In this article, I will discuss the How to Follow Crypto Whales. Whales make for excellent case studies as their strategies and decisions, which are often available for public viewing, can be very informational when it comes to predicting the current and future state of the market including the prices.

One can track the actions of influential market whale players by using whale tracking tools, sifting through on-chain data, and even participating in social media conversations.

What Are Crypto Whales?

Crypto whales, or crypto moguls, are single figures or businesses that own significant volumes of cryptocurrencies due to which they possess the ability to impact the market price and liquidity.

Due to the size of their holdings, crypto whales have the capabilities to execute large trades that can instigate price movement, hence their actions are closely looked at by traders and analysts instead.

Crypto moguls can purchase enormous amounts of the cryptocurrency to increase the market value, or dump their holdings causing the market price to collapse.

Tracking the behavior of crypto whales is extremely important for anyone who trades in cryptocurrency as they are able to indicate a particular shift in the market.

How to Follow Crypto Whales

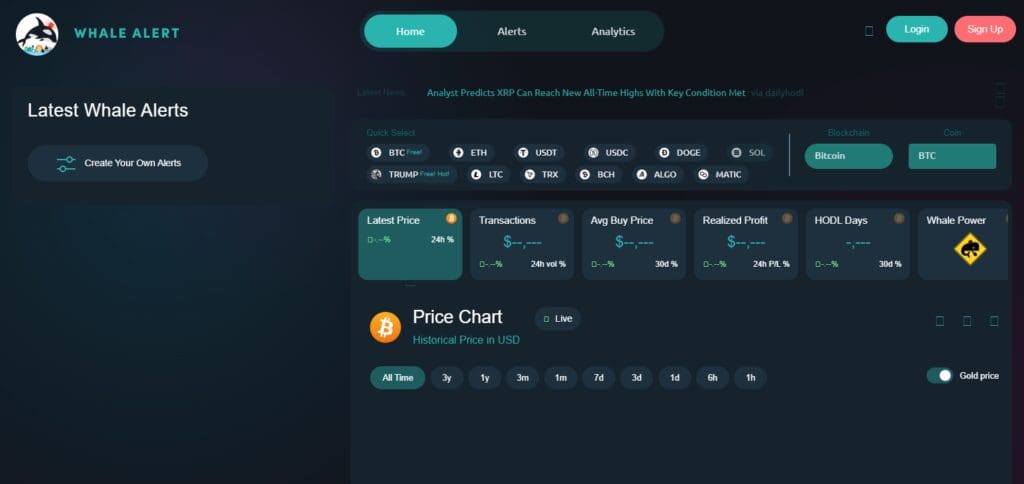

Tracking whale activity can give you unique insights as they are large holders of cryptocurrency who influence the market prices. Let’s take a look at how you can follow crypto whales on one such platform: Whale Alert.

How to Follow Whales Step by Step:

Understand What Whale Alert Does

Whale Alert is a platform which ‘hunts’ huge oversize cryptocurrency transactions and reports them in real time throughout many blockchains.

It tracks movements of Bitcoin, Ethereum, XRP, and other building potatoes.

Access Whale Alert

Visit the official website: https://whale-alert.io/. You can also keep track of updates through their Twitter handle (@whale_alert).

Monitor Real Time Transactions

Whale Alert marks transactions of 1 million dollars and higher with the amount and type of currency, addresses of sender and receiver, as well as time of transfer.

Analyze the data in order to see movement patterns, for example, a large percentage of whales shifting money to cold wallets, could suggest long-term holding pots.

Analyze the Data

Start scanning the seas for specific whale activities that stand out to you. For example:

If large influxes are flowing towards exchanges, whales could be preparing to sell. Large outflows from exchanges may be spent suggesting accumulation.

Merge this information with market developments and headlines to reach conclusions.

Create Notifications

Whale Alert has an API that allows developers to incorporate whale-tracking data into their software tools or trading bots.

You can also turn on notifications from their Twitter account to keep track of important trades.

Employ Other Solutions

Use Whale Alert together with other Glassnode, CryptoQuant and Santiment for deeper market analysis.

The popular platforms for tracking cryptocurrency whale movements

| Platform | Key Features | Notable Tools/Functions |

|---|---|---|

| WhaleAlert | Real-time tracking of large transactions | Alerts on whale movements, API access |

| CoinMarketCap | Whale watching through transaction size metrics | Whale alerts, market cap rankings, price tracking |

| Santiment | Data feeds for whale movements and sentiment analysis | Whale wallets tracking, on-chain data |

| Glassnode | On-chain analytics for whale activities | Whale distribution data, liquidity metrics |

| WhaleMap | Whale activity heatmaps for Bitcoin | Heatmaps of whale activity, market trends |

| TokenAnalyst | Tracks large transactions and addresses | Large transaction detection, wallet analysis |

Why Following Crypto Whales Matters

The importance of following crypto whales stems from several areas:

Market Influence

The forex traders are able to singlehandedly manipulate the market to their advantage by performing large trades. Their purchases or sales alone have the potential of moving the market in a great deal.

Price Swings

Significant buys or sells from whales can also shift the price of respective assets, causing sudden upward or downward movements in the capital markets. Tracking these activities can help traders understand how to position themselves better.

Liquidity

The ever-growing list of market participants gives rise to inefficiencies in the market. Those whales who actively trade and hold cryptocurrencies significantly increase the trading activity of the market, which increases liquidity conditions.

Psychological Impact

Psychological factors play a dominant role. The moves undertaken by whales can impact other traders as well. Huge buy positions bring faith in the market mood, while large sell positions easily switch towards bearish and fearful volatility inducing mood.

Market Signals

There is immense value in understanding this arena, for watching the market practices associated with such large players. All major movements made with wallets and shifts in exchanges always happen post a major buy/sell event and serves as a signal.

Pros & Cons Of Crypto Whales

Pros

Active Market Participation

Big traders bring in millions of dollars worth of crypto, consequently paying multiple times more, and creating the liquidity needed.

Less Volatile Markets

The risk associated with the fluctuation of prices is lower and market anomalies are rare due to whales selling their assets.

More Investors Participating Helps Overall Market Growth

More whales resulting or becoming active in the market fosters competition and capital investment which expands opportunities for growth.

Possibility To Reverse Financial Trends

By strategically selling or buying, whales can alter the already set strategy of smaller investors for better/exiting their trades or losing them.

Loyalty in the Market Can Bring Better Returns Over Time

The majority of these b whales never sell their assests, helping to stabilize overtrading and market conditions.

Cons

Significant Price Fluctuations

The hosing whales tend to buy or sell large portions at once, causing extreme changes in the market price, which creates panic.

Not Many People Can Have Control Over The Assets

A small group of people having these assets denies crypto its intended purpose of being open to all.

Catastrophic Events Causing Mass Liquidation

Huge dumps by whales risk the position of smaller trader which further diminishes their position in the market.

Always One Step Ahead of Others

Whales tend to have a competitive advantage against retail traders, having access to information or technology from trusted sources that will put them in a better position.

Fear & Uncertainty

Emotional retail traders tend to overreact to whale activity by buying or selling in a panic.

Conclusion

To conclusion, this ceases the analysis the impacts crypto whales have on the investor and trader decision making processes.

Investors can track the actions of whales with the use of whale tracking software, order book explorers, on-chain data analytics, social media, and even forums.

Trying to understand the transactions made by these market giants will give you insight into how to better prepare for any changes in ratio.

Following these CEOs will improve your standing in the competitive realm of crypto trading, since you will be the early market maker to a lot of scenarios that arise in this field.

Crypto trading will become less complex with the help of tools that get insights based on the whales activities.