In this article, I will discuss the How to Migrate Bridging Aggregator Tokens Across Networks From One Network To Another In A Simple And Practical Manner.

I will explain how you can use trusted aggregators to securely transfer tokens between different blockchains, avoid common mistakes, and facilitate seamless transfers. This guide is tailored for users who are interested in taking advantages of multi-chain DeFi services with low risk.

What Are Bridging Aggregators?

Bridging aggregators are a form of cross-chain token transfer that merges different blockchain bridges into one interface. Unlike traditional bridging methods that depend on a single bridge, these aggregators take different approaches to offer the most secure, efficient, and lowest-cost transfer processes.

By using multiple tokens and chains, they work towards ensuring that cross-DeFi ecosystem inter-operability exists. Bridging aggregators like LI.FI, Rango, and Socket are well known for maintaining high speeds and accuracy while operating on low gas fees and complexity. They focus more on over-simplifying the entire process on prioritizing numerous factors to improve reliability and speed.

How to Migrate Bridging Aggregator Tokens Across Networks

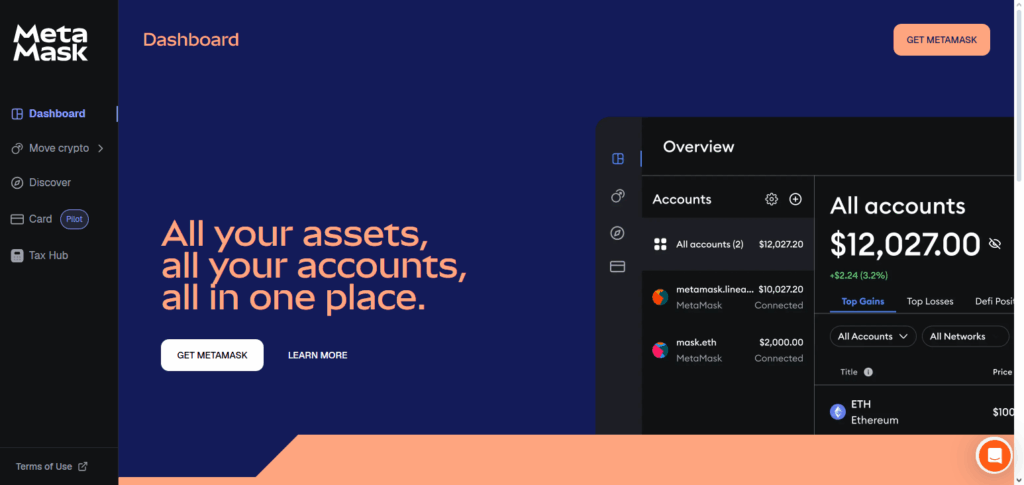

Example: Migrating USDC from Ethereum to Polygon with MetaMask Bridge

In this case, we leverage MetaMask Portfolio’s Bridge Aggregator that optimally routes through multiple bridge providers.

Access MetaMask Portfolio

- Visit portfolio.metamask.io

- Link your MetaMask wallet

Go to “Bridge” Section

- Hit “Bridge” on the side menu

- Set the following parameters:

- From Network: Ethereum Mainnet

- To Network: Polygon

- Token: USDC

- Amount: e.g., 100 USDC

Aggregator Searches Optimal Path

- MetaMask checks many bridges like LI.FI, Socket, Connext, and Hop.

- It displays:

- Estimated gas fees

- Time to complete

- Bridge provider (cBridge, Across, etc.)

Proceed with Approval

- Press “Approve” for the bridge access to the needed USDC

- Then, press “Bridge” to start the transfer

- Approve the transaction in MetaMask

5Wait for the Transfer Completion

- 2–10 minutes is the standard timeframe for most transfers.

- Confirmation will show when USDC is on Polygon.

Why Migrate Tokens Across Networks?

Access Better DeFi Opportunities:Unique farming yields, staking services, and even whole DeFi platforms may be unavailable on some networks, making them uniquely advantageous.

Reduce Transaction Fees: Moving assets to a differ ent network can be beneficial for places with lower gas fees as overall trading costs are considerably reduced.

Leverage Chain-Specific Utilities: Participating in certain dApps, games, or other protocols that are tied to specific chains necessitate token movement to join, hence the migration.

Improve Liquidity Options: Bridging tokens offers access to high-quality or more favorable liquidity pools from different networks.

Diversify Portfolio Risk: Exposing an asset to single congested network vulnerabilities can be risky. However, distributing them across multiple blockchains alleviates that risk.

Common Issues and Troubleshooting

Stuck or Delayed Transactions: Sometimes, bridges can get backed up and slowed down by congestion. It is helpful to check block explorers to make sure the transaction is going through and to give it some time before retrying.

Incorrect Network Selection: Picking the wrong source or destination chain can make a transaction end up failing or getting lost. Pay close attention to wallet settings and the bridge UI as both need to be error-free.

Unsupported Token or Chain: Every aggregator does not support every token or network. Before moving forward, ensure that your token is valid and that the bridged path is correct.

Insufficient Gas Fees: Transactions on networks require their own gas paying token. Make sure that you have4 sufficient balance of ETH, BNB, MATIC etc. before proceeding with the transaction.

Missing Tokens After Transfer: If tokens remain uncredited, you can try adding the token contract address manually or refreshing your wallet interface.

Failed Approvals or Errors in UI: Token failures to approve, static thumbs overs or lack of interaction implies refresh the page, unlink wallet then reconnect or switch to other aggregators.

Bridging to the Wrong Address: A last look at the wallet address meant for the tokens would be beneficial here. Sending tokens to incorrect locations would completely eliminate your funds.

Value Discrepancies and Slippage: You might encounter receiving fewer tokens than anticipated due to price volatility or routing problems. Check slippage settings prior to confirmation in each transaction.

Safety and Best Practices

Only Use Well Known Bridging Aggregators

Always use LI.FI, Rango, or Socket. Always check URL authenticity to stay clear of phishing attacks.

Confirm Network and Token Information

Make sure source and destination chains, tokens, and wallet addresses selected are correct before confirming any transaction.

Hold Enough Tokens for Gas Fees

Always ensure the gas fee relevant coin (ETH, MATIC, BNB) is sufficiently available on both chains to avoid failed transactions.

Activate Wallet Security Options

Hardware wallets and two-factor authentication provide added layers of security during transactions.

Avoid High Congestion Times for Bridging

Reduces delays, failed transactions, and high slippage.

Check Transactions with Block Explorers

Use Ethers can, BscScan, and Polygonscan to check transaction status and ensure completion.

Follow Official Social Channels of the Aggregator

Get updates, alerts, or notify users of any issues.

Token Addresses from Unknown Sources

Smart contract addresses should only be sourced from trusted platforms like CoinGecko or project websites.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables access to dApps and DeFi tools on other chains | Risk of transaction failure or delays |

| Aggregators offer optimized routes and lower costs | Requires gas fees on both source and destination networks |

| Supports cross-chain asset diversification | Some tokens or chains may not be supported |

| Simplifies complex multi-bridge transfers | Possible slippage or lower token output |

| Enhances liquidity and trading opportunities | Relies on third-party platforms — trust and security needed |

Conclusion

Transferring bridging aggregator tokens from one blockchain network to another is essential for unlocking new blockchain ecosystems, enhancing liquidity, and minimizing transaction costs. Users can conveniently and safely transfer assets by using trusted aggregators while thoroughly preparing for the transfer and adhering to security protocols.

As multi-chain DeFi expands, mastering token migration ensures you remain agile, effective, and poised to take advantage of opportunities across various networks.

FAQ

Is migrating tokens between chains safe?

Yes, if you use reputable aggregators and follow safety best practices, token migration is generally secure.

Do I need gas fees on both networks?

Yes, you’ll need the native token (like ETH, BNB, or MATIC) on both source and destination networks to pay for gas fees.

How long does bridging take?

It usually takes a few minutes, but times may vary depending on network congestion and bridge used.