This article will show you how to open a Coinbase Corporate Account for businesses and institutions. Corporate accounts let businesses buy, sell, and manage cryptocurrency as Coinbase compliantly and securely.

This guides you through the stepwise approach, documents, verification and best practices so that your business can confidently and safely leverage Coinbase for corporate crypto transactions.

What Is a Coinbase Corporate Account?

A Coinbase Corporate Account is another account type that accommodates businesses, institutions, and other legally recognized entities for buying, selling, holding, and managing cryptocurrency.

Corporate accounts cater to the operational and regulatory frameworks that businesses and institutions comply with. As such, corporate accounts come with advanced control and regulatory compliance regarding the supervision of account holders.

Companies working with corporate accounts will enjoy the ability to cooperate crypto transactions in high amounts and accounts for integration with advanced accounting, enterprise resource planning, and corporate financial management systems. Corporate accounts offer expanded functionality in comparative to personal accounts.

Corporate accounts will support the administration of several authorized accounts via distinct access rights for different levels of a transaction hierarchy, enhanced 2FA and cold storage access controls, and KYC and AML compliance supervision.

Corporate accounts ease the management of crypto assets, enhance the corporate treasury for crypto use, and of course, support the other crypto operational accounts that come along with Coinbase’s advanced institutional crypto management tools and crypto reporting.

How to Open a Coinbase Corporate Account

Example: How to Open a Coinbase Corporate Account

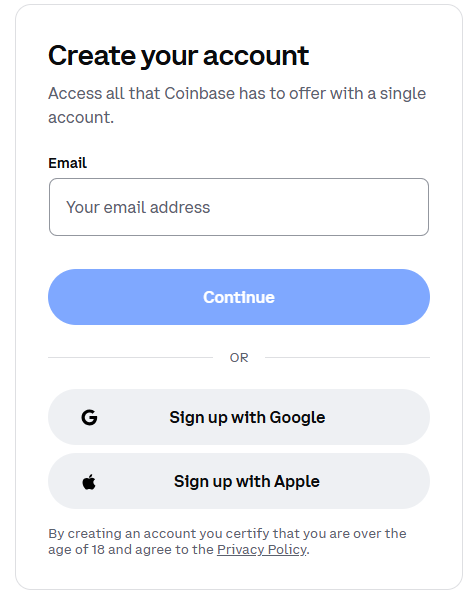

Step 1: Visit the Coinbase Business Signup Page

To start, access the Coinbase Business or institutional account page. Afterwards click on Get Started to register.

Step 2: Enter Company Information

Outline the most fundamental information about your business by specifying:

- The business name

- The business structure (LLC, corporation, partnership, etc.)

- The business location and how it can be contacted

Step 3: Add Authorized Representatives

Bollard accounts must be managed by individuals whom you assign, as mentioned below:

- The complete legal name

- The email

- The title or function in the business

Step 4: Upload Required Documents

Verifying your business and authorized users requires submission of these documents to Coinbase:

- The incorporation certificate or the business registration document

- A business address proof (lease agreement or a utility bill)

- IDs of authorized representatives (Government issued)

- Tax ID (EIN or equivalent)

Step 5: Complete Identity Verification

Soul to Coinbase of business authorized reps and users as hinges to open a corporate account. This process could include:

- A representative as a selfie validator

- Questions on business ownership or its activities

Step 6: Wait for Coinbase Review

Submission of documents and verification requests you to wait as Coinbase audits your application. This can vary from a few days to a couple of weeks, depending on how complete your submission is.

Step 7: Payment Set-up and Configure Security

Now that you have been approved, configure your account:

- Link your corporate bank accounts or fiat wallets

- Set-up two-factor authentication (2FA)

- Set permissions for multiple users (if applicable)

- Consider cold storage for larger balances

Step 8: Start Using Your Business Account

Now you can:

- Buy, sell and hold crypto in your corporate wallet

- Use crypto to assist in payroll or treasury functions

- Prepare detailed reports for accounting or reporting compliance

Benefits of Using Coinbase for Business Transactions

Institutional-Grade Security

Coinbase uses 2-step verification, cold storage, and lockboxes, allowing for large-amount holdings, and offers specialized audits for cryptographic business assets security.

Regulatory Compliance

With complete registration as KYC and AML, Coinbase serves necessary business legal and tax regulations.

Multi-User Access

Businesses can assign and distribute multiple authorized signatories different roles and permissions, streamlining and securing management of the business account.

Easy Fiat-to-Crypto Transactions

Coinbase streamlines business vendor payments, payroll management, and cryptocurrency investment by cryptocurrency integration and conversion.

Detailed Reporting and Analytics

Accounting and management materials are automated and simplified by complete business analytics and integrated tax and transaction auditing.

Global Accessibility

International, cross-border transactions are available with varying country and currency combinations.

Integration with Business Tools

Canonical business and financial workflows are automated and streamlined with the integration of Coinbase to payment processors and business-oriented accounting software.

Security Best Practices

Enable Two-Factor Authentication (2FA)

All authorized users must implement 2FA for an additional security layer at account logins.

Use Cold Storage for Large Balances

To defend against hacking, large portions of cryptocurrency funds should be kept in offline, cold storage wallets.

Regularly Review User Access

Access and permissions should be regularly reviewed, and auditing should include the removal of inactive, unnecessary, or excess accounts.

Set Role-Based Permissions

Users should be assigned defined roles which include specific permissions, ensuring critical functions can only be accessed by authorized individuals.

Monitor Transactions in Real-Time

All incoming and outgoing transactions should be observed to recognize and respond to abnormal transactions in a timely manner.

Secure Devices and Networks

Access to the corporate account should be done through encrypted and appropriate networks, and the devices should have up-to-date software and be properly secured.

Implement Withdrawal Whitelists

Implementing a list of approved withdrawal addresses can help restrict unauthorized transfers.

Regular Backups and Recovery Plans

Backing up private keys must be done securely, and recovery plans should be in place and actionable to address account compromises.

Common Issues and Troubleshooting

Verification Delays

- Issue: It can take several days for an account to get verified and approved.

- Solution: Make sure your documents are complete, clear, and current before submitting.

Document Rejection

- Issue: Submitted business documents or ID may get rejected.

- Solution: Use official documents and make sure they are clear and not expired.

Login or Account Access Issues

- Issue: Some users may have problems logging in and accessing the account.

- Solution: Make sure the password is reset, 2FA is checked and email is verified.

Transactions Not Going Through

- Issue: Transfers and crypto purchases not going through.

- Solution: Make sure there are enough funds in the account and wallet addresses are correct, and network fees are checked.

Payment Method Issues

- Issue: Issues with linking bank accounts and cards.

- Solution: Make sure bank details are the same as business registration and confirm with Coinbase.

Restrictions or Holds on Account:

- Issue: Accounts may be restricted due to suspicious activity by Coinbase.

- Solution: Provide the documentation requested for verification to Coinbase support.

Delays in Customer Support

- Issue: Delays in getting support responses.

- Solution: Reach out to Coinbase via their help center, live chat, or submit a detailed support ticket with all relevant info.

Pros & Cons

| Pros | Cons |

|---|---|

| Institutional-Grade Security – Advanced 2FA, cold storage, and regular audits protect business funds. | High Fees – Some transactions and conversions may have higher fees compared to other exchanges. |

| Regulatory Compliance – Fully compliant with KYC and AML regulations, simplifying legal and tax obligations. | Limited Availability – Corporate accounts may not be available in all countries. |

| Multi-User Access – Assign multiple users with role-based permissions for secure account management. | Verification Time – Approval process can take several days or weeks. |

| Easy Fiat-to-Crypto Transactions – Seamless conversions for payments, payroll, or investments. | Customer Support Delays – Response times can sometimes be slow during high-demand periods. |

| Detailed Reporting and Analytics – Transaction history and tax reporting simplify accounting. | Limited Advanced Trading Features – May lack some complex trading tools for professional traders. |

| Integration with Business Tools – Compatible with accounting and payment systems for streamlined operations. |

Conclusion

Businesses acquire security, compliance, and efficiency for all crypto transactions by opening a Coinbase corporate account.

Secure crypto transactions, automated crypto payroll, and digital asset integrations for complex crypto transactions are all made possible by completing all three steps—submitting your company paperwork, finishing verification, and granting secure system access.

Coinbase takes corporate crypto account management to a new level. Every corporate account comes with system features tailored to operational and regulatory requirements, including multi-user control, comprehensive auditing, and high-grade account security.

Every Coinbase account, no matter the size of the institution or the business, corresponds with high management of crypto and provides the most necessary transparency.

FAQ

Is Coinbase Corporate Account available globally?

Availability depends on local regulations. Some countries may have restrictions, so it’s important to check Coinbase’s business account eligibility for your region.

What security measures are recommended for a corporate account?

Enable two-factor authentication (2FA), use cold storage for large balances, set role-based permissions, and regularly review user access.

Who is eligible to open a Coinbase Corporate Account?

Businesses such as LLCs, corporations, partnerships, and other legal entities can open a corporate account. Authorized representatives must provide identification and business documentation.

What is a Coinbase Corporate Account?

A Coinbase Corporate Account is designed for businesses and institutions to securely buy, sell, hold, and manage cryptocurrencies while meeting regulatory and compliance requirements.