I’ll go over how cryptocurrency platforms fairly set staking rewards in this post. Staking payouts are a major motivator for users to join a network, and systems employ tokenomics, validator performance, transparent computations, and staking durations to guarantee equity.

Knowing these elements promotes network stability and security while enabling investors to generate steady returns.

What Are Staking Rewards?

Rewards for staking are one of the forms of passive income that can be generated with the help of cryptocurrencies, as long as they are held long enough. Users can obtain these rewards by participating in the proof-of-stake (PoS) consensus, essentially validating transactions.

Users can mine through different means, instead they choose to ‘lock’ their tokens. After a period of time, they are then rewarded in the same tokens that they staked, as well as, other tokens. The rewards often have a financial basis to them, but they also intend to give these users a pledge to the network.

The exact staking rewards are defined by, inflation of the network, time period to which they are staked, the activity of the validator, as well as the fees for the platform. By rewarding users for staking, platforms increase users activity, and also increase the stability of the ecosystem by token circulation.

How Crypto Platforms Set Staking Rewards Fairly

Example: Step-by-Step Calculation of Staking Rewards

Step 1: Specify Total Pool of Rewards

- The platform allocates a certain number of tokens per year for staking rewards based on the tokenomics/ network inflation.

- Example: 1,000,000 tokens reserved for stakers/year.

Step 2: Account for Staking Participation

- The platform calculates how many total tokens are staked by all the participants.

- Example: 50,000,000 tokens staked by all users.

Step 3: Establish Base Reward Rate

- The reward rate is determined by dividing the size of the reward pool by the number of staked tokens.

- Example: 1,000,000/50,000,000 = 2% annual reward.

Step 4: Consider Length of Time of Staking

- Longer staking periods get rewards that are proportionally higher.

- Example: 3-month lock = 1.8%, 12-month lock = 2.5%.

Step 5: Include Validator Performances and Fees

- Consider the platform’s fees and validator uptime when calculating the rewards.

- Example: A validator with 95% uptime may reduce rewards a bit to make for a more fair system.

Step 6: Calculate Rewards and Publish Them

- The platform publishes all of its calculations, so its users know how they got their rewards.

Factors Influencing Staking Reward Pricing

Network Inflation & Tokenomics

- Reward distribution is determined by the total supply and the rate of inflation of the crypto.

- Token value can decline over time due to high inflation.

Staking Duration & Lock-Up Periods

- Staking duration of the lock up periods is incentivized with the higher reward values.

- Insurance products are also available with low rewards.

Validator Performance & Reliability

- Rewards are influenced by the participation, evenness, and uptime of the validators.

- Users reward with poor validators are lower.

Platform Fees & Operational Costs

- Peripheral services and staking rewards are kept to a fraction of the percent to cover the costs of sustaining.

Market Demand & Token Liquidity

- A higher number of users can reduce the value of staking rewards.

- Limiting the value of rewards can occur by having high demand in the staked tokens.

Tips to Maximize Staking Rewards Fairly

Choose Reputable Platforms

- All staking platforms and exchangers should have proper security and unrivaled reputation with reward policies you can understand.

Stake Longer

- The rewards usually increase with the length of the locking period in the liquidity staked.

Diversify Your Staked Assets

- Better overall returns and less risks can be achieved through staking in more than one asset or platform.

Monitor Your Validators

- You could be in danger of getting less rewards or losing tokens if you have not performed scouting of good and high nominators of stakers.

Know the Reward Calculation

- You should learn the methodologies of reward calculations in each platform.

Stay Updated on Changes in the Network

- If there are proposals and changes in the network, they may affect the rewards in staked assets.

Reinvest Rewards Wisely

- Rewards can be compounded by reinvesting, which will generate and increase your staked liquidity for better returns.

Are staking rewards the same for all users?

No, not every user receives the same staking benefits. Rewards depend on several factors, including the amount of tokens staked, the chosen validator, and the duration of staking. Higher returns are usually obtained by users who commit tokens for longer periods of time or invest more of them.

Additionally, validator performance plays a significant role—validators with high uptime and dependable network participation distribute incentives more effectively, while poor validators can limit payments or even trigger penalties (slashing) for delegators.

Because some exchanges deduct a percentage prior to distribution, platform fees and operating costs also have an impact on net rewards. Individual payouts therefore differ, even on the same platform, depending on each user’s contribution, staking decisions, and the state of the network as a whole.

Risks & Considerations for Stakers

Market Fluctuations

- Prices of cryptoassets can change quickly, and the value of rewards from staking can diminish as a result.

Risks from Lock-Up Periods

- When funds are staked, they can become locked up and inaccessible, and withdrawing funds early could result in penalties and deferral of rewards.

Performance of Validators and Slashing

- Insufficient performance from validators, as well as erroneous network performance, can lead to a decrease in reward value and/or loss of a portion of the staked amount (slashing).

Risks from the Platform’s Security

- The staked assets can become compromised and lost from hacks, bugs, or other forms of staking platform mismanagement.

Risks due to Regulations

- New laws can change staking availability, taxation, or the way the platforms operate.

Reward Dilution and Inflation

- Network inflation can decrease the yield of the network over a period of time when rewards are diluted.

Risks of Illiquidity

- Staked assets are often not able to be traded and the ability to take advantage of market movements is limited.

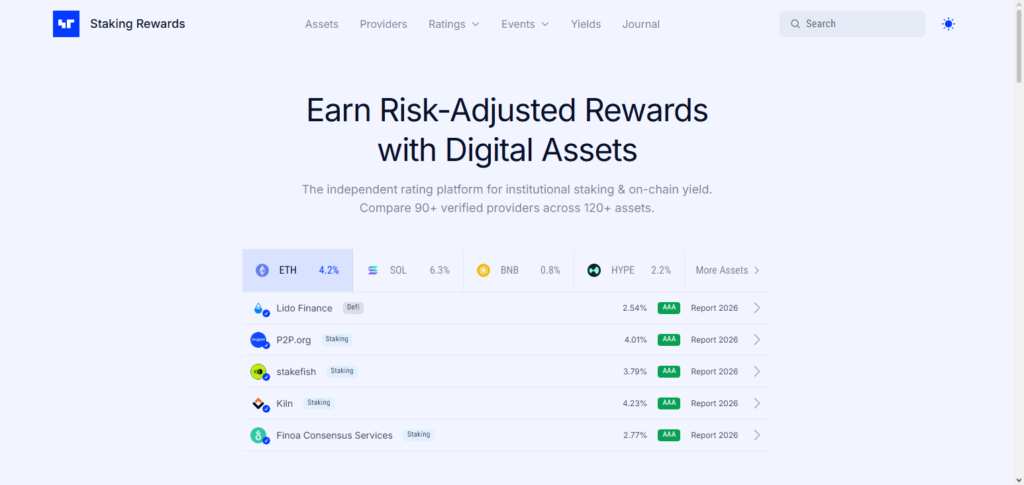

Examples of Crypto Platforms & Their Staking Rewards

Binance Staking

- Provides staking for numerous crypto assets with an annual yield of 3% to 20% depending on asset and lock-up period.

- Flexible staking options and locked staking period available.

Coinbase Staking

- Supports major proof of stake (PoS) cryptocurrencies like Ethereum, Polygon and Tezos.

- Rewards are auto-distributed and are usually from 4% to 6% APY.

Kraken Staking

- Provides both on and off-chain for a number of crypto assets.

- Annual rewards are 5% to 13% depending on the asset and duration of staking.

Crypto.com Earn

- Offers rewards that are tiered based on the amount of CRO or other tokens staked.

- Locked staking offers 14% APY for select assets.

eToro Staking

- Users can stake selected coins on the platform.

- Rewards are usually from 3% to 7% and paid out automatically.

Can staking rewards change over time?

Indeed, staking payouts might fluctuate over time due to a number of factors. The majority of cryptocurrency platforms base their reward calculations on market demand, validator performance, network inflation, and the overall number of tokens staked.

Because the reward pool is divided among many participants, individual benefits may decline as more users stake their tokens. In a similar vein, payments for a validator’s delegators may decrease if they perform poorly or are penalized for network outages.

Platforms may potentially adjust incentive rates to reflect changes in tokenomics, such as new token issuance or governance choices.

Staking incentives can also be altered by protocol modifications or network upgrades. Users are better able to plan their staking strategy and successfully manage expectations when they are aware that staking incentives are dynamic.

Future Trends in Staking Rewards

The future of staking incentives is projected to become more dynamic, transparent, and user-focused as blockchain technology progresses. Platforms are rapidly implementing flexible and algorithmic reward systems that modify rates in real-time according on token availability, demand, and network involvement.

Through smart contract interactions and liquidity pools, integration with DeFi protocols will enable stakeholders to generate extra revenue. Reward models are also being shaped by community governance, which allows users to influence the distribution and setting of rates.

Additionally, improved analytics and dashboards will assist stakers make informed decisions, while developments in cross-chain staking could provide payouts from many networks simultaneously. In general, staking systems that balance user incentives with network security and sustainability are becoming more equitable, transparent, and effective.

Benefits & Drawback

| Benefits | Drawbacks |

|---|---|

| Earn passive income on staked tokens | Tokens may be locked, reducing liquidity |

| Supports and secures the blockchain network | Market volatility can reduce the real value of rewards |

| Encourages long-term holding, reducing token supply pressure | Poor validator performance can lower rewards |

| Can offer higher returns than traditional savings | Platform fees may reduce net rewards |

| Opportunity to participate in network governance | Regulatory changes may affect staking eligibility |

| Potential for compounding rewards by reinvesting | Risk of slashing or penalties for network errors |

| Transparent reward systems on reputable platforms | Staking rewards may be diluted by high network inflation |

Conclusion

In conclusion, a variety of criteria, including network inflation, staking length, validator performance, platform fees, and market demand, are balanced by cryptocurrency platforms to determine staking rewards in a fair manner.

Clear communication, trustworthy validators, and transparent reward computation all contribute to ensuring that participants receive predictable and proportionate returns.

Although staking promotes network security and provides appealing passive income, it’s crucial for stakers to be aware of the hazards involved, such as market volatility, lock-up times, and possible fines.

Users may optimize their profits while supporting the stability and expansion of the blockchain ecosystem by selecting reliable platforms, diversifying their assets, and keeping up with network developments.

The network and its users gain from fairly organized staking rewards, which promote sustained participation and long-term growth in the cryptocurrency industry.

FAQ

What are staking rewards in crypto?

Staking rewards are incentives earned by users who lock their tokens to support a blockchain’s network operations, like validating transactions. They are usually paid in additional tokens.

How do platforms calculate staking rewards?

Rewards are typically calculated based on the total reward pool, the amount of tokens staked, staking duration, validator performance, and platform fees.

Can staking rewards change over time?

Yes. Platforms adjust rates based on network inflation, demand, tokenomics, and validator performance to maintain fairness and network stability.

Are staking rewards the same for all users?

No. Rewards can vary depending on the amount staked, the duration of staking, and the performance of the validators selected.

What risks should stakers consider?

Stakers should consider market volatility, lock-up periods, slashing penalties, platform security, and regulatory changes.