I will talk about How To Reduce Bridging Fees With Aggregator Discounts targeted at ensuring that users spend less while doing cross-chain transfers.

These tools allow users to cut their expenses and make bridging on blockchains more affordable. The term “aggregator“ means individuals or establishments offering bulk orders for incentive schemes by utilizing a superior route.”

What Are Cross-Chain Aggregators?

Cross-chain aggregators automatically maximize profit margins by analyzing various decentralized exchanges. A cross-chain aggregator utilizes enormous amounts of blockchain data which assists in gathering liquidity from multiple networks.

Their main goal is to streamline the entire process facilitating users to undertake asset swaps with little to no effort. They offer a variety of tools such as transaction fee comparisons, fee optimization, and transaction discounts.

How To Reduce Bridging Fees With Aggregator Discounts?

Comparison of Fees: Aggregators search many bridges and pools of liquidity to get the best possible fee for your transaction.

Given by Bridges: Some aggregators sponsor bridges and are able to set their own fees lower than the standard cost or pay rewards to users for using their service.

Multinetwork Transactions: Aggregators can lessen slippage and the cost of transactions by distributing transactions among several bridges or networks.

Gas Fee Optimization: Since Aggregators need to save money, they can group transactions together or use second layer solutions to lower gas expenses.

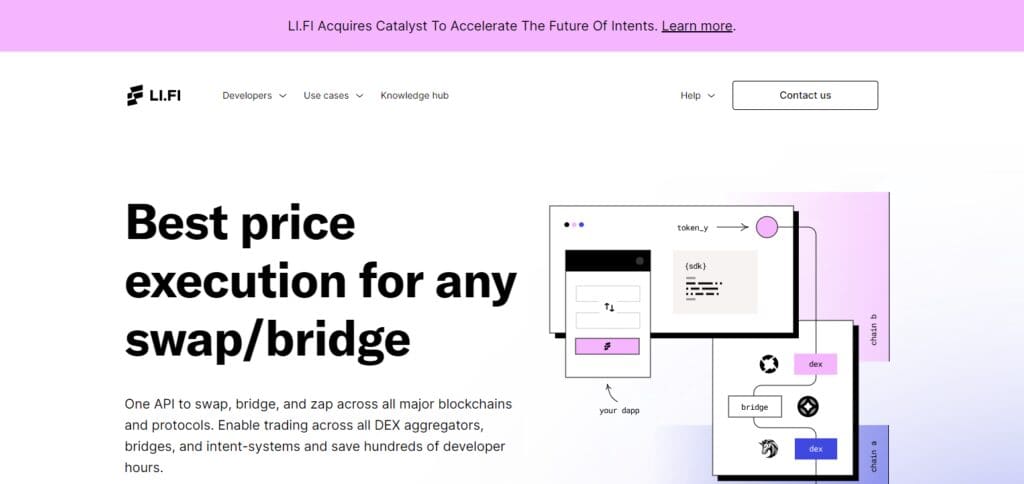

Case Study: LiFi Bridging Fee Reduction Example

Li.Fi can serve as a single point of access for over 20 blockchains, and works with popular bridges like Hop, Connext and Across, making Li.Fi one of the most popular cross-chain aggregators. Here is how wie Li.Fi works: for lower bridging fees.

Visit The Site: Go to the domain of Li.Fi and proceed to link your wallet.

Choose Tokens and Other Parameters: Select the token to be bridged and the source and target networks (for example, Ethereum and Polygon).

Check the Fees: Li.Fi will provide a number of available bridges with fees and estimated times for the transactions to confirm approvements.

Apply the Discount: Whenever Li.Fi needs to set partnered discounts on bridges, those fees will get automatically removed from the transaction fees.

Optimize Route: An additional suggestion, which may further reduce costs, is dividing up your transaction across multiple bridges.

Finalize the Transaction: Accept the transaction within your wallet and let Li.Fi do the magic.

With Li. Fi, you can save as much as 30-50% on bridging fees, unlike when you manually select a bridge.

More Aggregator Platforms To Target.

Socket Bungee: They have attractive prices and a high coverage of networks.

XY Finance

Offers a low-cost cross-chain swapping and bridging services.

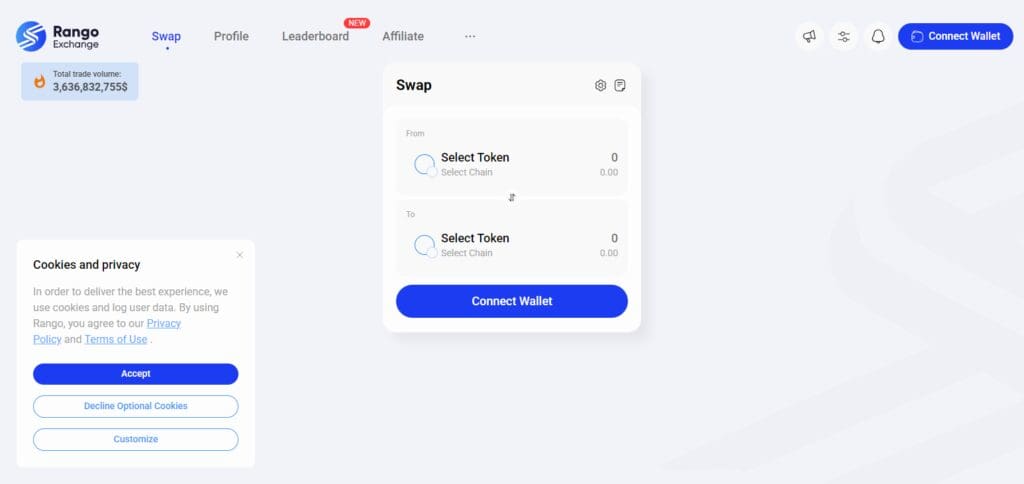

Rango Exchange

Covers bridges and DEXs for more efficient cross-chain services.

Potential Risks and Considerations

While aggregate services assist in minimizing bridging costs, all users should understand impending risks and concessions.

Security Risks

Smart Contract Vulnerabilities: The use of smart contracts by aggregators poses the risk of containing security loopholes.

Exploit Risks: The bridges and aggregators have suffered hacking loses due to funds not secured by breached security.

Hidden Fees and Markups

The savings from discounts some aggregators provide may prove as futile due to the hidden fees utilized. Always review the final cost of transactions beforehand in order to avoid unintentional bridge transfer confirmations.

Centralization Risks

Multiple different bridges are utilized by most centralizing aggregators for transactional purposes, therefore refraining from non-centralization. Transactions could be affected due to outages within the aggregator’s infra.

Slippage and Price Impact

Specific costs can be resulted to under anticipated conditions due to excessive market volatility.The aggregator must guarantee slippage protections or customize slippage boundaries instead.

Network Congestion and Delays

Poor network connection can reduce the effectiveness of gas fees, despite incorporating an aggregator. Due to lack of liquidity, certain transactions could be prolonged and executed later than the desired timeframe.

Regulatory and Compliance Issues

Multiple bridges and aggregators are problematic due to their lack of precision focus on compliance regulations, hence legal obligations.

Determine whether the aggregator uses the best conformance practices for your particular area.

Future of Aggregators and Bridging Fees

The Evolution of Aggregators and Bridging Fees

As blockchain technology continues to advance, aggregators are poised to become increasingly significant when it comes to facilitating cross-chain transactions. Some of the factors that are defining the future of aggregators and bridging fees are outlined below:

Lowering Competitive Barriers And Increased Competition

More aggregators joining the industry will increase competition and consequently lower bridging fees. Collaborations with Layer 2s and roll ups will further enhance the cost reduction.

Superior Smart Routing Artificial Intelligence

Automated smart routing will facilitate the comparison of transaction fees in real-time and select the minimum.

High gas price payment, low liquidity, transaction speed and other similar parameters will also be utilized under more intelligent algorithms.

Increased Security and Trustless Bridges

With the increase in finance theft comes the down fall of exploits out damaging risks so decentralized bridges need to be developed in greater numbers.

The use of zero-knowledge proofs together with multi-party computation will contribute to the security of the transactions.

More Integration and Enhanced UX

Direct incorporation of aggregators to wallets and dApps will enable borderless transfers across chains effortlessly.

Integrating dashboards for bridges will enhance comparison on range between fee rates and transaction speeds.

Improved Capital Efficiency and Fragmentation Reduction

Cross-chain liqudity network with unified liquidity can allow fragmentation reduction and improved capital efficiency.

Layer zero, Axillar and other similar cross-chain messaging protocols will allow smoother transfer through chains.

Compliance and Adoption of Institutions

Institutional users will likely see the emergence of new aggregators that are more compliant-friendly.

New regulations could be implemented by the government that impacts fee structures and cross-chain transaction borders.

Conclusion

The reduction of bridging fees is necessary for profitability when it comes to cross-chain transactions, and the use of aggregators can solve this problem.

Users can save a great deal of money courtesy of smart routing, bulk transaction discounts, gas optimizations, and other exclusive relationships. Selecting the appropriate aggregator, being cognizant of the risks, and employing additional methods of cost reduction such as optimal timing can facilitate greater savings.

Aggregators will continue to charge lower fees and provide better service without sacrificing security as technology improves, and the gaps will become more seamless. Staying well-informed about the tools available also enables users to reduce the cost incurred while moving assets across chains.