In this article, I will discuss the Grayscale XRP Trust, a financial instrument that enables investors to invest in XRP without buying or managing the cryptocurrency.

Being one of the Grayscale crypto investment trusts, it opens up investments in XRP.

In contrast, customers would have a safe and regulated way of investing in digital currencies to enhance their portfolios.

What is the Grayscale XRP Trust?

The Grayscale XRP Trust is an investment instrument established by Grayscale Investments. It allows accredited users to invest in XRP, the cryptocurrency used on the XRP Ledger for cross-border payments.

This enables investors to access XRP without buying, holding, or handling the cryptocurrency.

Instead, the Trust seeks to provide investors with the opportunity to invest in XRP without actually purchasing it by tracking the market price of the investment minus the applicable fees and expenses.

Furthermore, the future creation of an exchange-traded fund (ETF) is possible.

How Grayscale XRP Trust Works?

The Grayscale XRP Trust provides qualified purchasers with exposure to XRP, the virtual currency used alongside the XRP Ledger for settling fast and low-cost transactions, without taking actual ownership or exposure to the currency.

Investors acquire Trust shares, and XRP held in the Trust is done on their behalf.

Such share value represents the market value of the total assets managed, specifically the XRP, and less relevant management fees and other operating expenses.

This arrangement has enabled investors to participate in the digital currency market while utilizing Grayscale’s management of digital assets.

The Trust is also expected to be converted into an Exchange-Traded Fund, thus broadening its availability and liquidity.

Benefits of Investing in Grayscale XRP Trust

Participating in the Grayscale XRP Trust comes with many advantages, including;

Indirect Exposure

There are means for investors to obtain exposure to XRP without the purchase protrusion or storage or experience the challenges of managing such assets effectively.

Professional Management

The trust is managed by Grayscale Investments, a well-respected institution that has mastered the art of successfully managing digital assets. Thus, custodianship and control of the assets are done professionally.

Regulated Investment

The Trust is a registered investment vehicle, and it requires regulatory compliance, which is very important, especially to new investors in cryptocurrency.

Market Tracking

The Trust aims to achieve the investment objective of tracking the XPR market so investors can take advantage of the currency’s appreciating value.

Potential for ETF Conversion

In the future prospectus, it may be envisioned that the Trust may be changed into an exchange-traded fund, enhancing its liquidity and availability to the broader investor base.

How to Invest in Grayscale XRP Trust?

Putting money into the Grayscale XRP Trust is an excellent option to acquire exposure to the token XRP, which is aimed at cross-border transactions within the XRP ledger. The detailed investment process is described below:

Accredited Investor Status

Make sure you are an accredited investor. Prospective investors in Grayscale’s private placement products must meet this qualification.

Open an Account

When you qualify, you must also open an account with Grayscale. This requires submitting documents to confirm your accredited investor status.

Subscription Process

After this process, you can subscribe to the Grayscale XRP Trust.

This occurs through a private placement, which is the direct purchase of shares from Grayscale at a net asset value of twenty-four dollars per share.

Holding Period

Also, know that shares purchased through private placement usually have a holding period of at least one year.

Monitor Your Investment

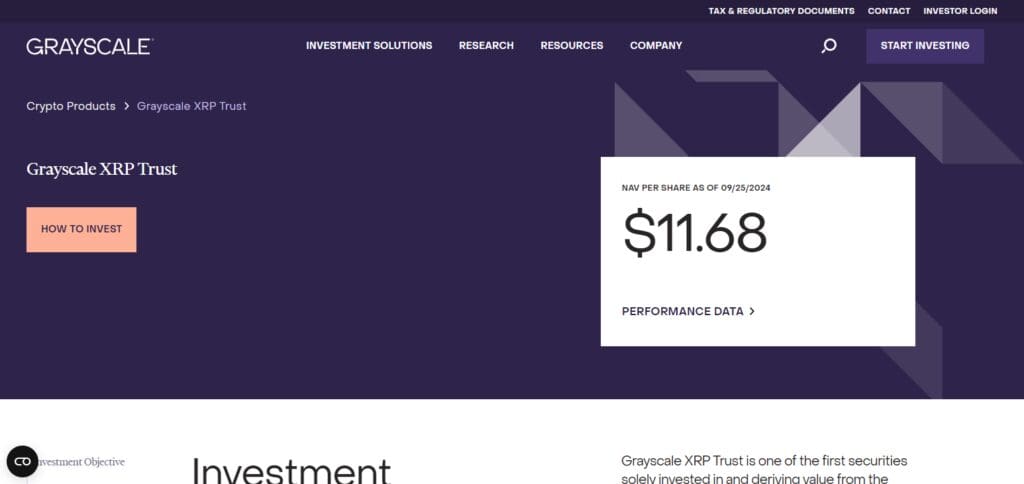

Estimate the net asset value per share after determining the share price and managing the trust.

Grayscale has intranets from which one can get information on the value and performance of investment products.

Risks and Considerations

Like any other, the Grayscale XRP Trust investment has its fair share of risks and considerations. Below are some of the pointers worth noting before proceeding further:

Market Volatility

The market value of XRP is very volatile and depends on several factors, including market opinion, regulations, and the economy in general. Because of this volatility, the value of your investment may vary widely.

Regulatory Risks

Assets like XRP are often exposed to risk regulations. If regulatory structures or laws are altered against XRP or its associated organisations, their valuation will be affected.

Liquidity Risk

Although Grayscale’s trusts are intended to create liquidity, you might face the challenge of selling your shares at the price you anticipate when the market is very turbulent.

Technology Risks

The XRP and XRP Ledger technologies are relatively complex and still developing. Any of the described technology failures, abuses, or transitions might adversely affect the worth of XRP.

Management Fees

The fees to be incurred include management fees, which Grayscale applies to the trust’s upkeep. If poorly understood, such costs could shave off some of your gains in the long run.

Holding Period

Shares acquired via private placements have an average holding period of less than one year. This means you won’t be able to offload any of your shares immediately if you require liquidity.

Market Sentiment

XRP value can potentially be affected by the prevailing market conditions, which is highly risky. Any news, good or bad, social media or the public in general can cause fluctuations in the price of XRP.

Diversification

It is also essential to consider how this investment relates to other assets in your portfolio. Investment diversification could contain investment risks.

Conclusion

Through Grayscale XRP Trust investment, individuals can acquire exposure to XRP, an enormous cryptocurrency capitalized for making capitalized payments.

Nonetheless, potential vulnerabilities must be considered, including market, regulatory, and liquidity risks.

In addition, one also needs to know the trust’s fee structure, the required period for holding the investment, etc., and only then should one consider investing.

Like any investment, options trading is an individualized equity plan included within a portfolio; it is fully integrated. Staying informed and alert will assist you in navigating the Grayscale XRP Trust investment.