In this article i will discuss the How to Calculate Staking Rewards Accurately. To ensure passive income from crypto assets, staking can be really beneficial, however, knowing how the rewards are disbursed is very important.

Understanding the main concepts and having the correct instruments enables one to better estimate profits and intelligent moves regarding staking.

What is Staking Rewards?

Staking rewards are the benefits, commonly in additional cryptocurrency, that a holder earns for actively participating in a cryptocurrency’s proof-of-stake (PoS) mechanism. When a user stakes their coins, they contribute to transaction validation and network security.

In exchange, users receive rewards, typically it comes in the form of more coins. Because of the variable parameters, such as the volume of staked coins, the duration of staking, and inflation in the network, as well as the performance of the validators, rewards can be adjusted.

While participating in the operations of a blockchain network, Staking provides passive revenue generation opportunities.

How to Calculate Staking Rewards Accurately

In Ethereum staking, accurate reward estimation is dependent on the amount staked, duration, network APY, and the validator’s performance. Here’s an example of how to calculate staking rewards for Ethereum (ETH):

Example: ETH Rewards Calculation

Decide the Amount to Stake – Let’s say you stake 10 ETH.

Check Your APY – The staking APY for this example will be 5%.

Calculate Annual Rewards – Calculate annually using the staked amount and APY:

- 10 ETH × 5% = 0.5 ETH (per annum)

Divide Monthly and Daily Reward Data –

- Monthly: 0.5 ETH ÷ 12 = 0.0417 ETH

- Daily: 0.5 ETH ÷ 365 = 0.00137 ETH

Account for Validator Charges – The net rewards, with a 10% fee, would be:

- 0.5 ETH × 90% = 0.45 ETH (after fees).

Other Place Where to Calculate Staking Rewards Accurately

Figment.io

Figment.io assists users in calculating staking rewards accurately by offering comprehensive data on validator performance and current network metrics—making them a reliable source.

Its defining trait is the provision of detailed analytics pertaining to various levels of staking and their relation to network dynamics. This helps the users gain more than mere guesswork.

As a result, users can monitor real and actual validator functionality, fee-earning, and network-wide activity, which vastly improves the accuracy of reward estimations over an extended timeframe.

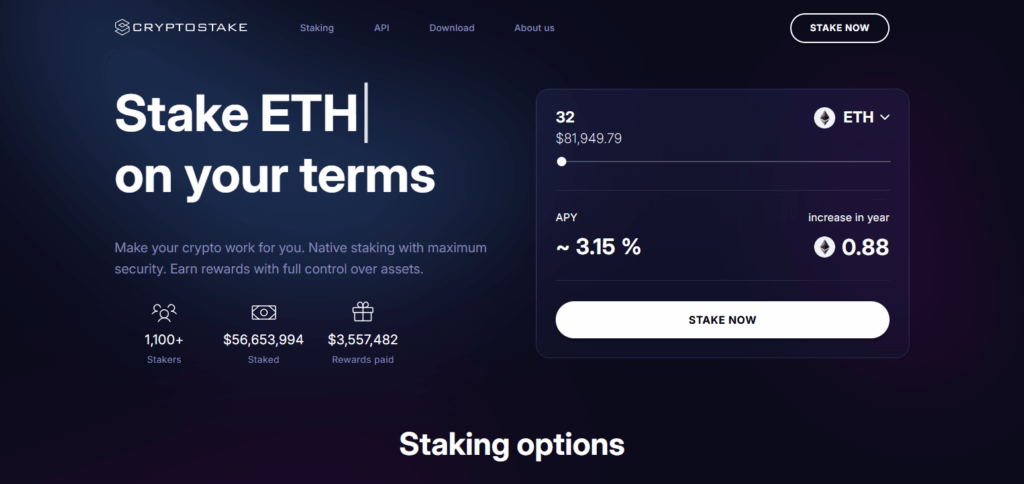

CryptoStake.com

CryptoStake.com provides an advanced staking rewards calculator which guarantees optimal estimation of earnings. With the current APY, staking time, and unique blockchain reward systems, the calculator provides precise estimations for ETH, DOT, ATOM, ADA, and SOL.

Its user-friendly interface and ETH, DOT, ATOM, ADA, and SOL portrayal features allow users to understand how their assets change over time. This is beneficial for the investors as it helps them make decisions and optimize their staking strategies.

EarnPark.com

EarnPark.com provides an advanced crypto staking calculator that gives users accurate estimates for anticipated earnings. Including factors such as APY, APR, compounding intervals and duration of the investment, the calculator provides specific results for different cryptocurrencies.

The allocator’s users friendly interface makes it easy to navigate and allows users to see how their holdings change with time graphically. With such tools, investors are in a better position to make informed decisions which will enhance their returns.

Using Online Calculators for Accuracy

Customization of Input: Lmost all the calculators enable the entry of multiple stake amounts, staking time, APY, and how often rewards are given to generate accurate estimates.

Particularized Network Measurements: Platforms like StakingRewards.com, alongside validator emitted networks, provide calculators specific to each coin complete with up-to-the-minute information.

Caveats: As is the case with every calculator, these come with estimates, lack accounting for the validator downtime, slashing, and other emerging conditions on the network. Always be sure to check facts.

Tips to Improve Accuracy in Reward Estimation

Adjust for Validator Fees

Remember to deduct validator commissions since they will always affect your net rewards.

Observe Network Parameters

Reward rate may change over time due to network inflation, participation cut-off, and even changes in protocol.

Verify Date of Calculation Tools

Always use reputable calculators that are well maintained for the best estimates.

Consider the Effects of Compounding

When rewards are auto-restaked, be sure to add compound interest for your calculations.

Check Frequency of Payment

Different networks have different payment frequencies, such as daily, weekly, or monthly and cumulatively affect returns.

Common Mistakes to Avoid

Ignoring Validator Performance

Picking unreliable validators may result in the loss of potential rewards or incurring slashing fees.

Assuming Fixed Reward Rates

Staking returns are subject to change based on the state of the network and inflation.

Overlooking Fees

Validator commissions, if ignored, are bound to result in earnings that are higher than actual and unaccounted for.

Forgetting Compounding Effects

Long-term projections failing to include compounding are highly inaccurate.

Locking Assets and Misunderstanding the Funds Accessibility

Certain assets have a time lock which restricts immediate access to the funds and rewards.

Pros & Cons

Pros:

Enhanced Earning Opportunities: Achieving accurate calculations helps in selecting the best validators and staking strategies which translates to optimal returns.

Better Accuracy on Spending While Re-evaluating Assets: Knowing what fees, lock-up periods, and variable rewards acknowledge ahead of time put your staking on autopilot.

Detailed Preparation: Understanding fee structure, lock-up durations, and reward volatility diminishes unexpected consequences.

Cons:

Excess Manpower: Additional manual calculation requires significant upkeep effort.

Adjustments Still Possible: Reward parameters will continue to be influenced network conditions or the conduct of the chosen validators.

Limited Use of Calculating Algorithms: Internet-based calculations fail to account slashings or left out downtimes when estimating real-world markers.

Conclusion

To enhance decisions and derive the maximum benefits in the crypto world, staking rewards need to be calculated precisely. Earning projections can be refined based on important factors like APR, fees charged by validators, compounding, and overall state of the network.

To optimize results in staking, never miss from using the right tools, be attentive to changes, and steer clear of mistakes. With proper strategies in place, staking has the potential of transforming into a sustained and self-sufficient income channel.