In this article, I will explore the How to Cash Out Crypto Without High Fees. These methods include low-fee exchange services, P2P trading platforms, and even crypto debit cards, so you can identify which methods provide the best value for converting your cryptocurrency into fiat currency.

Grasping the pros and cons of each method will allow you to make smart choices and avoid overspending— all while optimizing your expenditures during the cash-out process.

How to Cash Out Crypto Without Fees

In order to avoid high fees while withdrawing funds, it is important to choose methods and platforms that suit the customers best.

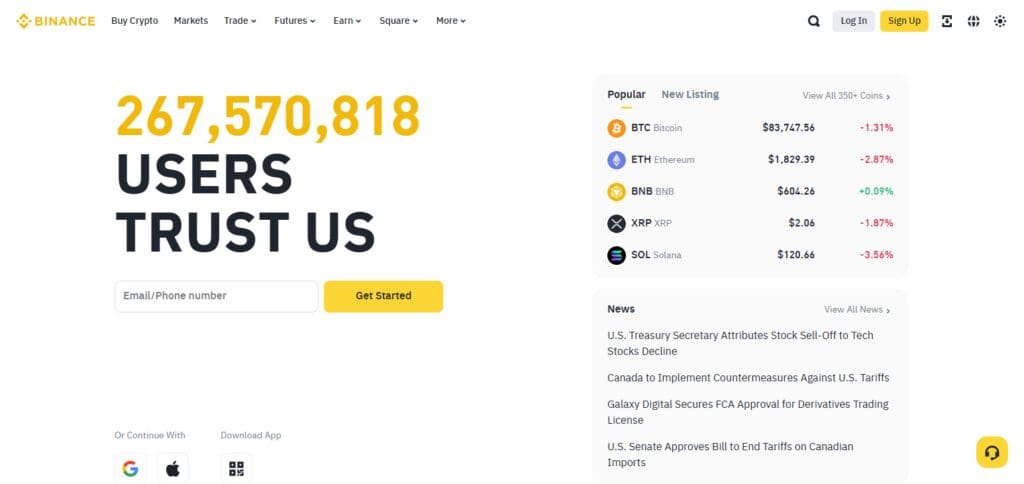

Binance, a widely known exchange for cryptocurrencies, has many inexpensive methods for changing cryptocurrencies to fiat money.

Low-Cost Methods to Cash Out Crypto:

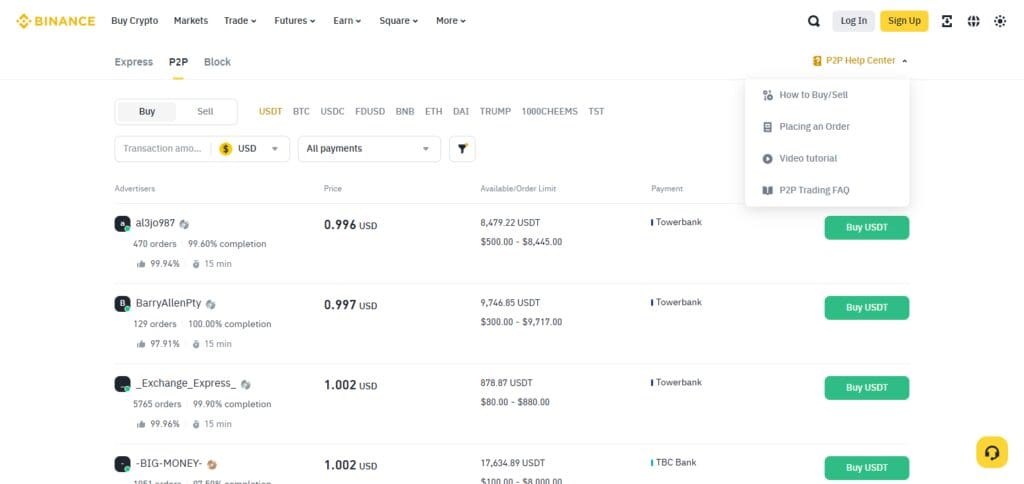

P2P Trading

On Binance P2P, you can now trade cryptocurrencies with other users and people. A lot of the time, there is no fee for transactions at all. You have the ability to choose your own rate and the way you want to be paid, which is very helpful.

Spot Trading

The spot trading platform offered by Binance has a fixed fee of 0.1% for every transaction made. Here the user sells the cryptocurrency he or she owns in the marketplace in order to turn it into fiat.

Crypto Debit Cards

Users of cryptos have the option of a visa debit card which allows direct purchasing of goods using cryptocurrency or cash withdrawal from ATM terminals.

This is a feature of great use, however, special attention must be paid to the fact that extra fees may be charged when converting the funds or withdrawing fiatcurrency from the ATM.

Cash Withdrawal Examples Using Binance P2P Selling Method

Sign up and Verifying

Open an account with KYC account verification and Bank identification accounts which allows you to unlock all offered.

Adding Cryptocurrency

Move required crypto assets from 3rd party wallets to secured Binance wallets.

Cryptocurrency Selling Using P2P

- Go to the P2P section on Binance.

- Select the cryptocurrency you want to sell alongside your preferred fiat currency.

- View existing offers or create your own listing with desired selling price and payment method.

- Complete the transaction as per the instructions of the platform after a buyer matches with you on the crypto exchange.

Withdraw Fiat to Your Bank Account

After concluding the P2P transaction, you can see the amount in fiat currency added your account in Binance.

Withdraw these funds using listed withdrawal methods to your bank account which is linked to your account.

Advantages of Using Binance

Competitive Fees: Binance is known for the low charges incurred while trading, with the spot trading fee being 0.1% and P2P trading being free most of the time.

Multiple Cash-Out Options: Cbesides P2P and spot trading, other available options that users might prefer includes crypto debit cards or direct transfer to banks.

Security and Trust: Binance is among the top used cryptocurrency exchanges in the world and has credible security methods to keep users’ assets safe.

If you want to sell cryptocurrency holdings and exchange it with fiat currency, Binance provides low-cost that can be efficiently used.

Tips to Minimize Crypto Cash-Out Costs

It is recommended to use the following strategies to avoid paying excessive fees (having cash-outs fees as the base reference). Maximizing your returns would require minimizing costs when cashing out cryptocurrency. Strategies which help reduce fees include:

Consider Withdraw Fee Policies of Exchanges

Look for withdrawal policies of cryptocurrency exchanges. Binance and Kraken for example have reasonable rates when compared to Coinbase.

Use Bank Transfers Instead of Credit and Debit cards

Transferring funds, from a bank to a client’s account, is cheaper than a debit or credit card withdrawal. This is true for Coinbase where most fees are absent for bank accounts.

Scheduling Transactions During Low Activity Periods:

Initiating transactions during times of low activities such as late evenings or early mornings could help reduce associated costs and fees.

Limit orders instead of Use Market Orders

Executing an order in a fast moving market results in high fees compared to setting a certain price value. With Limit orders, users set specific prices at which they are ready to sell.

Combine Transactions

Merging smaller transactions into one larger transaction may save costs on fees since many platforms charge a flat rate per transaction.

Continuously Update on Fee Structures

Track and analyze the fee structure of different exchanges and platforms as they vary over time. Being informed is always beneficial when choosing the right options.

As an Example, Take Debit Cards for Cryptocurrencies

Some companies provide debit cards for cryptocurrency expenditure, possibly eliminating or minimizing the need to convert funds and incurring charges.

Keep in Mind the Resulting Tax Costs

Know the tax costs that accompany cryptocurrency transactions within your region’s jurisdiction to avoid seemingly hidden expenses.

Common Mistakes to Avoid

Withdrawing funds from cryptocurrencies needs specialized considerations because of existing legislation and strategic losses that tend to surface if proper care isn’t taken. Keep these points in mind.

Avoid Using Non-Reputable Platforms: Using non-reputable exchanges increases potential for getting scammed or sustaining losses. Use a regulated trusted platform with positive user reviews and a reputation for good security.

Check Addresses Before Transactions: There are several reasons that can lead to irreversible loss. Verifying accuracy will ensure all wallet Transaction approve processes are done within target thresholds.

Check Hidden Fees: Always keep in mind network charges, cash out fees, exchange fees and all other secondary charges that will hinder the bottom line. Keeping check on final receipts will help manage expectations.

Avoid Sudden Large Fund Movements: Phone inquiries withdrawal triggers for a hidden or account standstill or blocks by financial institutions. Gaining access to large funds could invite unwelcomed attention, thus it is best to release funds in smaller bunches incrementally.

Neglecting Returns Fees: Avoiding these fees makes auditing one’s position easier, thus neglecting to notify profits can have further the scrutiny draw reports to needed files. Ensure to research jurisdictional lies concerning taxation and document spending and receiving money.

Guaranteed Return Offers: Being offered guaranteed returns should be heavily processed owing unsolicited requests. Receiving such promises directly from untrusted sources may warrant emptied pockets thus a lot of speculation should be encouraged.

Not Understanding the Cash-Out Process: Not understanding how to withdraw funds from an account may lead to knowledgeable errors. Take time to fully understand the processes of your preferred platform to avoid undue complications.

Overlooking Security Measures: Not using such security provisions as two-factor authentication (2FA) greatly increases the chances of fraud and losing funds. Enable all protective measures available to you and safeguard your funds.

Conclusion

The ability to redeem your cryptocurrency is usually pegged to withdrawal or transaction fees, which means that you would need to plan ahead if you want to extract money from your crypto account without high additional costs.

Platforms such as Binance or Kraken, which offer competitive transaction pricing, are preferable when it comes to reducing total fees. Other helpful methods include crypto debit cards and P2P trading, which provide low-cost conversion options.

Avoid network busy hours for every transaction, and combine multiple smaller transactions to achieve a fee break threshold—this technique saves on fees.

Ensure protection of funds by using reputable platforms and adopting best security measures. Following the above guidelines allows for easy, fast, and inexpensive cryptocurrency to fiat conversion.