In this article, I will cover the Hottest Stocks To Invest In Right Now in and explain the reasons for my decisions, focusing on aspects like growth opportunities, innovation, and market leadership. Sectors include: technology, healthcare, finance, and e-commerce.

These stocks provide investors different options. If you’re looking to have a well-rounded portfolio, you should consider these selections.

Key Point & Hottest Stocks To Invest In Right Now

| Company Name | Key Point |

|---|---|

| Meta Platforms | Leading in social media and investing heavily in AI and the metaverse. |

| Microsoft | Dominates enterprise software and cloud computing with Azure. |

| Amazon | Global leader in e-commerce and cloud services through AWS. |

| Alphabet | Controls search engine market via Google and expanding in AI development. |

| Nvidia | Top provider of GPUs powering AI, gaming, and data centers. |

| Palantir Technologies | Specializes in big data analytics for governments and enterprises. |

| Tesla | Innovator in electric vehicles and autonomous driving technology. |

| MercadoLibre | Latin America’s largest e-commerce and digital payments platform. |

| Visa | Global leader in digital payments and financial transaction processing. |

| Pfizer | Major pharmaceutical company known for vaccines and drug development. |

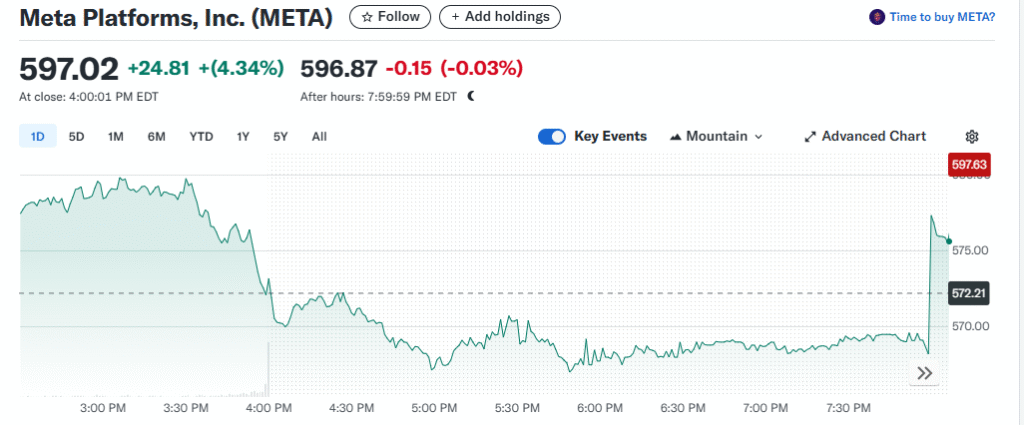

1. Meta Platforms (META)

Simply put, Meta Platforms is leveraging the advancement of AI and social media alongside the growth of their company. Through advertising alone, Meta was able to earn $164.5 billion in revenue in 2024, all while possessing over 3.3 daily users on their apps, such as Facebook, Instagram, and WhatsApp.

Further monetization through AI features, capable of increasing users to 1 billion, serves only to improve user experience. The company also has emphasized growth-focused markets such as virtual reality (the Metaverse) and Threads, which currently sees over 320 million users, is a social media platform also owned by Meta.

AI functionality alongside profitability have allowed analysts, such as Barclays, to project a target of $705 and view Meta as a strong investment opportunity despite market volatility.

Meta Platforms (META) Features

Social Media Presence: A whopping 3.3 billion daily active users of Facebook, Instagram, WhatsApp, and Threads combined.

Advertising revenue: Received $164.5 billion in 2024 due to ad revenue alone.

AI Achievements: Meta AI targets 1 billion users, with better ad engagement and user interaction.

Threads Growth: 320 million users on Threads, competing with X and benefitting metaplasma network’s ecosystem.

Metaverse: further bolstered by their investments in VR/AR with Meta looking to steer into deeper immersive tech markets.

2. Microsoft (MSFT)

With Azure cloud servicing, Microsoft is experiencing significant growth and maintains a strong position in AI and cloud computing. In Q1 2025, Microsoft reported a revenue of $70 billion, an increase attributed to the incorporation of AI in the Office Suite and Bing and all other services.

It stands to benefit from the $5.5 trillion AI market due to the partnership with OpenAI which is setting its AI iniving capabilities. Even though Microsoft’s stock experienced a decline of 12.3% in 6 months, the diverse portfolio which includes gaming and enterprise software ensures stability.

Analysts remain bullish on the stock as it is expected to incur long-term losses due to AI investement. The strong performance in the execution and innovation of Microsoft allows this company to be regarded as a top pick for those investors who need reliable tech options.”

Microsoft (MSFT) Features

Leader in Cloud Computing: Azure captures significant use in the $600 billion cloud computing market.

AI Integrations: Collaborations with OpenAI on AI services in Office, Bing, and company’s aid tools.

Enterprise Infrastructure: Respected for cybersecurity and productivity applications pervading enterprise-grade solutions.

Robust Financial Figures: $70b in Q1 2025 revenue validates earnings claims.

Diverse Holdings: Includes software, gaming via the Xbox, and expanding into hardware with Surface.

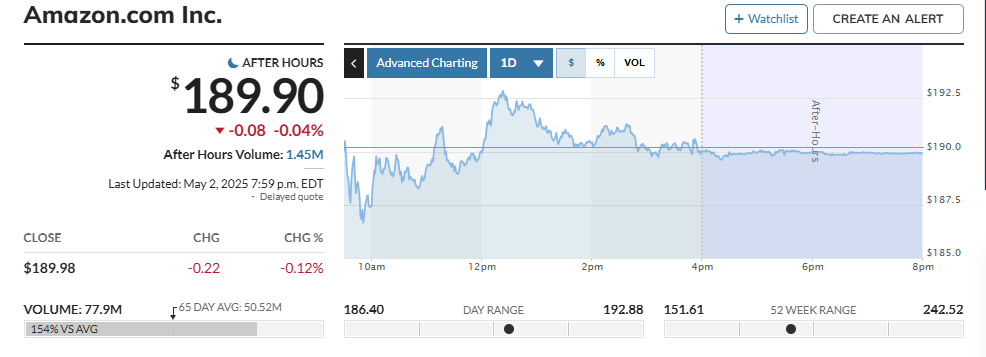

3. Amazon (AMZN)

Amazon is a leader in e-commerce growing service industry with its subsdiary called amazon Web Services which named Number One Server’s Vendor by 2024. The company had an annual revenue run of $115 billion.

Its fuel growing $AWS are ISV Nvidia chip offerings and in-house AI solutions powered by AWS for Clients. With the $4 billion small town delivery program, amazon’s expansion into retail is enabling the soar to retain its strength.

Certified retail contractors and drop shipping led to a stock dip by 21.3% in 2025 yet their forward P/E of 29 is convinient for long-term stocks. Operating efficiency from AI across border powered by diverse income streams makes this company one of the best to be considered investing in.

Amazon (AMZN) Features

E-commerce: The world’s leading retailer with an unmatched logistical infrastructure capable of same day deliveries.

AWS Reign: Booming at $115b annual revenue run rate for cloud and AI services, commanding the AWS market.

Retail Growth: Amazon is bolstering market penetration with laying out $4b for delivering to rural areas.

Admitted AI Claims: Providing Nvidia chips and proprietary AI aids lowers investment costs.

Reduced Spending: The revenue ration widens with retails, streaming via Prime Video, and ads.

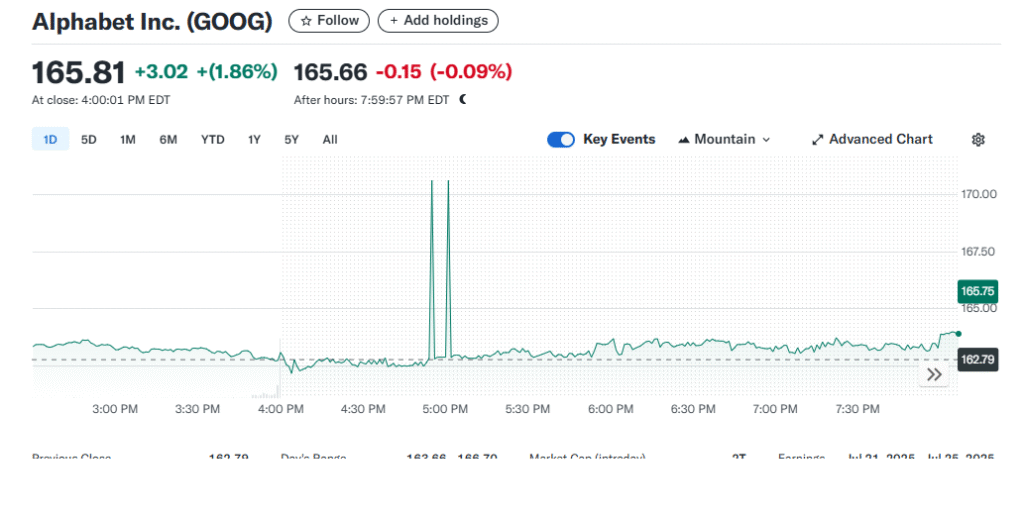

4. Alphabet (GOOGL)

Using Google as its flagship subsidiary, Alphabet still commands 90% of the global internet searches. However, it does face being muscled out by AI models such as ChatGPT, which pose a competitive threat to Google.

Wiz, for example, is a $32 billion cloud division and AI investment cum acquisition that propels growth. In 2025, Alphabet’s stock is down 19.5% but trades at an appealing P/E of 25, along with an estimated April growth of 15% earnings per annum.

Google alongside YouTube composes divergenced revenue generators while AI advancements seeks to mitigate loss of search dominance.

Buoyed by innovations along with leadership in the market, short-term hurdles remains worth the wait for long term tech change investors.

Alphabet (GOOGL) Features

Search Engine Monopoly: Google controls 90% of global search traffic.

Cloud Growth: Google Cloud is a quickly expanding segment with AI-powered offerings.

AI Investments: Cybersecurity and AI potential are cemented with the Wiz acquisition for $32 billion.

YouTube Revenue: Has a global reach as a vital ad and subscription revenue generator.

Innovation Hub: Active R&D in AI, quantum computing, and self-driving cars.

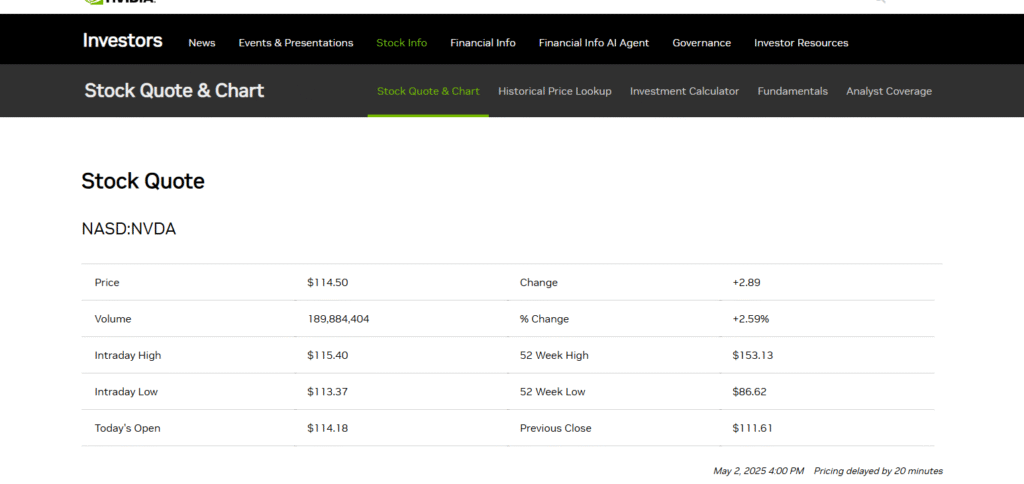

5. Nvidia (NVDA)

The boasts of having a dominace rule under its reign AI chip market are previleged on Nvidia courtesy of AI/data $1.7 trillion sector. AI model training requires the use of its GPU, which single-handedly returns 171.2% in 2024.

Even though they suffered a 24.4% drop in 2025, their P/E of 37 and projected 35% annual earnings offers a PEG ratio of 1 which signals value. Lately, the bigger market integrates desktop supercomputers in data centers.

AI capex from Meta worth $64 billion increases demand and boosts Nvidia’s credibility and trajectory which makes it a targeted investment, but these purchases should be made on dips.

Nvidia (NVDA) Features

AI Chip Leader: AI/data market stands at $1.7 trillion and Nvidia leads it with GPUs.

High Growth: 171.2% returns in 2024 due to AI model training requirements.

Innovative Products: Desktop supercomputers evolve beyond data centers.

Strong Financials: 35% projected annual earnings growth with PEG ratio of 1.

Market Demand: Gains from spending by tech businesses on AI capex like Meta’s $64 billion.

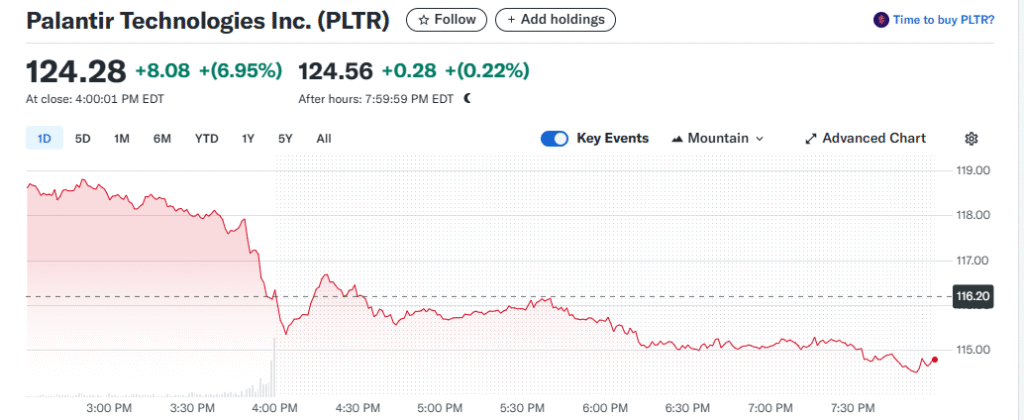

6. Palantir Technologies (PLTR)

Government and commercial clients are serviced by Palantir and its AI driven Data analytic software with a booming 2024 revenue projection is set to rise up to 608.4 million.

The increase in subscribers AI requested propelled the number of users by 35% to 497. The stock is still 32.7% off its 52 week high and is currently trading at a premium, despite Palantir gaining 340.5% in 2024.

The stock’s low rating is due to valuation concerns, which has led analysts to rate it a ‘Hold’. Nonetheless, Palantir did outperform Nasdaq’s 129.1% 52 week surge.

With Palantir’s boot camps and AI Platforms (AIP) other functions to drive efficiency, the stock presents significant risk and reward for those looking at the long-term impact of AI.

Palantir Technologies (PLTR) Features

AI Data Analytics: Platforms such as AIP cater to government and commercial clients.

Revenue Growth: Increase of 20% to $608.4 million in 2024 with customer growth of 35%.

High Market Performance: 129.1% surge over 52 weeks, beating Nasdaq.

Client Efficiency: Boot camps promote implementation of AI-based decision making tools.

Scalable Solutions: Broader application in healthcare, defense, and finance.

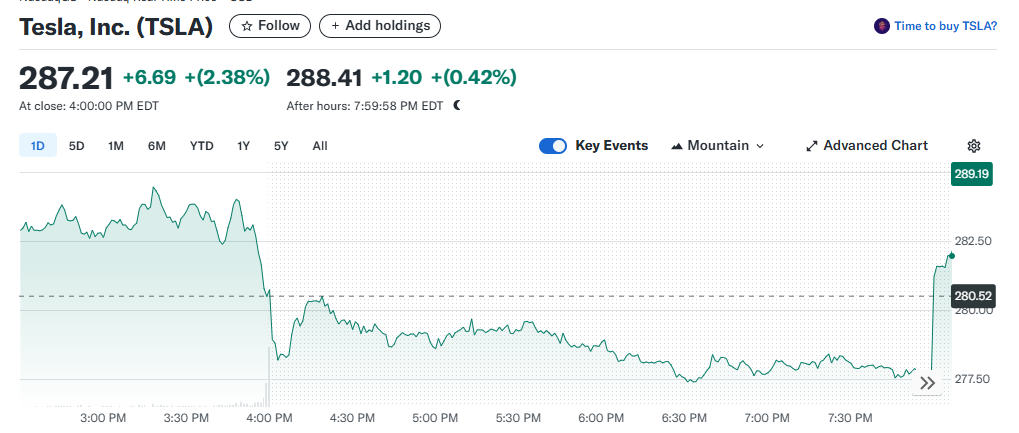

7. Tesla (TSLA)

The $1.5 trillion spending opportunity in EV/robotics marks competition from China’s Zeekr as a spurring challenge for Tesla, resulting in a 7% stock decline. Analysts believe there’s room for 26% growth.

The sustained growth of Tesla’s self-driving Megapack combined with energy storage technologies reinforces its value.

The company’s latest innovation in AI-powered autonomous driving may have led to a 23% dip in the March 2025 month-to-date figure, but it does keep the company in conversations.

For risk-hungry investors, the high P/E means volatility and attraction. The integrated long term vision with sustainable energy and robotics fuels interest in the stock.

Tesla (TSLA) Features

EV Market Leader: Remains unrivaled in electric vehicles, maintaining a sprawling global supply chain.

AI-Driven Autonomy: Self-driving technology progression for robotaxis.

Energy Solutions: Megapack and solar products megacapturing renewables.

High Growth Potential: Set sights on capturing \t$1.5 trillion EV/robotics market.

Brand Loyalty: Remains shielded from erosion by fierce competition.

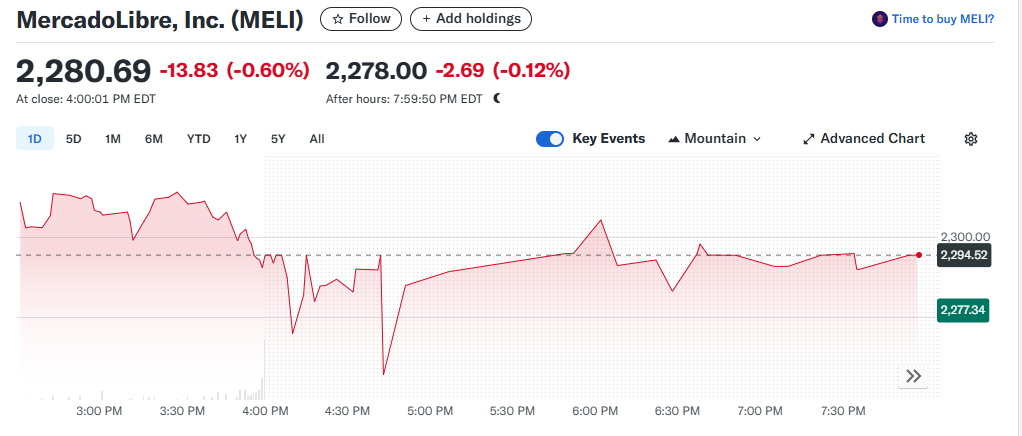

8. MercadoLibre (MELI)

The MercadoLibre marketplace has burgeoned throughout the years, as the Latin America’s leading e-commerce website they extensively export and tap into other regions as well.

The company alone is worth 1 trillion dollars and is projected to be it’s worth 14% greater due to stagnation in Mexico and Brazil’s economies.

Despite the gross income risks of South America, MercadoLibre is expending their user base which means they still have a chance, This is further enabled by it fortifying arm, Mercado Pag, which adds diversifacation through Mercado overlooks.

Even though the value is refuemed, they categorize as a high growing firm and enable exports to surging business sectors.

MercadoLibre (MELI) Features

Latin American Focus: Dominates e-commerce and fintech in Brazil and Mexico.

Fintech Growth: Surge of digital payments and financial services via Mercado Pago.

Logistics Strength: Advanced delivery system like Amazon.

High Revenue Growth: Expects 50 percent revenue growth in 2024 with a $1 trillion market.

Emerging Market Exposure: Access bodes well for investors seizing high-growth potential markets.

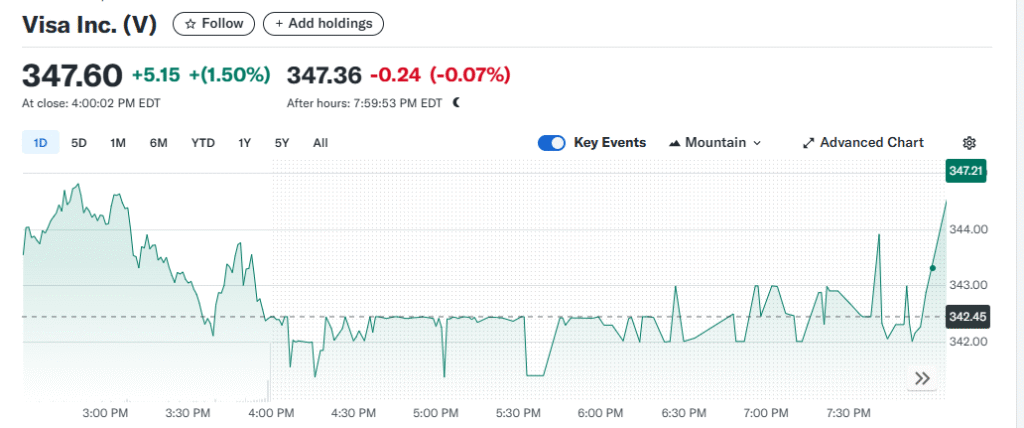

9. Visa (V)

Being a world leading countries in finances, Visa holds a massive scope of reputation and enables a tremendous amount of payments being processed every year hand in hand with digital payment option.

The benefit of consistently earning from fee charged transactions enable Invista to consistently remain profitable. Even during the economic downshift experienced in 2024, the company ensured good market stature.

Industry analysts speculate a 10-12% rise yearly for the period, them being caused from increase in e-commerce and revival of border traveling promising stronger business.

Instilling conservatism enabled the company to survive dangerous time by utilizing constructed Investma ensuring invista remain non-volatile. Alongside this, verstandig dieming widens the cooperation making fintech sky rocket with unmatched marketing.

Visa (V) Features

Global Payments Leader: Manages billions of transactions through their extensive networks.

Stable Revenue Model: Remains profitable from fees charged for each transaction.

E-commerce Growth: Gains from contactless and digital payments.

Low Volatility: Dependable stock with 30 P/E, 10-12% earnings growth.

Dividend Yield: Sought after stock due to income-making investors.

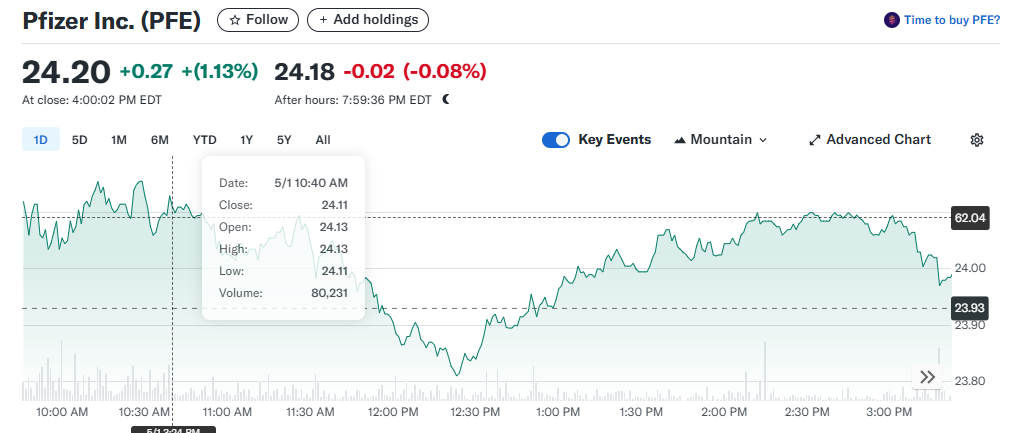

10. Pfizer (PFE)

Despite uncertain rate tariffs hindering US investment, caused by the company’s CEO, Pfizer allocates resources to cancer treatments and mRNA vaccines, which boosts long-term growth. In 2024, revenue was steady alongside expectations of 8-10% annual growth from analysts.

Pfizer’s peers are considerably more expensive, as he trades at a P/E of 12, pays high dividends, and is regarded as undervalued.

High demand for health services globally combined with pessimistic projections make his R&D capabilities appealing. Volatile markets have seen huge dips throughout the year, making Pfizer a prime target for value investors looking to avoid risk.

Pfizer (PFE) Features

Pharmaceutical: Robust pipeline in mRNA vaccines and cancer therapeutics.

Steady Income: Recurring profits due to sustained international healthcare consumption.

P/E 12 and above-average dividend yield indicate underpriced stock.

Increased spending on new technologies guarantees sustained development.

Broadly accessible consumables: Reliable name in medicine around the globe.

Conclusion

The stocks which will reach their peeks by 2025 include—Meta Platforms, Microsoft, Alphabet, Amazon, Nvidia, Palantir, MercadoLibre, Visa, Tesla, and Pfizer. These stocks will take hold of opportunities in tech, AI, eCommerce, medicare, fintech, EVs, and pharmaceuticals.

With regards to AI advancement, Nvidia and Meta take the lead while Microsoft and Amazon dominate the cloud computing industry. Palatir’s data analytics system makes them excel in AI along with Alphabet who balances between ai and search.

Pfizer makes healthcare investment affordable while Tesla establishes control and autonomy over EVs. Visa ensures stable payments while MercadoLibre works on unlocking the potential of Latin America’s market.

All of these stocks blend innovation with stability and growth making them enticing for investments. However, it is suggested to do proper research, if you are planning to invest in these stocks, before investing.