In this article, I will discuss the How to Create a DeFi Watchlist to track and manage your favorite decentralized finance tokens.

A watchlist helps you capture market developments, discover and monitor new opportunities, and decide on investments. With this guide, I want to help you set up a watchlist that is effective within DeFis.

What is DeFi Watchlist?

DeFi watchlist refers to a personalized list of decentralized finance tokens or projects that an investor wants to keep a close eye on. A Defi watchlist compiles all relevant price changes, volumes, and market cap into one easy-to-use control hub.

A watchlist earns its name by helping a user manage prioritized tokens, thus enabling smarter decisions and more efficient overall portfolio management. Be it DEXs, yield farming, or lending protocols, a DeFi watchlist does the heavy lifting, allowing effortless tracking and ensuring no market movements or investment opportunities go unnoticed.

How to Create a DeFi Watchlist

Building a DeFi watchlist allows all decentralized finance assets to be segmented and tracked with efficiency . Here is how to do it on altFINS, the crypto analytics powerhouse:

Example: Creating a DeFi Watchlist on altFINS

Sign Up & Log In

Go to altFINS and create an account.

Navigate to Watchlists

Click on the “Watchlist” tab to start building your personal list.

Add DeFi Tokens

Look for AAVE, SUSHI, COMP and other DeFi tokens and add them to your watchlist.

Set Alerts

Set alerts for a specific price, alert you on a new trend, or inform you with a new technical change.

Filter Signals

Refine your watchlist using trend analysis, MACD crossovers, or moving averages.

Monitor Performance

Looking at your watchlist for updates and checking for trades regularly should be a part of your routine.

Other Place Where to Create a DeFi Watchlist

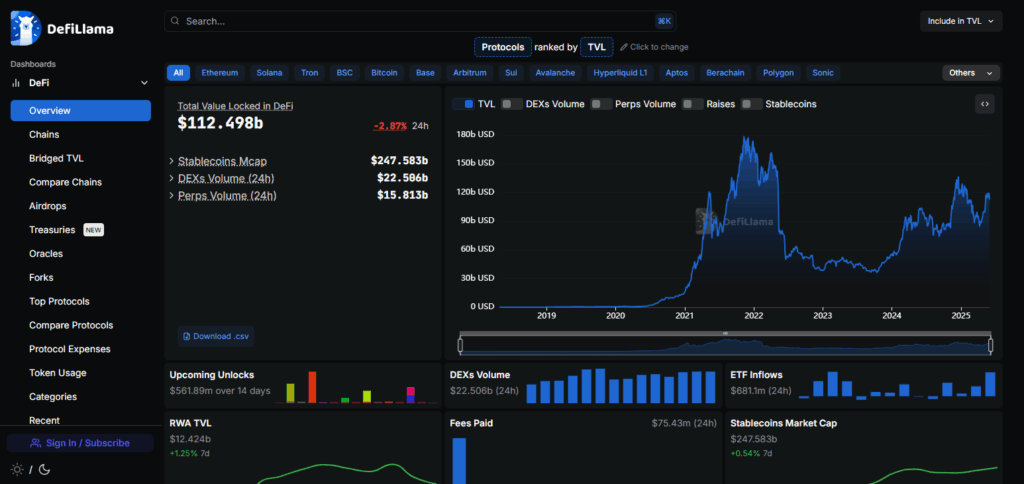

DefiLlama

DeFiLlama is an exceptional tool for building a DeFi watchlist because it tracks Total Value Locked (TVL) across different blockchains and DeFi protocols. This uniquely enables users to determine the actual project health and adoption of a project beyond the token price.

Accuracy and timeliness of data combined with a simple interface makes tracking the different protocols, comparing chains, examining trends, and monitoring liquidity effortless and insightful- a must for users seeking greater understanding of the DeFi world.

DeFi Pulse

Especially for Ethereum-based protocols users, DeFi Pulse is an outstanding platform for compiling a DeFi watchlist. Its main advantage is presenting real-time rankings based on Total Value Locked (TVL) which signifies the most actively utilized projects.

In addition, DeFi Pulse displays the trends and historical data of specific sectors, allowing users to discover the most actively used categories such as lending, DEXs, and various assets. This approach provides users the opportunity to design watchlists concentrated on dependable and actively used DeFi services with ease.

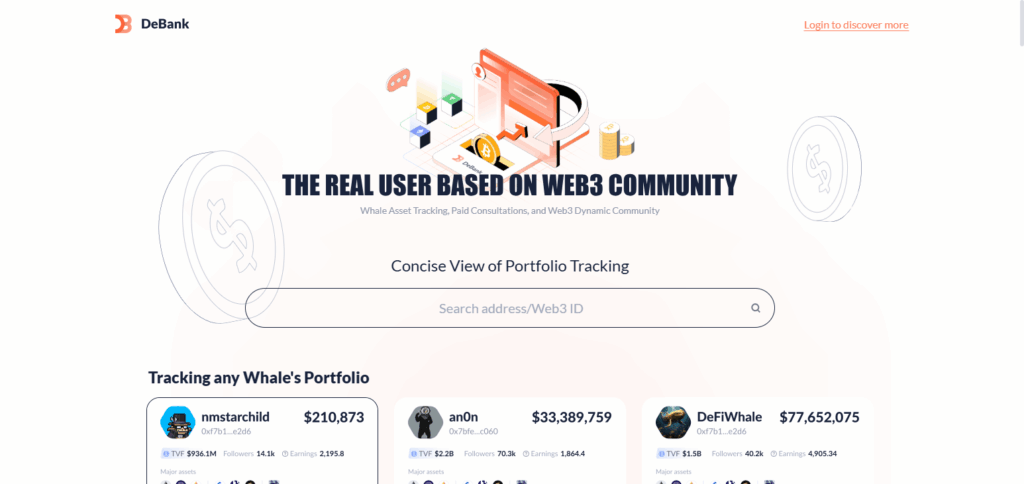

DeBank

Creating a DeFi watchlist is best with DeBank because it consolidates users’ portfolios from different blockchains and DeFi protocols. Its distinct capability is tracking via the wallet which provides real time monitoring of assets, debts, and yields.

Unlike other platforms, DeBank enables users to monitor positions and performance on multiple DeFi exchanges instead of just watching price. This is perfect for active investors focused on assessing and controlling their DeFi exposure from one centralized dashboard.

Why You Need a DeFi Watchlist

Receive Important Updates on the Market Outlook: A watchlist notifies you regarding the price activity, new tokens, or projects which have a potential future value.

Manage Your Preferred Projects Efficiently: Supervise the activity of the selected DeFi tokens without looking for them one after another.

Discover Potential Gaps Fastidiously: Recognize the increasing level of more new projects or tokens which are priced less than their value preemptively.

Automate Your Risk Management: Be informed of price movements or market fluctuations and adjust your position accordingly.

Increase Efficiency While Reducing Workload: Your information is consolidated in a single interface enabling quick and efficient decisions.

Tips for Managing a DeFi Watchlist Effectively

Keep It Focused: Avoid information clutter by limiting your watched projects to skillfully curated options that you keenly desire to observe.

Categorize by Sector: To facilitate easier comparison and analysis, cluster tokens by their primary function like lending or DEXs and even stablecoins.

Use Alerts and Notifications: React to fast-changing markets with price and volume alert notifications.

Review Regularly: Change your watchlist with the Project’s performance, recent news, and even the market changes periodically.

Track Fundamentals, Not Just Price: Analyze important metrics like Total Value Locked, active participants, and developers for a clearer perspective.

Risk & Considerations

Market Fluctuations

The prices of DeFi tokens are subject to rapid changes, which makes oversight harder.

Fraudulent Tokens

Many tokens which are devoid of any credibility or transparency, can show appealing signs.

Tendency for Overconfidence

Tracking a particular token can result in emotional decisions stemming from impulsive watching.

Stale Information

Not all services refresh their information. Make sure that your source is dependable when collecting data.

Risk from Other Parties

Projects pertaining to DeFi may be faced with other legal scrutiny which will have implications on their performance and prospects.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy tracking of selected DeFi tokens | May lead to overtrading or impulsive actions |

| Helps identify trends and opportunities | Risk of focusing on hype rather than research |

| Saves time with organized monitoring | Watchlists can become cluttered without updates |

| Enables better portfolio management | Data may not always reflect real-time changes |

| Supports informed decision-making | False sense of control in volatile markets |

Conclusion

Lastly, for the last statement I would like to passionately emphasize that Having a DeFi watchlist is important for anyone trying to keep track of developments in the crypto space because it helps them stay organized and informed within the rapidly evolving world of decentralized finance.

Having a curated selection of tokens and projects to track allows you to spot opportunities earlier, minimize risks, and optimize your investment decisions. Through regular updates and reviews, confident and clear navigation through the ever-changing DeFi ecosystem is maintained.