In this article, I will discuss the How to Buy NFT Land in the Metaverse properties throughout the metaverse.

You will understand how to select the most appropriate platform, create a cryptocurrency wallet, analyze the land’s worth, and finalize the transaction.

Regardless of whether it’s an investment or self-expression, knowing the core steps allows for smarter decision-making.

What is NFT Land ?

NFT land is a block in the metaverse that can be bought or sold as a non-fungible token on the blockchain. Examples of such platforms are Decentraland, The Sandbox, and Otherside.

Users are able to purchase, sell, and develop their digital property. Each NFT land block is one of a kind, can be verified, and provides endless possibilities for social, business, and gaming purposes.

Users can make money off their land by hosting events, leasing spaces, or opening their own businesses, making it a useful investment in the growing digital economy.

How to Buy NFT Land in the Metaverse

Acquiring NFT land in the metaverse is a thrilling new opportunity in virtual real estate investment. We will use Decentraland as an example, for ease of understanding.

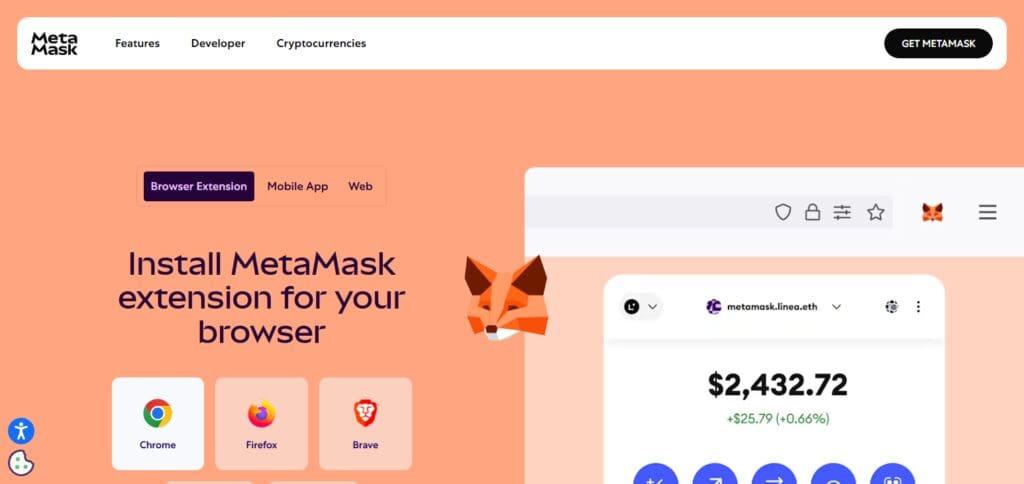

Create a Wallet for Cryptocurrency

Download a compatible wallet such as MetaMask.

Obtain MANA tokens issued in Decentraland. You can buy MANA on Binance orCoinbase exchange platforms.

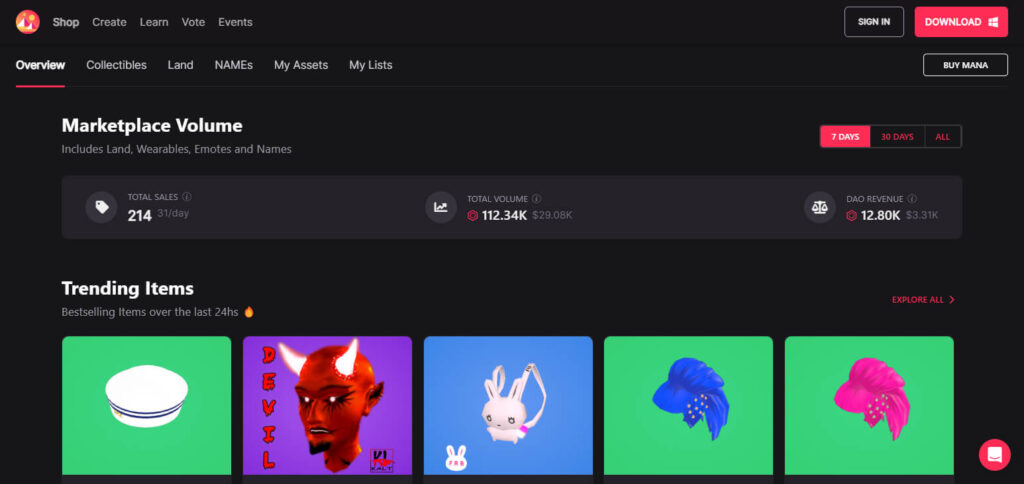

Go to Decentraland Marketplace

Access Decentraland Marketplace.

Link your wallet to the platform.

View Land Parcels Available for Sale

Check the marketplace for listings of land parcels.

Analyze the location, size, and price. More popular regions can be overloaded with people selling them, so check carefully.

Buy the Selected Land

To do this, locate the parcel in the map and hit purchase to view details.

Approve the transaction from your wallet and complete the purchase. Success means the land NFT is now in your wallet.

Maintain Your Virtual Property

Move, rent, or sell virtual land. Create experiences, conduct events, or exhibit artworks in the metaverse.

Risks and Precautions

Fluctuation of Value

Prices for NFT virtual lands can increase or decrease depending on the demand, how well the platform is doing, or what is popular in the market. Make sure to not invest more money than you are willing to lose.

Scamming

Listings can be fake and buyers can be tricked into giving their sensitive information. Always check the legitimacy of the listing by confirming the seller’s place details and reputation.

Risk Associated with the Platforms

Certain metaverse projects may not succeed and hence result in losing money. Ensure that you investigate the reputation of the platform including its credibility and its roadmap of development.

Not being Sure/Changed Government Policy

New laws can be introduced that can limit how NFTs can be owned or traded. Make sure to pay attention to the legislative changes in your community.

Consequences of Safety

Ensuring that your assets are protected can be done through having secure crypto wallets, and enabling 2 factor authentication, as well as not sharing private keys.

Future of NFT Land in the Metaverse

Growing Adoption

Virtual real estate investments by Individuals, businesses, and brands serve social, gaming, and commercial interests.

Integration with AI and VR

The value of metaverse land will increase as advanced AI and VR technologies will make the land more interactive and user-friendly.

Increased Monetization Opportunities

Virtual landowners can monetize through advertising and renting out virtual space, hosting events, and selling goods for cash.

New Regulatory Frameworks –

Policies related to owning, taxing, selling NFT land may be introduced, which would bring some stability to the market.

Interoperability Between Metaverses

Future innovations may allow NFT land to be used across different virtual worlds enabling multi-platform asset functionality.

Pros & Cons

| Pros | Cons |

|---|---|

| High Investment Potential – Virtual land can appreciate in value, offering profitable resale opportunities. | Market Volatility – NFT land prices can fluctuate significantly due to demand and speculation. |

| Ownership & Control – Owners have full control over their digital assets and can develop or monetize them. | Scams & Fraud Risks – Fake listings and phishing scams can lead to financial losses. |

| Monetization Opportunities – Earn income through rentals, virtual events, or advertising. | Platform Dependency – If a metaverse platform fails, the land could lose value. |

| Growing Adoption – More businesses and users are investing in metaverse real estate, increasing demand. | Regulatory Uncertainty – Future legal changes could impact ownership rights and transactions. |

| Enhanced User Experience – Integration with VR, AI, and blockchain offers immersive and interactive environments. | Security Concerns – Digital assets require strong cybersecurity measures to prevent hacks and theft. |

Conclusion

Investing, unleashing creativity, and owning digital property is made easier for users as they can buy NFT land in the metaverse. Investors can make sound decisions by selecting a reliable platform, obtaining a crypto wallet, and studying the land’s worth.

Even though there are risks like volatility in the market, scams, and legal proceedings, devising a robust plan to secure funds can deal with most risks.

As time passes, the world of virtual property is bound to develop, and people who got in early will see long term profits. Using a calculated strategy when investing in NFT lands will help yield profits while reducing losses.