In this article, I will explain the procedure of opening a custodial crypto account using a simple step-by-step method.

This guide is perfect for anyone new to cryptocurrency or searching for a secure asset management platform. Everything is laid out so you can start without any hurdles.

What is a Custodial Crypto Account?

A custodial crypto account is a type of account that a third-party service, such as a cryptocurrency exchange or platform, manages on your behalf.

Unlike non-custodial accounts, which let users manage their private keys, custodial accounts permit platform control, offering features such as cold storage, insurance, and customer support.

These accounts are simple to operate and many include trading, buying, and selling crypto options. Convenience aside, custodial accounts have their problems. These accounts are riskier since the platform controls how you access your assets.

How To Open A Custodial Crypto Account

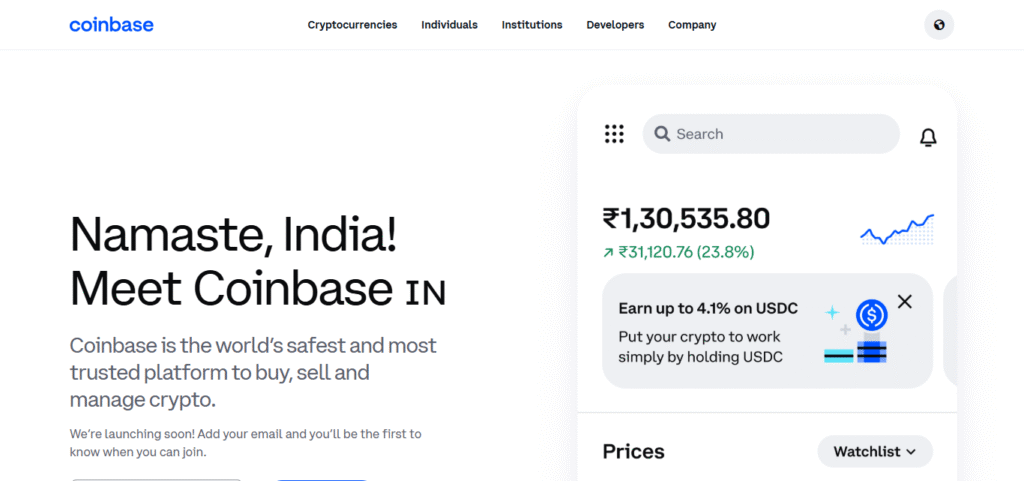

To open a custodial crypto account on Coinbase, a well-known app for buying, selling, and storing crypto assets, please follow the steps outlined below.

Opening A Coinbase Custodial Crypto Account – Instructions

Create An Account

- Download the Coinbase app or go to Coinbase’s website.

- Press on “Get Started” or “Sign Up.”

- Fill in your email address and set a password.

Confirm Your Email Address

- A verification message will be sent to your email by Coinbase.

- Confirm your email address by clicking on the link.

Supply Additional Information

- Provide a full name, date of birth, and residential address.

- Security in Coinbase is at an extra level which is why they will request for your phone number.

Verify Your Identity (KYC)

- KYC (Know Your Customer): Send a government ID. It can be your passport, driver’s license or any state ID card.

- You might also have to send a selfie or video for validation.

- With this, financial regulations are being followed.

Enable Two-Factor Authentication (2FA)

- Another security measure which Coinbase performs is the asking of 2FA.

- Use a Google Authenticator, if you want codes sent to your phone, or other methods to protect your account.

Deposit Funds into Your Account

- Select the method of deposit.

- Transfer funds through a Bank transfer of fiat currencies (USD, EUR, etc.)

- Crypto deposit from another wallet or exchange.

- Quick purchases can be made with a Credit/Debit card.

- Remember to check the deposit fees and the processing time.

Start Trading or Storing Crypto

- After setting up the account and depositing funds, you may commence:

- Purchasing Bitcoin or Ethereum through Coinbase.

- Storing crypto safely within the custodial wallet of Coinbase.

- Trading crypto effortlessly within the Coinbase crypto trading platform.

Withdraw Funds When Needed

- Your crypto or fiat can be withdrawn to your linked bank account or personal wallet whenever needed.

Why Open a Custodial Crypto Account?

Security features: insurance, backup systems, multi-sig

Loss of custodial account assets is mitigated using cold storage, multi-signature wallets, and insurance. These features restrict hacks and unauthorized access to funds which are personal to a higher level of tailored security than wallets.

Convenience: easy access, user-friendly interfaces

A custodial account enables users to seamlessly access crypto buying, selling, and storage functionalities. Supported by Coinbase and Kraken, custodial accounts allow smooth navigation to crypto trading and asset management, simplifying the experience for all, especially the newly initiated.

Customer support and services

Typically, custodial accounts come with a provided technical support service that assists in resolving access issues, transaction problems, or any tech-related account problems. Support is often a stress reliever and provides peace of mind when it comes to resolving problems in cryptos.

Regulatory and legal protections

There is always some legal protection guaranteed under local regulations as custodial crypto accounts frequently operate using them. These systems vouched for KYC (Know Your Customer) and AML (Anti-Money Laundering) terms, therefore making safe and legit operations which aids in reducing legal amour.

How to Manage a Custodial Crypto Account

Regular monitoring and security checks

When handling custodial crypto accounts, check it routinely to detect suspicious activities such as transactions that are not intended. To ensure heightened security, periodically change passwords, review 2FA (Two Factor Authentication) settings, and check other protective measures on the account.

Understanding fees and taxes

Remember to account for additional charges on transactions, withdrawals, and other services offered by the platform. In addition, keep track of taxation policies concerning crypto transactions since a good number of platforms issue tax reports designed to aid users in compliance with local tax policies during tax filing.

Taking advantage of customer support

For any concern or help needed for the first time, do not hesitate to contact the support section of the platform. Most custodial platforms provide live chat, email, or phone support and prompt resolution of the issues for better account management.

Are custodial crypto accounts regulated?

Custodial platforms are usually regulated on a country by country basis, paying attention to local alueznge compliance financial regulations. This may involve compliance with KYC, AML, and even tax reporting.

Such regulations ensure a level of protection to users such as identity verification, fraud prevention and legal compliance.

A careful examination of a platform’s regulatory coverage is a pre requisite for using it for the legal framework pertaining to the jurisdiction of the user is complied with and appropriate safety mechanisms are put in place.

Conclusion

In summary, With a custodial crypto account, the user gets enhanced security features, ease of crypto management, and customer assistance, which makes it a good fit for novices and people looking for simpler ways to hold crypto.

After completing the registration, KYC, and setting the security parameters, users can safely start trading or storing digital assets. Remember to use a credible exchange and keep track of their fee structures and regulatory compliance.