This article will explain how to create an EasyPaisa account and all the simple steps for Telenor and non-Telenor users.

It does not matter if you are installing this software through USSD, SMS, or an agent,

I believe this guide will assist you in enabling Easypaisa services and thus be able to manage your finances on your mobile phone.

What is Easypaisa?

Established in 2009, EasyPaisa is recognized as the first mobile banking service in Pakistan.

This service was the confluence between Telenor and Tameer Microfinance Bank.

The system also changed the performance of online transactions, as the audience could undertake even more functions than the former through a simple gadget.

With this app, money can be sent to others, bills can be paid, mobile recharges can be made, and many such things can be easily availed.

The interface is straightforward across Android and iPod applications. Hence, one can perform any transaction easily.

How to Create an EasyPaisa Account: Step-by-Step Guide

For Telenor Users

Via USSD Code:

To start the process, Dial *786# on your phone.

You will be asked to create a 5-digit PIN code.

Confirm the PIN and the account will be created.

At Telenor Franchises:

Walk into a Telenor franchise or Easypaisa retailer with your CNIC and phone.

They will help you in opening your account.

For Users not on Telenor Networks (i.e. Jazz, Ufone, Zong, Warid, Onic, Scom)

Applying by SMS:

To 0345-1113737: EP Your CNIC number.

There will be a verification call from an Easypaisa associate.

After verifying yourself, please send the following message to 0345-1113737 PIN Your PINConfirm PIN.

Please wait for an SMS confirmation that your account has been activated.

At the Easypaisa Retailers:

Please carry your CNIC and phone to any of the Easypaisa retailers for assistance in opening.

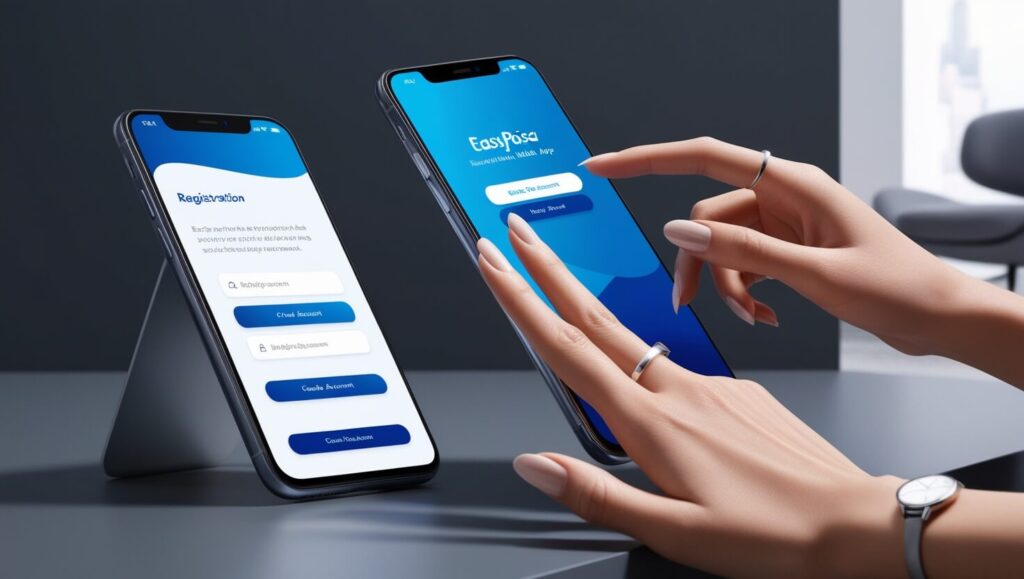

How to Create an Easypaisa Account on a Mobile App

It is easy to create an EasyPaisa account

Download the EasyPaisa Application

The application is available on the Google Play and Apple App Store.

Install and Open the Application

After the installation is completed, open the application on your mobile phone.

Submit Your Mobile Number

You will also be required to submit your mobile number to proceed.

Enter CNIC Details

Fill in your Computerized National Identity Card (CNIC) Number and the issue date.

Create a Next SOD PIN

Create a five-digit SOD PIN within a minute.

Verify Your Account:

An OTP validation may also be required to verify your account.

Complete the Setup

As is usually the case, you must finish the setup by complying with the instructions on the screen.

After your account is activated, you can use EasyPaisa for transactions like sending and receiving money and paying bills.

How many types Of EasyPaisa Accounts?

EasyPaisa provides a range of accounts, which are as follows:

Personal Accounts: Suitable for individual users managing their day-to-day accounts, making payments for various services, and making or receiving payments.

Merchant Accounts: Designed for businesses, enabling them to receive payments via a unique QR code for easy online transactions.

Business Accounts: Suitable for big corporations that need advanced financial solutions such as payroll and lump sum payments.

Features of EasyPaisa Accounts

EasyPaisa accounts provide various functionalities to enhance the facilitation of various financial transactions.

This enables a quick cross-border remittance through various methods and eases the need for travelling.

Bill Payments

Conveniently pay utility bills, including electricity, water, gas, telephone, and mobile phone bills, using the EasyPaisa account.

Mobile Top-Ups

Load money easily with your mobile phone to stay connected to your family and friends.

Savings Pocket

Provisions in the Extreme Lines All in One that allow saving but not for a very long period and offer some incentives upon demonstration of a rewarding attitude toward repayment

Biometric Verification

With the Android App, it is possible to verify transactions using the encryption and biometric features of the application itself.

No Hidden Charges

Normal transaction charges with no extra charges for payments made or funds sent during deployment

Monthly Account Limit

High threshold upon which clients can transact enormous transaction volumes10

Exciting Prizes

Every month brings you an emotional burden of expectations of getting new winnings.

Raast Transfer

An account where money should be deposited for payments after successful online purchases.

Raast Transfer

The transfer is executed using the Raast system

Common Issues and Troubleshooting

When you try to set up or use your Easypaisa account, you will probably face some common problems.

Here are some examples of common problems with their respective solutions:

PIN Code Errors

You can use features like ‘Forget PIN’ to reset your PIN because you have either forgotten it or entered it incorrectly several times.

Just dial *786# and reset your PIN, or ask an Easypaisa retailer to do it.

Account Verification Delays

If it seems like the process of verification is dragging on for too long, it may be helpful to check if your CNIC details supplied during registration are the same as those registered had been updated. You may have to reach out to Easypaisa support for help.

Transaction Failures

If you attempt to make a failed transaction, check your account, look for recipients, ensure their details are correct, and check your network coverage.

App Not Working

When the Easypaisa application is not working, procedures such as clearing the application cache, updating the application, and re-installing may be performed.

If the issue persists, you may switch the device off, turn it back on, or ensure an internet connection.

Conclusion

Overall, signing up for an Easypaisa account is quick and easy, regardless of whether one is a Telenor user or any other network provider.

The described methods can be completed: any person, whether a Telenor subscriber or any other, can log into their account and manage their money by phone or any other way, thanks to the Easypaisa app.

Easypaisa is also advantageous as it has a simple interface for sending money, paying bills, and performing many other functions.