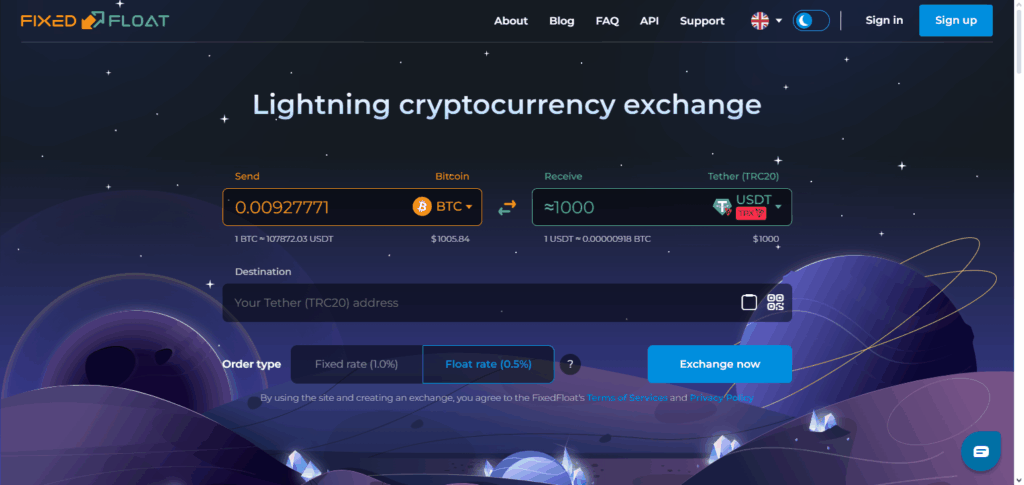

Choose Currencies

Choose the crypto you wish to send and the one you wish to receive.

Select Rate Type

Choose between Fixed Rate or Floating Rate.

Enter Wallet Address

Input with the proper receiving wallet address.

Confirm Details

Do a check on the amount, the rate and the destination wallet before proceeding.

Send Crypto

Send the selected amount to the address given by Fixed Float.

Receive Funds

After confirmation, the crypto that was swapped is sent directly to the wallet you provided Fixed Float.

How FixedFloat Works

Choose Your Swap Pair – Select the cryptocurrency you want to exchange for the one you wish to receive.

Pick Exchange Rate Option – Choose between a Fixed Rate, where the price remains constant, and a Floating Rate, where the price changes dynamically.

Enter Receiving Address – Specify the wallet where the exchanged crypto should be sent.

Confirm the Details – Check the swap details, including charges and total time required.

Send Your Crypto – Send the precise tokens to be deposited in the Fixed Float’s wallet.

Automatic Processing – Fixed Float conducts the required confirmation of the transaction on the respective blockchains.

Receive Exchanged Funds – The crypto which is swapped is directly sent to the wallet which you have specified.

Who Should Use FixedFloat?

Users of FixedFloat are those who appreciate quick and private dealings in cryptocurrency and who consider ease of use as a priority.

For users who want to exchange digital assets with no registration and no KYC waiting periods, this platform is targeted for users wanting to perform transactions seamlessly. FixedFloat is aimed at privacy-oriented users thanks to its non-custodial nature, as users always maintain total custody of their wallets.

Novice traders can appreciate user-friendly functionalities in FixedFloat’s interface, while veterans can enjoy its simplicity for instant arbitrage and cross-chain swap transactions. In a nutshell, FixedFloat is an ideal platform for stealth traders wanting instant and reliable transactions.

Benefits of Using FixedFloat

No registration required – Swap cryptocurrency instantaneously without the need to sign up, hand over personal information, or gain approval.

Privacy and anonymity – Since users do not need to undergo KYC verification, their identities are not revealed or disclosed.

Fast transactions – Processed in record time with a reduced number of confirmations required.

Non-custodial security – Wallets are never stored on-site. Users retain authority over their wallets at all times.

User-friendly and straightforward – Designed for both novice and experienced traders, users can easily navigate the interface.

Flexible exchange options – Users have the option to choose between a Fixed Rate (where the price is not flexible) or a Floating Rate (where the corridor surrounding the price is flexible).

Broad asset support – A Vast array of cryptocurrencies can be swapped.

Transparent fees – Users pay a cost before a transaction is approved.

Geographic freedom – Users can access the service anywhere in the world without being restricted by geographical borders.

Safety and Security Measures

Non-Custodial Wallet – FixedFloat does not act as a custodian for user wallets. Every crypto swap involves fund transfers from user wallets, which minimizes custody risk.

No KYC – FixedFloat does not collect sensitive information, which protects users from identity theft and data breaches.

Transparent Transactions – No confirmation charges or hidden fees. All fees and exchanges are disclosed before confirmation.

Verification on Blockchain – Every swap is confirmed and authorized through blockchains.

Platform Encryption – Transaction data is protected through secure communication protocols.

Control of Wallets – Users remain in control of crypto assets at all times as they provide their own wallet addresses.

Reduced Attack Surface – No account systems and stored balances result in lower attack vectors than centralized exchanges.

Is FixedFloat safe to use?

Yes, FixedFloat is considered safe to use because it never stores or controls user funds; it operates as a non-custodial exchange. All transactions are directly performed between wallets ,which maximizes user ownership and minimizes risks associated with custodial exchanges. Additionally, it does not require registration or KYC, which minimizes the chances of disclosing sensitive information.

FixedFloat is also considered a trustworthy platform because it utilizes SSL encryption and transparent fee structures with no hidden fees, ensuring trust in every transaction. Although network delays in the blockchain can be detrimental to speed, the FixedFloat platform excels in prioritizing user privacy, control, and security, making it a reliable platform for crypto swaps.

Key Features of FixedFloat

Instant Crypto Swaps

Provides rapid and simple swaps across a number of the most traded cryptocurrencies.

Non-Custodial Platform

FixedFloat does not hold user funds; therefore, users maintain complete ownership of their cryptocurrency.

No Registration & KYC

Start swapping right away without going through an onboarding process or sharing sensitive information.

Fixed & Floating Rate Options

Users can select between a Fixed Rate, which is a set price, and a Floating Rate, which is based on current market conditions.

Wide Cryptocurrency Support

Provides users with a wide array of coins and tokens, including BTC, ETH, USDT, LTC, and more.

Transparent Fees

All charges are fully disclosed and visible before the deal is finalized.

Fast Transaction Processing

Efficient and dependable swaps are attained through fast blockchain confirmations.

Simple Interface

A straightforward design that facilitates ease of use, especially for beginners.

Global Accessibility

It has no geographical limitations and can be used by anyone, regardless of their location.

Pros and Cons of FixedFloat

| Pros | Cons |

|---|---|

| No Registration or KYC – Users can swap crypto instantly without identity verification. | No Fiat Support – Only supports crypto-to-crypto swaps, not fiat currencies. |

| Fast Transactions – Quick processing with minimal confirmations. | Limited to Swaps – No advanced trading features like spot, futures, or margin trading. |

| Non-Custodial Security – Users keep full control of their funds. | Dependent on Blockchain Speeds – Delays may occur if the network is congested. |

| Privacy-Friendly – Ensures anonymity for traders. | Fewer Features than Centralized Exchanges – No charts, order books, or trading tools. |

| Transparent Fees – Costs are shown upfront before transactions. | Customer Support Limitations – Mainly online support, with no live chat or phone assistance. |

| User-Friendly Interface – Simple and accessible even for beginners. | Risk of Wrong Address Input – Mistakes in wallet addresses can’t be reversed. |

FixedFloat Crypto Alternatives

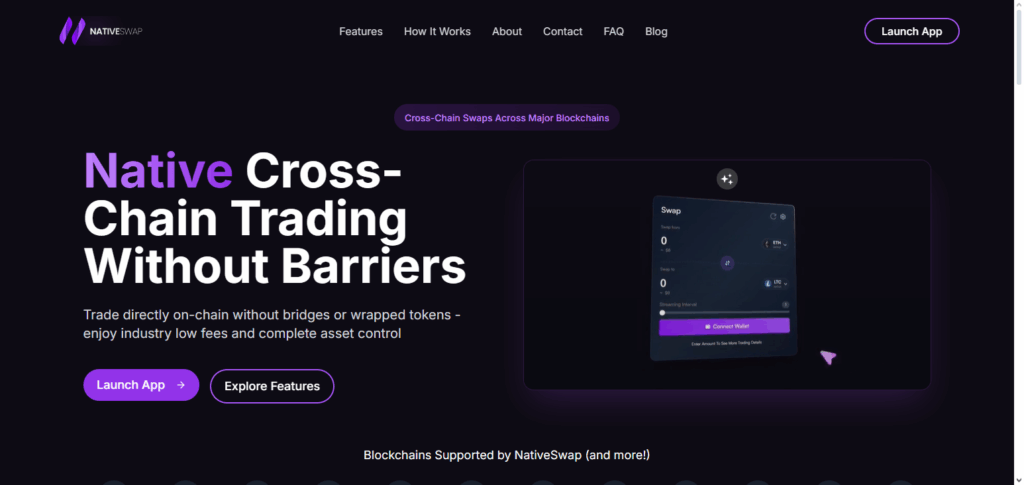

NativeSwap

Recognized as FixedFloat Crypto, NativeSwap is unique among instant exchange services as it has no account requirements, does not necessitate logins, and does not request KYC verification, making it a completely non-custodial and privacy-focused platform.

FixedFloat does not exchange user funds as traditional exchanges do; instead, it swaps funds directly between wallets, giving users complete account control. Its main, unique feature is the dual-rate system—providing both Fixed and Floating rates—enabling traders to select price stability or market-driven flexibility, thus making it fast, secure, and available worldwide.

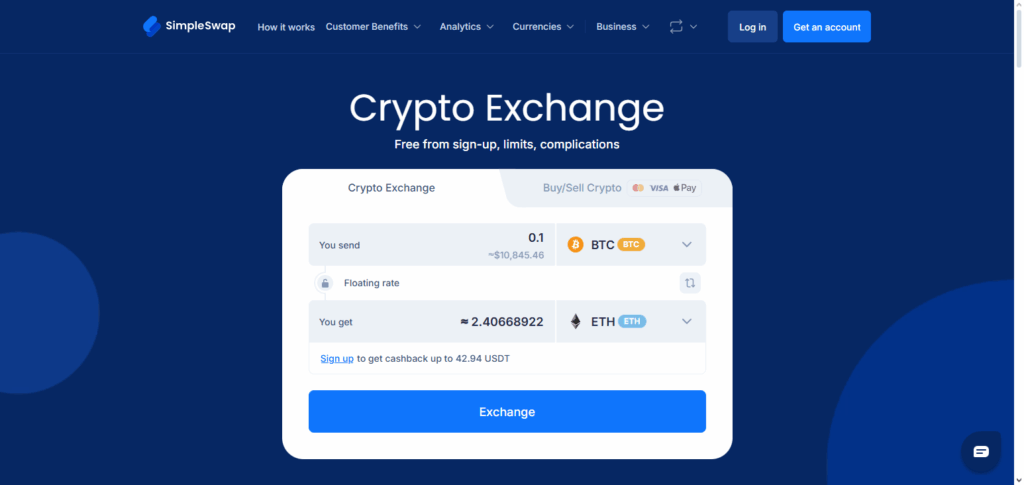

SimpleSwap.io

SimplySwap.io, in comparison to FixedFloat Crypto, also employs an instant exchange model, which appears to be the primary model they operate under. However, what sets FixedFloat apart is its concentration on speed, clarity, and flexibility of the rates.

Though both are non-custodial, FixedFloat is the preferred option because the customer is presented with a choice of fixed and floating rates and the fee transparency guarantees no concealed charges. Their streamlined fee structure eliminates redundant processes, thereby improving transaction speed and user privacy. This is the reason FixedFloat is considered the best solution.

Conclusion

Equipped with advanced technology, FixedFloat Crypto has become an exchange renowned for its impressive reliability and speed, serving users who require privacy and simplicity in their crypto transactions. It offers instant swaps, a non-custodial design, and a choice of fixed or floating rates, appealing to both newcomers and seasoned traders.

What FixedFloat does better than its competition is to remove registration and KYC controls, thus maintaining complete user autonomy and anonymity. Anyone seeking a reliable and user-friendly platform, particularly those with privacy concerns, will find FixedFloat to be highly impressive.

FAQ

What cryptocurrencies does FixedFloat support?

It supports a wide range of popular assets, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Litecoin (LTC), and many more.

Do I need to create an account to use FixedFloat?

No, FixedFloat does not require any account creation. You can swap instantly without sign-up.

Is FixedFloat safe to use?

es, FixedFloat is non-custodial, meaning it never holds your funds. Swaps go directly between your wallet and the exchange system.