I will talk about How to Run Bridging Aggregator Bots for Profit. To help maximize profits, you will learn the basic steps necessary to configure these automated systems, the best techniques to optimize income, and the primary platforms to utilize.

Learning how to effectively transfer assets between different blockchains can help you automate imbalance profit capturing and minimize costs for greater earnings.

What is Bridging Aggregator Bots?

Bridging aggregator bots are bots for bridging aggregators. These bots make use of blockchain bridges which help in the transfer of tokens between blockchains.

Bridging aggregator bots use automation to make transactions faster while reducing costs and taking advantage of cross-chain arbitrages.

Bridging aggregator bots are advantageous to any user owning cross-chain assets, helping make cross-chain asset trading and liquidity management more efficient. These bots represent a move towards a more user friendly multi-chain ecosystem.

How to Run Bridging Aggregator Bots for Profit

Bridging aggregator bots can be run to earn profits if you take a systematic approach to arbitrage across different blockchains. Here’s an example of how to set up one for optimal use.

Example: Arbitrage Bot for Cross-Chain Algorithm

Step 1: Choose the Strategy

TWO bridged asset blockchain networks will have differing prices of certain assets, and the bot will find the price inefficiencies.

Consider the price of Ethereum (ETH) on Polygon and BSC. The price is greater on one chain compared to the other.

Step 2: Use a Bridging Aggregator

Use a trustworthy bridging aggregator like LI.FI or Bungee, Router Protocol.

Verify whether it supports multiple bridges and has good chain routing.

Step 3: Create Bot Algorithms

Language used: Smart contracts will require Python or Solidity.

Logical deduction Sources: Use APIs from DEX Aggregators such as 1inch or Paraswap as well as blockchain data APIs.

Implementing Logic:

From the data gathered, keep watching for price differences.

Check why the swap is charged and how much gas is required.

Carry out swaps only when there are profit margins higher than all fees.

Step 4: Optimize Execution Risk

Using limit orders will help with slippage protection.

Batching helps optimize gas costs.

Prevent cover losses from quick price changes with rapid fire designs.

Step 5: Test and Launch

Have the bot run in a control setting.

Increase incrementally by investing smaller amounts at a time.

Continuously fine-tune within the given range according to the given market state.

Other Place Where to Run Bridging Aggregator Bots for Profit

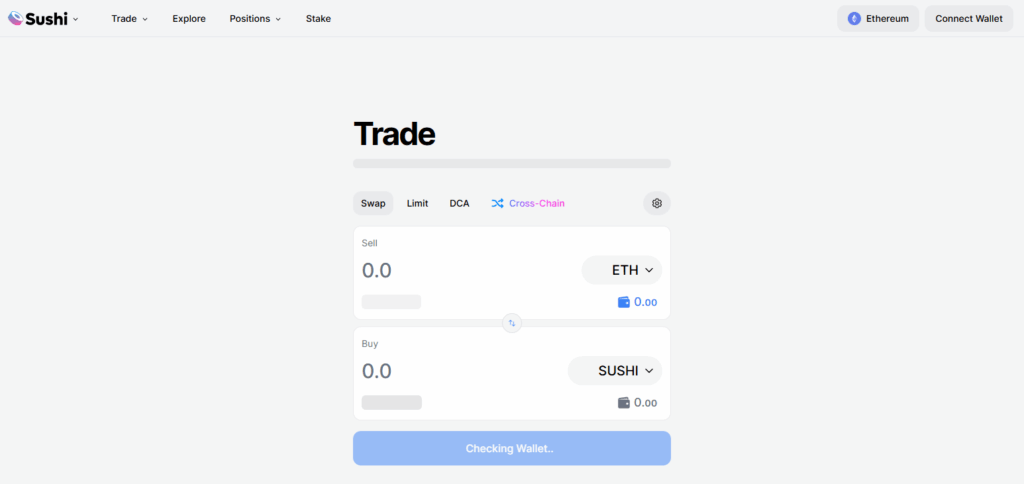

SushiSwap

With its multi-chain reach and incorporated liquidity pools, SushiSwap has emerges as a top platform for running bridging aggregator bots for profit. SushiSwap’s bridging capabilities allow bots to effectively move assets across chains because of its enormous liquidity and minimal slippage.

This allows cross-chain arbitrage and yield opportunities to be automated to take advantage of them. Also, the advanced bridging and trading that can be done with bypassing and fee relaxers promotes bot profit maximization in the active environment made by SushiSwap.

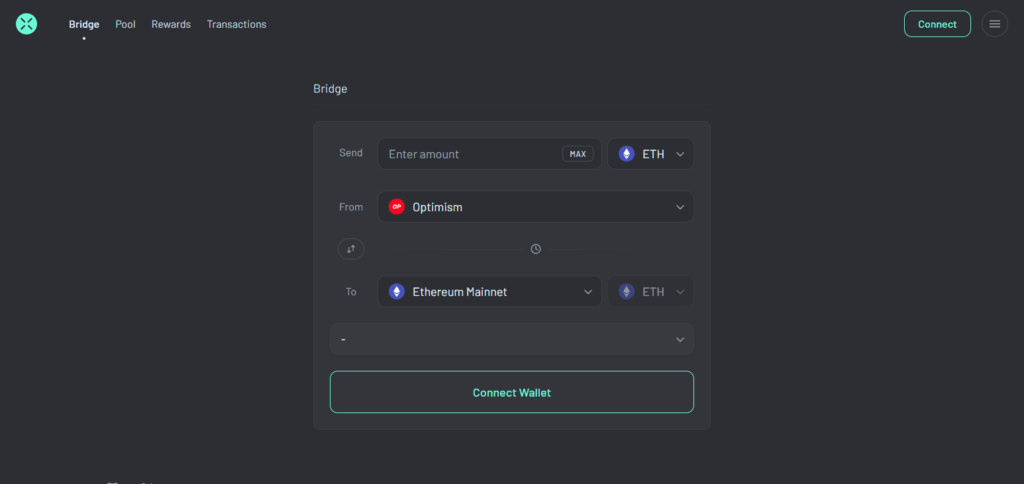

Across Protocol

From an earnings viewpoint, Across Protocol is very helpful for executing bridging aggregator bots due to its fast, secure and low-cost cross-chain transfer capabilities. The type of optimistic rollups employed by it greatly increase the amount of unused space within a blockchain, minimizing gas costs and transaction durations.

This allows the bot to perform numerous transfers within the limited time available. This heightened speed and reduced costs lets the bots take advantage of arbitrage opportunities and lower slippage. Moreover, the exceptional measures to guard funds during transfers provides reliable without risk, aiding in obtaining precise profits in a complex multi-chain ecosystem.

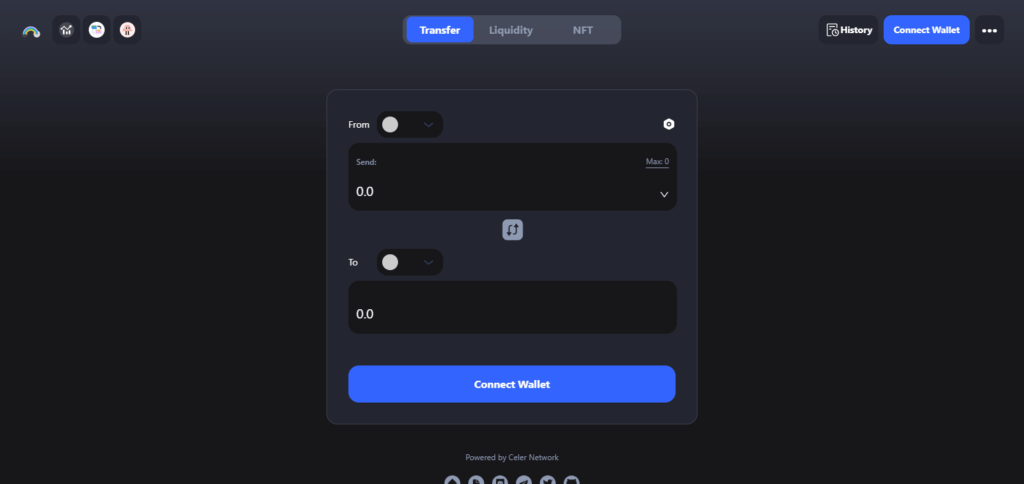

Celer cBridge

The ultra-fast cross-chain transfer technology of Celer cBridge and its layer-2 scaling solution make it one of the prime candidates for running bridging aggregator bots for profit. Transaction costs and confirmation times on the platform are significantly reduced.

This enables bots to do rapid arbitrage as well as asset swaps across numerous blockchains. Its supportive chains and liquidity pools make asset swapping more efficient and smooth. cBridge’s infrastructure combines affordability and speed, making it suitable for earning through automated strategies focused on cross-chain trading.

Tools and Platforms Required

Wallets: Compatible crypto wallets like MetaMask or WalletConnect to oversee and execute transactions.

Bridging Aggregator APIs: Use bridging APIs from LI.FI, SushiSwap, or Across Protocol for seamless automated bridge pathfinding.

Hardware/Software Requirements: Usage of Python or Javascript (Node.js) to implement the bot logic and control the framework.

Blockchain Nodes/RPC Providers: Platforms like Infura, Alchemy, and QuickNode that provide reliable blockchain access services.

Analytics Tools: Custom scripts or dashboards designed for monitoring bot execution, transaction fees, and profits.

Testing Networks: Employ testnets like Goerli or Mumbai for pre-deployment bot dry runs.

Strategies to Maximize Profit

Keep an Eye on Gas Costs: Transfer during low gas fee windows to save on transaction costs.

Streamline Bridge Routes: Use aggregators that provide the cheapest and quickest bridging paths.

Adjust Slippage Tolerance Carefully: Set a defined slippage tolerance to manage losses created due to price swings when swaps are executed.

Automatically Exploit Arbitrage Opportunities: Quickly identify and act on price disparities of tokens over various chains.

Automate Operations: Program the bots to execute during volatile market times as well as when congestion is expected in the bridges.

Chain Diversification: Spread over various blockchains to reduce risk while tapping into multiple profit streams.

Analyze Strategies in Real Time: Constantly manage performance to adjust strategies and maximize returns.

Risks and Challenges

Slippage and Price Volatility

Extremely quick changes in price can result in losing money when swapping tokens.

Transaction Failure

Transfer getting stuck or failed because of network congestion or bridge downtime.

Bridging Security Risks

During bridging, funds are at risk due to smart contract bugs or exploits.

Gas Costs

Sudden changes in gas price can result in an already negative profit margin.

Lack of Legal Clarity

Cross-chain transfers and crypto laws can result in changing operations.

Missing Setup Simplicity

Bots require constant technical involvement so active maintenance is mandatory.

Liquidity Risks

Reduced access to bridges and trading pools can limit available profits.

Best Practices for Running Bots Safely

Keep Private Information Secure: Use secure hardware wallets or software wallets to guard your private keys.

Connect through Trustworthy RPC Nodes: Refrain from using unknown RPC nodes which may have a lot of downtimes and errors. Use reliable providers Infura and Alchemy.

Enforce Rate Limits: Set an optimum number of API calls or node requests to avoid throttling or banning.

Test with Minimum Capital First: Run bots on limited funds to minimize potential losses.

Regular Updates are Required: Updating the bot code and bot dependencies regularly ensures that there are no exploits.

Track Performance of your Bots: Monitor transactions and real-time bot activity to identify problems as they arise.

Security Reviews and Saving Config Files: Backing up the bot configuration files and actively conducting security assessments are crucial.

Pros & Cons

| Pros | Cons |

|---|---|

| Automates cross-chain asset transfers | Requires technical knowledge to set up |

| Optimizes fees by choosing best bridges | Risk of failed or stuck transactions |

| Enables quick arbitrage opportunities | Potential losses due to slippage and volatility |

| Saves time compared to manual bridging | Security risks from smart contract exploits |

| Can operate 24/7 without breaks | Gas fees can spike unexpectedly |

| Access to multiple blockchain networks | Regulatory uncertainty around crypto bots |

| Increases trading efficiency | Requires constant monitoring and updates |

Conclusion

To sum up, executing bridging aggregator bot strategies for profit presents an automated approach to cross-chain asset transfers and exploit arbitrage opportunities across the multi-chain crypto system.

By picking the right tools, optimizing gas fee monitoring, route selection, and following the established security practices, users can maximize profits while minimizing risks. Even with technical issues and market volatility, properly setting up and managing bridging bots makes them an effective and efficient trading tool.