In this article, I will explain How to Buy SushiSwap (SUSHI) in a very simplified way. SushiSwap is a well-known automated market maker (AMM) which enables digital swaps within the DeFi marketplace with lots of features and earning opportunities.

If your wish is to invest in SUSHI this guide will walk you through every important detail. Choosing a reputable exchange and protecting investments in a safe wallet.

Be it your first time engaging in the crypto market or you are a pro trader, this article will shed light on many aspects of how the process works.

What is SushiSwap?

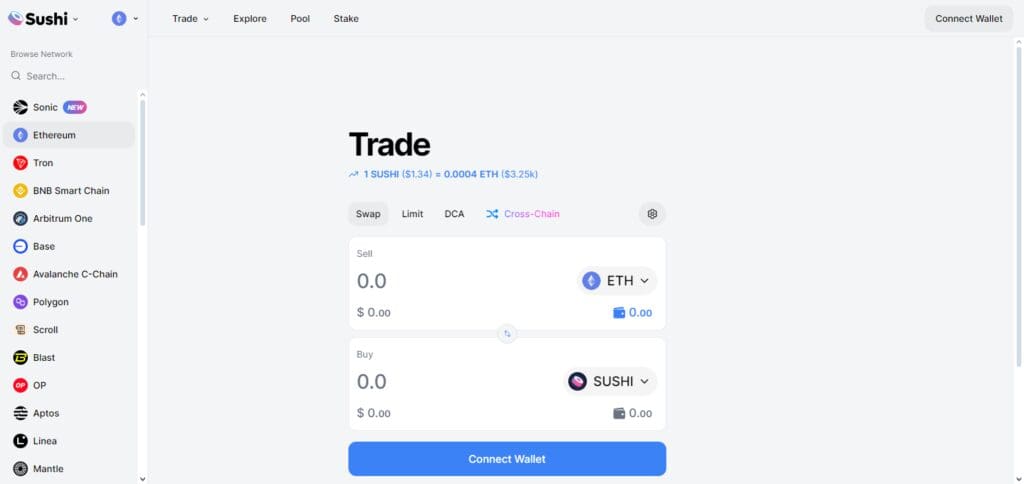

SushiSwap is a decentralized exchange (DEX) that operates as an Automated Market Maker (AMM) across multiple blockchain networks. It allows users to swap tokens and provide liquidity without relying on traditional order books.

With a swap and aggregation stack spanning over 40 chains, SushiSwap offers extensive liquidity access and competitive pricing for swaps, along with smart liquidity solutions for liquidity providers. The platform’s native token, SUSHI, provides holders with governance rights and a share of transaction fees.

Sushi Labs, the development arm of Sushi DAO, is building a multi-DEX ecosystem through strategic partnerships and innovative DeFi primitives, including projects like Susa, Saru, and Wara. For more information, visit SushiSwap.

How to Buy SushiSwap?

Identify a Suitable Crypto Exchange:

For SushiSwap’s purchasing, pick an exchange like Binance, Coinbase, Kraken, or Gemini.

Make sure that the exchange functions in your region and has a decent security record.

Create an Account:

Make an account with the above-mentioned exchange. Input your email and establish a sturdy password.

Get into your email account and confirm your account by selecting the link provided.

Go Through Identity Verification:

Verification of identity is required by several exchanges due to regulatory norms.

Provide the requisite documentation like government ID and undertake verification.

Add Funds to the Account:

Link a payment method to your exchange account. This could be a bank account, credit card, or other accepted method.

Select the deposit option, provide the preferred amount, and your account will be funded.

Look For SushiSwap (SUSHI):

Use the exchange’s search feature to find SushiSwap (SUSHI). Go to the trading pair that corresponds with your deposit currency (e.g., USD/SUSHI, BTC/SUSHI).

Settle on an Order:

Determine what kind of order you wish to implement. Placing a market order is the easiest method for the new traders, as it purchases SUSHI at a price dictated by the market.

Input the quantity of SUSHI which is to be bought and check the order for accuracy. Accept and send the order.

Properly Save Your SUSHI:

After your order is finished, you will have access to the purchased SUSHI tokens in the wallet of your exchange.

For better protection, move your SUSHI to an individual wallet either a hardware (Ledger, Trezor) or a software wallet (Trust Wallet, MetaMask).

Features of SushiSwap

Decentralized Exchange (DEX)

SushiSwap is a decentralized exchange that enables users to swap cryptocurrencies without relying on a central authority.

Automated Market Maker (AMM)

Employs an AMM protocol which facilitates trades between users and liquidity pools, thus streamlining the transactions.

Cross-Chain Support

Enables trading on various blockchains to increase flexibility.

Liquidity Pools

Users earn bonuses for liquidity provision through yield farming.

SUSHI Token

The governance token provides its holders with access to influence decisions as well as a portion of the protocol rewards.

User-Friendly Interface

The platform is simple enough for newcomers while providing tools for advanced traders.

Tips for Buying and Managing SushiSwap

Below are some carefully crafted tips that might assist you when buying and managing SushiSwap (SUSHI).

Buying Tips

Research: Make sure to study the SushiSwap’s platform, its use cases and the team behind it before purchasing SUSHI.

Exchange: Make sure to buy your SUSHI on well-known exchanges such as Coinbase, Kraken or Binance.

Security: Make sure to enable two factor authentication on your exchange account.

Make Consideration of Market Conditions: Ensure to avoid buying during extreme volatility unless you are experienced. Make sure to watch the market trend and changes in pricing.

Tiny Amounts: Make sure you take the time to know if you’re a novice. Test the waters by investing minimal funds to mitigate risk.

Managing Tips

Safe Wallet: Make sure to move your SUSHI funds into a more secure wallet, which can be either a hardware wallet (Ledger, Trezor) or software wallet (Trust Wallet, MetaMask).

Price Watching: Make sure to remain vigilant about the price value of your SUSHI along with changing market trends. This should help you in making buying, holding or selling decisions.

Follow Up Already Set News: Ensure to keep track of SushiSwap’s official channels and community for better understanding and news.

Risk of Investment with One Cryptocurrecny: Make sure to not put all your investments in one cryptocurrency to lessen the risk.

Passive Earning: If you would like to earn while saving, look for staking options in SushiSwap for more rewards.

You should always ensure that your mnemonic phrase or private key is stored safely. This backup will prevent you from losing access in the future

Is SushiSwap a good investment?

SushiSwap (SUSHI) is a project that can potentially make a great investment in the decentralized finance (DeFi) market. It is an AMM (Automated Market Maker) and has a derived DEX (decentralized exchange) that trades crypto directly from users’ wallets.

Recently, SushiSwap has grown in popularity due to its ease of use and other features like receiving SUSHI token staking rewards. Based on postcard comments which are largely believed to be true, many analyses created recently show great buy interest.

Nevertheless, it is appropriate to caution that one must always exercise due diligence and gauge investment risks while making up one’s mind.

Conclusion

In summary, SushiSwap is a multifunctional and easy-to-use DeFi decentralized exchange that incorporates automated market maker models, supports cross-chain transactions, and provides yield farming opportunities.

Apart from these opportunities, users also have control over how their assets are managed and can earn additional income. Apart from these, users can actively participate in decision- making and earn rewards by utilizing SUSHI governance tokens, however, the assets need to be thoroughly researched and understood because there are risks involved with investments.

This sets SushiSwap apart and provides a unique selling point that would appeal to any DeFi user whether they are new or veteran – the innovative approach and community focused model decisions that SushiSwap provides.