In this article, I will discuss the How to Check Liquidity of a Crypto. Every trader or investor needs to understand liquidity because it determines how smoothly and quickly you can transact in a cryptocurrency.

To ensure safer trading, I’ll discuss the major indicators as well as the tools, and the most frequent traps to avoid so you can make wiser trading choices.

What is Liquidity?

Liquidity describes how effortlessly or swiftly an asset like cryptocurrency can be sold or bought without causing a major impact on its price. It indicates high liquidity when there is an ample amount of buyers and sellers making trades seamless and effective.

On the other hand, low liquidity can result in challenges when trying to enter or exit positions and may result in price slippage. In terms of the crypto space, having liquidity is critical for stablility, equity, risk minimization, and when trading large volumes or working with volatile assets.

How to Check Liquidity of a Crypto Step-by-Step

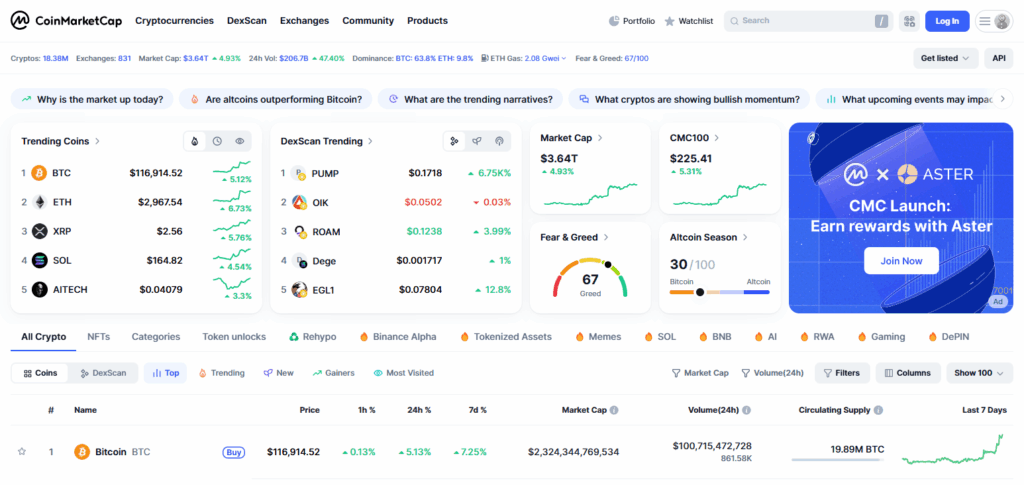

Example: Checking Liquidity of Solana (SOL)

Check Trading Volume

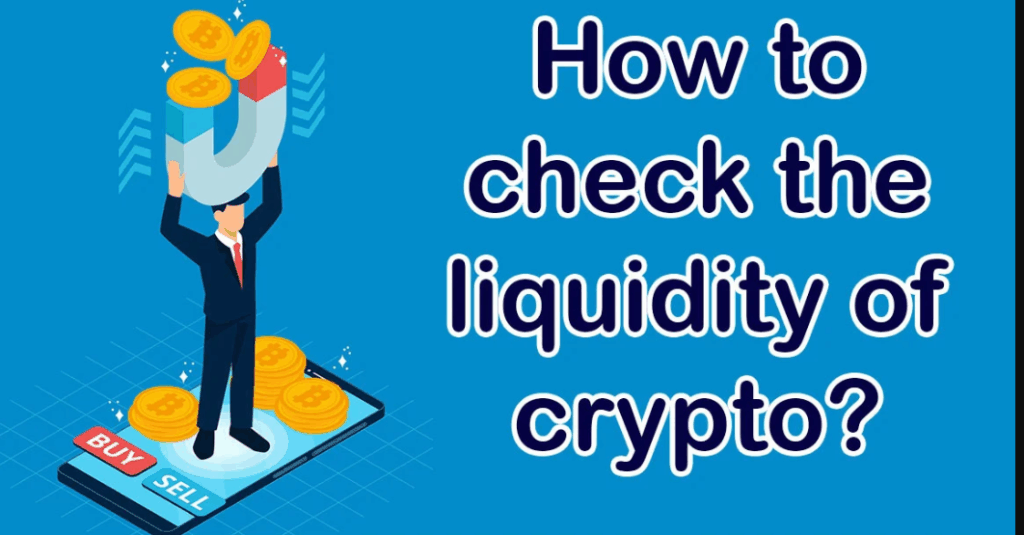

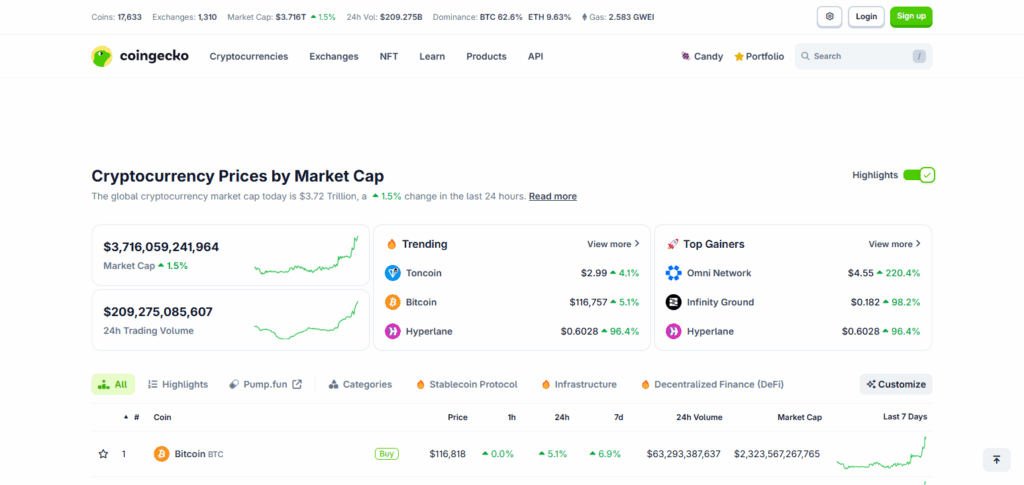

- Go to CoinMarketCap or CoinGecko.

- Search for Solana (SOL).

- Check the 24-hour trading volume. Stronger volume indicates more trading activity and thus better liquidity.

Review Exchange Liquidity

- Use a tool like the Liquidity Checker by GoodCrypto to evaluate liquidity on different exchanges.

- Determine which exchange has the highest liquidity for SOL/USDT or SOL/USD pairs.

Analyze Bid-Ask Spread

- Go to the exchange’s order book (like Binance or Coinbase).

- A tight spread suggests strong liquidity.

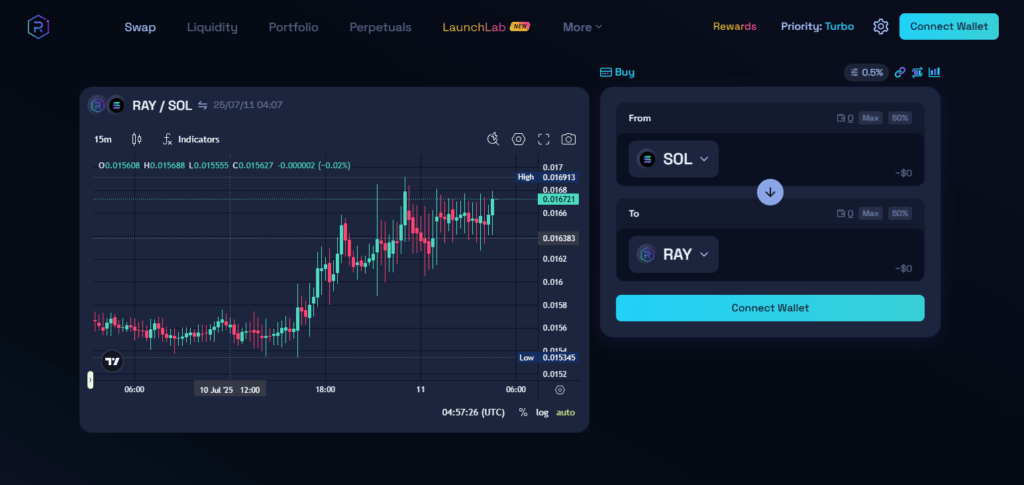

Check Liquidity Pool Metrics (for DEXes)

- While trading on a DEX like Raydium or Uniswap, check the Total Value Locked (TVL) and 24h volume for the SOL liquidity pool.

- Check pool health using DEXTools or GeckoTerminal.

Token Distribution Evaluation

- Check the ownership distribution of SOL using a blockchain explorer or any analytics tool.

- Having a broad distribution of a token’s supply sustains liquidity for trading.

Best Tools to Check Crypto Liquidity

CoinGecko

CoinGecko serves as one of the best platforms for tracking a cryptocurrency’s liquidity since it gives up-to-the-minute information on trading volume, spread, and market depth of different exchanges.

Its distinctive feature “Trust Score” provides the real liquidity of the markets using opaque order book analysis and trade verification, which helps circumvent phony volume data. This is particularly helpful for traders because it reveals the most active trading pairs and exchanges, thus enabling them understand where faster access is available for liquidity.

TradingView

TradingView assists in evaluating crypto liquidity with its detailed volume analysis as well as real-time price movement visualization. Its distinctive advantage lies in having customizable volume indicators and depth-of-market tools that let users monitor the flow of liquidity and identify whether there is buying or selling pressure.

Traders can add multiple indicators to determine market strength, identify possible slippage zones, confirm trade capital, and verify liquidity before executing orders. This functionality makes TradingView an indispensable platform for performing technical analysis and verifying liquidity in fast-moving markets.

Why Liquidity Matters for Traders

Quicker Order Filling: High liquidity makes it possible to fill orders swiftly with minimal delay.

Better Prices: Cost for every trade is reduced due to tighter bid-ask spread.

Lower Slippage Risk: High liquidity reduces the chances of substantial price shifts during big trades in both directions.

Greater Market Stability: Less prone to acute dramatic shifts in price movement when compared to thin markets.

Buy and Sell at Convenience: Traders can execute orders at targeted prices with minimal market influence.

Key Indicators of Crypto Liquidity

Volume of Trading: High volumes of 24-hour trading signify great movement in the market and convenience in trading positions.

Bid And Ask Spread: Better liquidity is availabale when the difference between the highest order of buy and the lowest order of sale is narrow.

Order Book Depth: A market is well supported when its order book is deep with large orders to buy and sell.

Slippage: An asset with low slippage is more desirable because it can be traded in larger quantities without a significant change in price.

Number of Active Markets: Having more listed trading pairs as well as having more exchanges is an indication of higher liquidity.

Common Liquidity Pitfalls to Avoid

Low Trading Volume: It may be difficult to sell or quickly sell to sell a token with low daily volume.

High Slippage: In illiquid markets, the price at which an order is filled can differ drastically from the price at which it was placed. This is referred to as slippage.

Wide Bid-Ask Spreads: Too much difference between sell and buy price results in an increase of trading cost.

Fake or Wash Trading: Some traders increase the trading volume deliberately for a token which leads to a misleading perception of liquidity.

Limited Exchange Listings: Assets may be illiquid because they are listed on very few exchanges.

Conclusion

Evaluating a cryptocurrency’s liquidity is indispensable for informed and risk-free trading. Assessing the trading volume, slippage, bid-ask spread, order book depth, and other key indicators reveals the ease with which the asset can be transacted.

For accurate market data, consider using CoinGecko or TradingView, as these platforms provide reliable information devoid of false data. Avoiding liquidity check before trading increases risk, worsens execution, and destabilizes price in the crypto market.

FAQ

How do I know if a crypto has high liquidity?

Look for high trading volume, tight bid-ask spreads, deep order books, and minimal slippage on major exchanges.

Which tools can I use to check liquidity?

CoinGecko, TradingView, CoinMarketCap, and DexTools are popular platforms that offer liquidity data.

Why is liquidity important in crypto trading?

High liquidity ensures faster trades, lower costs, and reduced price volatility, making trading safer and more efficient.